Regulating Motivation A New Perspective on the Volcker Rule

The myriad problems with the Dodd-Frank Act’s ban on proprietary trading by banks have led to a rare bipartisan consensus: the Volcker Rule must be pared back or even repealed. At the root of the Rule’s problems is the fundamental definitional challenge posed by the current approach. The definition of banned proprietary trading turns on the motivation underlying a trade, which is difficult for regulators to determine. Regulators must adopt either a hardline approach that risks deterring banks from engaging in core financial intermediation functions or a more permissive approach that risks the continuance of speculative gambles that threaten the financial system.

We propose a new paradigm for achieving the Volcker Rule’s objectives that resolves this dilemma. Rather than define and ban proprietary trading, regulators should simply ban banks from paying traders on the basis of trading profits. Our proposal takes advantage of the competition between proprietary trading firms in two markets: they compete in the securities market to identify and exploit trading opportunities, and they compete in the labor market to hire and motivate the best traders. Because speculative trading is a zero-sum game, handicapping banks relative to unregulated entities, such as hedge funds, in the labor market for traders would generate powerful incentives for banks to get out of the trading game. Our simple compensation-based approach would likely be more effective at ending speculative trading at banks—and do so at lower cost—than the complex and loophole-ridden current approach.

If you want to be trading, you have to have a lawyer and a psychiatrist sitting next to you determining what was your intent every time you did something.

Jamie Dimon, CEO of JPMorgan Chase & Co., Jan. 9, 2012[1]

Introduction

The Volcker Rule is among the most controversial provisions of the Dodd-Frank Act. By banning proprietary trading by banks and their affiliates, the rule attempts to reduce the risk-taking of banks. But “proprietary trading” is an amorphous concept. The rule is intended to ban speculative trading aimed at profiting from short-term price movements. Many core functions of banks, however, entail the bank buying and selling financial instruments and assuming price risk as a principal for its own account. The Volcker Rule does not seek to constrain such trading if it is incidental to core financial intermediation functions, like market making, but rather only proprietary trading of a “speculative” sort. Determining whether a transaction constitutes banned proprietary trading therefore requires an inquiry into the motivation for the trade. Did the bank buy these securities to meet an anticipated client need or for some other permissible motivation, or is the bank just making a bet that their price is headed up?

The challenge in identifying the type of transactions that should be prohibited has led to a complicated scheme of definitions, presumptions, carve-outs, and quantitative tests. Roberta Romano argues that the resulting “Rube Goldberg-like Volcker Rule,” at “over 900 pages,” will “produce further surprises, in addition to imposing substantial compliance costs.”[2] While this is somewhat of an exaggeration on length—the regulatory release in total may run around 900 pages, but the text of the final rule itself is a mere 40[3]—compliance is indeed expensive.

More fundamentally, the definitional challenges inherent in the approach create real risks of both under- and over-deterrence. Speculative trading at some banking entities may continue under the rule, while at others, socially valuable intermediation activities like market making may be inhibited out of fear that the necessary transactions would be mistaken for illegal proprietary trading. These problems also plague a similar proposal by the European Commission to define and ban proprietary trading at EU banks.[4]

Concerns about the cost and effectiveness of this “define and ban”-type regulation have led prominent academic commentators to conclude that the game is not worth the candle and to call for the repeal of the Volcker Rule,[5] a call taken up in draft legislation recently introduced in Congress.[6] Existing proposals for reform short of repeal entail tinkering with the same basic define-and-ban approach.[7]

But what if there were a better way to achieve the objectives of the Volcker Rule, at far lower cost, based on a fundamentally different regulatory strategy? Instead of the current define-and-ban approach, we propose that banks should simply not be permitted to pay compensation to traders based on trading profits. If banks cannot pay traders based on trading profits, neither the bank nor individual traders would want to engage in speculative proprietary trading, and banks would have incentives to devise their own schemes that permit trading that is incidental to core banking functions but eliminate speculative trading.

Our proposal takes advantage of the competition between firms in two key markets that are essential to proprietary trading: the securities market and the labor market for traders.[8] First, firms that engage in the type of speculative trading targeted by the Volcker Rule compete in the securities market to identify and exploit trading opportunities. Doing so requires skill in acquiring and analyzing information that predicts future price movements of securities. Importantly, however, making bets on short-term price movements of securities is inherently a zero-sum game: for every winner, there is a loser. For a trader to systematically earn profits from speculative trading requires not some absolute level of skill but rather a high degree of relative skill. The trader must be better at predicting future price movements than the counterparties with which he or she trades, which include other speculative traders.

Second, given the importance of having skillful traders, firms that engage in proprietary trading must compete for these traders in the labor market. To attract and incentivize trading talent, firms offer high-powered incentive contracts in which the individual trader enjoys a significant share of his or her trading profits. The individual traders who excel at this game are rewarded handsomely for it. Many different types of firms compete for the same trading talent, including hedge funds and other types of entities outside the scope of the Volcker Rule as well as the banking entities subject to the rule.

Our proposal is based on a simple insight that follows from the competition between proprietary trading firms in these two markets. Prohibiting banking entities from paying individuals based on their trading profits would put them at a substantial disadvantage to unregulated entities like hedge funds in the labor market for traders. Because of the zero-sum nature of betting on short-term price movements, firms that can only attract subpar traders—the “B-team”—do not merely stand to make lower profits than firms with traders in the A-team, they stand to make losses. Put simply, if a firm cannot attract and motivate the best trading talent, it is better off staying out of the speculative trading game altogether. Thus, banning banking entities from paying individuals based on their trading profits would create powerful incentives for banks to cease such trading. Our simple compensation-based approach would likely be more effective at ending speculative trading at banks—and do so at lower cost—than the complex and loophole-ridden current approach.[9]

Our Essay proceeds as follows. In Part I we summarize, and discuss the shortcomings of, the current define-and-ban approach to implementing the Volcker Rule. Next, in Part II, we explain our alternative approach of banning banks from compensating traders based on their trading profits. In Part III we address potential objections to our approach. Part IV concludes.

I. The Volcker Rule

Section 619 of the Dodd-Frank Act, commonly known as the Volcker Rule, prohibits banking entities from engaging in proprietary trading or from maintaining an interest in or sponsoring a hedge fund or private equity fund.[10] “Banking entities” are defined as insured depository institutions, any company that controls an insured depository institution, any bank holding company, or any affiliate or subsidiary of a bank holding company.[11]

A. The Justification for the Rule

For purposes of this Essay, we take as given the Volcker Rule’s objective of eliminating proprietary trading by banks and simply ask how best to achieve that objective. The primary goal of the Volcker Rule is to reduce the systemic risk posed by banking entities and to increase financial stability.[12] Speculative trading by banks aimed at profiting from short-term price movements of securities inefficiently increases the riskiness of bank assets and therefore systemic risk. Such bank risk-taking is expected to be socially excessive because of the spillovers caused by bank failures. Banks play crucial roles in credit intermediation and in the payments system. Moreover, the failure of any one bank can have a domino effect on the health of other banks. As the recent financial crisis painfully demonstrated, bank failures produce outsized social costs. Concern over those costs motivates prudential regulation generally, including restrictions like the Volcker Rule on the activities of banking entities.

