Texas Wind Energy and the Missing Money Problem

Wind energy in Texas has experienced exponential growth over the last two decades. This growth resulted from a combination of factors, including the availability of state and federal subsidies and Texas’s mandate that electricity providers derive a minimum (and increasing) amount of their electricity from renewable sources. Today, wind energy accounts for nearly a fifth of electricity generation in Texas.

While wind energy has many benefits, it also poses unique challenges to the reliability of the grid in the context of Texas’s “deregulated” energy market. These challenges stem from three primary factors. First, government subsidies and policies influence wind generators to behave in a way that detrimentally affects wholesale electricity prices. Federal income tax credits incentivize wind generators to generate and sell electricity into the market at any price point—suppressing electricity prices when the winds blow. Additionally, wind speeds are seasonal. This means that the supply of wind-generated electricity often decreases when demand peaks, leaving traditional generators to fill the void in an electricity market with inelastic supply and demand. High wind speeds during most of the year only worsen the problem, sustaining wind generation at a magnitude that suppresses wholesale electricity prices in all but two or three months. This makes it economically difficult for traditional generators that are needed to ensure the grid’s reliability when the winds calm. This is known as the “missing money problem.” Finally, state policies concerning wind generation have resulted in much more prolific wind energy generation in the state than would otherwise exist, amplifying the aforementioned reliability issues.

Industry analysts have proposed several solutions to this reliability problem—none of which are satisfactory. This Note, though, provides a novel solution that incorporates the benefits of the main proposed solutions. This proposal would require electricity providers—incentivized by market forces—to lock in long-term commitments from generators to produce electricity sufficient to meet expected demand, thereby providing the stability needed for long-term investment in reliable generation capacity.

Introduction

The promise of wind-generated electricity is one of low-cost and sustainability for Texas consumers. As wind capacity has grown at an astounding rate over the past two decades, Texas’s main electric grid, ERCOT, has increasingly relied on wind-generated electricity to satisfy ever-growing demand.[1] In fact, wind accounted for nearly a fifth of the state’s electricity generation in 2019.[2] The introduction of such a substantial, low-cost source of energy has put significant economic pressure on wind competitors, especially coal generators.[3] But low cost is not the only factor important to energy consumers. The other is reliability: if a customer turns on the light switch and the room stays dark, the low rate for energy does not seem quite so important.

The emergence of wind-generated energy, in the context of Texas’s quasi-free market for electricity, has led to significant concerns about the reliability of electricity in Texas. In a true free market, buyers and sellers—guided by their own self-interest—make numerous decentralized decisions about how much product to produce and sell at a given price. These decisions, in turn, lead to an efficient allocation of resources on the broader scale. But for wind generators, Mother Nature makes the production decisions, and her decisions have little to do with the demand for electricity. Variability in wind speeds—often calming when electricity demand peaks—can create a reliability problem if other non-wind resources do not have enough capacity to step in and fill the void on a calm day.[4] This reliability problem will only worsen as wind-generated electricity becomes more widespread.

But wind speed variability is only part of the problem. Subsidies for wind-generators in the form of federal tax credits, minimum renewable electricity requirements, and publicly-funded transmission lines greatly exacerbate the reliability problem.[5] This is so for two reasons. First, federal renewable energy tax credits are based on production. The more electricity a generator produces and sells, the greater the federal tax credit available to it.[6] This structure, along with the low variable cost of wind energy generation, incentivizes wind generators to continue producing and pouring electricity into the grid at low—and even negative—price levels. Such a flood of supply can make it unprofitable for other non-wind generators to operate, often driving them out of the market altogether. Consequently, the grid is left to rely on wind generators still more, aggravating the reliability problem.

Second, most wind generators sit in rural locations, far-removed from the consumers demanding electricity in the state’s metro areas.[7] To address this problem, the Texas Legislature approved the construction of transmission lines (at no cost to the wind-generators) to transport the electricity from the wind farms to the consumers.[8] By enabling wind generators to avoid the substantial cost of building transmission lines (the total cost of approximately $6.79 billion was funded by state-ordered customer surcharges), the state removed a key market signal from the wind-generator’s investment decision of whether and how many wind turbines to build.[9]

In the first instance, this meant that wind generators could build more wind turbines than they otherwise would have been able to, increasing the supply of wind-generated electricity to the Texas electricity market. Indeed, before the construction of the transmission lines, many proposed wind developments would not go forward until wind developers secured access to transmission lines.[10] And going forward, this means that wind generators do not have to “recover” the cost of the capital outlay for the transmission lines in their subsequent net profits. That is, wind generators can continue to be financially viable in a pricing environment that would be unsustainable for other generators that did not benefit from this kind of subsidy.

Texas is left with few alternatives to remedy this situation. It cannot abrogate federal tax credits, and it cannot require wind generators to put more skin in the game for transmission lines already built. Nevertheless, Texas must find a way to introduce longer-term stability and accountability into the wholesale electricity market to help ensure reliable electricity for Texans.[11] This will only become more imperative as lower-reliability renewable energy sources grow and come to predominate the Texas electricity market. Wind and other sustainable sources of electricity generation may offer the noteworthy benefit of carbon-neutrality. But until advances in technology make the storage of excess electricity generation a viable option or until other renewable generating sources come online, policymakers should work to ensure a reliable grid for all citizens.

Readers should note that this problem and its solutions are relevant outside of Texas as well. While Texas is ahead of the curve in wind generation capacity, other states have fast-growing wind capabilities. As wind energy continues to dominate new investment in electricity generation, other states will be able to learn from the lessons of Texas to help ensure they do not sacrifice the reliability of the electric grid for the benefits of low cost and sustainability promised by wind energy.

This Note sets forth a description of the electricity reliability problem in Texas, as well as proposed solutions. First, this Note describes the design of the Texas electricity market. Then follows a discussion of the interplay between the structure of the Texas electricity market and the emergence of wind-generated electricity. This Note concludes with descriptions and analyses of proposed solutions to the reliability problem, culminating with an enumeration of a novel proposition to the reliability problem in Texas: the introduction of a market for “generation rights.”

I. Overview of the Texas Electricity Market

A. Deregulation

In the late 1990s, Texas legislators sought to deregulate aspects of the Texas electricity market, which culminated in the passage of amendments to the Public Utility Regulatory Act (PURA) in 1999.[12] Under these amendments, the legislature found that the production and sale of electricity did not constitute a monopoly and that electricity prices should be determined by “customer choices and the normal forces of competition.”[13] As a result of the “deregulation” amendments to PURA, Texas’s wholesale and retail electricity markets began a fundamental change from markets characterized by regulatory rate-setting to today’s (mostly) free market.[14]

While PURA brought about fundamental changes to Texas’s electricity market, it left rulemaking and oversight authority over the market with the Public Utilities Commission of Texas (PUC)—including authority to make and enforce rules concerning the reliability of the electric grid.[15] The PUC, in turn, may delegate its rulemaking and oversight function to a duly-qualified “independent organization.”[16] The PUC has done so, entrusting the responsibility to administer and oversee the wholesale electricity market to the Electric Reliability Council of Texas (ERCOT).[17] But any rule made by ERCOT or the PUC must use “competitive rather than regulatory methods . . . to the greatest extent feasible” and must be narrowly tailored so as to “impose the least impact on competition.”[18] This strict-scrutiny-like test makes plain the Texas Legislature’s policy judgment that competitive forces should play a dominant role in the Texas wholesale electricity market. And indeed, after PURA’s amendments, wholesale electricity prices in Texas are the result of supply and demand for electricity on any given day.

