Corporate Crime and Punishment: An Empirical Study

For many years, law and economics scholars, as well as politicians and regulators, have debated whether corporate punishment chills beneficial corporate activity or, in the alternative, lets corporate criminals off too easily. A crucial and yet understudied aspect of this debate is empirical evidence. Unlike most other types of crime, the government does not measure corporate crime rates; therefore, the government and researchers alike cannot easily determine whether disputed policies are effectively deterring future incidents of corporate misconduct. In this Article, we take important first steps in addressing these questions. Specifically, we use three novel sources as proxies for corporate crime: the Financial Crimes Enforcement Network (FinCEN) Suspicious Activity Reports (SARs), consumer complaints made to the Consumer Financial Protection Bureau (CFPB), and whistleblower complaints made to the Securities and Exchange Commission (SEC). Each source reveals an increase in complaints or reports indicative of corporate misconduct over the past decade. We also examine levels of public company recidivism and find that they are likewise on the rise. And we document a potential explanation: recidivist companies are much larger than nonrecidivist companies, but they receive smaller fines than non-recidivist companies (measured as a percentage of market capitalization and revenue). We conclude by offering recommendations for enforcement agencies and policymakers. In particular, our results suggest that enforcers are unlikely to achieve optimal deterrence using fines alone. Enforcement agencies should therefore consider other ways of securing deterrence, such as by seeking penalties against guilty individuals and the top executives who facilitate their crimes.

Introduction

Throughout the COVID-19 pandemic stimulus negotiations, corporate liability was a sticking point. Senate Majority Leader Mitch McConnell and other Senate Republicans demanded that any additional support to struggling households be paired with federal liability shields that would restrict pandemic lawsuits from targeting corporations and their employees.[1] Democrats contended that liability shields would precipitate negligence by businesses, universities, and hospitals that knew they would never be held accountable for misbehavior.[2]

Although the pandemic brought these issues to the surface, they are not new, and indeed, the standards by which we hold businesses accountable for malfeasance is a significant area of public concern. Complex trade-offs govern the existing legal framework: on the one hand, forceful punishment for firms may chill beneficial economic activity; on the other, the failure to hold businesses and their employees accountable for misconduct can encourage future bad behavior. These arguments were at the forefront of the conversation during the financial crisis of 2008, when the Department of Justice’s (DOJ) lax approach to pursuing individual bankers precipitated public outrage.[3] And they will surface again.

A crucial and yet understudied component of this debate is understanding how corporate misconduct fluctuates in response to changes in enforcement and punishment. Perversely, however, the government makes no attempt to measure corporate crime.[4] Compare this dearth of data to what exists for public-order crime: each year, two government agencies provide detailed crime statistics for each category.[5] This data allows researchers to evaluate changes in litigation and other enforcement practices and consider whether they are optimally deterring criminal conduct. When it comes to corporate crime, however, the same body of research does not exist.

The importance of this asymmetry should not be understated. Most basically, the lack of statistical data surely hampers corporate criminal enforcement efforts. Suppose that the police in your city took no steps to measure the number of robberies each year. As such, if there was a steady increase, the police (and the government agencies with authority over the police) would not know about it, nor would they be able to develop an adequate response. In reality, government bodies take great pains to measure the level of violent crime in their jurisdiction because it helps them calibrate whether or not additional steps need to be taken to increase deterrence.[6] But for corporate crime—which can affect millions of people’s lives and bring down entire economies—enforcement plows forward blindly, subject to political winds rather than taking a clear look at whether crime is being adequately deterred.

Even more importantly, the lack of corporate crime statistics contributes to inequity in our criminal justice system. It is evident that the U.S. operates a two-tier criminal justice system that disproportionately affects people of color.[7] In particular, blue-collar offenders generally serve jail sentences for public-order crimes; white-collar criminals are rarely prosecuted, and when they are, they generally bear less severe consequences.[8] Much has been written about the reasons for this inequity, and we offer an additional explanation: crime statistics play an important role in fueling policing efforts. If the public notices an upward trend in crime, it clamors for additional enforcement—increased monitoring of vulnerable areas, a quicker response time when calls are received, stronger charges in cases against arrestees—and police and prosecutors generally respond. There is no such information to guide public opinion when it comes to corporate crime. Not only that, the lack of statistics for corporate crime insulates enforcement agencies that take a lenient approach to corporate punishment. Without any information about whether crime is increasing, agencies can hide behind statements that their enforcement policies are adequately, or even optimally, deterring crime. Indeed, as the 2008 financial crisis shows, enforcement agencies rarely face a reckoning unless their lax policies contribute to an environment that nearly brings down the global economy.

This Article takes important steps toward addressing this asymmetry. It first offers an empirical analysis of the shift in the legal landscape over the past decade that not only decreased the likelihood that corporations would be prosecuted and that individuals would be held criminally liable, but also increased the size of monetary fines imposed on corporations. It then identifies three novel data sources that shed light on the question of whether crime has risen at U.S. public companies in the wake of these changes. Specifically, it identifies three proxies for corporate misconduct in order to study trends over time. Proxy data are particularly useful in this context—unlike most violent crime, corporate crime can be harder to observe and is often defined by broad and amorphous criminal statutes, complicating its measurement.

