Different Name, Same Result: Why Master Limited Partnerships Are Unlikely to Finance Our Green Energy Future

Introduction

The world is losing the war against climate change.[1] The burning of fossil fuels is widely considered to be the cause of severe floods, droughts, heat waves, and rising sea levels assaulting our planet.[2] Climate change is now seen by the rest of the world as the greatest threat to international security.[3] Humanity can no longer afford to ignore its effects. Certainly, the United States has a role to play, as it contains three of the world’s top-ten cities with the biggest carbon footprints.[4]

Successful climate-change mitigation requires timely decarbonization of the American electricity sector, the largest source of U.S. greenhouse gas emissions alongside transportation.[5] And the United States is responding. Renewable electricity generation has doubled since 2008.[6] Natural gas, the cleanest fossil fuel, is quickly replacing coal as the primary fuel for electricity generators across the country.[7] But burning natural gas still emits too much greenhouse gas to meet the goals of the global Paris Agreement.[8] Scientists consider these goals—specifically, limiting warming to two degrees Celsius as compared to preindustrialization levels—vital in order to avoid permanent damage to the environment.[9]

The United States is ill-suited to form a national renewable energy policy.[10] Structural[11] and cultural[12] impediments suggest that the U.S. system of government is not good at government-led transformations of the economy, such as mobilizing significant amounts of capital to remake our energy infrastructure.[13] Instead, the United States allows states and private companies to experiment with different approaches, using the markets to decide what works best.[14] States[15] and private actors[16] have taken it upon themselves to fuel the clean-energy transition with varying levels of success.

Private ordering alone has not been able to drive the transition. Because environmental externalities are not accounted for and assigned to polluters, private actors have little incentive to mitigate the negative consequences of burning fossil fuels.[17] While economists are in “near-universal” agreement that putting a price on greenhouse gas emissions is the most efficient policy to accomplish such a transition,[18] climate change and pollution are exceedingly difficult to measure. The level of emissions from some activities is uncertain.[19] And even if emissions could be estimated accurately, their precise effect on temperature is debated.[20] If temperature changes could be accurately forecasted, their welfare effects would nevertheless be difficult to predict.[21] And finally, most effects of climate change will not be felt for several decades, and thus must be discounted back to the present with some disputable discount rate.[22] Given these inherent uncertainties, there is no global consensus about the climate cost of carbon.[23] Pollution, too, is difficult to measure, and its effects would need to be assigned to the polluter.[24]

The ability to externalize most of their societal and environmental costs allows coal, gas, and other fossil fuel power providers to continue producing and selling electricity at competitive rates with renewable energy sources, even in spite of rapidly declining costs of renewable energy.[25] Other costs, such as net energy,[26] intermittency,[27] and capital intensity,[28] also contribute to fossil fuel entrenchment.

As a result, the federal government has recognized that some intervention is necessary.[29] Various approaches have been proposed for cost-effective promotion of renewable energy deployment, including a federal cap-and-trade regime, federal renewable-portfolio standards, and a federal feed-in tariff.[30] Though each has its merits, none have gained significant political support.[31] Rather, Congress has expressed a systemic preference for tax policy over nontax policy options to promote renewables.[32] As an example, Congress has repeatedly renewed expiring tax credits for renewables.[33] Their political advantages make them our politicians’ favorite mechanism for subsidizing renewable energy.[34]

Yet, this is unsurprising. Tax incentives have long been the federal policy of choice to promote the development of all energy infrastructure—fossil fuels included. The Internal Revenue Code allows for up-front tax deductions for drilling oil and gas wells,[35] exploration and development of oil shales,[36] depletion of oil and gas deposits,[37] and general domestic manufacturing.[38] Accelerated depreciation rates allow energy companies to recognize lower taxable income in earlier years,[39] freeing up investment capital. This preference for using tax policy over more-direct spending measures suggests that the smoothest and fastest way to promote renewable energy development is through amendments to the current tax structure.

The most important tax benefits for renewable energy have been the production tax credit (PTC)[40] and the investment tax credit (ITC).[41] Tax credits incentivize investment by reducing the after-tax cost of the tax-favorable activity—in this case, development of renewable energy generation. But the evidence is mixed on whether these benefits have meaningfully affected the country’s energy production.[42] Though billions of dollars in federal subsidies have been distributed,[43] they have been insufficient to raise the share of wind, solar, geothermal, and other low-carbon renewable sources in the electricity mix beyond 18%.[44] And future growth is expected to remain inadequate, with renewables expected to account for no more than 31% of American electricity generation by 2050.[45] United States federal debt now exceeds $22 trillion, and America may not want to spend more money on clean-energy policy moving forward.[46]

The primary issue with the existing tax incentives is that they do not benefit those without adequate tax liability to absorb the credits.[47] Most renewable energy developers, at least at the outset, are too small in size or lack sufficient profitability to generate tax liabilities capable of absorbing the credit.[48] These losses are partly due to the life cycle of the business,[49] as well as the effects of accelerated depreciation deductions[50] or immediate expensing[51] of capital expenditures. Ironically, these advantages do not pair well together. As a result, the current tax incentives are inefficient.

This problem is exacerbated by restrictions in the Internal Revenue Code. Congress does not allow the transfer of tax credits; therefore, project developers must enter into partnerships with corporate investors that have income to shelter.[52] Professor Felix Mormann explains: “In the absence of taxable income to offset, renewable energy project developers are unable to reap the immediate benefit of their projects’ tax credits without the help of a tax equity investor who can monetize [in a timely fashion] the credits by offsetting tax liabilities from other sources.”[53]

Developers who are unwilling to give up ownership or management of their projects seek out these tax equity investors to obtain capital.[54] But there is a shortage of available tax equity investors;[55] historically, fewer than twenty-five sophisticated and profitable entities—mainly large banks, insurance companies, and other financial firms—have been capable of supporting renewable energy projects through their tax equity investments.[56] These investors exploit their exclusivity to receive higher rates of return than the project’s risk would otherwise require.[57] And the cyclical nature of the tax equity market further depresses the value of tax credits during economic downturns, when developers are most desperate for capital.[58] The participation of a tax equity investor in renewable-power projects results in high transaction costs.[59] It also limits a developer’s ability to raise project capital from more cost-efficient sources, such as cheaper debt financing.[60]

Therefore, under the current regime, renewable energy developers can realize no more than two-thirds of the value of their project’s tax benefits, even when bringing in a tax equity investor.[61] And while a project developer could forego tax equity investors and elect to carry forward his credits into the future until his tax bill is high enough, this delay would cost him up to two-thirds of the net present value of his project’s tax benefits.[62]

The Master Limited Partnership (MLP) business structure has been proposed as a possible solution to the subsidy problem. Rather than using tax credits, MLPs promote growth by simply removing a layer of taxation on profits. Allowing renewable energy developers to structure as MLPs would provide a financing option that bypasses the tax equity market and provides a competitive advantage over corporate entities that are subject to double taxation.

There are compelling reasons why the MLP could be effective. From 2009–2011, the Treasury experimented with the § 1603 program,[63] which allowed taxpayers to receive direct grants from the Treasury—in lieu of back-end credits—and thus avoid the problems that plague the tax equity market.[64] This policy has been credited with broadening the pool of renewable energy investors[65] and has provided $25.7 billion of funding for installed capacity of 34.5 gigawatts.[66] Similarly, the MLP would guarantee that benefits flowed through to the developer, without concern for having enough taxable income to benefit from credits.

Such a solution has garnered tremendous support over the past several years. Proponents include professors,[67] law students,[68] non-law students,[69] professionals,[70] and even governmental bodies.[71] The Financing Our Energy Future Act (FOEF Act) is the most recent attempt to apply the MLP model to the renewable energy industry. Part I of this Note introduces the FOEF Act and provides an overview of the Master Limited Partnership structure. Part II argues that the MLP was a deliberate attempt to encourage investment in the midstream oil and gas industry. It considers the purpose and history of the MLP to determine whether its success could be replicated in the renewable sector. Finally, Part III evaluates the possible benefits of the FOEF Act and assesses whether it would have the success anticipated by its proponents. I conclude that it likely would not.