B. The Emergence of Wind-Generated Energy

Perhaps ironically, the same PURA amendments that purported to deregulate the wholesale electricity market also introduced substantial new regulations that require electricity providers to derive a minimum amount of their electricity from renewable sources.[19] In complying with the statute, electricity providers could use either their own renewable energy generation, or they could purchase “renewable energy credits,” created by other provisions of the act.[20] Because of the combined effect of this legislative mandate, federal tax incentives,[21] and Texas’s windy climate, wind generation in Texas took off—so much so, in fact, that wind-generated electricity overwhelmed the grid’s existing transmission capacity, requiring ERCOT to curtail wind production in many cases.[22]

This congestion problem led to another issue—the so-called “chicken or egg problem.” That is, wind developers would not begin new projects until sufficient transmission capacity was established; at the same time, transmission utilities would not build new transmission infrastructure until wind developers guaranteed that their projects would be built and operated.[23] The Texas Legislature eventually solved this standstill by creating the “competitive renewable energy zones” (CREZ) program.[24] Under this new program, the legislature authorized the construction of transmission lines between Texas’s high-population metropolitan areas and the rural areas of the state ideal for wind farms.[25] In identifying these CREZ zones, the PUC—in consultation with ERCOT—was to consider various factors, including whether the area had suitable land for development of renewable electricity generation, as well as the level of financial commitment from generators within each area.[26] Once the PUC designated the CREZ, construction of the transmission lines began and was completed at a total cost of approximately $6.79 billion.[27] This cost was borne by the Texas ratepayers, not the transmission utilities or the wind generators.[28] Once the legislature solved the “chicken or egg problem,” wind generation development projects continued at their breakneck pace.[29]

The federal income tax code also contributed to the exponential growth of wind development projects. Specifically, § 45 of the tax code provides a variable tax credit for wind producers.[30] The base tax credit under this section is 1.5 cents per kilowatt hour ($15 per megawatt hour) of electricity produced from wind sources and sold to unrelated parties during a taxable year.[31] Compare this to the average wholesale price of electricity (which was about $38 per megawatt hour for ERCOT in 2019),[32] and one can see federal income tax credits offer a sizeable reward for wind generators—especially given the near-zero operating cost of a wind turbine. Indeed, many of the owners of Texas wind developments undertake these projects primarily for the tax benefits that such wind projects can offer—even if the wind project itself is not profitable.[33]

C. The Texas Electricity Market Today

The confluence of government actions and subsidies mentioned above led to exponential growth of wind energy in Texas. Today, Texas leads the nation in wind-generated electricity, producing about 28% of all U.S. wind-generated electricity in 2020.[34] And while the contribution of wind-generated electricity to the overall grid varies considerably by the hour,[35] on average, wind-generated energy accounted for nearly a fifth of total Texas electricity generation in 2019.[36]

In addition to the hourly variation in wind-generated electricity, there is also seasonal variability. The areas where most Texas wind turbines sit experience substantially more wind in the spring—and to a lesser extent, the fall—meaning there is more wind-generated electricity during those months as well.[37] For example, on a monthly basis in 2019, wind generation ranged from 6.3 thousand gigawatts in June to a high of 7.9 thousand gigawatts in April[38]—meaning the decrease from the highest to lowest generation month was more than 20%. Unfortunately, Texas consumers demand the greatest amount of electricity during the summer months, when the wind generation is historically at its lowest ebb.[39] In 2019, for example, the monthly energy load for ERCOT was around 33% greater in the months of June–September than during the remaining months of the year.[40] Because wind generation is at its trough during these months of peak demand, non-wind generators must make up the shortfall.

This discussion reveals some key realities about wind generation: (1) wind turbines can only produce electricity when the wind blows, (2) wind speeds are unpredictable by the hour, (3) the spring and fall seasons are historically windier, and (4) the summer months tend to be the calmest—when electricity demand peaks. These realities have material consequences to the Texas electricity market as a whole, especially given the current (and growing) prevalence of wind-generated electricity in the market.

II. Wind’s Effect on the Texas Wholesale Electricity Market

Wind-generated electricity plays a significant role in the Texas wholesale electricity market. First, the significant government subsidies available to wind generators give these generators the incentive to sell their electricity into the market at virtually any price point—even a negative price. Such behavior can distort the information typically conveyed by market prices and can thus lead suppliers to behave in ways they otherwise would not, generally distorting the wholesale electricity market. Second, because of the inelastic supply and demand commonly seen in electricity markets, even small changes in the quantity of electricity supplied can trigger dramatic swings in the wholesale price—and can even cause electricity shortages. And the inherent volatility of wind generation portends exactly these kinds of unexpected supply shifts. Finally, the increasing prevalence of wind-generated electricity in Texas means that the effects of wind generation on the broader market are substantial—and growing.

A. Federal and State Subsidies for Wind Generators

Government subsidies can distort the forces of supply and demand normally at play in a competitive market. In the case of wind-generated electricity, both the federal and state governments have provided substantial subsidies, as discussed below. These subsidies provide incentives to which wind generators naturally respond. In a competitive free market, however, these kinds of signals are normally sent by prices, which result from the market forces of supply and demand.[41] Wind generators’ responses to these extra-market signals have a significant effect on the workings of the wholesale electricity market.

As discussed above, the federal income tax code provides substantial tax credits to wind generators.[42] The effect of these tax credits is amplified because the very purpose of many wind generation projects is to take advantage of the tax benefits such projects offer. Specifically, a substantial number of these wind projects are backed by “tax equity” investors—that is, investors who contribute capital for the primary purpose of reaping the tax benefits associated with wind generation to offset their other federal income tax liabilities.[43] The incentive to harvest tax benefits combined with wind generators’ low marginal operating costs gives wind generators the incentive to produce and sell as much electricity as possible—regardless of wholesale electricity prices.[44] That is, when it costs a generator essentially nothing to harness the wind to generate electricity, it almost always makes economic sense to do so and sell the electricity into the market—even at negative prices, as when the generators pay the market to take the electricity. In so doing, the generator thereby receives (or perhaps pays) the wholesale price of the electricity sold and locks in the significant federal tax credits available to wind generators. These benefits are almost guaranteed to exceed the near-zero marginal operating costs of wind generation.[45] And the tax credits are not merely an ancillary benefit for wind generators. Indeed, some industry analysts estimate that generators realize as much from subsidies as they do from electricity sales revenue.[46] Notably though, wind generators must produce and sell electricity to qualify for the tax credit.[47] What this means for the broader market is that, when the wind is blowing, wind generators will be generating and selling as much electricity as they can into the market, suppressing prices in the process.[48] Conversely, when the wind is not blowing, the would-be supply from wind generators is missing, which elevates prices.[49]

Like federal government subsidies, state subsidies also play a role in the Texas electricity market. The CREZ transmission line project paved the way for the continued exponential growth of wind generation projects in Texas—at no cost to the wind generator beneficiaries.[50] Likewise, the Texas legislature’s mandate establishing minimum renewable energy goals made the pursuit of renewable energy mandatory for Texas generators, thereby ensuring the continued growth of wind generation in Texas.[51] Essentially, in the absence of these subsidies and legislative mandates, there would be far fewer wind projects in the state, and thus wind would play an undersized role in the broader wholesale market. In this way, the state’s subsidies amplified the market-distorting effects of the aforementioned federal tax credit subsidies.

B. Wind Generation Variability and Its Effect on a Market with Inelastic Supply and Demand

The market forces of supply and demand play a unique role in the wholesale electricity market. On the supply side, most traditional suppliers operate near capacity—especially during seasons of high demand.[52] This is so because of the capital-intensive nature of traditional electricity generation. Specifically, capital-intensive industries in general, and electricity generators in particular, have a high proportion of fixed costs relative to variable costs.[53] This means that the marginal cost of production is below the average cost for a plant operating below capacity.[54] And as long as the wholesale market price exceeds the marginal operating cost of the plant, a generator is better served by generating than by cutting off production in response to low price levels.[55] Thus, traditional generators are often incentivized to operate near capacity by the nature of their cost structure. This means that the supply of electricity tends to be inelastic—i.e., the quantity supplied stays fairly constant notwithstanding fluctuations in price.[56]

Demand also tends to be inelastic, meaning the quantity demanded remains roughly the same regardless of fluctuations in the wholesale price.[57] This makes intuitive sense. A typical customer will use electricity as his or her needs dictate.[58] Fluctuations in price on any given day are rarely even known by an end user. If a customer wants to conserve anything, it is the quantity of electricity consumed during a monthly billing cycle, regardless of the day-to-day price level.[59] The average—or even the well-informed—electricity customer does not know the wholesale price of electricity on any given day.[60] In fact, retail customers may not even be immediately exposed to fluctuations in the wholesale price, having contracted for a fixed rate for a set period of time.[61] Thus, electricity demand tends not to be influenced by fluctuations in prices.