To proxy for corporate crime, we utilize three distinct data sources: the Financial Crimes Enforcement Network (FinCEN) Suspicious Activity Reports (SARs), consumer complaints made to the Consumer Financial Protection Bureau (CFPB), and whistleblower complaints made to the Securities and Exchange Commission (SEC).[9] These data come from a variety of vantage points: SAR reports are required to be filed by financial institutions under certain circumstances that are highly suggestive of malfeasance, while the CFPB data are generated by aggravated consumers of financial products.[10] Whistleblower complaints are generally filed by employees of banks and companies who suspect that financial crime has occurred; if the information leads to a successful enforcement action, the whistleblower is eligible for a large bounty.[11] By examining both reports by employees who report observed crimes and consumers who are harmed by misconduct committed by institutions with which they do business, we can usefully extrapolate information about overall crime trends.

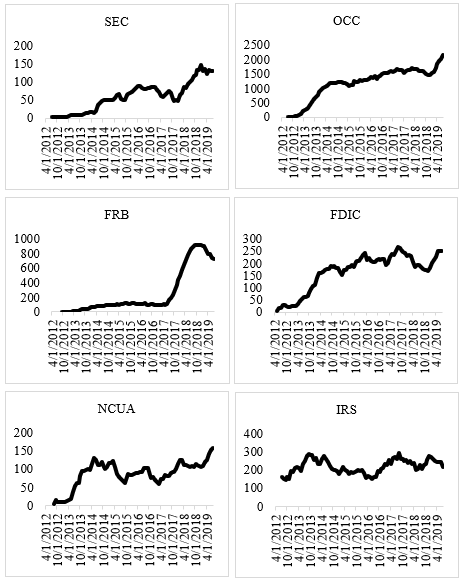

Our results are summarized as follows: In the period from 2012 to 2019, we document a steep upward trend in SARs filed across every single agency that collects them (the OCC, the FDIC, the FHIFA, the NCUA, the FRB, the IRS, and the SEC). We focus only on those cases where SARs report insider involvement in financial crimes; thus, our data indicate that financial institutions flagged their own involvement in a greater number of transactions suggestive of money laundering, fraud, or other financial crimes in each year for the past five years.[12] In addition, we document an upward trend in consumer complaints submitted to the CFPB from November 2014 to August 2019, in all but a single category. Finally, we also observe a steady increase in whistleblower tips submitted to the SEC from 2011 to 2018. In sum, our data suggest an upward trend in reports of financial misconduct from three distinct sources that cover a broad range of crimes.

We recognize, however, that the implications that can be drawn from this data are necessarily limited due to imperfections in these datasets. For one, our data proxy for corporate misconduct, which may not correlate perfectly with corporate crime. We infer, however, that broader evidence of misconduct generally infers broader criminal activity and allows us to estimate trends in corporate criminality over time. However, factors that impact the incidence of misconduct reporting can confound our results. For example, it is possible that following the financial crisis, financial institutions were more careful to report suspicious activity, and therefore SAR filings increased for that reason. Likewise, perhaps whistleblower tips trended upward not because of an increase in criminality, but because of growing recognition of the large bounties available. Finally, perhaps consumers of financial products were simply becoming familiar with a new tool provided by a new agency, and that fact explains the increase in complaints made to the CFPB. Regarding the latter concern, however, we document a decrease in consumer complaints related to mortgages after July 2016; all other complaint types increase. This fall in mortgage complaints is consistent with increased scrutiny from the federal government about mortgage practices in the years following the financial crisis, as new regulations and regulatory oversight helped eliminate abusive practices.[13] Although this is not the only plausible explanation—it could be attributable to a fall in mortgage delinquencies, for example[14]—it suggests that the increase in other types of complaints is not solely attributable to an increase in consumer familiarity with the consumer complaint resource. If that were the sole cause, we would expect to see an increase in complaints across all dimensions.

In general, the volatility in our data series suggests that we are picking up on something more than changes in reporting practices. Taken together, our data show that corporate crime levels rise postcrisis, but in a non-monotonic way. It is certainly possible that this volatility is a by-product of changes in enforcement priorities, but it is likely that at least a portion of the uptick we document reflects an increase in the underlying level of criminal behavior. And given the features of the federal enforcement regime that we observe—the near disappearance of individual liability, especially for top executives, and the low number of corporate prosecutions—our results are unlikely to strike many as surprising.

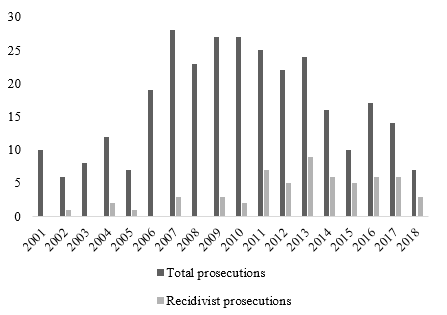

As further support for our interpretation of the data, we study public company recidivism, relying on data provided by Brandon Garrett.[15] We define a corporate recidivist to be a public company that was prosecuted more than once between 2001 and 2018. We normalize fines by three measures of firm size—assets, revenue, and headcount. And we document a steep rise in recidivism during this time period, across public companies in all industries.[16]