I. The Financing Our Energy Future Act

A. What Is the Master Limited Partnership?

Master Limited Partnerships are publicly traded limited partnerships that combine the pass-through tax treatment of partnerships with the liquidity of ownership interests associated with publicly traded corporations. Because MLPs are not subject to entity-level taxation, they realize greater net cash flows and have more cash available to distribute to their unitholders.[72] This gives them a competitive advantage over taxable entities such as corporations.

As a general rule, publicly traded companies are subject to entity-level taxation.[73] But in 1987, Congress passed the Omnibus Budget Reconciliation Act, providing an exception for certain partnerships having at least 90% of gross income derived from “qualifying” sources.[74] While qualifying income is generally passive-type income such as interest, dividends, and rent,[75] § 7704(d)(1)(E) extends such qualifying sources to also include: “income and gains derived from the exploration, development, mining or production, processing, refining, transportation (including pipelines transporting gas, oil, or products thereof), or the marketing of any mineral or natural resource (including fertilizer, geothermal energy, and timber), industrial source carbon dioxide, or the transportation or storage of [certain] fuel[s] . . . .”[76]

Because of the § 7704(d) exception, most MLPs satisfy the qualifying-income test with income from natural resources.[77] And natural-resource MLPs comprise 90% of all MLP market capitalization.[78]

Not all minerals and natural resources qualify; notably, qualifying income excludes income derived from “inexhaustible sources.”[79] With this specific prohibition, Congress left no room for statutory interpretation that would make renewables MLP eligible. If an MLP fails to meet the 90% qualifying-income threshold, the partnership is deemed to have transferred “all of its assets (subject to its liabilities) to a newly formed corporation in exchange for the stock of the corporation” and to have distributed “such stock to its partners in liquidation of their interests in the partnership.”[80] In effect, it would be subject to federal income tax on its earnings.

By listing on public stock exchanges, MLPs can access far more investors than a privately held partnership. MLPs are attractive investments for many investors because unitholders are entitled to distributions on a quarterly basis.[81] Under MLP partnership agreements, the MLP is required to distribute all “available cash” to its partners.[82] Since paying these distributions is critical to the success of an MLP, businesses that generate consistent cash flows are better suited to the MLP structure than volatile businesses such as those exposed to commodity-price risk.[83]

Critics of the current MLP qualifying-income requirements question why the benefits from an energy MLP are exclusively available to producers of nonrenewable energy. MLPs helped fuel the rapid expansion of fracking nationwide during the shale boom. This expansion happened while the rest of the world was preparing for the transition to renewables.[84]

B. The Financing Our Energy Future Act

The Financing Our Energy Future Act[85] was introduced on June 13, 2019 and has been referred to the Senate Committee on Finance[86] and the House Committee on Ways and Means.[87] The bill was initially proposed by Senator Chris Coons of Delaware in 2017 as the “MLP Parity Act.”[88] Earlier this year, Senator Coons provided the following description during Senate proceedings:

This bill expands to renewable forms of energy, to carbon capture and sequestration, and to renewable and so-called clean energy a popular and long-established tax tool for financing energy projects that the oil and gas and pipeline sectors have enjoyed for decades. It would level the playing field. It would stop picking winners and losers in terms of energy tax policy. It would be, literally, an “all of the above” energy financing strategy.[89]

1. Expansion of Qualifying Income.—The clear objective of the bill is “to extend the publicly traded partnership ownership structure to energy power generation projects and transportation fuels.”[90] Section 2(a)(4) extends eligibility to “[t]he generation of electric power . . . exclusively utilizing any resource described in section 45(c)(1) or energy property described in section 48 . . . .”[91] These new “qualified energy resources” would include wind, biomass, geothermal, solar, hydropower, and hydrokinetic (wave) energy.[92]

The expansion is significant for five reasons. First, the bill expands qualifying income to many renewable sources of energy for the first time. Only geothermal energy is provided for under the current law.[93] Second, the bill extends MLP eligibility into power-generation equipment for the first time. While it does so for power generation from renewable sources, it makes no mention of fossil fuel electricity generators such as coal or natural gas. Third, it makes no mention of companies that transmit electricity generated from renewable sources; the Internal Revenue Code, however, presently considers the transportation of mineral resources to be a qualifying activity.[94] Fourth, the bill does not remove or alter any of the existing categories of business activities eligible for structuring as an MLP.[95] Finally, nuclear energy—though widely considered “clean”—is excluded from the legislation as currently written. This exclusion is consistent with the global trend away from nuclear as a significant energy source.[96]

The expansion of qualifying income is expected to enlarge the investor base for renewable energy projects. Once an MLP is formed, the general partner would handle the operations of the renewable energy project. Hundreds of limited partners (the investing public) would invest capital and receive quarterly dividends. The MLP, as a pass-through entity, is not subject to corporate income tax. Investors are taxed according to their individual rate only on dividends received.[97] Thus, the Act would allow the investing public to purchase units of renewable-electricity partnerships to finance America’s clean-energy transition. Previously, individuals were unable to invest in new utility-scale renewable energy projects because of the immense investment required.[98] Capital would no longer need to come from private equity, hedge funds, or institutional investors.[99]

2. Congressional Support and Likelihood of Passage.—The bill has drawn support from a broad range of institutions, including states, businesses, trade associations, environmental advocates, and investors.[100] The supporting trade associations largely represent various renewable energy interests that would directly benefit from the bill.[101] Environmental advocates have acknowledged the success of MLPs in the fossil fuel industry and recognize the Act as an “important complement to other renewable energy policies.”[102]

Surprisingly, the bill has also been endorsed by many traditional oil and gas companies.[103] And oil-patch senators have cosponsored the bill.[104] While Republicans have traditionally supported fossil fuel interests and Democrats are more likely to support renewable energy,[105] such endorsement could be a political tactic to entrench the MLP as a continued subsidy for fossil fuels. There are many who would prefer the complete elimination of the MLP structure and its tax benefits rather than its expansion to renewables.[106] However, the inclusion of renewables as eligible resources could generate a bipartisan coalition protecting the subsidy,[107] making it nearly impossible to eliminate the tax-favored status for fossil fuel MLPs.

Despite widespread support, the bill has been overlooked in previous congressional sessions.[108] Some critics have indicated that they would not support the Act unless both the production- and investment-tax credits are eliminated.[109] However, Senator Coons recently reaffirmed his intent to pass the Act in the current legislative session.[110] His commitment to the bill is evidenced by his recent efforts to rebrand the legislation with a new, catchy name.[111]

II. Are MLPs a Good Fit for Renewables?

This Part considers the legislative history of the Master Limited Partnership to determine whether its expansion into renewables is presently warranted. It attempts to interpret the sparse text of the Financing Our Energy Future Act. Finally, it evaluates the MLP’s success in the midstream oil and gas industry and whether conditions in the renewable industry are similar.

A. Legislative History of the Master Limited Partnership

The overarching purpose of the 1987 Omnibus Budget Reconciliation Act was to counteract the “explosion of shelters and limited partnerships created solely for the purpose of evading tax responsibilities.”[112] Congress limited the entities that qualify for MLP status because the “proliferation of publicly traded partnerships” caused “concern about long-term erosion of the corporate tax base.”[113] The exception was meant to cover only those companies providing passive-type income. Energy companies are generally not considered passive investments.[114]

The legislative history of the 1987 Act does not explicitly state Congress’s reason for allowing energy companies to participate in the qualifying-income exception.[115] However, the exception was very likely intended to encourage the development of energy infrastructure within the United States. When the law was passed, the energy industry was depressed and energy imports were on the rise.[116] The committees responsible for drafting the legislation held three days of hearings to review the use and taxation of MLPs.[117] Witnesses explained how partnerships could be used to more easily raise capital for oil and gas exploration.[118]

For energy infrastructure to be built, the right economic incentives must be in place. Investors require a rate of return that compensates them for both the cost of a project and its associated risks—in the case of energy projects, the risks of delay or cancellation.[119] Expanded regulatory reviews of these types of projects increase their uncertainty, causing investors to demand more as a risk premium on their investment.[120] The MLP’s tax advantages afford it a lower cost of capital, which enables it to more easily attract investor capital. Rational investors will invest their capital in companies offering higher returns after adjusting for risk. By allowing energy companies to benefit from these advantages, investment flows into the industry.