The problem of excessive bank risk-taking is exacerbated by the moral hazard that results from formal and informal government guarantees. Taxpayers bear much of the cost of the failure of an insured depository institution. In addition, large banking entities affiliated with insured depository institutions, even if they are not themselves insured depository institutions, enjoy an informal guarantee. This informal guarantee results from the expectation that the government is likely to bail out “too big to fail” institutions in times of crisis.[13]

Proprietary trading by banks can also crowd out their core functions of deposit-taking and lending.[14] In short, banks might be tempted to allocate their scarce funds to short-term trading rather than investing in long-term lending, and it is the latter activity that may justify the special government subsidies that banks enjoy.[15]

Another concern motivating the Volcker Rule was that proprietary trading by banks produces conflicts of interest vis-à-vis their customers.[16] For example, a bank might profit from betting against a financial instrument that the bank itself had created and sold to customers, as Goldman Sachs was accused of doing during the run-up to the financial crisis.[17]

In addition to these incentive problems, Paul Volcker himself took the position that proprietary trading at banks had eroded the conservative bank risk-management culture. The idea is that the outsized compensation packages of traders that gave them powerful incentives to take risks had resulted in a shift in organizational culture at the bank more generally toward excessive risk-taking.[18]

Finally, proprietary trading by banking entities was an attractive regulatory target because allowing it conferred little benefit.[19] Banks do not seem to enjoy meaningful economies of scope in proprietary trading.[20] And other asset managers including hedge funds already engage in proprietary trading and could be expected to fill any gap left by the exit of banks from this activity.[21]

B. The Prohibition on Proprietary Trading

Under the Volcker Rule, a banking entity may not engage in “proprietary trading,” which is defined as “engaging as principal for the trading account of the banking entity in any purchase or sale of one or more financial instruments”[22] unless a specific exception applies. The scope of that definition in turn hinges largely on the meaning of “trading account.” The primary test is purpose-based and encompasses accounts used by a banking entity to trade financial instruments principally for the purpose of reselling in the short term; profiting from arbitrage or short-term price movements; or hedging against a position resulting from one of the foregoing.[23] A position held by a banking entity for fewer than sixty days or a position with respect to which a banking entity transfers the risk within sixty days is presumed to meet this test.[24]

C. Exceptions to the Prohibition on Proprietary Trading

The statutory rule carves out from its prohibitions certain permitted activities that represent or are integral to core banking functions performed in the service of banks’ customers.[25] The three most important permitted activities for our purposes are market making, underwriting, and hedging.

1. Permitted Market Making-Related Activities.—Market making entails a banking entity acting as an intermediary to match buyers and sellers, including by purchasing and holding in its inventory a financial instrument for which there is not a ready market buyer, or conversely, selling from its inventory a financial instrument for which there is not a ready market seller. Such market making-related activities are permissible if they comply with specific regulatory requirements. Among others, the trading desk purporting to engage in market making must exhibit the traits generally characteristic of a market making operation;[26] the banking entity must establish a reasonable internal compliance program;[27] and compensation arrangements may not be designed to reward or incentivize banned proprietary trading.[28]

2. Permitted Underwriting Activities.—Also permissible under the final rule are underwriting activities.[29] As an underwriter, the banking entity facilitates debt and equity offerings by acting as an intermediary between the issuer and the market purchasers of the security.[30] In that role, the banking entity often guarantees the sale of a set number of shares by committing to purchase them in the event that they cannot be sold on the market at the offering price.[31] During the period before and immediately after the sale, it also acts as a market maker in order to provide liquidity and stabilize the secondary market.[32] The rule allows banking entities to continue to trade in order to perform these underwriting functions as long as they conform to requirements regarding the type, size, and time period of positions held.[33]

3. Permitted Hedging Activities.—Integral to banks’ ability to engage in market making and underwriting is the ability to hedge their positions in order to reduce risk. Thus, “[r]isk-mitigating hedging activities . . . designed to reduce the specific risks to the banking entity in connection with” other permitted activities likewise qualify as permitted activities.[34]

D. Volcker’s Fundamental Definitional Challenge

An ideally constructed Volcker Rule would clearly define banned proprietary trading in a way that made it easily distinguishable from the desirable banking functions the rule seeks to preserve, such as market making and hedging.[35] Common characteristics of desirable and undesirable banking activities, however, make that practically infeasible. The fundamental difference between prohibited proprietary trading and other types of transactions regards the reason for which inventory is held, and under any formulation it is likely to remain difficult to distinguish between inventory purportedly held to meet anticipated client needs, for example, and inventory held in the hope of profiting from price movements.[36] Banking entities trying to circumvent the Volcker Rule may thus shut down their explicitly denominated proprietary trading desk but continue to engage in proprietary trading under the guise of permitted activities.[37]

Defining the scope of banned proprietary trading thus requires a classic tradeoff between false positives and false negatives. Given the bleed between proprietary trading and permitted activities, broad rules that capture and deter all forms of proprietary trading impinge on desirable bank activities, whereas narrow rules giving wide berth to permitted activities leave room for speculative proprietary trading in the interstices.[38] That a junk-bond trader at Goldman Sachs reportedly made profits of $250 million—a magnitude that suggests that substantial capital was put at risk—while, according to an internal review, complying with the Volcker Rule[39] may be an indication that not all trades that Paul Volcker would have wished to ban are within the scope of the rule.

1. Market Making v. Proprietary Trading.—The delineation between market making and proprietary trading is one of the hardest to make. Not only do the two manifest similar outward characteristics, but a degree of proprietary trading and assumption of risk is inherent in market making.[40] Banking entities serve an important function as market makers by matching buyers and sellers, including by purchasing from a seller a position for which there is not a ready buyer and holding the position as inventory until such a buyer becomes available.[41] In doing so, the banking entity assumes the risk that the value of the position will change. The degree of risk may be particularly large in illiquid markets such as those for over-the-counter derivatives, which are frequently unique instruments that were specially created for the seller.[42] This dynamic—purchasing and holding a security in inventory, so that the banking entity bears the risk of price changes—precisely mirrors that of proprietary trading. The two manifest similar outward characteristics, with the critical distinction being the purpose with which the banking entity acts—in the case of market making, to provide its client with a buyer or seller; in the case of proprietary trading, to profit from holding the position.[43]

The notice of proposed rulemaking for the Volcker Rule acknowledges that these underlying similarities may beget practical difficulties in distinguishing between market making-related activities and impermissible proprietary trading:

It may be difficult to distinguish principal positions that appropriately support market making-related activities from positions taken for short-term, speculative purposes. In particular, it may be difficult to determine whether principal risk has been retained because (i) the retention of such risk is necessary to provide intermediation and liquidity services for a relevant financial instrument or (ii) the position is part of a speculative trading strategy designed to realize profits from price movements in retained principal risk.[44]

Commentators have expressed pessimism about the feasibility of making the distinction. Richardson et al. argue that the carve-out for market making “reads like a green light for continuing carry trades.”[45] Gary argues that broad carve-outs embodied in the statute reflected the hatchet work of financial industry lobbyists who succeeded in substantively gutting the rule while preserving its skeleton, which Congress could tout to the public.[46]

2. Hedging v. Proprietary Trading.—Distinguishing permitted hedging from proprietary trading presents a similar difficulty. Both exhibit outwardly similar characteristics in that both entail the bank holding a financial instrument in its inventory and assuming the risk of price changes. The distinction is in what the banking entity seeks to obtain from that change in value: a straight profit, in the case of proprietary trading, or a counterbalance to another position, in the case of a hedge.[47]

By hedging, banking entities are able to mitigate the risks that arise from their market making transactions as well as from their other core banking functions.[48] Fulfilling its role as market maker often leaves a banking entity holding an inventory with a one-sided risk profile. Hedging serves as a critical corollary to market making by allowing the banking entity to mitigate this one-sided risk, which is a prerequisite to its willingness to act as market maker in the first place. Hedging also plays a role outside the context of market making in mitigating risks that stem from banking entities’ core business functions—namely, credit and interest rate risk.