We also observe some interesting characteristics of recidivist firms and their penalties. We find that larger firms tend to be recidivists; firms that offend only once are much smaller (as measured by market capitalization and number of employees) than recidivist firms. In addition, although recidivist firms bear fines that are, on average, twice the size of those borne by non-recidivist firms, these penalties are miniscule when scaled by the company’s assets or employees. For large firms, therefore, it may be more appropriate to think of these fines as inconsequential “parking tickets”[17] rather than meaningful deterrents.[18] For smaller firms, fines represent a greater burden.[19] This may explain why their deterrent value (as measured by the likelihood of offending again) is higher than the relatively lower fines ascribed to their larger counterparts. Perversely, therefore, concern about the potential adverse effects of criminal prosecution on large firms and their shareholders and the ramifications for the broader economy may insulate the malfeasance that is most socially disruptive from adequate punishment.[20]

In sum, our data indicate that corporate misconduct is on the rise, and we theorize that the current federal enforcement regime has a share of the blame. Although high fines imposed irregularly could result in efficient and adequate deterrence under certain circumstances,[21] our results indicate that fines are too low or imposed too sporadically to effectively deter crime.[22] In theory, a fine that is set equal to the social cost of the crime, adjusted upward to account for the probability of underdetection, will cause management to optimally prevent future instances of harm.[23] But the optimal fine might not be possible to calculate (what is the social cost of eighty-six lives?) or legally or politically feasible to levy (what if the optimal fine puts the firm into bankruptcy or is well beyond the statutory cap?).[24]

Not only that, there are also practical limitations to the corporation’s ability to adequately deter future incidents of crime when the only punishment is an entity-level fine.[25] Quite obviously, a fine primarily affects shareholders, not necessarily the individuals who committed the crime and who may have garnered private benefits from its commission. In theory, shareholders should have an incentive to demand reforms that would deter future criminal behavior that will depress the value of their shares, but rationally apathetic shareholders might not recognize the problem or understand how to address it.[26] In addition, the ultimate deterrent effect of fines against corporations and their shareholders may be muted: although a company’s stock price generally falls when charges are filed, it usually bounces back very quickly and tends to rise upon the fine’s announcement.[27] Therefore, shareholders might not demand an appropriate reduction in activity levels or the right amount of firm-wide monitoring to avoid future instances of crime.[28]

Our Article therefore makes two primary contributions. First, we use three novel data sources as a proxy for corporate crime. Importantly, we are one of the only papers to look beyond enforcement data, which is subject to endogeneity concerns, when evaluating corporate criminal enforcement.[29] And we generate several pieces of evidence indicating that corporate crime is on the rise. Second, we identify flaws in enforcement practices that are likely responsible for this underdeterrence, and in particular, an overreliance on fines as the primary penalty. We recognize, however, that our crude proxies do not allow us to precisely identify the aspects of the U.S. enforcement regime that are failing us nor the appropriate course of action to correct it. Therefore, our principal policy recommendation is for the government to treat corporate crime like any other type of crime and measure it. If our results are confirmed with further study, the normative implications are clear: enforcement agencies should increase the deterrence punch of each penalty by moving beyond fines and pursuing culpable individuals. We recognize that it is often difficult to charge individuals, and especially the top executives who are insulated from the commission of the crime, which may explain the dearth of actions against them. Indeed, we view this as a principal failing of the federal corporate crime enforcement regime and one that very likely contributes to the trends that we observe. Therefore, in Part III, we discuss one potential path forward: a new cause of action that would make it easier for prosecutors to pursue executives who facilitate crimes by lower-level employees.

Our Article proceeds as follows. Part I describes the U.S. enforcement regime and notable trends over the past decade, including declining corporate and individual prosecutions and (until 2018) rising fines. It then notes the puzzling absence of reported crime rates, the principal tool used to evaluate criminal enforcement in other areas and offers some theories as to why such data does not exist. Part II describes our proxy data and results that indicate that corporate crime is on the rise. Part III discusses implications for lawmakers. It urges the government to make additional data available for researchers to study and further contends that enforcement agencies should move beyond entity-level fines as the primary mechanism for punishment.

I. Corporate Criminal Enforcement

In the United States, corporations can be held criminally liable for crimes committed by agents in the scope of employment through the doctrine of respondeat superior.[30] When we discuss “corporate crime,” we are referring to crimes committed by corporate agents that could be attributed to the entity under this doctrine. If convicted of a crime, the corporate entity can be subject to a wide range of penalties, including fines, restitution, community service, and a loss of charter (of course, the guilty agents can also be subject to liability).[31]

In this Part, we describe major trends in federal corporate criminal enforcement in the past two decades. We then consider whether these enforcement practices could be consistent with optimal deterrence under law and economics theory. Finally, we observe a unique aspect of corporate criminal law scholarship: while legal scholars elsewhere study changes in underlying crime rates to evaluate enforcement, corporate criminal law scholars work backwards, studying enforcement to glean insights about crime rates.