When a market has inelastic supply and demand, even small swings in the supply curve can have dramatic effects on the market-clearing price.[62] This situation is exacerbated when the market is not fully competitive.[63] Such a situation can put even a small seller in a position of market power, because other suppliers—operating near capacity—cannot increase their output in response to the other seller’s actions.[64] While the Texas Legislature ostensibly deregulated the Texas wholesale electricity market with its amendments to PURA,[65] the market is not in any sense a genuine undistorted, competitive market. The presence of federal and state subsidies distorts the signaling function that market prices usually serve. Consequently, the concerns about supply inelasticity, worsened by a lack of market competition, are relevant for the Texas grid, leaving consumers exposed to dramatic price swings or even blackouts when supply decreases in times of high demand.

Unfortunately, wind generation necessarily involves the kinds of fluctuations in supply that can lead to such price shocks—and shortages—in a market with inelastic supply and demand. Three primary factors dictate the supply of wind-generated electricity on any given day—and each factor involves or promotes fluctuations in supply. Each of these factors has been explained in detail above. Briefly, they are: (1) federal tax credits and their role in incentivizing the maximum level of wind-generated electricity production at any price level;[66] (2) the role of state subsidies and legislative actions in helping to make the Texas wind industry larger (and thus more influential) than it would have been if the industry had been left to pure market forces;[67] and (3) the natural variability in wind speeds, which are unpredictable on an hourly basis and generally predictable based on the season.[68] Overall, when the wind blows, wind generators sell their generation into the grid, thereby lowering the overall price level. And when the wind is not blowing—which tends to happen when electricity demand peaks[69]—a substantial supply source diminishes and the price spikes.

C. The Example of August–September of 2019

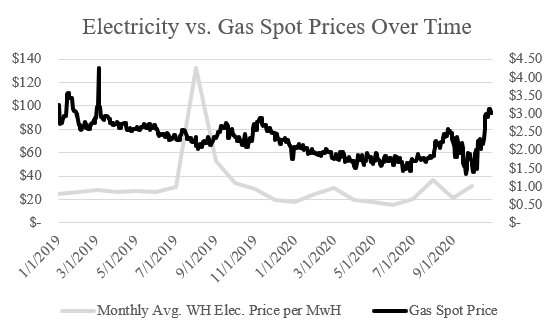

Texas has already experienced an example of the of the dramatic swing in price that can result from an unexpected shift in supply. While wholesale electricity prices in ERCOT tend to closely follow natural gas prices (see Exhibit A below),[70] this correlation broke down in August and September of 2019 due to a decrease in supply from wind generators.

Exhibit A[71]

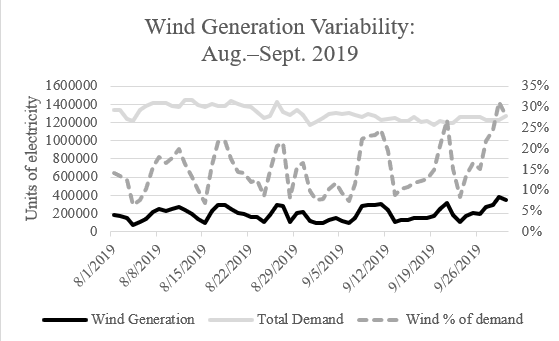

As shown above, wholesale electricity prices dramatically increased in response to a decrease in supply from suppressed wind output combined with typically elevated summer electricity demand conditions.[72] During this time frame, wind output—which experiences seasonal lows during the summer in any case—fluctuated significantly in relation to total electricity demand. Specifically, wind generation accounted for a low of 6.5% of total daily demand on an especially calm day and a high of 31.3% on a windy day during this period.[73] This wide range demonstrates the significant variability in wind generation. Importantly for the wholesale market, the days in August–September 2019 when wind generation dipped correspond to a decrease in electricity supply that caused the aforementioned price spikes.[74] On certain days, these price spikes approached 49,000%.[75] In response, ERCOT engaged its price caps—then set at $9,000 per Megawatt hour—and issued warnings about the potential need to initiate rolling blackouts to force electricity demand down to the level of available supply.[76] The August–September 2019 variation in wind generation is shown in Exhibit B below.

Exhibit B

Notably, the price spikes brought about by the dips in wind generation did not occur on the days of peak electricity demand.[77] Instead, the price spikes parallel the days experiencing the highest “net load”—that is, the total electricity demand minus wind and solar production.[78] This evidences the important role that wind generation plays in causing the kinds of supply shifts that can lead to price spikes. Because other generators operate near capacity at these times of elevated demand, they cannot respond to dips in wind-generated supply by boosting their own output. This results in a leftward shift in the supply curve, with steady demand levels, leading to significant increases in electricity prices and, potentially, shortages.

D. Long-Term Implications

The example of August and September of 2019 shows that the Texas wholesale electricity market is subject to the kind of price shocks that economic theory would predict for a market with inelastic supply and demand. As wind generation continues to grow, the problems experienced in 2019 could reoccur with greater frequency and could threaten the grid’s reliability on any given day. First, as mentioned above, the inherent variability in wind speeds can lead to reliability issues and price spikes when wind speeds dip and other generators are unable to fill the supply gap.[79] And because Texas winds tend to calm in the summer—when electricity demand peaks—increasing reliance on wind generation portends ominous consequences for grid reliability in Texas.[80] ERCOT’s reserve margin, which is the surplus between total generation available in the grid and forecasted peak demand, is already thin.[81] And increasing wind generation’s share of overall electricity generation will only exacerbate the problem. A heavy reliance on wind leaves policymakers with a choice between (1) building significantly more wind generation than typically needed to ensure that variability does not result in reliability issues or (2) ensuring traditional generators continue to operate and have the ability to increase their generation output in response to shortfalls in wind-generated electricity.[82]

Second, and perhaps more importantly, wind generation adversely affects the financial viability of traditional generators. The effects of wind generation make it financially more difficult for traditional generators to operate and dampen the incentive to make the kinds of long-term investments in new generation needed to help ensure the grid’s reliability into the future.[83] This is so for a variety of reasons. As discussed above, federal tax credits incentivize wind generators to generate as much as wind conditions allow, no matter the price level.[84] This means that the supply of electricity increases in windier periods, suppressing wholesale prices and thereby decreasing the revenues of traditional generators.[85] And even when traditional generators can take advantage of higher prices during times of high demand and decreased wind generation, ERCOT has imposed price caps that necessarily limit the amount of revenue generators can earn.[86] Furthermore, such times of high demand and low wind generation are few and far between, representing less than a quarter of the year (i.e., the late summer months). Overall, these conditions do not provide sufficient financial reward to ensure the generators’ continued viability and incentive to invest in future projects needed to maintain the grid’s reliability.[87] If traditional generators scale back or drop out of the market altogether, it will only make the grid’s future reliability problems more dire.[88]

This, in short, is the missing money problem: The “free market” for wholesale electricity does not adequately compensate traditional generators, but these generators are needed to ensure the grid’s reliability because of the variability of wind speeds.[89] And this problem will only worsen as wind generation continues to grow in relation to other generation sources.[90] If reliability has already become a concern when wind generation accounts for only a fifth of the grid’s total generation, the problem stands to worsen considerably when wind comes to predominate the wholesale market.[91] That is, in a world where concerns about climate change drive policy decisions to generate substantially all electricity from renewable sources (meaning the marginal cost—and thus price levels—will float around $0), how will the market fund the investment required to ensure the long-term provision of electricity?[92] Policymakers should craft solutions to this problem before it grows to threaten the reliability of the entire grid—especially in times of greatest demand.