That a hedge has a counter-position to which it should correspond makes identifying hedging more practically feasible than distinguishing market making, where there is no equivalent outward verification of the principal’s intent. The complexity of the risks against which banks seek to hedge, however, makes it difficult to discern the extent to which a given position is intended as a hedge as opposed to a trade intended to profit the bank.[49] Most positions against which banks seek to hedge do not have counterparts that are both liquid and perfectly offset the risk of the position. What purports to be an imperfect hedge, however, may be risk that was purposefully assumed by the bank in order to profit on its own account as a form of concealed proprietary trading.[50]

Senators Merkley and Levin, who drafted the statutory provision, recognize the difficulty of surreptitious proprietary trading accomplished through intentionally imperfect hedging but express confidence that this difficulty will be mitigated by the Rule’s requirements that banking entities identify the specific positions against which the hedge is designed to operate, combined with quantitative metrics.[51] The manner in which banking entities manage their hedging, however, will make the process of assessing hedges against their corresponding hedged positions, at the very least, trying and costly. Banks routinely hedge not on an instrument-by-instrument basis but en masse, on a portfolio level.[52] Doing so is frequently the most efficient way to hedge, but it creates a further distance between the primary position and purported hedge that makes it more difficult to test the nature of the relationship between the two.[53]

In sum, the core characteristic of the activity that the Volcker Rule seeks to prevent is inherent in the activities that the Volcker Rule seeks to preserve as well. Assumption of risk by the principal, even knowingly assumed risk to the principal, is therefore not itself dispositive of proprietary trading.[54]

E. Implications of the Definitional Problem

The difficulty with distinguishing prohibited proprietary trading from permitted activities results in various practical problems. One result is a complicated rule, which raises compliance and enforcement costs. Reliance on quantitative measures to identify proprietary trading and differentiate between it and permitted activities such as market making requires banks to expend considerable resources developing and implementing programs to monitor such measures.[55] This logistical task is formidable, given that banks may themselves have trouble quantifying the level of risk posed by their assets.[56] The Office of the Comptroller of the Currency estimates that the total compliance costs to banking entities will be at least $4 billion,[57] although an SEC commissioner has challenged that figure as too low.[58]

Second, these definitional problems result in a significant risk of over-deterrence. Would-be market makers, for example, may be deterred from fulfilling that role by the lack of clarity between conduct that regulators will regard as permitted market making versus that which they will regard as banned proprietary trading.[59]

Third, attempts to prevent such over-deterrence by explicitly carving out broad classes of permitted activities might conversely result in under-deterrence. For example, the statute carves out any transaction in MBS issued by the GSEs (e.g., Fannie Mae and Freddie Mac) from the prohibition on proprietary trading.[60] This may allow banking entities to continue to speculate on the housing market, despite the fact that bets on housing by such entities played a critical role in the recent financial crisis.[61]

Indeed, the define-and-ban approach might even exacerbate bank risk-taking. Consider the presumption under the rulemaking implementing the Volcker Rule that any position held by a banking entity for fewer than sixty days constitutes proprietary trading.[62] This presumption was included to clarify what counts as proprietary trading. A downside of this presumption, however, is that banks that are engaged in bona fide market making or hedging, but are unsure about the applicability of the exceptions, might hold positions for longer than they would otherwise in order to reach the sixty-day mark, just to be on the safe side. Moreover, banks that try to engage in proprietary trading that violates the letter or spirit of the Volcker Rule might similarly hold on to positions for longer than sixty days to escape or reduce scrutiny.

To be sure, the sixty-day cutoff in the current rules and the strength of the presumption for positions held for more or less than sixty days, respectively, could easily be modified. However, any scheme that relies on a define-and-ban approach to end short-term proprietary trading and that seeks to provide effective guidance to banks would have to use some cutoffs and presumptions which, in turn, can lead to undesirable distortions in banks’ trading activities.

II. A Better Approach: Prohibiting Compensation Based on Trading Profits

Given the definitional challenges of the Volcker Rule, we outline here a better approach to achieving its objectives: banning banking entities from compensating individuals based on their trading profits. Rather than seek to identify the motivation behind a trade, our approach seeks to demotivate proprietary trading by handicapping banking entities relative to their unregulated competitors.

A. The Markets in Which Proprietary Trading Firms Compete

Firms that engage in proprietary trading compete in two key markets: the securities market and the labor market for traders. In the securities market, firms compete to identify and exploit mispricing of securities. Speculative trading in securities is inherently a zero-sum game. This is most obvious in the form of bilateral securities, like a credit default swap. If two parties make opposing bets using a credit default swap, then if the reference security defaults, the buyer will make money on the contract and the seller will lose money—and vice versa if the reference security does not default. Speculating on short-term price movements of securities is fundamentally similar. The securities market as a whole will generate some total return. Short-term buying and selling of securities only affects who gets what share of that total return.

One implication of the zero-sum nature of speculative trading is that the returns to the activity depend on the relative skill of competing traders.[63] The relevant skills include the ability to ferret out information, to assess it, and to predict accurately the reaction by market participants to future events. Skilled professional traders compete with each other to seek out profitable trading opportunities generated by investors who trade for nonspeculative reasons and by other speculative traders. In order to profit systematically from trading, a trader must be better than his or her trading counterparties at identifying mispricing. The firms that hire and effectively motivate the best traders will generally build profitable trading businesses. Firms that are unable to do so, however, engage in proprietary trading at their own peril.

Reflecting this, the second key market in which firms that engage in proprietary trading compete is the labor market for traders. Both banking entities covered by the Volcker Rule and financial institutions outside of its scope, such as hedge funds, compete to hire the best traders. A common incentive compensation contract used to attract and motivate traders—employed by both hedge funds and by proprietary trading desks at banks—pays the individual trader a fraction of his or her trading profits.[64] Incentive compensation may also incorporate, in addition to individualized performance measures, collective measures based on the performance of the trading unit or overall firm. Individualized measures, however, have increasingly come to predominate as banks compete to retain top trading talent, which as a rule prefers individualized compensation arrangements in which their gains are not diluted within a firm-wide pool.[65]

Such incentive compensation serves both a screening and effort-inducing function. More talented traders are more willing to take such incentive contracts because they are more confident that they will produce the trading profits needed for a big payday. Moreover, such pay structures provide traders with strong incentives to exert effort to identify and exploit profitable trading opportunities on behalf of the firm.

B. Handicapping Banking Entities in a Competitive Zero-Sum Game

The competition between proprietary trading firms in these two key markets suggests a simple way to get banking entities out of the game: ban them from paying individuals on the basis of their trading profits. Consider first the effects of such a ban on the competition for trading talent in the labor market. With an effective ban in place, banking entities that wanted to engage in speculative trading would be at a distinct disadvantage relative to hedge funds in attracting and motivating trading talent. Start with the motivation point. Traders at banking entities would have relatively weak incentives to identify and exploit trading opportunities since doing so would have little effect on their compensation. Moreover, the most talented traders would be able to earn higher expected compensation at hedge funds and other entities that could pay them a share of their trading profits. The resulting labor-market advantage of these unregulated entities relative to banking entities would lead to the best trading talent congregating at hedge funds.

The disadvantage of banking entities in the labor market for traders would in turn put them at a profound disadvantage in the competition to identify and exploit trading opportunities in the securities markets. Traders employed by banking entities would be on average less adept at making money and avoiding losses than those employed by their unregulated competitors. This would dramatically reduce banking entities’ incentives to engage in proprietary trading.

Importantly, banks stuck with lower quality traders—the “B-team”—would not merely expect to make lower trading profits than unregulated institutions that can employ the A-team. Banks would expect that their B-team traders regularly engage in trades with A-team traders or pursue trades that the A-team has declined to pursue. Because of the zero-sum nature of trading, banks would expect, on average, to make losses in these trades.