A. Enforcement Data

This subpart provides data showcasing major trends in enforcement practice over the past two decades. To summarize, since the early 2000s, enforcement agencies have pursued fewer cases against corporations, brought fewer actions against individuals, increased the number of settlements, and obtained increasingly higher fines.[32] First, corporate prosecutions and convictions have been steadily falling. For example, the number of corporate prosecutions filed by the DOJ fell 29% between 2004 and 2014.[33] This trend has continued since then, and in 2018, the number of corporate convictions fell to ninety-nine, breaking a record for the lowest number ever recorded.[34]

Second, although the number of prosecutions has declined, the number of settlements has increased—especially among the largest companies.[35] From 2006 to 2019, for example, only twelve corporations were convicted after a trial.[36] Traditionally, the DOJ would settle cases with companies using a plea agreement after charges were filed in court.[37] Today, an increasing share of corporate criminal enforcement actions are settled without a plea, using non-prosecution agreements, or “NPAs,” and deferred prosecution agreements, or “DPAs.”[38] The use of these settlements reached a high point of 101 in 2015, which represented approximately a tenfold increase from 2005.[39] That number has since fallen somewhat, but the percentage of corporate criminal cases that are settled remains much higher than early-2000 levels.[40] Relatedly, the number of corporate declinations, where the DOJ determines that a case has merit but is not pursued because of the company’s “voluntary disclosure, full cooperation, remediation, and payment of disgorgement, forfeiture, and/or restitution,”[41] are rising for FCPA cases.[42] This type of settlement is especially lenient for defendants, as the government essentially determines that it will not take on a case that it thinks has merit.[43]

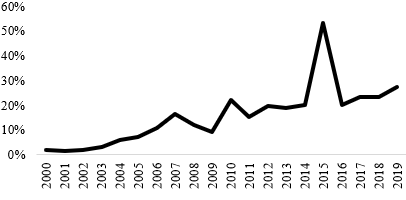

Figure 1: Deferred and Non-Prosecution Agreements (Share of Total Prosecutions)[44]

Third, individuals are rarely charged when charges are settled. In a study of DPAs and NPAs entered into from 2001 to 2014, Brandon Garrett found that only 34% involved individual prosecutions.[45] Most of those individuals were low-level employees.[46] This is true outside of the settlement context as well. Even in the wake of the Yates memo, which admonished enforcement agencies to pursue individuals more often,[47] not much changed—“[i]f anything, individual charging has declined in the years since [the memo] was adopted.”[48] In addition, the Trump Administration amended the Yates memo to emphasize that investigations should not be delayed “merely to collect information about individuals whose involvement was not substantial, and who are not likely to be prosecuted.”[49] As a result, in 2018, white-collar prosecutions fell to their lowest level in twenty years.[50] Even when individuals are charged, they are more likely than not to get off without jail time: Of the 414 individuals prosecuted from 2001 to 2014, only 30.9% received a prison sentence.[51]

Figure 2: DPAs and NPAs with Corresponding Individual Suits (Share of Total)[52]

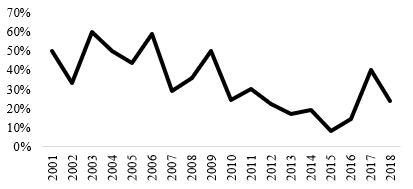

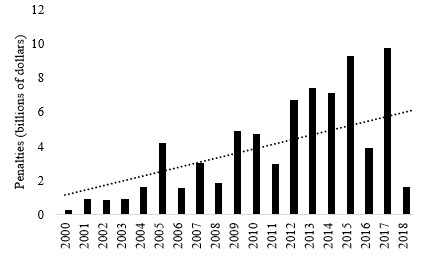

Fourth and finally, although individual punishment has declined, entity-level fines have steadily increased over the past two decades, falling off slightly to return to precrisis levels in 2018. This reversal in a decades-long trend toward increased fines is reflective of a skeptical DOJ attitude toward large financial penalties. In 2018, then-Deputy Attorney General Rod Rosenstein stated that corporate prosecutions should “avoid imposing penalties that disproportionately punish innocent employees, shareholders, customers and other stakeholders.”[53] In a separate speech, he described a new policy that would help enforcement agencies avoid the “piling on” that occurs when multiple regulators impose fines involving the same conduct, again, out of a concern for “innocent employees and shareholders.”[54]

Figure 3: Aggregate Annual Corporate Criminal Penalties for All Prosecutions[55]

In sum, over the past two decades, the DOJ has generally forgone individual liability in favor of entity liability, favored settlements over trials, and until 2018, sought higher and higher fines.

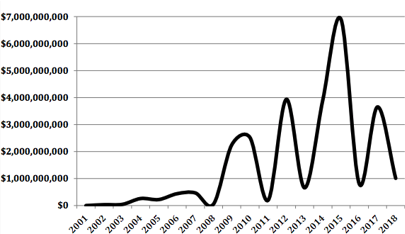

If we look at the subset of prosecutions that involve banks, these trends are especially stark. Before 2008, banks were rarely prosecuted. That changed in the wake of the financial crisis, where the DOJ secured a number of record-breaking fines against financial institutions.[56] Indeed, nearly $7 billion of the total $9 billion paid in corporate penalties in 2015 came from financial institutions.[57] But these penalties are composed of a handful of blockbuster cases—the overall number of prosecutions has generally remained steady in the past few years, and it has fallen since 2017.[58] In addition, the vast majority of fines were secured via settlement, rather than after trial and conviction.[59]

Figure 4. Financial Institution Penalties, 2001–2018[60]