E. Winter Storm Uri and the Exposure of Texas’s Unreliable Electricity Grid

In February 2021, Winter Storm Uri engulfed the entire state of Texas, bringing with it prolonged below-freezing temperatures, snow, and ice. This bitter cold resulted in electricity demand that significantly outpaced historical and expected seasonal demand.[93] At the same time, generation supply plummeted—for mostly weather-related reasons.[94] Gas-powered electricity outages peaked at more than 25,000 MW of lost capacity.[95] And wind-generation outages approached 20,000 MW of lost capacity at their apex.[96] Texas’s already-strained grid could not keep up, forcing ERCOT to “shed load” from the system.[97] This caused thousands of Texans to be without power, heat, and water—killing at least 246 people.[98]

As noted above, the generation outages experienced during the storm principally resulted from weather-related causes. For example, ice prevented many wind turbines from turning, and the bitter cold weather caused some natural gas-powered electricity plants to shut down.[99] Because the generation loss resulted from the weather’s impact on generation facilities, many have taken from the storm a lesson that electricity generation facilities simply need to be winterized.[100] While this is potentially a prudent idea, it does not get at the underlying problem with the Texas grid: Wind energy, with its government subsidies and inherent, uncontrollable variability has distorted a Texas wholesale electricity market that relies on market forces to ensure a sufficient and reliable source of electricity. Lean operating conditions are the status quo for the Texas wholesale electricity market—not a freak winter-storm-related exception. Any unexpected shift in supply or demand can pose a threat to grid reliability. Winter Storm Uri was just one example—though an extreme one. And, similar to the discussion of wind speed variability above, Winter Storm Uri was another example of how unpredictable weather can influence the capacity of wind turbines to generate electricity. It is this issue that policymakers should address going forward.

III. Proposed Solutions

To counteract the effects of wind energy on the grid’s overall reliability, policymakers realize the need to take proactive, creative action. Industry analysts have proposed a range of solutions to the reliability issues created by wind generation—some of which ERCOT is already implementing. First, grid operators might help ensure that generators are adequately compensated for providing electricity in times of scarcity. To do this, grid operators might remove price caps on wholesale electricity or develop a system of scarcity pricing in which the provision of energy in times of scarcity is rewarded with some type of bonus to be included in the wholesale price.[101] Second, end consumers of electricity could be incentivized to modify their electricity usage in response to electricity price levels—thereby decreasing the strain on the grid when suppliers would not otherwise be able to meet the market demand.[102] To be implemented successfully, consumers would have to be equipped with “smart meters” that would automatically reduce electricity consumption in response to real-time prices in accordance with each customer’s unique preferences.[103] Another solution involves the use of capacity markets. Here, the grid operator holds an auction where generators submit bids to supply a set amount of electricity over an extended period with electricity buyers allocated the cost of accepted bids over the same pre-defined term.[104] Finally, this Note proposes a novel solution to the reliability issues associated with wind energy, combining the best aspects of a market-based solution with the general idea behind capacity markets. This proposal would require purchasers to secure sufficient generation capacity in advance via the purchase of “generation rights” from generators. It would also penalize: (1) generators that do not live up to their generation commitments in the form of previously-sold generation rights and (2) wholesale purchasers that underestimate their customers’ electricity needs and therefore fail to purchase sufficient “generation rights” in advance. Each of these proposed plans has associated benefits and disadvantages, which are described in the sections that follow.

A. Market Compensation for Generators Supplying During Times of Scarcity

One solution policymakers have proposed theorizes that a free market should, on its own, provide adequate compensation to generators to ensure continued investment and grid reliability.[105] Under this approach (often referred to as an energy-only market), the grid operator supplements market prices with added bonuses called “scarcity prices” during times of scarcity, and price caps sit at significantly elevated price levels or are removed altogether.[106] The idea is that this structure will provide generators able to supply electricity during times of scarcity with adequate compensation to incentivize them to continue to be available to produce during future times of scarcity.[107] As a part of this plan, grid operators also contract for emergency backstop electricity supply to further ensure that the grid’s reliability is not imperiled.[108] Here, the overall goal is to rely on “scarcity pricing” to provide marginal suppliers with sufficient revenues to cover long-term investment costs.[109]

This approach has two primary benefits. First, it enables the market to withstand short-term, unexpected supply shocks.[110] That is, when supply levels decrease and prices rise in response, generators are incentivized to increase their supply to the maximum extent to take advantage of the increased prices available. This is especially so when grid operators offer so-called “scarcity pricing,” which provides a kind of bonus payment for sellers in times of scarcity.[111] When generators act to take advantage of elevated prices, it leads to increases in supply and decreases in price levels. Second, this approach allows for a solution that does not require a complete restructuring of the market, which would necessarily involve significant complexity and uncertainty.[112]

On the other hand, this market-based approach has significant downsides that outweigh the benefits. The main argument against this approach is that ERCOT already uses it, but the grid’s reliability problems persist nevertheless.[113] Additionally, this plan requires that emergency backstop resources procured by the grid operator are only used as a last resort in order to protect the market from distortions, and this is operationally difficult.[114] If the emergency backstop resources were deployed too soon, it would not allow the generators able to supply electricity during times of scarcity to be compensated by the elevated market prices to the greatest extent, thereby decreasing some of the incentive to be up and running during future times of low supply—a key characteristic of the energy-only market. But grid operators may be pressured to use the backstop procurement before it becomes absolutely necessary in the face of swelling electricity prices. Furthermore, this solution is completely supplier-focused and does not allow for a demand response (i.e., where end consumers can decrease their electricity usage based on price conditions).[115] Finally, this approach is inefficient, because it requires the grid operator to procure emergency backstop electricity supply.[116] That is, it requires administrative, rather than market-led, procurement solutions for the emergency backstop supply.[117]

Overall, this approach on its own does not provide a satisfactory solution to the reliability issues in the Texas grid. However, it does have the substantial benefit of allowing prices to provide information to suppliers, enabling them to inform their production decisions in a way that benefits the market as a whole.[118] Because of this, it is likely that aspects of this approach may be used in conjunction with other measures in responding to Texas’s reliability issues.

B. A Demand-Side Response

While most of the solutions to the so-called “missing money” problem focus on the supply side, one method approaches the problem from the demand side. Here, end customers can alter their electricity usage in response to changes in market prices.[119] For example, customers can elect to shut off electricity flow to certain appliances when prices reach a specified level.[120] This is achieved using “smart meter” technology—installed at each electricity customer’s location—which automatically executes the customer’s electricity usage prioritization decisions in response to real time fluctuations in electricity prices.[121] In many ways, this solution is the previous solution’s demand-side counterpart. That is, where the previous solution focuses on providing incentives to increase supply during times of scarcity—thereby lowering the price level—this approach seeks to incentivize actions that decrease demand (or at least make it more elastic), likewise bringing prices down to acceptable levels. Under this approach, reductions in demand decrease the price level and can thereby reduce the incentive for generators to sell electricity into the market, bringing the market back into more of a state of equilibrium.

Unfortunately, this solution is not yet workable for technological reasons. This is because the approach relies on widespread availability of smart metering technology, which is not yet available on such a generalized basis.[122] But even were the technology widely available, the solution involves another disadvantage. Namely, it involves a common-good-type problem.[123] That is, end users of electricity are faced with a collective action problem and are unwilling to voluntarily reduce their individual consumption to ease the strain on the grid.[124] Overall, this solution is, at present, unavailable but may be a valuable component of a broader solution when the technology becomes available on a widespread basis.

C. Capacity Auctions

Many jurisdictions have turned to capacity auctions in response to the “missing money problem.”[125] In a capacity market, the grid operator holds an auction at which generators submit bids to supply electricity on a long-term basis.[126] A regulatory body or the grid operator makes the decision of how much electricity to procure at the capacity auction.[127] At the auction, the price for capacity is determined by taking the lowest price at which the estimate of required capacity (including reserve margin) will be supplied in the future.[128] The goal of capacity markets is to directly allocate market value to generators able to guarantee a set amount of generation over a given time frame.