Thus, an effective ban on trading-profit-based compensation produces fundamentally different incentives for banks than the define-and-ban approach. Under the define-and-ban approach, banks would still want to engage in speculative proprietary trading, but are constrained by the fear of liability if they engage in such trading that violates the rules and their activities are detected. Banks will thus have incentives to exploit gaps and ambiguities in the define-and-ban regime to engage in speculative trading that is, at least arguably, not prohibited as well as to conceal the true nature of any speculative trading from their regulators. These incentives, in turn, necessitate the complex regulation and costly enforcement that characterize the current regime.

Under a ban on trading-profit-based compensation, by contrast, banks will no longer want to engage in speculative trading. Banks will thus come up with their own schemes to control the trading activities in their market making, hedging, and underwriting operations. Moreover, if traders will not receive compensation based on their trading profits, they will likewise lack incentives to engage in underhanded speculative trading. Engaging in such trading, against bank guidelines, would not earn, say, a market maker higher pay, but may result in her losing her job. A bank’s incentives and ability to inhibit speculative trading under a ban on profit-based compensation are thus much stronger than under the define-and-ban approach. Our compensation-based approach is hence likely to be both simpler and more effective than the current define-and-ban approach.

C. Implementing the Ban

The ban of compensation based on trading-based profits that we propose would have three components: a ban on contracts that explicitly base compensation on the individual’s trading profits (or on the trading profits earned by a unit or subunit); a ban on legally nonbinding representations that the individual’s pay will be tied to their trading profits; and a ban on the practice of basing compensation (such as discretionary bonuses) on the individual’s trading profits.[66] Likewise, bank decisions to retain or terminate an employee may also not be based on the amount of trading profits generated by the employee (although, as discussed below, employees could be fired if they generate trading losses). Violations of this rule would result in a fine to the entity, claw-back of the individual’s impermissible incentive pay, and potential criminal liability for intentional violations.

Although we would ban compensation based on trading profits, banks would be free to provide other forms of incentive compensation. In particular, under our proposal, banking entities would be allowed to pay their employees (or independent contractors) on the basis of profits in two specific ways: (1) if the profits are calculated excluding trading profits; or (2) if the employee’s share of profits is “sufficiently diluted.” Furthermore, banking entities would be allowed to incentivize their employees not to make trading losses (i.e., to pay traders whose trades generate losses less than traders whose trades break at least even).

1. Excluding Trading Profits from Compensation.—Under our proposed approach, banking entities could compensate employees on the basis of profits so long as “trading profits” were excluded from the measure of profits used in determining their compensation. For these purposes, “trading profits” would constitute any change in the value of the securities portfolio of the firm over the period. In particular, trading profits would include profits from speculative proprietary trading banned under the Volcker Rule as well as profits from proprietary trading, such as market making and hedging, permitted under the Volcker Rule. Thus, unlike the Volcker Rule, our proposal does not require any rules distinguishing between various types of trading.

Firms would remain able to pay employees on the basis of avoidance of trading losses in a securities portfolio. The reason why avoidance of losses should be a proper basis for compensating employees is to enable them to incentivize hedging. Hedging activities are designed to reduce the risk of losses (and the possibility of gains). But as discussed, hedges are not perfect. Traders who are better in hedging may find better hedges—hedges that involve a smaller risk of losses (and a smaller possibility of gains)—and it would be entirely appropriate for banks to reward traders based on the ex post accomplishment of the goal of loss avoidance.

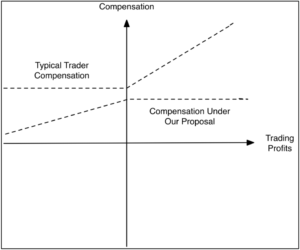

Figure 1 below provides graphical representations of the structure of the typical trader compensation contract and the trader compensation contract allowed under our rule. The horizontal axis represents trading profits and the vertical axis represents trader compensation. The typical trader contract is flat for the region of negative trading profits—traders are generally paid a salary and are not charged for any trading losses they cause. In contrast, it is sloped upward over the positive region of trading profits, reflecting the share of profits enjoyed by the trader. The trader compensation scheme allowed under our rule is the mirror image of the typical trader compensation contract. It is flat in the region of positive profits and sloped only in the negative region of trading profits, since banks could deduct from trader profits for any trading losses they cause in order to motivate hedging.

Figure 1: Notional Trader Compensation Contracts

While enabling banks to reward good hedgers is the principal reason for permitting compensation based on loss avoidance, we note that a compensation scheme that rewards traders for loss avoidance, but not for profit making, would generally enhance—rather than create a loophole to—the prohibition of basing compensation on trading profits. A scheme that reduces compensation for trading losses but did not increase compensation for trading gains would induce traders to hold a conservative portfolio: a portfolio that is expected to generate no losses (and no gains), i.e., one that is hedged. Most traders would only reduce their expected compensation by adding speculative risk to their portfolio.

To be sure, there may be instances where reducing compensation for losses could induce risk-taking. Consider, for example, a trader whose hedges so far have not worked out and who has accumulated significant losses. Such a trader may have incentives to speculate to reduce these losses, even at the risk of incurring further ones. But such situations should be rare. We stress, moreover, that the important issue is not whether a compensation scheme that penalizes traders for losses could create incentives for traders to engage in speculative trading—it sometimes could—but rather whether banks would want to use such a scheme to hire and motivate top speculative traders. Traders who have accumulated large losses—and may now want to engage in speculative trading to avoid being penalized—are presumably exactly the traders whom banks would not want to engage in speculation. So banks would have proper incentives to monitor the trading by such traders, limit their risk exposure, or even to fire them, to reduce any speculation. Or, if such measures are not sufficiently reliable, a bank could simply not reduce pay based on trading losses.

2. Employee’s Share of Profits Is “Sufficiently Diluted.”—Banking entities could also pay employees a share of profits even without excluding trading profits so long as their share is “sufficiently diluted.” To see the intuition, consider the most common form of incentive pay: stock options. Equity options effectively provide a share in the overall profits of the firm, including changes in the value of the firm’s securities portfolio. But for the banking entities subject to the Volcker Rule, any individual employee’s share in the profits of the firm through option grants is so small, and the portion of the firm’s profits attributable to that individual’s trading activity is so small, that the use of such options could not be an effective way to attract and motivate talented traders. Stock grants similarly could be allowed with little risk of incentivizing proprietary trading.

D. The Ability to Detect Compensation Based on Trading Profits

One key advantage of our proposal is that it does not entail the complex line-drawing required under the existing Volcker Rule to distinguish banned speculative proprietary trading from permitted market making, underwriting, and hedging. Because our approach, however, also requires line-drawing—between banned compensation based on trading compensation and permitted compensation that is fixed or based on other metrics—it is important to highlight the reasons why this form of line-drawing does not generate costs equivalent to those of the existing Volcker Rule.

As a preliminary matter, note that for a ban on profit-based compensation to have the desired effect, it needs to affect traders’ expectations rather than the actual compensation they receive per se. As long as a trader does not anticipate receiving a share of her trading profits, even a compensation scheme in which traders turn out to receive a share of profits will not have the screening and effort-incentive functions the bank desires. Paying profit-based compensation after the fact, without traders knowing ex ante that they will receive such compensation, will thus neither enable the bank to compete for A-team traders with hedge funds and other unregulated entities nor motivate the traders it hires to excel.