In the end, Congress merely explained that the activities in natural resource industries “have commonly or typically been conducted in partnership form, and . . . disruption of present practices in such activities is . . . inadvisable due to general economic conditions in these industries.”[121] “In the case of natural resources activities, special considerations apply.”[122] These special considerations were likely related to the United States’ reliance on foreign energy. And it is possible that this fear prompted Congress to take protective action in creating the Master Limited Partnership.

Economic conditions today are markedly different from those of the 1980s, when the MLP was created. Industry experts are no longer concerned with the global supply of oil.[123] Widespread use of hydraulic fracturing and directional drilling have brought about the shale oil and gas boom, unlocking an abundance of energy resources.[124] As a result, proved reserves[125] of domestic crude oil and gas have approximately doubled in the last decade.[126] U.S. oil production nearly doubled in the past ten years, from five million barrels per day in 2007 to nearly ten million barrels per day in 2017.[127] Natural gas production has increased by about 50% over the same period.[128] Foreign imports have been substantially reduced and domestic production has thrived, curtailing national security concerns.[129]

But while energy independence has dramatically improved, national security may still be a valid reason for expanding the MLP to renewable sources. Shocks to global energy supply and demand cause domestic economic disruptions. For example, the 2011 instability in Libya caused domestic energy prices to skyrocket.[130] Avoiding these shocks has been a primary objective of U.S. foreign policy for the past fifty years.[131] This tradition is perhaps most evident in President George H.W. Bush’s invasion of Kuwait in 1990[132] and (arguably) President George W. Bush’s invasion of Iraq in 2003.[133]

Politicians ordinarily try to prevent energy spikes by increasing domestically produced oil. However, this approach is not entirely responsive.[134] Because the global energy market is so interconnected, U.S. energy prices would still rise if the global supply—from the Middle East, for example—was interrupted. This is because global consumers would bid up the price of U.S. oil if they could not purchase from the Middle East.[135] The real solution is creating excess capacity in the global market, which can also be achieved by reducing demand. Reducing reliance on oil by diversifying the U.S. energy infrastructure to include more alternative energy options leads to self-sufficiency, and can be a valid means of enhancing national security. Notably, electricity (generated from green sources) is insulated from global supply shocks because it has no global market.[136]

Congress has remained relatively inactive in § 7704 since the law was initially passed, but it did make small changes to the definition of “qualifying income” in recent years. The Emergency Economic Stabilization Act of 2008[137] expanded the definition of qualifying income to include the transportation and storage of certain renewable and alternative fuels, including ethanol and biodiesel.[138] The limited expansion of qualifying income could indicate that Congress intended for the enumerated list of qualifying activities to be read narrowly.

However, Congress could also have intended to delegate more specific interpretations to the Internal Revenue Service (IRS). Many companies have sought private letter rulings (PLRs) from the Internal Revenue Service to confirm whether their income streams meet the requirements of § 7704.[139] In response to an increasing number of these requests, the IRS issued specific regulations in January 2017 to provide further guidance on qualifying income.[140] Among the reasons for issuing these rulings was that “investor demand for higher yields has increased the incentive to push for an expanded definition of qualifying income through PLR requests concerning novel or non-traditional activities.”[141] Further, MLP activities have expanded beyond the more traditional qualifying activities due to “technological advances, deconsolidation, and specialization.”[142]

Congress’s budgetary fears in 1987 no longer hold weight with regard to the Financing Our Energy Future Act. While the proliferation of partnerships could reduce tax revenue and erode the corporate tax base, almost all renewable energy projects already use the classic partnership structure to finance themselves.[143] Therefore, the foregone tax revenue attributable to renewable energy MLPs would not exceed that which renewable energy partnerships already enjoy by way of pass-through taxation.[144]

So, while the legislative history does not conclusively reveal Congress’s purpose for prescribing the Master Limited Partnership, the buildout of renewable energy as advocated by the FOEF Act may still be warranted. Similar to oil and gas companies in 1986, the vast majority of renewable energy developers are structured as partnerships.[145] Additional renewable energy infrastructure could alleviate national security concerns. And, Congress may have simply wished to defer detailed interpretation to the IRS rather than defining an exclusive list of qualifying income. Section II(A)(2), below, considers how current IRS interpretations of § 7704 could be applied to the Financing Our Energy Future Act.

B. Interpreting the Financing Our Energy Future Act

The Financing Our Energy Future Act is short—the entire bill is fewer than 1,500 words.[146] Absent a thorough discussion by Congress, the IRS would have to provide additional guidance on how the law applies to the renewable energy industry. Academics have not yet attempted to interpret the Act; however, the legislative history of § 7704 informs how the IRS is likely to construe its provisions. Specifically, the IRS’s 2017 guidance—though addressing the current provisions of § 7704 applying to oil and gas activities—is instructive.[147] It can be used to resolve four particularly relevant ambiguities in the text of the FOEF Act.[148]

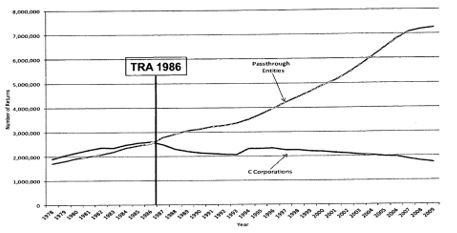

First, the IRS has tended to interpret the exceptions within § 7704(d) narrowly. The initial purpose of § 7704 was to restrict the growth of pass-through partnerships, which it viewed as eroding the corporate tax base.[149] In response to the Tax Reform Act of 1986, the tax community was engaging in a mass transition from the corporate structure into partnerships to take advantage of the preferential individual tax rates.[150] Several publicly traded companies attempted to disincorporate and restructure as a Master Limited Partnership.[151] Because Congress perceived this disincorporation as a threat to its tax base, it created a general prohibition against public entities receiving the more-favorable individual tax rates. The following graph illustrates the proliferation of partnerships resulting from the 1986 amendments to the tax code.

Figure 1[152]

Because § 7704(d)(1)(E) was an exception to the general rule,[153] the IRS interprets it narrowly.[154]

Applying these rules to the FOEF Act produces interesting results. While the bill extends MLP eligibility into power-generation equipment for the first time,[155] it makes no mention of fossil fuel electricity generators, and therefore, they are presumably ineligible. Similarly, nuclear energy generation is excluded and is presumably ineligible. But the exclusion of natural gas-fired power plants is particularly noteworthy, as natural gas is forecasted to be the leading provider of electric power in the coming decade.[156] Low natural gas prices resulting from the shale boom are driving the shift from coal-burning to natural gas-fired plants.[157] Perhaps the bill was drafted with this risk in mind: as both natural gas and renewable energy sources compete to replace coal, the FOEF Act could help renewables fighting to stay afloat amidst low natural gas prices.[158]

The IRS did acknowledge that reading the listed exceptions too narrowly would be problematic because it would ignore technological advances in the mineral- and natural-resource industries.[159] This problem is even more pronounced as it relates to the generation of electricity from clean sources, as the technologies will undoubtedly continue to develop.[160] But while the “Treasury Department and the IRS agree with commenters that the list of § 7704(d)(1)(E) activities should not be exclusive,”[161] both natural gas and nuclear technologies are widely known and sufficiently developed, indicating that Congress intended to exclude them from qualifying income under the Financing Our Energy Future Act.