Capacity markets boast of many advantages. First, they impose resource adequacy on the overall market using a semi-market-based method.[129] As long as the grid operator holding the auction is roughly correct in its estimate of long-term demand[130] and bidders live up to their generation commitments, this method ensures that the demand for electricity will be satisfied. And in using an auction mechanism, this approach allows prices to provide signals to would-be market entrants and directly compensates generators for the valuable service of committing to supply electricity at a set time.[131] Capacity markets also improve transparency and predictability for investors regarding pricing.[132] This is so because generators—who would otherwise be subject to the whims of market prices—know in advance of a guaranteed source of revenue for their operations. This eliminates a substantial degree of uncertainty for generators and may make the difference between deciding to continue to operate (and invest in new generation capacity) or to shut down. Furthermore, the centralized auctions used in capacity markets tend to be easy to administer and monitor, and they tend to mitigate supplier market power in comparison to a bilateral market.[133] Finally, though many critics of capacity markets fear high capacity prices that unduly increase the cost of electricity to end consumers,[134] prices have been well below expectations in some jurisdictions that have adopted the capacity market approach.[135]

Capacity markets also have significant disadvantages—mostly concerning the central-planning-style role of the grid operator or regulator in determining the amount of long-term capacity to procure. The most important disadvantage of a capacity market system is that a regulatory-like body makes the long-term procurement decisions, rather than the entities actually buying electricity from generators.[136] This decision maker has one primary incentive: keep the lights on for end consumers.[137] Cost considerations are of only secondary importance, and this, in turn, leads to a risk of over-procurement.[138] And over-procurement leads to a vicious cycle ending in a command economy for wholesale electricity. First, over-procurement necessarily leads to lower future wholesale electricity prices because supply outpaces demand.[139] This situation will require higher future capacity auction prices to make up for generators’ diminished revenues from selling electricity.[140] Lower future wholesale prices also serve to raise the entry cost for new generators, given the decreased future revenue prospects for would-be market entrants.[141] And no generator would enter the market absent a capacity agreement in light of the substantial benefits that such an agreement gives a supplier under this system.[142] All this means that decisions about new generation become entirely up to the regulatory entity making the procurement decisions for the capacity auction, thereby extricating the key free-market feature that Texas sought to take advantage of in its electricity market.[143]

While capacity markets go a long way toward eliminating reliability issues for an electricity grid, they do so at a long-term cost that may not be worth it for Texas policymakers. On the one hand, capacity markets directly assign value to guaranteed future electricity generation.[144] But in doing so, capacity markets undermine the key tenet of Texas’s approach to its electricity market: that customers are best served by allowing supply, demand, and resulting price levels to inform the decisions of generators and consumers, thereby enabling the most efficient allocation of resources. Adopting the pure capacity market approach would be antithetical to Texas’s free-market approach to its electricity market.[145]

D. A Market-Based Approach to Compensating Capacity

Despite the many benefits associated with each of the approaches discussed thus far, none of them provides a complete solution to the missing money problem in Texas. The pure market (or energy-only) approach does not provide adequate compensation for generators able to guarantee generation capacity. The demand-focused approach—while promising for the future—is not currently feasible for technology reasons. And the capacity market approach has the significant weakness of tending to make the wholesale electricity market into a miniature command economy. On the other hand, each approach does have advantages that could help solve Texas’s reliability problems. An ideal solution would combine the best aspects of each proposed solution in a way that minimizes their associated disadvantages.

One such solution would combine the capacity market approach’s requirement that wholesale purchasers proactively secure expected future capacity needs with the pure market approach’s emphasis on decentralized decision-making. Specifically, this approach would require wholesale purchasers to lock in commitments from producers to generate enough electricity to cover expected demand many months (or even years) in advance—with financial incentives put in place to encourage an accurate estimate of demand and generation capacity. This could be achieved by creating a market for “generation rights”—i.e., privately negotiated contracts between generators and purchasers. The agreements would take the form of a commitment from a generator to produce a set amount of electricity at a set time in the future at either (1) a negotiated price or (2) existing market prices when the generation commitment comes due.

In return for the commitment, the generator would receive cash, based on the then-prevailing market price for the generation right. Generators would also receive a guarantee that they would be able to sell their electricity into the market before any generator not a party to such a generation right agreement. This would ensure that generators that invest the capital to meet their future electricity generation commitments are allowed to sell their electricity into the market before another generator that just happens to have electricity to sell into the market on a given day (for example, a wind generator—not a party to a generation right agreement—on a windy day). On the other hand, a generator failing to meet its commitment would have to make the generation right purchaser whole at then-prevailing market prices, plus penalties imposed.

Purchasers, for their part, would be naturally incentivized to accurately estimate their expected electricity demand, because penalties would be imposed for purchasing electricity in excess of generation rights held by a purchaser (that is, for underestimating demand). In this system, there would be no need for ex ante regulatory oversight of purchasers’ demand estimates. Instead, the presence of a penalty for purchases exceeding generation rights holdings would act as a sort of self-enforcing regulation. In this system, there is also no need for long-term prognostication of future electricity demand by a centralized grid operator. Instead, the appropriateness of wholesale purchasers’ demand estimates will be determined based on what the actual demand turned out to be—a much more objective and practical measure. ERCOT, with all its technical and grid-management expertise, would serve as the administrator of the generation rights market—a kind of stock exchange for the generation rights. That is, ERCOT would serve as an independent clearinghouse for generation rights transactions, settling transactions and assessing penalties between the various counterparties based on market rules and individual contracts.

Penalties imposed under this system could be used for a variety of purposes. First, the penalties might go toward helping “innocent” generators or purchasers whose counterparties did not live up to their commitments. For example, penalties imposed on generators that did not produce enough to meet their commitments under previously sold generation rights might go toward helping electricity purchasers buy electricity on the spot market. Alternatively, penalties could go to ERCOT for use in procuring backup or “ancillary” generation or for other reliability-enhancing measures like winterization. Ultimately, lawmakers could choose between these various proposals, or they could leave it to ERCOT or the PUC’s discretion. The main point of the penalties, though, is to provide the incentives to market participants that ultimately enhance the grid’s reliability.

A brief illustration may be helpful in explaining the mechanics of this proposal. Assume that at time period 0, a wholesale electricity purchaser estimates that electricity demand at time periods 1–3 will be 100, 105, and 110 megawatts (MWs), respectively. As a result, the generator purchases generation rights to cover exactly this expected demand for time periods 1–3 at prevailing market prices. Now assume that actual demand for time periods 1–3 is 105, 103, and 109 MWs, respectively. This means that the purchaser underestimated demand by 5 MWs at time period 1 and overestimated demand by 2 and 1 MWs at time periods 2 and 3, respectively. These results are shown in the table below.

Table 1: Purchaser Example

| Time Period | Expected Demand

(MW) |

Generation Rights Purchased

(MW) |

Actual Demand

(MW) |

(Under)/Over Estimate of Demand

(MW) |

| 1 | 100 | 100 | 105 | (5) |

| 2 | 105 | 105 | 103 | 2 |

| 3 | 110 | 110 | 109 | 1 |

Because of its 5 MW underestimate of demand for time period 1, the purchaser will be subject to a penalty for that time period. That is, the purchaser did not lock in enough generation rights commitments (100 MWs) to cover its actual demand (105 MWs) for time period 1. And notably, other purchasers would have priority over this purchaser who is seeking to purchase the 5 MWs for which it did not purchase generation rights in advance (subject to grid operational security). The penalty imposed on the underestimating wholesale purchaser would be calculated as follows:

Penalty = wholesale electricity spot price x underestimate of demand x (1 + penalty rate)

Because the purchaser had sufficient generation rights to cover its actual demand for time periods 2 and 3, it would not be subject to penalties for those time periods under the proposal.