Importantly, moreover, a ban on trading-profit-based compensation need not fully eliminate any expectation of compensation based on trading profits to be effective. The reason is that, as we have discussed, banks’ success at proprietary trading hinges on their relative ability to compete with hedge funds and other unregulated entities in two markets: the labor market for traders and the securities market. As long as the ban substantially reduces the percentage share of profits that a trader expects to receive, relative to the compensation available at other entities, a bank will be at a significant competitive disadvantage in the labor market for traders. In turn, that labor market disadvantage will produce a trading disadvantage. Thus, the possibility that a bank could, under the guise of some neutral principles, pay a somewhat higher compensation to traders who make larger profits would do a bank little good.

The three elements of our prohibition—explicit promised tie-in, implicit promised tie-in, and actual tie-in—are designed to reduce the ability of firms to generate expectations on the part of their traders that they will receive a share of trading profits. Banning explicit and implicit promised tie-ins would go a long way to reduce such expectations. Enforcing the ban on explicit trading-profit-based compensation should be relatively easy. Determining whether actual compensation contracts create an explicit tie-in is straightforward. Since several traders will be aware of any implicit promises of a tie-in, those that fail to generate profits may have an incentive to inform regulators. And the threat of criminal liability for intentional violations would further deter bank managers from making express, though legally unenforceable, promises to their traders. Without banks making a legally binding promise, or at least communicating, to their traders that their compensation will be based on their trading profits, traders will harbor significant uncertainty and doubts about this relationship.

The last element of our ban—de facto tie-in—further inhibits the ability of banks to create a reputation for basing compensation on profits. To generate a reputation for basing compensation on profits, the relationship between compensation and profits would have to be sufficiently persistent (across traders and over time) and strong (in terms of compensation for an individual trader). Such a persistent and strong relationship could be easily detected through statistical means. If the bank lacks any other plausible explanation for why it just happens that traders who make more profits keep receiving more compensation, one could infer that the bank uses a de facto trading profit-based compensation scheme. Evidence of a substantial relation could also lead regulators to investigate more closely whether the bank uses an implicit promised tie-in. In the context of such an investigation, there would be a high chance that any implicit tie would be detected. That any impermissible pay may be clawed back further reduces the trader’s expectation that they will in fact receive—and retain—compensation based on their trading profits.

E. An Illustration: The London Whale

Perhaps the most infamous example from recent years of the risk of proprietary trading gone awry is the “London Whale” incident that generated $6.2 billion in losses for JPMorgan Chase & Co. (JPM).[67] The episode is instructive as to both the challenges of the define-and-ban approach and the critical role of compensation in incentivizing speculative trading.

The trading that led to the large losses occurred in the synthetic credit portfolio (SCP) managed by the bank’s Chief Investment Office (CIO), which was responsible for investing excess deposits on behalf of JPM.[68] The SCP was originally established to hedge JPM’s exposure to credit risk. To do so, the SCP took various positions in credit default swaps.[69] (A credit default swap is like an insurance contract covering default on a bond.) Even though the SCP originated as a hedging operation, over time it became a major revenue generator in its own right. In 2011, for example, swaps held in the SCP generated a $400–$550 million “windfall” gain (in the words of an internal report) to JPM when American Airlines declared bankruptcy.[70]

Shortly after the American Airlines bankruptcy, the CIO received instructions to reduce its risk-weighted assets (RWA), and the management of CIO decided to do so by cutting the RWA of the SCP in particular.[71] But simply unwinding the SCP book would have been costly: the traders involved estimated that unwinding the SCP quickly, given the resulting “fire sale” prices the bank would receive, would result in losses of $516 million.[72] In addition, traders were concerned about the potential loss of profits that the current SCP positions would generate if further corporations declared bankruptcy. Echoing this concern, the head of the CIO, Ina Drew, instructed traders to ensure that the SCP remained well-positioned to profit from future “American Airlines-type” defaults.[73]

SCP traders responded to this mix of objectives—reduce RWA, minimize execution costs, remain positioned to profit from corporate defaults—by adding long positions in credit default swaps on investment-grade bonds (i.e., selling insurance that these bonds will default) rather than simply unwinding their short positions on high-yield bonds.[74] These long positions, the traders believed, would help offset the risks of the short positions and hence reduce the RWA.[75] Moreover, the premiums earned from the long positions helped fund the purchases of additional short positions.

The long positions in credit default swaps on investment-grade bonds served as a hedge against any changes in default risk that affected investment-grade bonds and high-yield bonds similarly. At the same time, however, these positions transformed the positions held by JPM into a more targeted bet on the differential in default risk between investment-grade bonds and high-yield bonds.

After the trades began to be executed in January 2012, the spreads between high-yield bonds and investment-grade bonds declined.[76] As a result, the bank lost more money on its short position on high-yield bonds than it gained on its long position on investment-grade bonds.[77] As the SCP’s mark-to-market losses accumulated, SCP traders responded by growing their positions, in the hope that future defaults on junk bonds would result in profits that would offset the accumulated losses.[78] Ultimately, the SCP added more long positions so that the portfolio was net long on credit risk, dispensing with even the façade that the portfolio was a hedge against JPM’s exposure to credit risk rather than, as a Senate subcommittee investigation concluded, “a high risk proprietary trading operation.”[79]

Two key aspects of this episode are instructive for our purposes. First, the London Whale trades occurred in a portfolio that the bank insisted served as a hedging operation allowed by the Volcker Rule. Bank executives characterized the trading as “consistent with what we believe the ultimate outcome will be related to Volcker” in its April 13, 2012, earnings call.[80] JPMorgan CEO Jamie Dimon himself insisted again in May 2012 that the trading involved hedging that was allowed by the Volcker Rule.[81] Likewise, JPM’s regulator, the Office of the Comptroller of the Currency, informed the Senate Banking Committee that “the whale trades would have been allowed under the draft Volcker Rule.”[82] These characterizations by bank management and its regulator illustrate that the define-and-ban approach will allow proprietary trading to continue under the rule’s permitted activities exceptions.

Second, there is good evidence that the expectation of key CIO executives and traders that they would share in profits generated by their trading led them to adopt their risky trading strategy. CIO traders and management received discretionary incentive compensation,[83] where the factors that influenced this discretion included individual and business-unit financial performance.[84] The yearly correlation between SCP profits and the bonuses for key employees with responsibility for SCP trading suggests that the unit’s trading gains were an influential determinant of incentive compensation.[85]

Despite these facts, an internal JPM study concluded that the bank’s “compensation system did not unduly incentivize the trading activity that led to the losses.”[86] It instead attributed traders’ attempt to make a profit in unwinding the SCP to a communication failure about compensation: “management . . . should have emphasized . . . that, consistent with the Firm’s compensation framework, [traders] would be properly compensated for achieving the [reduction in risk-weighted assets] . . .—even if, as expected, the Firm were to lose money doing so.”[87] This claim, however, is belied by Ina Drew’s role in pushing SCP traders to make a profit similar to the one they had through the American Airlines bankruptcy.[88] But even if we were to accept the JPM internal study’s conclusion that the problem was one of communication, that itself implies that in the normal course these traders were compensated based on trading profits: exactly because traders expected to be compensated based on trading profits, it was imperative to communicate to them that in this instance reducing RWA took priority and that they would not be penalized for the losses this reduction would generate.

In sum, the London Whale incident illustrates the challenges for the define-and-ban approach and the promise of the compensation-based approach. The attempt to avoid over-deterrence by creating exceptions to the ban on proprietary trading for hedging and other permitted activities, combined with the pay practices predominant in big banks in which annual bonuses turn on a business unit’s, or even an individual’s, profits and losses, risks the continuance of proprietary trading at banks. If the compensation earned by Ina Drew and the SCP traders did not depend on trading profits, it is hard to see why they would have undertaken such speculative trading after being instructed to reduce risk-weighted assets. And if JPM did not believe that it could attract first-rate trading talent, it is hard to see why it would have permitted SCP traders to incur that much risk.