In addition, when banks are pursued, individual bankers are rarely charged. As Judge Jed Rakoff complained, as of 2014, no high-level executives had been successfully prosecuted in connection with the financial crisis.[61] From 2001 to 2014, of the sixty-six DPAs and NPAs entered into with financial institutions, only twenty-three cases, or 35%, featured individual prosecutions.[62] Most of these involved low-level employees.[63] For certain types of financial institution crime, there is a complete dearth of individual prosecution. As an example, no individual employees or officers were prosecuted in cases involving alleged violations of the Bank Secrecy Act, which proscribes money laundering.[64]

B. Evaluating Enforcement

Is the current U.S. federal enforcement regime, with its emphasis on large fines and lack of individual liability, supplying adequate deterrence? The answer to this question is subject to much debate. On the one hand, many politicians,[65] judges,[66] academics,[67] and journalists[68] are skeptical. For example, Judge Jed Rakoff has been a vocal critic of prosecutorial efforts in the wake of the 2008 financial crisis.[69] As discussed, the DOJ under the Trump Administration has taken the opposite view, adopting policies that decrease the likelihood of individual prosecutions[70] and limit the size of fines and other penalties in favor of securing “reasonable and proportionate outcomes in major corporate investigations.”[71] In this subpart, we first briefly consider how the DOJ’s efforts fare under law and economics theory. We then discuss a puzzling divergence between the corporate criminal law literature and that of public-order crime: a lack of empirical study of corporate crime rates.

1. Theory.—

The principal aim of corporate criminal liability is deterrence—other goals, such as retribution or incapacitation, make less sense when the subject of the penalty is a legal entity. Therefore, law and economics scholars have been influential in theorizing how to efficiently deter corporate misconduct. And under the classic model for criminal enforcement developed by Gary Becker, high fines might well be the most efficient way to deter crime.[72] Under Becker’s model, identifying the optimal level of criminal enforcement requires comparing the benefits to society from punishing and deterring crime with the costs of catching and punishing offenders.[73] Therefore, punishment by fine might deter crime most efficiently because fines avoid the social costs created by other forms of punishment, such as imprisonment. In sum, according to Becker’s model, fines are sufficient, and even preferable, so long as they are set equal to the social cost of crime multiplied by the probability of detection.[74]

However, this is not how fines are calculated.[75] The sentencing guidelines instead require the organization to remedy harm and then set the fine range based on “the seriousness of the offense” (reflected by the amount of pecuniary loss) as well as the corporation’s “culpability.”[76] Organizational culpability is based on, “(i) the involvement in or tolerance of criminal activity; (ii) the prior history of the organization; (iii) the violation of an order; and (iv) the obstruction of justice.”[77] The guidelines also allow penalty mitigation whenever the company has “an effective compliance and ethics program” or cooperates with authorities.[78] In other words, the sentencing guidelines adjust penalties based on culpability rather than the probability of nondetection.[79] And the fact that fines are often decreased as a reward for compliance rather than multiplied to compensate for the low probability of punishment suggests that fines alone will not supply adequate deterrence.

More importantly, time has revealed flaws in the Beckerian model. In particular, Jennifer Arlen and Renier Kraakman have argued that “the state cannot deter misconduct simply by setting liability high enough to ensure that firms cannot profit from it.”[80] Their position is that individual liability is a necessary component of corporate criminal enforcement because entity-level fines are unlikely to burden employees who are not shareholders, or who have small stakes in the company.[81] Instead, employees will be motivated to commit crimes that increase corporate profitability so long as the chance of detection is low because doing so will allow employees to reap personal benefits—increased job security, higher pay, and promotion.[82]

Therefore, under Arlen and Kraakman’s model, it is critical that the government detect and punish individual wrongdoing. However, information asymmetries limit the government’s ability to do this.[83] Therefore, entity liability can be usefully employed to induce companies to produce information that would help the government detect and punish guilty individuals.[84] According to Arlen, an optimal enforcement regime would enlist companies to detect crime, identify wrongdoers, and report to federal agencies, therefore making it easier for the government to pursue and convict guilty individuals.[85]

Arlen’s precept that cooperation between firms and enforcement agencies can be used as a means of punishing and deterring bad actors has not been embraced by the DOJ. Instead, as the previous subpart reveals, the government has mostly abandoned individual-level punishment.[86] When the government prosecutes employees, it primarily pursues only low-level actors.[87] This disparity is likely because it is very difficult to successfully prosecute top executives.[88] In addition, it may be unrealistic to rely on corporate cooperation as the primary mechanism for accountability because management will likely be motivated to shelter employees, especially their top executive colleagues. Therefore, viewed from the lens of law and economics theory, it is unlikely that the federal enforcement regime is optimally deterring crime.[89]

2. Data.—

In other areas of criminal law, theory is bolstered by data analysis. Although theory is certainly important for predicting how and understanding why certain enforcement practices affect criminal behavior, these conversations progress alongside an evaluation of how changes in enforcement affect overall crime rates.[90] To take an infamous example, consider the “broken windows” theory and the literature it generated. In 1982, James Wilson and George Kelling suggested that targeting misdemeanor offenses could reduce more serious crime.[91] This idea caught on like wildfire, influencing the enforcement practices of police in New York, Chicago, and Los Angeles, with some apparent success—crime rates mostly declined in these places.[92] But an exhaustive literature evaluating the link between the implementation of a broken windows policy and falling crime rates soon cast doubt on the efficacy of this theory, and by the early 2000s, multiple empirical studies had concluded that there was little evidence to support the claim that broken windows policing contributed to the sharp decrease in crime in the 1990s.[93]