Under this arrangement, the inclination by purchasers to significantly over-procure to avoid the penalties would be at least partially negated by their own profit incentives. That is, purchasers would not want to buy significantly more electricity than needed to avoid penalties if the cost of the excess electricity exceeded the potential under-procurement penalties. This risk of over-procurement could be managed through the fine-tuning of the penalty rate imposed. And in any case, as a purchase date draws nearer, a purchaser realizing it had over-procured electricity for that day could sell its excess generation rights (including to a generator that had realized it would be unable to meet its generation commitments under generation rights it had previously sold).

Similarly, in the dynamic market contemplated in this proposal, a purchaser that realized it did not have sufficient generation rights for an upcoming date could go to the market to purchase additional generation rights for that time period. In doing so, however, the purchaser would have to pay the now-prevailing (and probably higher) market prices for these generation rights because of the little advance notice to the generator. This too would incentivize the purchaser to lock in sufficient generating capacity in advance.

But at the same time, generators with more volatile capacity like wind generators—who might be more hesitant to aggressively sell generation rights for time periods far in advance with no long-range forecast of wind speeds—could step in and sell additional generation rights on short notice, with the added security of high wind speeds in the short-term forecast. Thus, this proposal would incentivize purchasers to lock in enough generation capacity to meet their expected demand far in advance but would also allow non-traditional generators like wind and solar generators to be available to step in on short notice and sell their excess capacity—perhaps even at premium prices. In this way, the market for generation rights effectively forces the demand and supply side of the markets to secure sufficient generation in advance. And in the long-term, it discourages market participants from assuming a given day will be windy (with the incremental wind generation capacity that comes with a windy day), while also providing wind generators a way to capture the excess generating capacity of a windy day in the short-term market for generation rights.

Next consider the generation side of the preceding example. At time period 0, a generator believes it can realistically generate 100, 105, and 110 MWs at time periods 1, 2, and 3, respectively. It therefore sells generation rights equal to its expected output at these time periods at prevailing market prices. This guaranteed cash helps the generator invest in its generation facilities to ensure it can live up to its future generation commitments. Importantly, it also reduces the uncertainty of its future revenue stream, since it has locked in a commitment to sell a given amount of electricity in the future. This reduction in uncertainty also promotes long-term investment in generating capacity. At time periods 1–3, the generator actually generates 100, 99, and 115 MWs at time periods 1, 2, and 3, respectively. This means that the generator produced enough electricity at time periods 1 and 3 to meet its commitments under the generation rights it previously sold. But at time period 2, the generator fell short of its prior commitments and would be subject to a penalty imposed by the grid operator. These results are shown in the following table:

Table 2: Generation Example

|

Time Period |

Generation Rights Sold

(MW) |

Electricity Generated

(MW) |

(Under)/Over Generation

(MW) |

| 1 | 100 | 100 | 0 |

| 2 | 105 | 99 | (6) |

| 3 | 110 | 115 | 5 |

In the mirror image to the wholesale purchaser, the generator will be subject to a penalty when it produces less electricity than it had previously committed to generate through its sale of generation rights. Specifically, at time period 2, the generator in this example would be subject to a penalty for the difference between its actual generation (99 MWs) and the electricity it committed to generate by selling generation rights (105). This penalty would be calculated as follows:

Penalty = generation shortfall x wholesale electricity spot price x (1 + penalty rate)

Conversely, for time periods 1 and 3, the generator would not be subject to a penalty because it generated at least as much electricity as it had previously committed to produce through its sale of generation rights. For these time periods, the generator could attempt to sell additional generation rights in the days preceding time periods 1 and 3 if it knew of its excess capacity. As discussed above, this is a feature of the dynamic market under the proposal—as opposed to a capacity market that does not allow for additional capacity transactions after the capacity auction has concluded (months or years in advance).

Alternatively, the generator could sell the excess capacity into the spot market at time periods 1 and 3 at prevailing spot prices (without having previously sold generation rights). Similar to wholesale purchasers, though, a generator transacting in the spot market without a corresponding generation right would be prioritized below a generator selling under a corresponding generation right. That is, a generator selling without a corresponding generation right would only be able to sell into the market after transactions executed under a generation right had cleared the market (again, subject to grid security considerations). ERCOT would make rules about this aspect of the market and would oversee its execution in practice.

Like wholesale purchasers, generators can avoid the imposition of penalties by taking proactive measures. Specifically, if a generator suspects that it will not be able to meet its electricity production commitments prior to the relevant time periods, the dynamic market considered by the proposal would allow the generator to attempt to transfer its generation rights to another generator—or buy generation rights held by a purchaser—at prevailing market prices. As discussed above in the context of the wholesale purchaser, prices for generation rights closer to their “maturity date” would likely be much higher, resulting in a financial loss to the generator seeking to transfer generation rights that it cannot expect to honor. But in doing so, the generator can avoid the penalties imposed on generators that do not produce enough electricity to meet the commitments resulting from the generation rights they sold. In this way, the proposed system enables market participants to self-correct. And by engaging in this proactive self-correction, the proposal helps avoid the kinds of short-term supply and demand shocks that result in price spikes and blackouts for consumers. This is because suppliers and wholesale purchasers would be continuously monitoring whether their prior estimates align with current market conditions and retail demand—making proactive adjustments to account for any unforeseen developments. By doing so, they both avoid financial penalties and efficiently maintain the reliability of the grid.

As the example shows, the proposal as applied to generators would: (1) provide the guaranteed cash necessary to invest in electricity generation infrastructure needed for the future, (2) incentivize generators to commit to produce only what they could reasonably expect to generate for a given time period, (3) provide flexibility to generators to sell excess capacity in the near term, and (4) incentivize generators and wholesale purchasers to be proactive in adjusting to changing market conditions to avoid financial penalties and thereby help ensure grid reliability.

This proposed system would also give non-wind generators the longer-term view needed to justify substantial capital outlays necessary to ensure the grid’s long-term reliability. This long-term view would incentivize the kinds of winterization improvements that must be mandated by the legislature in the current system in response to Winter Storm Uri. This is because generators would seek to avoid the penalties imposed for failing to meet their future generation commitments (including for weather-related reasons) under the generation-rights system. The proposed system would also allocate value to the reliability aspect of electricity generation—a real and valuable asset. This value would be assigned by the forces of supply and demand in the market and would retain the traditional informational role of prices that is lacking in the capacity market model.

Importantly, this approach aims to solve the missing money problem in a way that leaves the decision of how much electricity to procure to entities with skin in the game rather than a regulatory body whose chief incentive is to keep the lights on[146]: Reliability is important, but the grid design should not facilitate waste at the expense of everyday consumers. Furthermore, this solution would introduce accountability into the system that would help reduce the risk that the market is materially affected by variations in wind patterns. While wind generators—like every other generator—would be able to sell generation rights, they would be incentivized to only commit to what they could reliably produce in light of the inherent variability in wind speeds (both seasonal and daily). On the other hand, as discussed above, the dynamic shorter-term market offered by the proposed system would give non-traditional generators the flexibility to sell their excess capacity and to step in and fill short-term supply gaps.

Critics of the system might argue that it puts wind generators at a significant disadvantage because of their inability to reliably forecast wind speeds on a long-term basis—thus making their participation in the sale of long-range generation rights risky. But wind generators still have many advantages in the proposed system—notably their near-zero marginal cost of production and the government subsidies available for renewable generation. The goal of the system is not to stifle renewable energy generation. Instead, the proposal seeks to maximize the low-cost and sustainable characteristics of wind energy without sacrificing the reliability of the grid—something that everyday Americans depend on.