III. Responses to Potential Objections

In this Part, we address various objections that might be raised to our proposed ban of trading-profit-based compensation. We first consider the objection that existing regulation of compensation within banks already achieves an effective ban on compensation based on trading profits. Next, we examine the concern that the ban would inhibit the market making and underwriting businesses of banks. Third, we address the concern that banks would engage in speculative proprietary trading even if they are not permitted to compensate traders based on their trading profits. Finally, we consider whether taxing away banks’ trading profits would be preferable to our proposed compensation-based approach.

Objection 1: Existing regulations already effectively prevent banks from paying traders on the basis of trading profits.

One objection to our proposal is that the existing Volcker Rule and other Dodd-Frank rules already ban compensation on the basis of trading profits and hence meet our proposal. In terms of the Volcker Rule itself, there are at least three aspects of the current approach that mimic, to some degree, our proposed ban. First, for trading to qualify under the rule’s permitted activities exceptions, the compensation arrangements of those engaged in the activity may not be designed to reward or incentivize proprietary trading.[89] Second, banking regulators, in enforcing the rule, will no doubt consider compensation arrangements in which individuals are paid on the basis of trading profits as indicia of banned proprietary trading.[90] Third, the ban on proprietary trading itself affects the labor market for traders in a way similar to our proposed ban. In particular, an A-team trader would find the inevitable constraints imposed by the current regulatory approach to be unattractive relative to the freedom to trade at, say, a hedge fund. Consistent with the view that the current approach functions similarly to our proposal, in 2012 Bloomberg reported that a large number of top traders were decamping from investment banks, where their incentive compensation had been curtailed, to hedge funds, which offered to pay them up to 12% of their trading profits.[91]

However, while it is true that the existing approach has affected compensation arrangements for traders, the objection misses the mark for two reasons. First, our proposal entails regulating compensation instead of defining and banning proprietary trading subject to numerous exceptions. The result will be lower cost in terms of direct compliance costs entailed by the complexity of the current approach, over-deterrence costs, as well as under-deterrence costs.

Second, on the under-deterrence point, the current rule does much less to inhibit compensation on the basis of trading profits than our proposal would. Consider, for example, the provision in the current rule requiring that the compensation arrangements of persons involved in underwriting “are designed not to reward or incentivize prohibited proprietary trading.”[92] In response to comments on the proposed rule, the promulgating agencies defended the use of the term “designed,” stating:

The banking entity should provide compensation incentives that primarily reward client revenues and effective client services, not prohibited proprietary trading. For example, a compensation plan based purely on net profit and loss with no consideration for inventory control or risk undertaken to achieve those profits would not be consistent with the underwriting exemption . . . . The Agencies continue to believe it is appropriate to focus on the design of a banking entity’s compensation structure, so the Agencies are not removing the term “designed” from this provision. This retains an objective focus on actions that the banking entity can control—the design of its incentive compensation program—and avoids a subjective focus on whether an employee feels incentivized by compensation, which may be more difficult to assess.[93]

This interpretation seems to allow ample room for a banking entity to adopt a discretionary bonus structure like the one used for the JPM traders involved in the London Whale episode that, while not designed to primarily encourage proprietary trading, in practice produces “subjective” expectations on the part of the relevant personnel that do just that. In contrast, we would go much further, explicitly prohibiting such practices.

Finally, Section 956 of the Dodd-Frank Act (a provision distinct from the Volcker Rule) requires the relevant agencies to issue rules prohibiting “any types of incentive-based payment arrangement . . . that the regulators determine encourages inappropriate risks” at banking institutions.[94] In 2016, a proposed rule implementing this requirement[95] provided that an incentive-based compensation arrangement is considered to encourage inappropriate risks, and therefore banned, unless it “(1) [a]ppropriately balances risk and reward; (2) is compatible with effective risk management and controls; and (3) is supported by effective governance.”[96] Nothing in the rule, however, would prevent banks from paying traders on the basis of their trading profits, including through the type of arrangement used by JPM for employees responsible for the trading in the London Whale incident.

It is noteworthy, however, that regulators could use Section 956 as the statutory basis for a rule implementing our proposal to ban compensation on the basis of trading profits. By adopting such an approach, combined with a simpler “bright line” approach to implementing the define-and-ban approach required by the statute, regulators could effectively implement our proposal with no statutory changes.

Objection 2: Banning banking entities from paying trading-profit-based compensation would reduce their ability to perform market making and underwriting.

As we have explained, banks engaged in market making and underwriting will inherently take proprietary positions in the securities involved. Banks engaged in market making will hold, in their proprietary accounts, certain securities for sale to customers or buy, for their own accounts, certain securities from customers seeking to sell. Banks engaged in underwriting buy the securities they underwrite from a customer and then try to resell them immediately—but take on the risk that they are unable to resell them quickly. Finding perfect and liquid hedges for these securities is often impossible or impracticable. Indeed, the lack of such hedges is the very reason why market making and underwriting businesses exist.

Market making and underwriting, however, differ in one crucial respect from proprietary trading. Banks engaged in market making and underwriting provide valuable services to their customers. These activities, unlike speculative trading, are not zero-sum games. As a consequence, a bank may well be able to build a profitable market making business without employing A-team traders.

From a bank’s perspective, the ideal employee working on market making or underwriting would excel in all aspects of the respective business. The ideal market maker would excel at anticipating the future demand by customers who would wish to buy or sell, at finding liquid hedges to reduce the risk of proprietary positions, and at predicting future price movements. The ideal underwriter would excel at predicting demand for underwritten securities and, if the securities cannot be sold at the underwritten price, at assessing whether the bank should sell them quickly at a lower price or whether it should retain a proprietary position and try to sell them later. That is, the ideal market maker and underwriter would have the same skills as the ideal proprietary trader, as well as additional skills specific to market making and underwriting.

If not permitted to base compensation on trading profits, banks will not be able to compete for market makers and underwriters who have top proprietary trading skills. Banks, however, should be able to hire as market makers or underwriters employees who have top skills specific to market making and underwriting. Banks would not face direct competition for these employees from unregulated entities engaged in “pure” speculative trading. Banks could still base the compensation of these employees on nonprofit metrics, such as customer satisfaction, speed of execution, or commission revenues generated and reduce compensation if a market maker or underwriter incurs losses from proprietary positions. And, as discussed, banks can incentivize their employees to avoid trading losses. These incentive mechanisms should enable banking entities to attract as market makers and underwriters employees who, in addition to having top skills specific to market making and underwriting, also make the B-team (rather than, say, the F-team) in terms of their proprietary trading skills.

Conceivably, proprietary trading is such an important aspect of market making or underwriting that banks that can attract only employees with B-team proprietary trading skills (albeit top skills in other aspects of market making or underwriting) will no longer be able to compete in the market making and underwriting business. Also, conceivably, talent is distributed such that employees with top skills in other aspects of market making or underwriting will also have top proprietary trading skills—and will accordingly prefer to work as traders for an unregulated entity. In these cases, a ban on compensation based on trading profits could have the incidental effect of causing banks to quit the market making or the underwriting business.[97]

We doubt that this will be the case. However, if it turns out that we are wrong, then banks being in the market making and underwriting business is probably incompatible with the spirit of the Volcker Rule. Put differently, if market making or underwriting is not sufficiently profitable for banks so that it pays them to stay in the business without earning additional profits from speculative trading, then the objectives of the Volcker Rule would be furthered if banks quit these businesses.

Objection 3: Even with an effective ban on paying trading-profit-based compensation, banks would engage in speculative proprietary trading.