Second, the FOEF Act makes no mention of the transmission of electricity derived from renewable sources. This is somewhat inconsistent with the prevailing Internal Revenue Code because § 7704 already provides an exception for the transportation of mineral resources,[162] whether via pipeline, marine vessel, rail, or truck.[163] The rule does not require ownership or control of the transported minerals, so the transmission of electricity could be considered a qualifying activity.[164] But again, the absence of an explicit provision in the FOEF Act suggests that income from the transmission of energy from renewable sources would not qualify. Only the generation would qualify.[165] Perhaps this was because transmission of electricity from fossil fuel generators has never been permitted to qualify; electricity is not considered a “mineral or natural resource.”

Third, the Financing Our Energy Future Act does not clarify whether traditional utilities sourcing or generating all of their energy from qualifying renewable sources would be allowed to structure as MLPs. This issue presents the most uncertainty and has been hotly debated in the context of natural-resource MLPs.[166] The IRS’s current interpretation precludes qualifying income for transportation of natural resources to retail customers.[167] The IRS specifically considers utility sales to retail customers to be ineligible.[168] However, in an example provided by the IRS, a publicly traded partnership would be eligible to sell diesel to a government entity at wholesale prices if it delivers those goods in bulk.[169] While renewable energy generators can sell to utilities, what if the utility itself—which sells to retail customers—is engaging in the qualifying generation? The prohibition against selling to retail customers would conflict with the authorization for renewable energy generation.

Fourth, the FOEF Act makes no mention of hedging activities and whether hedging of renewable energy generation would qualify. However, the IRS ruled that “hedging income, when it is derived from a section 7704(d)(1)(E) activity, should give rise to qualifying income under section 7704(d)(1)(E).”[170] In permitting such activities to qualify, it recognized that hedging is a common part of the industry and a prudent business practice.[171] It is reasonable to expect that hedging transactions for renewable energy generation would also qualify.[172] This understanding of the Act’s provisions will assist with further analysis of the bill.

C. Regulatory Environment

The successful extension of the MLP structure to renewable energy also depends on whether the appropriate regulatory environment is in place. But what is the appropriate environment for renewable energy companies? It is widely accepted that fossil fuel MLPs have facilitated the buildout of America’s energy infrastructure. Therefore, this subpart proceeds by comparing the regulatory environment of the renewable and fossil fuel industries to identify where the MLP could be a good fit.

1. Comparison of Gas and Electricity Markets.—In the 1900s, the investor-owned public utility emerged as the dominant model in American gas and electricity markets.[173] Under this model, regulators certified monopoly providers of natural gas and electric services and set the prices of those services ex ante.[174] The Federal Power Act (FPA)[175] and the Natural Gas Act (NGA)[176] authorized the Federal Power Commission to regulate wholesale sales of electricity and natural gas in interstate commerce. The regulation of retail sales was left to the states.[177] Under close regulatory scrutiny, utilities delivered gas and electricity to customers over growing networks of pipelines and wires. As regulated entities, these companies tended to be vertically integrated, which allowed them to provide customers with both energy and the service of transmitting it.[178]

In 1992, the Federal Energy Regulatory Commission (FERC) issued Order 636, ordering full unbundling of gas-transmission services from gas sales by all pipelines.[179] Market-based rates were permitted for wholesale gas sales where sellers were unaffiliated with pipelines.[180] Pipeline customers, which include local distribution utilities, electric generators, and large industrial users participating in wholesale markets, were able to buy their gas at the best available market price and hired the pipeline only to transport the gas.[181] This gas transmission, however, remained subject to rate regulation under the NGA.[182]

Electricity generators followed a similar path toward deregulation in the late twentieth century.[183] But electric utilities were more vertically integrated than their natural gas counterparts and owned most of their own generation.[184] In 1996, FERC issued Orders 888 and 889, mandating that electricity transmission from electricity sales in wholesale markets be unbundled and that owners of transmission lines act as common carriers providing transmission service on a nondiscriminatory basis to affiliated and nonaffiliated companies alike.[185] At the same time, FERC authorized market-based rates for the wholesale of electricity as long as the seller lacked market power.[186] As a result of deregulation, non-utilities—also known as independent power producers (IPPs)—have been able to enter competitive power markets.[187]

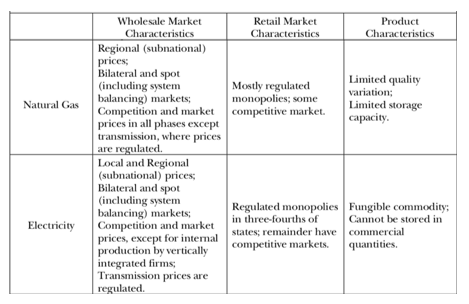

Consequently, some states began to introduce market-based rates into their retail electricity markets.[188] This caused utilities in these states to sell off most of their generation assets and increased the number of independent merchant generators.[189] In these deregulated states, the FERC pushed owners of transmission lines to form “independent system operators” (ISOs) and “regional transmission organizations” (RTOs) to ensure the reliability of the grid and prevent discrimination in the provision of transmission services.[190] In those states that did not engage in restructuring of retail markets, some public utilities continue to generate most of the electricity they sell to customers, while others satisfy most of their electricity needs from wholesale markets.[191] Notably, electricity transmission rates remained regulated.[192] The following chart compares the two regulatory frameworks.

Figure 2: Characteristics of Energy Product Markets[193]

An evaluation of the regulatory environments yields three important takeaways. First, transmission of each energy product remains subject to rate regulation. Second, wholesale gas and electric markets both are largely deregulated. And third, states vary as to whether they preserve the traditional vertically integrated utility structure for their electricity markets. The wider variety of regulatory schemes in electricity markets makes it difficult to draw broad conclusions about the efficacy of the FOEF Act outside the scope of the oil and gas industry. But some inferences can be made.

2. The MLP Is a Natural Fit in Regulated Industries.—Midstream oil and gas companies have been the primary beneficiaries of the MLP structure. Forty-six of the seventy-five energy MLPs are in the midstream sector.[194] And from 2005 to 2009, MLPs were involved in 27% of all U.S. natural gas pipeline-infrastructure projects.[195] This heavy concentration is no coincidence; it suggests that the midstream industry possesses characteristics that are favorable to the MLP structure. This is most likely because the midstream industry is subject to rate regulation.

State and federal agencies have established ceilings on the rates that regulated entities such as pipelines can charge.[196] Cost-based ratemaking is widely accepted as the general methodology for setting pipeline transportation rates.[197] Under cost-of-service ratemaking, rates are designed based on a pipeline’s cost of providing service, including an opportunity for the pipeline to earn a reasonable return on its investment.[198] What constitutes a “reasonable return” is a complex determination that varies by jurisdiction and pipeline, and may be disputed by either pipelines or their shippers.[199] If rates are set too low, pipeline companies may be discouraged from initiating new projects. While regulated entities are generally considered to be less risky assets, the risk–return profile is not attractive for all investors.

The ratemaking restrictions can make it more difficult for regulated entities to compete for investor capital. And this phenomenon is no secret. It is possible that the legislature recognized the unique challenges that midstream companies face in attracting capital and responded by creating the MLP. The Master Limited Partnership addresses these concerns because its tax advantages afford a reduced cost of capital.[200]

3. Regulation in the Renewable Energy Industry.—Like the NGA, the FPA requires that charges for transmission rates be “just and reasonable, and that no public utility grants undue preference or advantage to any entity or charges different rates to similarly situated transmission customers.”[201] The transmission of electricity is regulated in a similar manner to the transmission of gas. Under the simple analysis provided in the subpart above, regulated transmission of electricity could be a good fit for the MLP model. But the text of the FOEF Act does not make transmission a qualifying activity.[202]

On the production side, independent power producers are like upstream gas companies in that their sales are subject to market pricing in wholesale product markets. MLPs, however, have been much less effective in the upstream sector than the midstream sector. For example, when crude oil fell from $40 in 1981 to $10 in 1986, virtually all the MLPs involved in cyclical-commodity businesses suffered dramatic drops in valuation or failed.[203] This happened again when oil and gas prices bottomed out in 2014.[204] Renewable-electricity generators structured as MLPs could face similar issues, as generation[205] and market prices[206] are highly variable. Additionally, nonregulated upstream companies do not face the same challenges in attracting investor capital as do midstream companies; they have more upside because they are not subject to rate regulation. The “sexy part of oil and gas has always been exploration and production and the pipelines follow.”[207]

A remaining question is whether the Financing Our Energy Future Act could be implemented for traditional utilities. Because such entities are vertically integrated, they may contain generation, transmission, and distribution capabilities. Recall, though, that the current tax laws require that an MLP derive at least 90% of its income from qualifying activities. While utilities are subject to government oversight and regulation (and therefore stable), it is unlikely that they would derive 90% of their income from generation—the only qualifying activity under the FOEF Act.[208] Pure retail (downstream) utilities would also be ineligible based on the IRS’s current guidance.[209] Nonetheless, the deregulation of the power industry is significant because it allows the Act’s benefits to apply to independent power providers.