By contrast, the corporate criminal law literature tends not to evaluate enforcement based on changes in crime rates. What explains the divergence between these two areas of scholarship? The principal cause is the fact that the government does not provide estimates of corporate crime levels, as it does for other types of crime, making it difficult to study. Likewise, the government does not attempt to measure aggregate levels of white-collar crime—the last time the government issued a comprehensive report of white-collar crime was in 1986, and this report summarized the characteristics of enforcement actions against white-collar criminals.[94] Compare this dearth of data to the statistics that are available for public-order crime: each year, both the FBI and the Bureau of Justice Statistics (BJS) collect data and present reports documenting the number of murders, rapes, sexual assaults, robberies, and assaults. The FBI collects this information by pooling reports by law enforcement agencies on a monthly basis; the BJS collects data by interviewing roughly 160,000 people in 95,000 households.[95]

Given the significance of corporate crime and its adverse economic consequences, it is certainly surprising that there has been no recent government attempt to estimate overall corporate crime rates. There are likely a few reasons why. First, the act of tallying corporate crime is more difficult than that of tallying public-order crime. When windows break, glass shatters; corporate crime, by contrast, can be difficult to observe. Not only that, but as Samuel Buell explains, violent crime tends to be more easily specified than white-collar crime, the latter of which tends to be defined under amorphous and broad criminal statutes.[96] Consider corporate fraud as an example. Some is easy to recognize, like the fraud perpetrated by Bernard Madoff. Other frauds are more difficult to determine. For example, what about an executive who technically complies with accounting rules but bends them in a way that ends up misleading shareholders about the financial health of the company? In the case of WorldCom CEO Bernard Ebbers, this was deemed criminal behavior despite his argument that he had broken no law.[97] Ultimately, the act of estimating corporate crime rates may require a number of difficult judgment calls about the types of misconduct that count as criminal.

Second and relatedly, public-order crimes tend to have identifiable and sympathetic victims, and those victims aid in statistical collection by reporting crime. For white-collar crime, by contrast, “the class of victims is typically diffuse, in the sense of being spread far and wide and standing at some distance removed in a chain of causation from the acts of the principal offender, whom the victims may never see, deal with, or even identify.”[98] This is not always the case: in the high profile cases of fraud, such as the Wells Fargo fake account scandal, the victims were easily identifiable and could alert regulators to misconduct.[99] Compare such fraud to the typical FCPA violation, where a company pays a bribe to a foreign government in order to secure a contract. There, the harm is quite diffuse—as then-President Jimmy Carter explained when he signed the bill, “[c]orrupt practices between corporations and public officials overseas undermine the integrity and stability of governments and harm our relations with other countries.”[100] In the case of a bribe, there will not always be victims who are poised to file a report.

We recognize that these hurdles to corporate crime data collection exist, but do not view them as entirely insurmountable. Although certain violent crimes are fairly easy to observe and measure, not all are. Consider rape as an example. Often, rape goes unreported; even when the victim reports, determining whether a rape occurred may require judgment calls about whether there was consent.[101] In addition, the answer may differ depending on the law of the particular jurisdiction, complicating the job of estimating an underlying rate. But these limitations do not stop the government from supplying an estimate each year. In Part III, with full recognition of the complications inherent to this project, we discuss paths that the government could take to provide data that would aid researchers in measuring corporate crime rates.

In the meantime, despite the substantial limitations that complicate the project of measuring corporate crime, several paths forward exist for researchers. One approach is to rely on survey data.[102] Indeed, public-order crime data provided by the BJS is gleaned from surveys; private organizations provide similar data for organizational crime. For example, the Ethics Resource Center surveys employees “understand how they view ethics and compliance at work.”[103] Every few years, the center also polls employees of Fortune 500 companies. These studies have been used by researchers to argue that rates of corporate criminality are increasing.[104] But a major limitation with survey data is that respondents might not honestly answer about their criminal behavior. This problem plagues researchers studying violent crime,[105] and there are a few reasons to think it would be an issue in this context. For example, employees—whether they be low-level workers or top executives—might feel pressure to give an overly rosy report about the company’s compliance. Not only that, survey design is also enormously important.[106] Without careful planning, surveys can be plagued with sampling errors and undercoverage issues.[107] For an example of a possible source of selection bias, the Ethics Resource Center survey is optional, and most employees who are selected decline to fill it out, leading to the inference that those who do submit answers have a reason to provide an especially extreme view. For these reasons, we are reluctant to rely on a single survey of corporate employees as an accurate measure of underlying crime rates.

We believe that researchers should instead identify and measure proxies for corporate crime to supplement information gleaned from survey data. Studying proxies for criminal misconduct avoids the problems that come from asking researchers to measure crime that is generally unobservable, rarely reported, or difficult to specify. Therefore, proxy data, though limited by the fit between the proxy and criminal misconduct, offer a promising avenue for scholars who seek to measure crime trends over time.