Our principal argument has been that, if banks cannot compensate traders based on their trading profits, they will not be able to hire A-team traders; and if banks cannot hire A-team traders, then, due to its zero-sum nature, they will not want to engage in speculative proprietary trading. However, plausibly, certain types of speculative proprietary trading—such as high-speed trading based on computer algorithms or trading based on nonpublic information learned from customers—may be profitable to banks even if they do not have highly talented traders. In addition, plausibly, banks may be able to attract A-team traders even without offering them compensation based on their trading profits, such as by offering very high fixed compensation to traders with a proven track record.

For various reasons, we do not believe that these possible scenarios undermine our proposal. First, the existing Volcker Rule leaves significant scope for speculative proprietary trading, among others by targeting only short-term speculative trading and by exempting trading in several types of financial instruments from its scope. Thus, even if our proposal were to leave scope for certain forms of speculative trading, this would not necessarily render it inferior to the existing rule.

Second, to the extent that certain forms of proprietary trading are profitable to banks even if banks do not have highly talented traders, such trading could be restricted through a supplementary ban as long as such trading can be easily distinguished from regular market making, underwriting, or related hedging. The complexity of the current Volcker Rule stems not from the fact that it takes a define-and-ban approach, but from the fact that certain banned trading closely resembles permitted trading, especially in the form of market making and hedging of positions taken on in the context of market making. But forms of trading that are sufficiently distinct, such as algorithmic trading, lend themselves to be banned through a define-and-ban regime. Similarly, to the extent that a goal of the Volcker Rule is to prevent banks from using information supplied by bank clients to take proprietary positions adverse to their clients’ interest, more targeted regulations can address that concern.[98]

A more serious objection is that banks may be able to hire A-team traders by offering them a compensation package that does not include profit-based compensation. As we have explained, such a package would be suboptimal and more costly for banks (in terms of expected compensation paid, of the trading talent attracted, and of the effort induced) than a package that includes profit-based compensation. Whether banks would want to pursue proprietary trading with this handicap is ultimately an empirical question.

But even if it turns out that our proposed ban on profit-based compensation is, on its own, not sufficient to induce banks to cease all speculative proprietary trading, it could easily be extended in two directions to further deter speculative proprietary trading. First, one could impose additional regulations on compensation. For example, one could limit the amount of total compensation paid to employees who engage in proprietary trading on behalf of banks. Since speculative trading talent does not come cheap, and since the ban on profit-based compensation would require banks to offer a high amount of noncontingent compensation, such limitations may make it impossible for banks to attract A-team traders.

Second, one could supplement the regulation of compensation with restrictions on proprietary trading that is clearly unrelated to any activity permitted under the current Volcker Rule. These restrictions should be in the form of rules that are much simpler and more easily applied than those under the current define-and-ban approach.

More generally, the thrust of our proposal is that regulation of compensation is a superior way to tackle speculative trading than regulation designed to distinguish banned speculative trading and permitted market making, underwriting, and hedging. The exact form that such regulation should take, and whether a ban on profit-based compensation is sufficient, is secondary. Moreover, our view that compensation restrictions are a superior regulatory tool than define-and-ban implies that the principal regulatory effort should be devoted to devising and enforcing proper compensation restrictions; it does not mean that define-and-ban regulations that are not overbroad and that do not entail significant compliance costs should not also be part of the regulatory regime.

Objection 4: Would it not be simpler and preferable to impose a confiscatory tax on trading profits?

An alternative to both the define-and-ban approach and to our compensation-based approach to the Volcker Rule would be to impose a confiscatory tax on the profits derived from proprietary trading. In its simplest form, banks would have to pay to the government all trading profits earned over a particular accounting period. One might argue that this would be a simpler, and perhaps more effective, approach than our compensation-based approach. Such a tax, however, would suffer from the same flaws as define-and-ban: it would over-deter proprietary trading and result in large compliance and enforcement costs.

To see this, note that a confiscatory tax on trading profits would tend to induce banks to cease all forms of trading—both the proprietary trading of the speculative sort that is the target of the Volcker Rule and trading that is incidental to market making, hedging, and underwriting. Such a tax would thus be highly overbroad.

One approach to mitigating this problem would be to impose the tax only on profits above a certain threshold, set at the level of profits a market making and underwriting business would be expected to generate. Setting such a threshold would be a complex undertaking, however, and not just because expected profits will vary with the specific activity (e.g., the type of instruments for which a market is made), but because it requires an accurate measure of the scale of the activity (e.g., how much “market making” a bank is engaged in). If the threshold is set too low, then this tax would likewise induce banks to exit the market making and underwriting businesses.

But even a tax set “correctly” at the expected profit level would hamper banks’ market making and underwriting business. Consider market making. While banks engage in market making in order to earn a bid-ask spread, market makers will also earn incidental trading profits (or suffer losses) from price movements in the securities they hold in their trading account. Such profits or losses would arise whenever a position is not fully hedged—and the difficulty of finding a perfect hedge is of course a reason why market makers exist to start with. Having to pay a confiscatory tax on such incidental profits from advantageous price movements, while bearing the losses from disadvantageous price movements, will result in market makers, after accounting for the tax, earning less than the expected profits. To cushion market makers against this downward bias, the threshold exemption would have to be set above the profit level that market making would be expected to generate. But at such a level, it may pay a bank to engage not just in market making, but also in proprietary trading of the speculative sort.

Furthermore, a confiscatory tax would generate significant enforcement, compliance, and evasion costs. Such a tax, much like our compensation-based approach, would be based on a definition of trading profits. But, unlike in our approach, the precise dollar amount of trading profits (as opposed to nontrading profits or a lesser amount of trading profits) would matter, and matter a lot, in every single instance. Companies would be required to segregate trading accounts in their books, and tax authorities would have to determine whether these books are properly kept. Even banks that have no interest in engaging in speculative proprietary trading would have strong financial incentives to minimize their trading profits or shift them from one year to another—by characterizing profits as nontrading profits, offsetting them through expenses or trading losses, manipulating recognition events, undervaluing noncash consideration received, or selling securities below their fair value to favored customers (who may reciprocate by giving the bank other business). A confiscatory tax on trading profits, like any other tax at a high rate, would be a boon to accountants and tax advisors, but not attractive from a policy perspective.

Conclusion

In the wake of the financial crisis of 2008, former Federal Reserve Board Chairman Paul Volcker called for prohibiting banking entities from engaging in risky activities such as proprietary trading. In the Dodd-Frank Act, Congress decided to implement Volcker’s objective through Section 619— dubbed the Volcker Rule—which seeks to define and ban proprietary trading. But because illicit proprietary trading is hard to distinguish from proprietary positions that banks take incidental to desirable banking activities, the define-and-ban approach both entails high compliance costs and creates the risk of under- and over-deterrence.

In this Essay, we propose a different approach to achieve Paul Volcker’s objective: ban banking entities from compensating traders based on trading profits. Our proposal does not hinge on the ephemeral distinction between proprietary trading intended to make profits from short-term price movements and proprietary trading incidental to other profit-making activities, such as market making or underwriting. Instead, our proposal exploits the fact that speculative trading is a zero-sum game in which only players who can attract top trading talent can expect to succeed. Banks, if not permitted to compensate traders based on trading profits, will not attract sufficiently talented traders to make speculative trading worth their while. Rather than threatening banks with sanctions for engaging in proprietary trading that (but for the sanctions) would be profitable—an approach that creates incentives for banks to find loopholes in the regulatory regime and conceal their proprietary trading and hence requires a complex enforcement apparatus—our approach targets banks’ abilities to engage in profitable proprietary trading directly. It is therefore likely to be both less costly and more effective at ridding banking entities of proprietary trading than the define-and-ban approach taken by the Dodd-Frank Act.