The similarities in the regulation of the natural gas and electricity markets suggest that expansion of the MLP structure to renewable generation could be effective. Electricity-transmission providers appear to be the best fit for the MLP structure, but are not accounted for in the Act. In the case of energy generation, which is provided for under the Act, the deregulated wholesale markets could still benefit from the MLP structure. Deregulated markets will choose energy sources based on the economic costs captured in market prices, which means that an MLP’s lower cost of capital could effectively incentivize investment.[210]

D. Characteristics of a Successful MLP

Six factors have been identified as characteristics of successful MLPs in the oil and gas sector.[211] Whether the MLP structure would be a good fit in the renewable industry also depends on whether these conditions can be replicated.

1. Stable, Growing Cash Flows.—MLPs are attractive investments for many investors because unitholders are entitled to distributions on a quarterly basis.[212] Under MLP partnership agreements, the MLP is required to distribute all “available cash” to its partners.[213] Since paying these distributions is critical to the success of an MLP,[214] businesses that generate consistent cash flows—like pipelines—are well-suited to the MLP structure.[215] Pipeline companies typically operate under long-term cost-of-service or take-or-pay contracts that produce stable, predictable income and are unaffected by volatility in the industry.[216]

The ability of renewable energies to generate power is limited by factors including daily hours of sun, wind speed, or water pressure. While lower-than-expected production cannot be avoided, solid planning of renewable projects and technological advances are enhancing generation capacity. Another risk is that wholesale energy sold on the spot market might be for a low price. But this risk can largely be mitigated through long-term power-purchase agreements (PPAs)[217]—essentially energy hedges—put in place at the outset of operations.[218] PPAs can also be used to bypass regulatory barriers in traditionally regulated states via elaborate legal arrangements that are essentially “virtual,” or financial, PPAs.[219] Under such an arrangement, a corporate buyer pays for energy that a renewable energy developer sells into the wholesale power market.[220]

2. Low, Predictable Maintenance Capital Expenditures.—A successful MLP is defined as one that makes regular, growing distributions to its unitholders.[221] One important component of increasing earnings is minimizing costs. Midstream pipelines are long-lived assets that are depreciated over thirty-five years; however, if properly maintained, they can be used for close to one hundred years.[222] Upstream companies have more volatile expenditures because exploration requires large and irregular investments.[223]

Renewable energy projects also involve long-lived assets, though not as long as midstream oil and gas assets. Renewable energy generation assets are usually depreciated over twenty years, but with proper maintenance capital expenditures, they may be used in excess of twenty-five years.[224] Like midstream assets, they require very little maintenance capital expenditures.[225]

3. Regulations that Protect Revenues.—Energy investors require a rate of return that compensates them for both the cost of a project and the risk of its possible failure.[226] Regulatory uncertainty elevates this risk, causing investors to demand more as a risk premium on their investment.[227] As discussed above, MLPs are particularly effective in industries subject to cost-of-service rate regulation because it is highly likely that they will recover their investment.[228] The FERC closely regulates midstream MLP assets.[229] And MLPs diversify their risk by holding intrastate assets too, which are regulated by agencies within the individual states in which they operate.[230]

The federal government’s inconsistent commitment to renewable energy growth is one of the leading risk factors investors consider when evaluating a potential solar or wind investment. While renewable energy projects are not subject to rate regulation, they have benefited from tax credits, which Congress has consistently renewed.[231] But because the extensions of these credits do not extend far into the future, determining whether an energy project will fully benefit can be challenging for taxpayers.[232] The deregulated nature of the power-generation industry is also a primary difference; deregulated markets do not share the same predictability in income as do regulated markets.

4. High Barriers to Entry.—Most MLP assets operate in a natural monopoly.[233] Pipelines are very capital-intensive, and high barriers to entry exist for new market entrants.[234] Pipelines often span thousands of miles across private land, requiring costly negotiations for easements or eminent-domain proceedings. The government permitting process requires a substantial investment of time and labor.[235] And pipelines feature economies of scale as throughput volumes increase because most of a pipeline’s costs are fixed and unaffected by throughput.[236] Once built, it is easier for an owner of such a pipeline to exercise market power in any given market.

Renewable power plants require relatively greater up-front capital expenditures for planning, construction, and equipment than their fossil fuel counterparts.[237] Renewable energy projects—like fossil fuel—can take ten or more years before they recover their high up-front capital expenditures and begin to generate taxable profits.[238] While market entry for power generators might be easier from a regulatory perspective, the higher capital costs are still a sizeable barrier to entry for new market players.

5. Access to Capital Markets.—Because an MLP pays out most of its operating cash flows to unitholders, it relies on capital markets for access to equity and debt financing.[239] The payout structure prevents MLPs from accumulating cash that could be used for expansion projects; therefore, they must access the capital markets in order to grow their distributions. Regulated entities are typically investment grade because of stable cash flows and ratemaking that permits recovery of costs.[240]

Funding for renewable projects may be more difficult to obtain depending on the price of competing power suppliers, the reliability concerns, and the investment-grade nature of the technologies.[241] But renewable projects may still seek debt financing from banks, public bond issues, or private bond issues; in terms of equity financing, renewables projects may seek funding from pension funds, private-equity firms, investment arms of various operating companies, or investment banks.[242] While borrowing may be more expensive for renewable projects, they nonetheless have access to the markets. Expanding the MLP to renewable generation would lower financing costs, alleviating this concern.

6. Low Exposure to Commodity-Price Risk.—Midstream companies such as pipelines typically do not own the physical assets that they transport. By avoiding physical possession, they do not engage in the sale or purchase of the commodity, and therefore are not exposed to commodity-price fluctuations.[243] In this regard, they are less risky than upstream exploration and production companies.[244] Several upstream energy companies have gone bankrupt in recent years due to greater volatility in cash flows.[245]

Renewable energy power assets generally have low exposure to commodity-price volatility. Like successful upstream MLPs, they hedge production.[246] They often possess long-term offtake contracts[247] with a utility or corporate buyer, locking in long-term energy prices.[248]

III. Practical Application of the Financing Our Energy Future Act

The similar industry conditions suggest that the success of the MLP could be replicated; however, it would depend on the ability of renewable energy generators to produce consistent, predictable cash flows, which could be difficult in the absence of regulations protecting revenue.[249] This Part considers whether the Financing Our Energy Future Act—if implemented—would meaningfully contribute to decarbonization of the United States.

A. Purported Benefits of the Act

Because of the inefficiencies associated with tax credits, the MLP has been suggested as a better tool for generating investment. But pairing the MLP structure with the tax-credit regime would render the credits practically useless[250] because “it is almost impossible for single-project MLPs to fully [monetize] tax credits and depreciation benefits.”[251] For this reason, proponents suggest that the MLP replace tax credits as a means of promoting investment in renewable energy.[252]

Is the MLP without tax credits really a better alternative than tax equity financing with credits? Importantly, renewable energy companies are already eligible to structure as corporations, and corporations share many of the Master Limited Partnership’s financing advantages.

Proponents of the FOEF Act provide several reasons why the law would stimulate investment in renewable energy infrastructure. They argue that the bill would avoid many of the issues created by tax credits by allowing renewable energy companies to bypass the tax equity market. But they fail to explain why the MLP would be a superior financing option to the traditional corporate structure, which has repeatedly been spurned in favor of tax equity investment. These arguments rely on assumptions that may be inappropriate, outdated, or unsupported by empirical evidence. I address each, in turn.