Of course, this approach is not without its challenges. It is an untested method; the author knows of no grid to have employed this approach.[147] Additionally, this solution involves administrative complexity in that the grid operator would act as a clearinghouse of sorts for the generation rights market—ensuring that penalties are assessed completely and accurately for purchasers that underestimate electricity demand or generators that fail to live up to their production commitments. This role may prove burdensome and complicated—though surely no more so than the role ERCOT already plays in administering the day-to-day wholesale electricity market with all its associated complexities. Furthermore, as with capacity markets, the longer the forward time frame to estimate electricity demand, the greater the uncertainty and potential for estimation error. That said, this market solution would allow participants to dynamically adapt to changing conditions by buying and selling generation rights as conditions warranted—though they might be met with less favorable market prices for generation rights if their initial estimates proved insufficient. Finally, this approach would likely be seen as an attack on renewable energy in favor of politically connected natural gas extractors and electricity generators. While this is a purely political downside, it may prove significant nonetheless. Perhaps such concerns could be allayed by proposing that a portion of penalties paid under the proposal be used to offset retail customers’ electricity bills during periods of high prices.

While these challenges are significant, the benefits of this approach may prove greater still. This approach should allow the PUC to fulfill its mandate to ensure a reliable electricity source for consumers in a way that relies—to the greatest extent possible—on market forces that harness the efficient resource allocation power of a free market.

Conclusion

While the rapid growth of wind generation in Texas likely brings with it associated environmental and cost benefits (notwithstanding the potential for price spikes discussed), it also poses challenges to the grid’s continued reliability. Policymakers should take on these issues now before they become a crisis to be addressed without the benefit of time for contemplation on how best to solve the problem. While analysts have offered a range of proposed solutions to the problems that come with substantial wind-generation, none offered to date provides a complete, workable solution. The best approach may be to require purchasers to secure long-term generation commitments in a system that combines the best elements of the capacity market and pure free market (energy-only) approaches. This proposal addresses the problem in a way that respects the Texas Legislature’s chosen approach of relying on free markets to efficiently allocate resources.

- .See infra notes 34–38 and accompanying text. ↑

- .See infra note 36 and accompanying text. ↑

- .See infra notes 83–92 and accompanying text. ↑

- .See infra notes 53–82 and accompanying text. ↑

- .See infra notes 42–51 and accompanying text. ↑

- .I.R.C. § 45(a). ↑

- .Alison Lund, Map of the Month: Wind Energy in Texas, Texas A&M Nat. Res. Inst.

(Dec. 21, 2017), https://nri.tamu.edu/blog/2017/december/map-of-the-month-wind-energy-in-texas/ [https://perma.cc/4JAK-2FDM]; see infra notes 23–29 and accompanying text. ↑ - .Lund, supra note 7. ↑

- . Id. ↑

- .See infra note 23 and accompanying text. ↑

- .While some have suggested that Texas has caused its own problems by refusing to interconnect its grid with other states, it is far from clear that this would solve Texas’s reliability issues. See, e.g., Cayla Harris, Benjamin Wermund & Staff Writers, Should Texas Join the National Power Grid? Congressional Democrats Say It’s Worth Exploring, Houston Chronicle (Feb. 19, 2021, 6:49 AM), https://www.houstonchronicle.com/politics/texas/article/Should-Texas-join-the-national-power-grid-15961654.php [https://perma.cc/3PUA-2H48]. Texas is a leader in wind energy, and other grids may begin to experience the same reliability issues as Texas as they increase their reliance on wind. Also, Texas’s vast size might make it difficult—or at least expensive—to “share” electricity from other states with large population centers located deep within the state. In any case, the idea of grid integration is beyond the scope of this paper. ↑

- .1999 Tex. Sess. Law Serv. ch. 405 S.B. 7 (West) (codified at Tex. Util. Code Ann. §§ 39.001–.918). ↑

- .Tex. Util. Code Ann. § 39.001(a) (West, Westlaw through 2021 Regular and Called Sess.). ↑

- .Notably, the transmission and distribution aspects of the electricity industry remained regulated monopolies. See id. (excepting transmission and distribution services from the scope of the law’s deregulatory aim). ↑

- .Id. § 39.151(d) (Westlaw); see also id. § 39.101(a), (e) (Westlaw) (granting the PUC the authority to issue regulations to ensure customers have “safe, reliable, and reasonably priced electricity” and providing that the PUC may enforce such regulations with civil and administrative penalties) (emphasis added). ↑

- .Id. § 39.151(c) (Westlaw). ↑

- .16 Tex. Admin. Code § 25.361(a), (b) (West, Westlaw through 2021). ↑

- .Util. § 39.001(d) (Westlaw). ↑

- .1999 Tex. Sess. Law Serv. ch. 405 S.B. 7 (West) (codified at Tex. Util. Code Ann. § 39.904). This requirement created a government-imposed market for renewably-sourced electricity—acting as another subsidy for wind generators. See infra note 51 and accompanying text. ↑

- .Util. § 39.904(b) (Westlaw). ↑

- .See infra notes 40–48 and accompanying text. ↑

- .Becky H. Diffen, Competitive Renewable Energy Zones: How the Texas Wind Industry Is Cracking the Chicken & Egg Problem, 46 Rocky Mtn. Min. L. Found. J. 47, 65 (2009). ↑

- .Id. at 66–67. ↑

- .Util. § 39.904(g) (Westlaw). ↑

- .Id. ↑

- .Id. Notably, the “financial commitment” from generators to be considered by the PUC did not require that the generators contribute capital to construct the proposed transmission lines. Instead, the PUC considered commitments to build additional renewable generation in the areas in question, as well as commitments to build lines to connect renewable generation to the to-be-constructed CREZ transmission lines. 16 Tex. Admin. Code § 25.174(c), (e)(3) (West, Westlaw through 2021). That is, the “financial commitment” considered by the PUC asked whether developers were committed to building wind turbines, assuming transmission lines were constructed. ↑

- .Kate Galbraith, Cost of Wind Power Transmission Lines Rises Sharply to $6.79 Billion, Tex. Trib. (Aug. 24, 2011, 3:00 PM), https://www.texastribune.org/2011/08/24/cost-texas-wind-transmission-lines-nears-7-billion/ [https://perma.cc/K98M-FZZE]. ↑

- .Id.; Jim Malewitz, $7 Billion Wind Power Project Nears Finish, Tex. Trib. (Oct. 14, 2013, 6:00 AM), https://www.texastribune.org/2013/10/14/7-billion-crez-project-nears-finish-aiding-wind-po/ [https://perma.cc/5EX4-BN5K]; see also Util. § 39.904(g)(2) (Westlaw) (providing that the transmission construction plan be made “in a manner that is most beneficial and cost-effective to the customers”) (emphasis added). ↑

- .See Net Generation by State by Type of Producer by Energy Source, U.S. Energy Info. Admin. (Oct. 8, 2021), https://www.eia.gov/electricity/data/state/ [https://perma.cc/29YM-CQ7F] (reporting an increase in Texas net wind generation of over 1,800% between 2005 and 2019—a compound annual growth rate of 23.7%). ↑

- .I.R.C. § 45. ↑

- .Id. § 45(a). This credit is also subject to certain phaseouts beyond the scope of this paper. See id. § 45(b) (describing the phaseout of credit). ↑

- .Wholesale Electricity Prices Were Generally Lower in 2019, Except in Texas, U.S. Energy Info. Admin. (Jan. 10, 2020), https://www.eia.gov/todayinenergy/detail.php?id=42456#:~:text=

Day%2Dahead%2C%20around%2Dthe,13%25%20from%20their%202018%20average [https://

perma.cc/N3N9-2L5H]. ↑ - .See Brent Bennett, Karl Schmidt, Jr. & Gary Faust, Texas Pub. Pol’y Found., The Siren Song that Never Ends: Federal Energy Subsidies and Support from 2010 to 2019, at 6–7 (2020) (describing the role of “tax equity investors” that provide capital to build wind turbine facilities in exchange for allocations of the tax credits generated by the projects, which incentivizes wind generators to “produce as much electricity as possible regardless of market conditions”). ↑

- .Texas State Profile and Energy Estimates, U.S. Energy Info. Admin. (Apr. 15, 2021), https://www.eia.gov/state/?sid=TX [https://perma.cc/3Z3Y-TV7M]. ↑