- .Jamie Dimon: U.S. Experiencing ‘Mild’ Recovery, CNBC (Jan. 9, 2012), https://www

.cnbc.com/video/2012/01/09/jamie-dimon-u-s-experiencing-mild-recovery.html [https://perma.cc/

79RM-TK5W]. ↑ - .Roberta Romano, Regulating in the Dark and a Postscript Assessment of the Iron Law of Financial Regulation, 43 Hofstra L. Rev. 25, 72 (2014); see also Chloe Brighton, Development Article, The Finalized Volcker Rule, 33 Rev. Banking & Fin. L. 514, 517 (2014) (describing the proposed Volcker Rule as “over 963 pages long, with 2,826 footnotes and 1,347 questions” (quoting The Volcker Rule: More Questions Than Answers, Economist (Dec. 14, 2013), https://

www.economist.com/news/finance-and-economics/21591587-push-make-americas-banks-safer-creates-new-uncertainties-more-questions [https://perma.cc/B3HW-2ADN]) (internal quotation marks omitted)). ↑ - .12 U.S.C. § 1851 (2012). ↑

- .European Commission, Proposal for a Regulation of the European Parliament and of the Council on Structural Measures Improving the Resilience of EU Credit Institutions 7 (Jan. 29, 2014), http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52014PC0043&from

=EN [https://perma.cc/2GEH-KC7K]. For a comparative perspective on the approaches taken in the United States, UK, and EU, see Jan-Pieter Krahnen et al., Structural Reforms in Banking: The Role of Trading, 3 J. Fin. Reg. 66 (2017). ↑ - .See Matthew P. Richardson & Bruce Tuckman, The Volcker Rule and Regulations of Scope, in Regulating Wall Street: CHOICE Act vs. Dodd-Frank 69 (Matthew P. Richardson et al. eds., 2017); Robin Greenwood et al., The Financial Regulatory Reform Agenda in 2017 (Project on Behavioral Finance and Financial Stability Working Paper No. 2017-09), http://people.hbs.edu/

asunderam/Reg_Reform_20170214.pdf [https://perma.cc/U9W7-2S8H]. ↑ - .Financial CHOICE Act of 2017, H.R. 10, 115th Cong. (2017), https://financialservices

.house.gov/uploadedfiles/hr_10_the_financial_choice_act.pdf [https://perma.cc/VE53-PKV2]. ↑ - .The Trump Administration, for example, has proposed exempting banks with less than $10 billion in assets, narrowing the definition of “proprietary trading,” and expanding the definitions of permitted activities. See U.S. Dep’t of the Treasury, A Financial System that Creates Economic Opportunities: Banks and Credit Unions 71–78 (2017), https://

www.treasury.gov/press-center/press-releases/Documents/A%20Financial%20System.pdf [https://

perma.cc/G9W6-E9ZE]. ↑ - .By traders, we mean all persons involved in making investment decisions and executing trades as well as their direct and indirect supervisors. ↑

- .In an important contribution, Lucian Bebchuk and Holger Spamann suggest regulating the pay of bank executives to reduce risk-taking. See Lucian A. Bebchuk & Holger Spamann, Regulating Bankers’ Pay, 99 Geo. L.J. 247 (2010). Their article is similar to ours in as much as it makes a proposal to use pay regulation to reduce bank risk-taking. However, our proposal is based on a different link between compensation and bank risk. Our proposed scheme is based on the insight that pay regulation would make it harder for banks to compete for quality traders and thus primarily reduces the incentives of the banks themselves, at the firm level, to engage in proprietary trading. The Bebchuk–Spamann proposal, in contrast, is aimed at reducing the incentives of the pay recipients, the executives, to engage in risk-taking. ↑

- .Dodd-Frank Wall Street Reform and Consumer Protection Act § 619, Pub. L. No. 111-203, 124 Stat. 1376 (codified as amended at 12 U.S.C. § 1851(a)(1) (2016)) [hereinafter Dodd-Frank Act]; Proprietary Trading and Certain Interests in and Relationships with Covered Funds, 12 C.F.R. § 44.3(a) (2017). ↑

- .12 U.S.C. § 1851(h)(1) (2016); 12 C.F.R. § 44.2(c)(1) (2017). Provided that certain conditions are met, insurance companies, venture capital companies, and foreign banks are exempt from the rule. 12 U.S.C. § 1851(d)(1)(E)–(F), (H). ↑

- .See 12 U.S.C. § 1851(b)(1)(A) (listing first among enumerated purposes of the statute to “promote and enhance the safety and soundness of banking entities”). Related purposes that are also enumerated include to “protect taxpayers and consumers and enhance financial stability by minimizing the risk that insured depository institutions and the affiliates of insured depository institutions will engage in unsafe and unsound activities”; and to “limit activities that have caused undue risk or loss in banking entities and nonbank financial companies supervised by the [Federal Reserve], or that might reasonably be expected to create undue risk or loss in such banking entities and nonbank financial companies supervised by the [Federal Reserve].” Id. § 1851(b)(1)(B), (E); see also H.R. Rep. No. 111-517, at 868 (2010) (Conf. Rep.), as reprinted in 2010 U.S.C.C.A.N. 722, 725 (“Title VI improves prudential regulation of banks, saving associations, and their holding companies.”). ↑

- .Sens. Jeff Merkley & Carl Levin, The Dodd-Frank Act Restrictions on Proprietary Trading and Conflicts of Interest: New Tools to Address Evolving Threats, 48 Harv. J. Legis. 515, 521–22 (2011); see also Matthew Richardson et al., Large Banks and the Volcker Rule, in Regulating Wall Street 181, 202 (Viral V. Acharya et al. eds., 2011) (describing how banks acquired large positions in mortgage-backed securities funded by low capital costs that derived from explicit and implicit government guarantees). ↑

- .Arnoud W.A. Boot and Lev Ratnovski, Banking and Trading, 20 Rev. Fin. 2219, 2235–40 (2016). ↑

- .As Paul Volcker himself put it,[T]he continuing explicit and implicit support by the Federal government of commercial banking organizations can be justified only to the extent those institutions provide essential financial services. A stable and efficient payments mechanism, a safe depository for liquid assets, and the provision of credit . . . clearly fall within that range of necessary services. Proprietary trading of financial instruments—essentially speculative in nature—engaged in primarily for the benefit of limited groups of highly paid employees and of stockholders does not justify [] tax payer subsidy . . . .

Paul Volcker, Commentary on the Restrictions on Proprietary Trading by Insured Depositary Institutions, Wall Street J. (Feb. 13, 2012), http://online.wsj.com/public/resources/documents/

Volcker_Rule_Essay_2-13-12.pdf [https://perma.cc/6QFU-ZBZX]. ↑ - .Fin. Stability Oversight Council, Study & Recommendations on Prohibitions on Proprietary Trading & Certain Relationships with Hedge Funds & Private Equity Funds 48 (2011) [hereinafter FSOC Study & Recommendations], http://www.treasury

.gov/initiatives/Documents/Volcker%20sec%20%20619%20study%20final%201%2018%2011%20rg.pdf [https://perma.cc/T6BF-9ZZB]. ↑ - .See Press Release, Sec. Exch. Comm’n, SEC Charges Goldman Sachs with Fraud in Structuring and Marketing of CDO Tied to Subprime Mortgages (Apr. 16, 2010), https://

www.sec.gov/news/press/2010/2010-59.htm [https://perma.cc/FK66-JAZU]. ↑ - .Volcker, supra note 15, at 2. ↑

- .Richardson et al., supra note 13, at 200–01. ↑

- .Id. ↑