1. Access to Capital Markets Promotes Broad Investor Appeal.—Under the current regime, a limited number of large and wealthy investors are able to finance renewable energy projects. Tax credits are incentivizing the use of the tax equity structure to ensure that credits are monetized. However, MLPs can be structured to pool illiquid financial assets—the PPAs themselves—into marketable partnership units.[253] This process of securitization could attract investors who are deterred by the prospect of tying up capital in long-term energy projects[254] or who wish to diversify their risk across multiple natural-resource projects.[255] The argument is that access to the public-equity markets would cure this problem.[256] But the corporate structure is already available to renewable energy companies to securitize energy projects.

The MLP does not broaden the investor base beyond that which a traditional corporation can. Investment in MLPs is actually limited in several ways. Some institutional investors cannot own MLPs, which reduces the number of investors that are able to purchase MLP units.[257] MLPs are also excluded from the S&P 500 index despite satisfying the market-capitalization requirements.[258] Because many investment funds hold a portfolio of the S&P 500 index, unit prices are depressed and less capital reaches the MLP. Further, foreign investors typically avoid MLPs because they must file a United States tax return and pay U.S. income taxes.[259] Nor are MLPs attractive investments for investors using tax-advantaged retirement accounts.[260] All of these factors contribute to low trading volumes of MLP units, which disadvantages the MLP in raising money in the public-equity markets.[261]

2. Access to Capital Markets Lowers the Cost of Financing.—Proponents claim that the MLP structure would reduce the transaction costs associated with financing renewable energy projects—the role currently filled by tax equity investors.[262] Tax-equity deals require case-by-case contracts that must be custom tailored for each transaction.[263] The general view is that MLPs for renewables would reduce the complexity of project financing structures with relatively standardized deal structures to reduce lead times and transaction costs.[264] This is because the United States “has the largest and most efficient capital markets in the world.”[265]

But MLPs themselves have high transaction costs; they have been described as “Wall Street’s dream” because they are “fee machines.”[266] Although MLPs are a product of federal tax law, they are governed by state partnership law—typically Delaware[267] limited partnership law.[268] One of the key principles of Delaware partnership law is “to give maximum effect to the principle of freedom of contract and to the enforceability of partnership agreements.”[269] The Supreme Court of Delaware reinforced this notion in 1999, stating that:

[T]he partnership agreement is the cornerstone of a Delaware limited partnership, and effectively constitutes the entire agreement among the partners with respect to the admission of partners to, and the creation, operation and termination of, the limited partnership. Once partners exercise their contractual freedom . . . [they] have a great deal of certainty that their partnership agreement will be enforced in accordance with its terms.[270]

Because of this deference, MLP partnership agreements are typically long, complex, and drafted with great care.[271] MLPs incur significant legal fees in drafting these agreements and structuring drop-down asset transactions. Additionally, MLPs must carefully monitor sources of income to ensure that the qualifying income requirements are satisfied.[272] Finally, the K-1 tax form that partnership unitholders receive is a more burdensome and expensive endeavor for MLP investors to file.[273] These costs exceed those burdening a similarly sized corporate entity.

Proponents further argue that the MLP reduces transaction costs by creating a security that is readily tradeable on a secondary market.[274] This is because the owners of the partnership interests are readily able to purchase, sell, or exchange such interests on an established securities market, permitting them to exit an investment easily should the need arise.[275] It is true that MLPs provide enhanced liquidity over tax equity investments. Section III(A)(3), below, explains why this benefit is overstated.

3. Capital Markets Provide Increased Transparency to Investors.—Proponents claim that because MLPs are listed on a public exchange, increased transparency will better inform investors about the status of their investments.[276] With publicly traded shares, MLPs could improve the liquidity of renewable energy investment.[277] MLPs do so by providing the option to sell shares freely and easily, and by creating a secondary market for existing renewable energy projects to refinance themselves.[278] As discussed earlier, however, MLP partnership units are less liquid than other publicly traded securities for several reasons, and these factors contribute to low trading volumes of MLP units.[279]

Proponents also assert that the trading prices for renewable energy MLP units is informed by market forces, which could “help investors better assess a project’s technological reliability, resource quality, off-take risk, and other critical characteristics.”[280] But according to a leading global asset manager, “no corner of the US equity market is more inefficiently valued that [sic] MLPs.”[281] This is because investors focus mainly on the current yield and do a poor job distinguishing between high- and low-growth MLPs.[282] The MLPs’ unique valuation methodology—based on multiples of cash flow rather than net income[283]—make accurate valuations particularly difficult for individual investors.

Irrational MLP investors also inhibit market transparency. Consider, for example, the following trend. Energy MLPs within the midstream sector are traditionally insulated from commodity-price risk and typically enjoy modest, consistent returns. Yet, in its 2017 investor bulletin for Master Limited Partnerships, the SEC disclosed that MLPs are subject to “[i]ndustry risk and concentrated exposure.”[284] While midstream companies are not directly affected by downturns in energy prices, their customers (upstream companies) suffer when prices are low. Pipeline companies are subject to credit risk associated with customers that may declare bankruptcy and refuse to pay for services. For this reason, midstream MLPs are somewhat sensitive to industry-wide trends.

But credit risk does not fully explain the relationship. The Alerian MLP index—an exchange-traded fund representing a portfolio of most large MLPs—is correlated with the price of crude oil.[285] While some upstream energy companies use this structure, the vast majority of MLPs are in the midstream sector.[286] The most likely explanation for the correlation is that investors (irrationally) assume that all MLPs are exposed to volatility in oil and gas prices and alter their investing strategy accordingly.[287] According to Alerian’s research analysts, “investor sentiment play[ed] a huge role” in the MLP sell-off estimated at tens of billions of dollars.[288] Recent bankruptcies of upstream MLPs may be contributing to such investor wariness, distorting market valuations for the rest of the sector.[289] Market transparency in the context of MLPs is a myth.

4. Renewables Must Raise Equity Capital Through Classic Corporate Structures that Are Doubly Taxed at the Entity and Individual Levels.—The federal tax code exempts MLPs from paying the entity-level income taxes that other publicly traded companies must pay.[290] Proponents claim that subjecting corporate renewable energy companies to a double layer of taxation increases their cost of capital above that of MLPs.[291] Because only fossil fuel companies are eligible to structure as MLPs, renewable energy generators are perceived to be at a competitive disadvantage.

Before 2018, MLPs had a tax advantage of 8.4% over corporations, assuming the investor resides in the highest tax bracket.[292] In December 2017, President Trump signed the Tax Cuts and Jobs Act into law.[293] While it did not repeal § 7704(c) of the Internal Revenue Code—which allows the qualifying income exception—it had two significant effects.