Corporate criminal scholars have generally relied on corporate criminal enforcement as a proxy for crime levels—the number of prosecutions, convictions, and settlements, as well as their terms.[108] We are skeptical that this information tells us much about underlying crime rates.[109] Enforcement data is subject to a host of exogenous variables: enforcement agency priorities, enforcement resources, and technological advances, to name a few.[110] A rise in enforcement actions against corporate criminals could mean a rise in underlying crime, or it could mean that the agency has decided to take a tougher stance on corporate crime. The usefulness of enforcement as a proxy for corporate criminal behavior is further diminished in our context because we know of (and indeed aim to study the effect of) substantial changes in enforcement over our sample period. Therefore, enforcement data is a poor proxy for underlying rates of corporate crime.[111]

Researchers in finance have thus far identified a few alternative proxies for financial misconduct: accounting restatements, securities class action lawsuits, and auditing enforcement releases.[112] These databases provide a proxy for securities and accounting fraud and have been useful in establishing that only a tiny fraction of such fraud is detected and punished.[113] Our analysis in the next Part considers additional proxies for misconduct based on reporting (both mandated and voluntary) by firm employees and their customers. Our goal is to say something about corporate crime trends more broadly, beyond the relatively narrow inquiry of this prior work.

II. Corporate Crime on the Rise

In this Part, we identify three novel proxies for corporate criminal behavior based on reported instances of misconduct. Specifically, we rely on data from the Financial Crimes Enforcement Network (FinCEN) Suspicious Activity Reports (SARs), consumer complaints made to the CFPB, and whistleblower complaints made to the Securities and Exchange Commission (SEC). Each dataset in our sample is unique—it represents reports by different groups of individuals made to different regulatory agencies and implicates different types of misconduct. First, SARs are an anonymous filing required by the Bank Secrecy Act to be filed whenever a bank employee suspects a violation of that Act. Because our focus is on corporate crime, we isolate those SARs that flag misconduct by bank employees. Second, CFPB complaints are lodged by aggrieved customers of financial products. Third, corporate employees file whistleblower tips with the SEC to tip the agency off to possible corporate misconduct. In each subpart, we describe these datasets and the trends that we observed over time. We explain why we believe these proxies correlate with corporate criminality, and also discuss the many problems that complicate and weaken our interpretation. In the last subpart, we study public company recidivism, relying on enforcement data from Brandon Garrett. In so doing, we are able to learn more about the principal enforcement tool used by the DOJ—the fine—and whether or not it is deterring future incidents of institutional crime.

A. Suspicious Activity Reports

SARs are an anonymous mechanism to report financial crimes used by institutions subject to the Bank Secrecy Act.[114] The intuition behind the SAR requirement is that financial institutions are best positioned to detect illegal use of the financial system; as such, they should be enlisted in helping the government root out financial crime.

SARs are required to be filed whenever an employee or other individual[115] suspects that an agent within the institution has attempted to perform a transaction in furtherance of money laundering or other violation of federal law.[116] “Agent within the institution” is defined broadly to include not only insiders, but also bank customers and suppliers.[117] However, suspicious transactions below a $5,000 threshold do not require a SAR.[118] The failure to comply with SAR filing requirements is punishable by criminal and civil penalties, including large fines, loss of the bank’s charter, and imprisonment.[119] As a result, all financial institutions train employees on how to identify and flag suspicious activity.[120]

SARs are confidential, meaning that the person who is the subject of the report is not told about it, nor is anyone outside of the institution privy to the information. Any unauthorized disclosure is punishable as a criminal offense. In addition, the SAR filer need not disclose their name and is awarded immunity during the discovery process.[121]

A SAR describes the suspicious behavior, the crime categories to which the behavior pertains,[122] and the agent’s relationship with the institution. After the institution receives a report, it must undertake a multistage review process, which ultimately entails sending it to the bank’s financial investigators, management, and attorneys.[123] Financial institutions are required to file SARs within thirty days after the detection of suspicious behavior at their institution.[124] Finalized SARs are sent to one of seven federal agencies—the FRB, the IRS, the SEC, the OCC, the FDIC, the NCUA, or the FHFA.[125] Under certain circumstances, such as when the SAR implicates national security, the SAR may be sent to a fusion center that makes the information available to state and federal agencies that may be interested in acting.[126]

There have been a few important changes in SAR filing requirements in the past few decades. Most importantly, in 2002, the USA Patriot Act made SAR reporting requirements mandatory for broker-dealers who suspect any violation of law or regulation (including state law), therefore subjecting broker-dealers to broader requirements than those of financial institutions.[127] Immediately following the enactment of the Patriot Act, there was a spike in SAR filing, even by banks who were subject to the same requirements as before (an earlier analysis of SARs shows that the spike eventually tapered off around 2010, just before our analysis begins).[128] A former Treasury official speculated that the acceleration in filing may have been the result of financial institution concern about reputational risk after 9/11.[129] Since 2002, however, SAR reporting requirements have been relatively stable.[130]

We secured all available SAR enforcement data from the U.S. Treasury FinCEN.[131] The SAR data comprise both business-related and individual suspicious activity. To proxy for financial-institution crime (rather than individual crimes that could not be attributed to the entity under respondeat superior), we isolate SARs where suspects are institutional insiders (employees, directors, agents, officers, and owning or controlling shareholders).[132] The underlying data are reported monthly and exhibit a high degree of volatility; to aid with data visualization and interpretation, we perform one-sided winsorizing at the 90% level and take a twelve-month moving average of the series.[133]

Figure 5 reveals an increase in SARs filed across all agencies studied, which suggests an increase in crimes committed by bank insiders. We acknowledge that there is not a one-for-one relationship between SARs and underlying financial crime; however, we think that this data is a better proxy for violations than Bank Secrecy Act enforcement data. As discussed, measures of criminal enforcement—such as arrests and prosecutions—are dependent on factors like the ability to detect criminal behavior, the availability of admissible evidence, and agency resources. By contrast, bank employees are required to file SARs whenever they suspect that malfeasant behavior is occurring, and therefore, the data collected is not subject to the same endogeneity concern. Thus, while SARs may overstate the amount of crime (i.e., contain false positives), we doubt that they systematically and directionally err in reflecting aggregate financial crime trends.