- .For example, the contribution of wind to total energy generation varied from as little as 0.2 gigawatts to as much as 21.2 gigawatts on an hourly basis in the first nine months of 2020. Wind Is a Growing Part of the Electricity Mix in Texas, U.S. Energy Info. Admin. (Oct. 15, 2020), https://www.eia.gov/todayinenergy/detail.php?id=45476 [https://perma.cc/LG73-AZQR]. ↑

- .See U.S. Energy Info. Admin., supra note 29 (demonstrating that wind generation accounted for 83.6 million megawatt hours—or 17.3%—of the state’s total electric power generation for 2019). ↑

- .See U.S. Energy Info. Admin., supra note 35 (noting that wind generation in Texas is usually highest in the windier spring season). ↑

- .Id. ↑

- .See, e.g., 2019 Demand and Energy Report, ERCOT (Mar. 9, 2020), http://

www.ercot.com/content/wcm/lists/172485/DemandandEnergy2019.xlsx [https://perma.cc/7YM6-WAB2] (reflecting that peak hourly electricity demand for the months of June through September ranged from 68,159–74,820 megawatts, compared to a range of 51,640–65,304 megawatts for the non-summer months). ↑ - .See id. (revealing a per-month average net energy available for a load of 38.4 million megawatts for the months of June through September compared to 28.8 million megawatts for the non-summer months). ↑

- .E.g., F.A. Hayek, The Use of Knowledge in Society, 35 Amer. Econ. Rev. 519, 526 (1945). Recognizing the important signaling function of prices, F.A. Hayek has famously noted:Fundamentally, in a system where the knowledge of the relevant facts is dispersed among many people, prices can act to coördinate the separate actions of different people . . . . The whole acts as one market, not because any of its members survey the whole field, but because their limited individual fields of vision sufficiently overlap so that through many intermediaries the relevant information is communicated to all.Id. ↑

- .See supra notes 30–33 and accompanying text. ↑

- .Bennett, supra note 33, at 6–7. Note, too, that the other investors in the wind farm project may not receive income allocations until the tax equity investor has earned its negotiated rate of return. See Michelle D. Layser, Improving Tax Incentives for Wind Energy Production: The Case for a Refundable Production Tax Credit, 81 Mo. L. Rev. 453, 478–79 (2016) (describing the typical structure of a wind project operating agreement whereby tax equity investors receive all income and tax distributions until reaching their negotiated rate of return). This structure further incentivizes a wind farm operator to sell electricity at low price levels, because the sooner the tax equity investor achieves its target rate of return, the sooner the other owners can get paid. ↑

- .Bennett, supra note 33, at 7. ↑

- .Of course, the available tax credits alone are insufficient to incentivize a would-be developer to commit the substantial capital required to build a wind farm. One analysis suggests that the (undiscounted) federal production tax credit may end up paying for around 38% of the initial capital cost of a turbine project. Magdi Ragheb, Economics of Wind Power Generation, in Wind Energy Engineering: A Handbook for Onshore and Offshore Wind Turbines 537, 549 (Trevor M. Letcher ed., 2017). Relatedly, a typical tax equity investor in a wind project may be willing to contribute up to 60% of the up-front capital of the project. See Layser, supra note 43, at 478. Thus, tax incentives are just one factor—albeit an important one—that goes into longer-term investment decisions concerning wind farms. But once a wind farm is built—as so many already have been—the up-front capital outlay is a sunk cost, and the only relevant question becomes: Does the marginal revenue of selling electricity into the grid (i.e., revenue plus production tax credit) exceed the near-zero marginal operating cost? As has been noted in this subpart, it most often does. ↑

- .Bennett, supra note 33, at 11. ↑

- .I.R.C. § 45(a)(2)(A)–(B). ↑

- .Bennett, supra note 33, at 7 (discussing the “strong distorting effect on electricity markets” of federal tax credits for wind generation, which constrain prices when the wind is blowing and inflates prices when it is not). ↑

- .Id. ↑

- .See supra notes 27–29 and accompanying text. ↑

- .See Tex. Util. Code Ann. § 39.904(b) (West, Westlaw through 2021 Regular and Called Sess.) (“Any retail electric provider . . . that does not satisfy the [minimum renewable energy] requirements . . . by directly owning or purchasing capacity using renewable energy technologies shall purchase sufficient renewable energy credits to satisfy the requirements by holding renewable energy credits in lieu of capacity from renewable energy technologies.”). ↑

- .See infra notes 53–56 and accompanying text; see also NERC Report Highlights Potential Summer Electricity Issues for Texas and California, U.S. Energy Info. Admin. (June 18, 2019), https://www.eia.gov/todayinenergy/detail.php?id=39892 [https://perma.cc/E2WE-F56W] (noting that ERCOT “may have relatively little unused electric generating capacity during times of peak electric load”). ↑

- .Severin Borenstein, The Trouble with Electricity Markets: Understanding California’s Restructuring Disaster, 16 J. Econ. Persp., Winter 2002, at 191, 196. ↑

- .Id. ↑

- .Id. ↑

- .Id. at 195–96. ↑

- .Id. ↑

- .See id. at 196 (noting the inelastic demand for electricity among United States consumers). ↑

- .See, e.g., Setting Goals to Reduce Your Energy Use, Sense (Apr. 23, 2018), https://blog.sense.com/reduce-energy-use-goals-and-budget [https://perma.cc/9J65-MYF2] (discussing energy spending reduction goals in terms of long-term appliance use and monthly billing cycle time frames). ↑

- .See Shannon Najmabadi, Texans Blindsided by Massive Electric Bills Await Details of Gov. Greg Abbott’s Promised Relief, Tex. Trib. (Feb. 22, 2021, 3:00 PM), https://

www.texastribune.org/2021/02/22/texas-pauses-electric-bills/ [https://perma.cc/GJA2-F7WB] (describing the large electricity bills received by unknowing customers on variable rate electricity plans during Texas’s Winter Storm Uri). Admittedly, the author is not himself aware of the day-to-day fluctuations in Texas wholesale electricity prices. ↑ - .See, e.g., Pub. Util. Comm’n of Texas, Plan Results for Zip Code 75219, Power to Choose, http://www.powertochoose.org/en-us/Plan/Results [https://perma.cc/NC7D-SKWQ] (listing residential electricity plans with fixed rates for electricity usage from 3–36 months in term). ↑

- .See Borenstein, supra note 53, at 195–97 (“The price volatility resulting from inelastic demand and inelastic supply (when output nears capacity) is further exacerbated by the high capital intensity of electricity generation. . . . Even small changes [in demand] will lead to a price boom or bust.”). ↑

- .Id. at 196. ↑

- .Id. ↑

- .See supra notes 12–14 and accompanying text. ↑

- .See Bennett, supra note 33, at 11–12 (describing the role of federal tax incentives on average wholesale electricity prices in Texas, which “almost doubled from 2016 to 2019 despite little change in natural gas prices”). ↑

- .See Robert Michaels, Texas Pub. Pol’y Found., Intermittent Generation Comes to Texas: The High Cost of Renewable Energy 6 (2019) (discussing the distortive market effects of Texas’s CREZ project); see also David Newbery, Missing Money and Missing Markets: Reliability, Capacity Auctions, and Interconnectors, Energy Pol’y, July 2016, at 401, 405 (asserting that increasing the amount of renewable capacity (1) “add[s] little” to reliable capacity when it is unavailable when needed most, (2) requires construction of generation capacity significantly above average demand because of intermittency issues, and (3) decreases wholesale prices in windy conditions thereby threatening traditional generation sources’ viability). ↑

- .See supra notes 35–40 and accompanying text. ↑

- .See supra notes 39–40 and accompanying text. ↑

- .Potomac Econ., 2019 State of the Market Report for the ERCOT Electricity Markets 6–7 (2020). ↑

- .This graph was created using hourly wholesale electricity pricing data compiled from ERCOT from January 1, 2019, through October 31, 2020, ERCOT Real-time Price, Energy Online, http://www.energyonline.com/Data/GenericData.aspx?DataId=4 [https://perma.cc/