First, the corporate tax rate was substantially lowered. The tax-reform law dropped the corporate income-tax rate from 35% to 21%.[294] While this is great for corporations, it significantly reduces the key advantage held by MLPs. The tax rate for corporate dividends remained at 20%, for a new effective rate of 36.8%.[295]

This was partially offset by a lowering of the individual tax rate. Under the new law, pass-through income is taxed at the investor’s ordinary income tax rate of 37%.[296] But the law also includes a temporary 20% deduction of pass-through income[297] that takes the new effective rate to 29.6%.[298]

The overall result is an MLP tax advantage of 7.2%, which is lower than before. It is also noteworthy that the additional 20% deduction that MLP investors are receiving sunsets in 2025, at which time corporations will have a more favorable tax treatment than MLPs.[299] Going forward, these factors are likely to reduce the popularity of MLP investments. Yet, this is unsurprising; in 2011, the Congressional Research Service recognized that subjecting MLPs to corporate taxation “could place greater capital constraints on, and potentially reduce investment in, industries currently able to use the MLP structure.”[300] Academics agree with this conclusion.[301] The Senate Committee on Energy and Natural Resources has heard evidence that the cost-of-capital benefits associated with the MLP are better attributed to lower financing costs in the public markets, rather than the tax advantages.[302]

5. MLPs Have a Proven Track Record for Rising Capital.—Proponents’ final claim is that the MLP’s success in the oil and gas industry is indicative of its success for renewable energy projects.[303] Because of the tax arbitrage of holding these assets in the partnership structure, there was a transition of MLP-qualifying assets from corporations to MLPs, proving their popularity among companies.[304] And the market value of the MLP sector grew from just $8 billion in 1996 to around $480 billion in 2013, evidencing investor support.[305] Proponents assert that strong historic growth in the market capitalization of MLPs—despite modest dividend payments—suggests that investor demand for MLPs exceeds the supply.[306]

But the MLP’s success is largely unfounded. There has been a systematic decline in MLP popularity over the past few years, including a recent movement for MLPs to simplify and restructure their ownership models.[307] In 2014, Kinder Morgan stunned the corporate world by abandoning the Master Limited Partnership structure that it helped to popularize throughout the early twenty-first century.[308] This trend is now spreading throughout the industry. In 2017, ONEOK’s parent corporation acquired its MLP.[309] In 2018, Enbridge Energy Partners,[310] Energy Transfer Partners,[311] and Williams Partners[312] underwent similar transformations. And there has been a sharp decline in the number of MLP IPOs; only one has occurred since 2017.[313]

The reasons proffered for these restructurings includes “the MLPs’ prohibitively high costs of capital and the need to lower the cost of capital to pursue more investments.”[314] These explanations are surprising, considering the MLP’s tax advantages. Rating agencies and legal scholars note that ineffective corporate governance is prohibitively raising the MLP’s cost of capital beyond that of a comparable corporate entity.[315] These problems are inherent in the MLP structure and unlikely to be avoided by renewable energy generators.[316]

Empirical evidence demonstrates that the S&P 500 has consistently outperformed pipeline companies over the past ten years.[317] And this data does not consider the full extent of the tax changes, which took effect only last year.[318]

Commentators predicted the MLP to be an important player in facilitating infrastructure growth in the wake of the shale boom,[319] and for a time, they were correct. The oil and gas industry in the United States was growing rapidly until very recently. The increased supply of oil and gas created a need for additional infrastructure to ship and store the minerals. Consequently, processing facilities and pipelines were built across the country.[320]

While MLP proponents contend that the MLP structure facilitated the buildout of energy infrastructure, this Note suggests the opposite. Perhaps the increased need for infrastructure created a demand for more MLPs, causing them to increase in popularity. The shale boom fueled the growth of MLPs, but when energy prices bottomed out, their popularity declined. It might have been the market that was making the MLP successful—not the inverse. There can be no assurance that renewable energy MLPs would experience any more success than MLPs in the midstream oil and gas sector.

6. Tax Credits Will Continue To Be Inefficient Incentives.—Those who wish to eliminate the tax credits cite the difficulty that developers face in monetizing them. But the shortage of eligible investors associated with tax equity financing may not persist. Corporate investors are beginning to play a more prominent role in the financing of renewable-infrastructure projects. Socially responsible investing is a new theme in the capital markets.[321] Companies that want access to renewable energy are some of utilities’ largest customers.[322] Corporations such as Google and Apple have been initiating their own generation projects for several years.[323] And now, nontech companies such as Budweiser, Gap, and MGM Resorts are entering the mix.[324] Tax credits can still be a workable incentive for profitable corporate entities; corporations can utilize credits by sponsoring their own renewable generation project or participating in the financing of an independent power producer.

7. Result: MLPs Would Not Be Superior to Tax Credits.—Despite the costs associated with private-equity financing, renewable energy companies still pursue tax equity investment as the preferred financing tool. The logical conclusion is that tax credits do incentivize investment. It is unlikely that the MLP—without the benefit of tax credits—would have more success than the current arrangement. This subpart explained that the market considers corporations to be superior to MLPs in the oil and gas industry, which already do not enjoy the benefits of the ITC and PTC. And the market has also chosen private-equity financing (with credits) over corporate financing in the public markets. Therefore, the corporation’s superiority over the MLP suggests that expansion of the MLP structure is disfavored by the market.

One concern, though, is the longevity of these tax credits. The PTC is only available through 2019, and has been phasing down since 2017.[325] The ITC is also phasing down toward its terminal credit value of 10%.[326] While Congress has a history of renewing these credits, the Trump Administration has not demonstrated a commitment to renewable energy.[327] The expiration of these credits would provide a more compelling reason to expand the Master Limited Partnership to renewable energy sources.[328]

The decrease in the corporate tax rate from 35% to 21% is also expected to reduce the impact of renewable energy tax benefits. A 2017 analysis estimated that tax equity investments in new wind projects would fall from 68% of total capital to around 60% in 2018.[329] Similarly, investment in new solar projects was expected to fall from around 45% to 37% in 2018.[330] This is because each tax equity investor “has 40% less tax appetite than they did before.”[331] And on top of that, the depreciation benefits of renewable energy projects are worth less because of the reduced rate.[332] The Tax Cuts and Jobs Act has both crippled the MLP and reduced the value of renewable tax credits.

B. The Financing Our Energy Future Act’s Effect on Decarbonization

Subpart III(A) identified many of the flaws in the MLP structure as a tool for raising capital. But the Financing Our Energy Future Act maintains bipartisan support and has been reintroduced in the most recent Congressional session.[333] If the bill does pass, and is able to incentivize investment, what would be its effect on decarbonization in the United States? The analysis from Part II can help in forming a prediction.

First, the principal effects of the FOEF Act would be limited to decarbonization of the electricity market. The Act expands the MLP structure to renewable-energy-generation activities, comprising 27.5% of national emissions.[334] It does not, however, solve emissions problems associated with transportation activities (28.7%), industry (22.4%), and agriculture (9.0%).[335] These other economic sectors are emitting a significant amount of the country’s greenhouse gasses.

The FOEF Act may, however, indirectly affect emissions within other economic sectors. For example, increased electricity generation could advance the country’s movement toward electric vehicles in the transportation sector. While the U.S. transportation sector is still highly dependent on oil over other forms of energy, efforts to power vehicles with ethanol, biofuels, and electricity are underway.[336] Each of these sources is included as a qualifying source under the FOEF Act.[337]

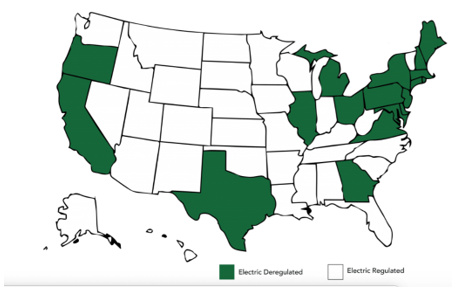

Second, the FOEF Act would be most effective in deregulated energy markets. The Act is intended to benefit independent power producers, and vertically integrated utilities are unlikely to satisfy the qualifying income requirements. But a significant number of Americans continue to live in regulated electricity markets. The following diagram illustrates the current state of the U.S. electricity market:

Figure 3[338]

Fortunately, the benefits would be enjoyed by some states with the highest consumption of electricity, such as Texas, California, and New York.[339]

The exclusion of traditionally regulated utilities is problematic because they are the companies that are most resistant to change. Regulated utilities have an economic interest in their existing fleet of electric power plants, which mostly run on coal and natural gas. Consumers are captive to that utility’s generation portfolio because competition is prohibited. For this reason, it has been easier for consumers wanting to buy renewable energy to do so in a restructured state where they can elect to buy from a range of generators, some proffering electricity generated from renewable resources.[340] Perhaps the FOEF Act could be amended to include the participation of vertically integrated utilities.

Third, promoting only renewable-generation capacity, without the accompanying transmission infrastructure, is problematic. Renewable energy generation frequently occurs in locations far from where the electricity is eventually consumed. For example, wind energy is plentiful in the Midwestern United States, far from major cities.[341] Solar energy is most available in the deserts of the southwestern United States, which are also sparsely populated. Transmission lines are needed to bring electric power to population centers and often do not keep pace with new generation.[342]

Transmission congestion is already a problem.[343] And it is only expected to get worse. Generation capacity is currently growing faster than transmission, and big transmission upgrades require the coordination of multiple states and cooperation among the companies that own the grid.[344] As a result, renewable energy projects that rely on interconnections with the transmission grid may experience increased expense and regulatory delay associated with the installation of new transmission lines needed to transmit the newly produced energy.[345] The FOEF Act might be improved by permitting the transmission of renewable electricity as a qualifying activity.

Several other effects of the FOEF Act deserve note. A serious concern in the transition to green electricity is the operability of the U.S. electric system. At high levels of renewable-electricity penetration, challenges arise related to variability and uncertainty in output.[346] Nuclear energy is often mentioned as a possible solution to intermittency.[347] But the Act does not incentivize nuclear; it is omitted as a qualifying source of income.[348] Rather, it includes energy storage as a solution for inconsistent generation by renewables.[349]

In 2018, FERC Order 841 created a structure for energy storage companies to participate in U.S. wholesale capacity, energy, and ancillary-services markets.[350] Order 841 directs RTOs and ISOs to come up with market rules for energy storage to participate in the wholesale energy markets.[351] This Order is expected to provide certainty for investors, accelerate renewable energy development, and counteract intermittency.[352] Storage is especially relevant to areas where there is already a large amount of renewable energy generation because excess energy production is more likely to occur in these areas.[353] But because fossil fuels are cheaper forms of storage themselves, these technologies are not yet widely used. The Act is unlikely to affect storage technologies in the near future.[354]

Conclusion

Renewable energy tax credits are problematic because of the mismatch between the economic benefits enjoyed by a small group of high-income tax investors and the costs across American taxpayers.[355] These challenges are not unique to renewable energy companies. Startup companies and other projects with high up-front costs and modest returns over a long period of time also struggle to monetize tax incentives.[356] The efficiency of tax credits would be improved significantly if the ITC and PTC were made refundable, thereby eliminating the need for costly tax equity investment structures.[357]

This Note assessed whether the Financing Our Energy Future Act can facilitate America’s clean energy transition. It did so by evaluating the Master Limited Partnership’s ability to incentivize investment in renewable energy. The analysis provided the following six takeaways:

Economic conditions in the United States are markedly different than those in 1986, when Congress established the Master Limited Partnership to promote the development of oil and gas infrastructure. However, national security may still be a valid reason for expanding the MLP structure to renewable energy resources.

The Financing Our Energy Future Act is short and would require interpretative guidance by either Congress or the Internal Revenue Service. Guidance issued by the IRS in 2017 indicates that MLP expansion would be limited to the generation of electricity from renewable sources.

The Master Limited Partnership has been used to promote the development of midstream oil and gas infrastructure. Differences between the renewable energy industry and the midstream industry suggest that renewable energy generation may not be a perfect fit for the MLP structure.

The Financing Our Energy Future Act would primarily benefit independent power producers in deregulated energy markets. Vertically integrated utilities are unlikely to meet the qualifying income requirements.

Amending the FOEF Act to include transmission of renewable electricity might make the bill more effective.

The Master Limited Partnership is not likely to be an effective replacement for tax credits. The preference for private-equity investors over the corporate structure evidences the effectiveness of credits. The advantages of the corporation over the MLP indicate that it will be even less popular.

Renewable energy advocates have lined up to support the Financing Our Energy Future Act. They point to the inequity between government incentives; subsidies for wind and solar (tax credits) are temporary while subsidies for oil and gas (MLPs) are permanent.[358] But, contrary to popular opinion, the Master Limited Partnership is unlikely to finance America’s green-energy future.

- .The World Is Losing the War Against Climate Change, Economist (Aug. 2, 2018), https://www.economist.com/leaders/2018/08/02/the-world-is-losing-the-war-against-climate-change [https://perma.cc/8B59-SL3U]. ↑

- .Alexa Lardieri, Evidence Humans Are Causing Global Warming Reaches ‘Gold Standard,’ U.S. News (Feb. 25, 2019), https://www.usnews.com/news/politics/articles/2019-02-25/study-evidence-humans-are-causing-global-warming-reaches-gold-standard [https://perma.cc/Y66T-J73Z]. ↑

- .Sintia Radu, Climate Change Seen as World’s Greatest Threat, U.S. News (Feb. 10, 2019, 6:00 PM), https://www.usnews.com/news/best-countries/articles/2019-02-10/climate-change-isis-seen-as-greatest-global-threats-survey-finds [https://perma.cc/46K8-4E3G]. ↑

- .Jordan Friedman, Cities with the Biggest Carbon Footprints, U.S. News (Feb. 19, 2019), https://www.usnews.com/news/cities/slideshows/cities-with-the-most-carbon-emissions [https://perma.cc/772L-QN5T] (ranking Chicago at number eight, Los Angeles at number five, and New York City at number three). ↑

- .U.S. Envtl. Prot. Agency, Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990-2017, at ES-24 (2019), https://www.epa.gov/sites/production/files/2019-02/documents/us-ghg-inventory-2019-main-text.pdf [https://perma.cc/T63K-GPLD]. ↑

- .U.S. Renewable Electricity Generation Has Doubled Since 2008, U.S. Energy Info. Admin. (Mar. 19, 2019), https://www.eia.gov/todayinenergy/detail.php?id=38752 [https://perma.cc/2X4W-GXD8]. ↑

- .More Than 60% of Electric Generating Capacity Installed in 2018 Was Fueled by Natural Gas, U.S. Energy Info. Admin. (Mar. 11, 2019), https://www.eia.gov/todayinenergy/detail.php?id=38632 [https://perma.cc/HAZ4-ZHUF]. ↑

- .See James H. Williams et al., Policy Implications of Deep Decarbonization in the United States 14 (2015), http://deepdecarbonization.org/wp-content/uploads/2015/11/US_Deep_Decarbonization_Policy_Report.pdf [https://perma.cc/8V38-Y7FQ] (“Policies (including state-level) that drive a ‘natural gas transition’ without also driving a major expansion of renewable, nuclear, or CCS generation will not achieve the required emission intensities.”). ↑

- .For a description of the necessary pace for decarbonization of the global-energy economy, see Intergovernmental Panel on Climate Change, Global Warming of 1.5° Celsius 95 (2019), https://www.ipcc.ch/sr15/ [https://perma.cc/FX27-THHJ]. ↑

- .E. Donald Elliott, Why the United States Does Not Have a Renewable Energy Policy, 43 Envtl. L. Rep. 10095, 10095 (2013). ↑

- .Regulatory authority of energy is fragmented, where fifty different states regulate electric utilities while the federal government regulates wholesale transportation of electricity. Id. at 10096. The United States has difficulty maintaining consistent energy policies because of frequent changes in government control by our political parties. Id. at 10097. And future generations who would largely derive the benefits of clean energy are largely unrepresented in current politics. Id. at 10098. ↑

- .American citizens have come to expect energy to remain cheap because it has historically been cheap. Id. The United States’ strong free-market ideology opposes heavy government intervention. Id. at 10099. And our electricity system is controlled by private ownership of electric utilities, oil, and coal companies, which are powerful lobbying forces against change. Id. ↑

- .Elisabeth Rosenthal, Portugal Gives Itself a Clean-Energy Makeover, N.Y. Times (Aug. 9, 2010), https://www.nytimes.com/2010/08/10/science/earth/10portugal.html [https://perma.cc/W7PA-KZML] (insisting that, to catch up, the United States “must overcome obstacles like a fragmented, outdated energy grid poorly suited to renewable energy”). ↑

- .Elliott, supra note 10, at 10100. ↑

- .Nat’l Conference State Legislatures, State Renewable Portfolio Standards 2 (Feb. 1, 2019), http://www.ncsl.org/research/energy/renewable-portfolio-standards.aspx [https://perma.cc/8QJZ-92DY]. ↑