Figure 5: SAR Counts by Agency

It is important to note that SAR filings are not exogenous to the enforcement environment. Earlier data highlight this reality directly: the 2001 Patriot Act did not change the reporting requirements for banks but instead expanded them to other entities.[134] Yet, even for banks, there was a substantial uptick in SAR reporting. This uptick may have resulted from increased concern about bank reputation, or increased SAR filing enforcement by regulators. The uptick in reporting that we observe necessarily conflates both changes in the level of criminal behavior and in the reporting of that behavior by financial institutions.

Two helpful facts minimize this endogeneity concern. First, unlike the lax enforcement of the early 2000s, FinCEN took SAR filing seriously during the entire period of our sample. Before 2005, FinCEN had not consistently pursued enforcement actions for the failure to file SARs; that changed in 2005 after the agency prosecuted Riggs Bank criminally for the willful failure to file SARs, ultimately securing a $16 million fine and five years of criminal probation for the bank.[135] Since that time, the agency has regularly brought enforcement actions against banks that fail to file SARs.[136]

Second, although it is true that there has been a level shift upward in SAR reporting across agencies, it is not the case that these patterns are identical. Even within an agency, trends in SAR filings differ across categories. In 2012, mortgage loan fraud reported by depository institutions decreased by 29 percent—after having risen each year since 1996.[137] In that same year, banks saw increases in 12 of the 21 other suspicious activity categories.[138] This volatility suggests that something other than an increased willingness to report is driving our results.

A related concern is that our results may be driven by heightened regulatory scrutiny of bank compliance following the financial crisis, which caused banks to dramatically expand compliance programs and rendered employees much more sensitive to the risk of enforcement. This regulatory scrutiny came from multiple directions. For example, the DOJ began pursuing banks and securing record-breaking fines in the immediate aftermath of the crisis, as discussed in Part I. In addition, bank compliance failures came under a spotlight from the OCC, the FRB, and the New York Department of Financial Services, which was created only in 2011. These agencies supplemented FinCEN’s efforts by penalizing banks that failed to adopt effective anti-money laundering controls.[139] In addition to increased regulatory scrutiny, banks were subject to a host of new regulations that required them to dramatically expand their compliance programs. And we recognize that the combination of heightened scrutiny, as well as larger and more sophisticated compliance programs, could lead to an increase in reporting unrelated to any underlying crime. Regarding compliance, however, the largest increases in bank spending on compliance occurred in the immediate aftermath of Dodd–Frank—from 2009 to 2012.[140] If the increase in reporting was solely caused by increased resources spent on compliance, we would expect to see a spike in reports from 2009 to 2012 (and possibly in the years that followed) and then a levelling off. This is not what our data shows.

However, it is entirely possible that SAR reporting increased because employees rightly perceived that bank regulatory scrutiny was on the rise and would continue in the wake of the financial crisis, leading to excessive cautiousness. But a few facts counsel against interpreting employee cautiousness and regulatory scrutiny as the sole cause of the increase we see. For one, we do not see an immediate increase in the wake of the crisis, when bank regulatory scrutiny was at its highest point. This may be because SAR filing had increased dramatically in the wake of 9/11 and remained at high levels. It is likely, therefore, that banks were already filing a large number of SARs well before the financial crisis, meaning that we could expect to see less of an impact from this next wave of bank scrutiny. In addition, there is ample variation in the data following the financial crisis, and the SAR counts begin their uptick at different periods for different agencies—the SEC data begins to rise in 2014, while the FRB shows a steep increase in 2017, and the OCC data shows an increase in 2012. This variation suggests that the data is picking up on something other than employee sensitivity to regulatory scrutiny, which began in earnest in the immediate wake of the financial crisis.

In sum, although we recognize that our data likely overstate the level of criminal misconduct at banks, we do not believe that the rise in SARs is solely explained by an increase in resources spent on compliance, nor by concerns about the increased risk of regulatory enforcement; instead, we think it suggests that financial institution crime, and Bank Secrecy Act violations in particular, are trending upward.

B. CFPB Consumer Complaint Database

Under Dodd–Frank, the CFPB is required to maintain a consumer complaint database that allows consumers to submit complaints about unfair, deceptive, or abusive acts or practices by financial services companies.[141] These complaints give the agency “insights into problems people are experiencing in the marketplace and help [it] regulate consumer financial products and services under existing federal consumer financial laws, enforce those laws judiciously, and educate and empower consumers to make informed financial decisions.”[142] The CFPB also intends that the database will be used by researchers to identify harmful business practices that might harm consumers.[143] The CFPB has accepted complaints regarding credit cards since its first day of operations in July 2011, and it has since expanded to several categories: mortgages, bank accounts and services, private student loans, vehicle loans, other consumer loans, credit reporting complaints, and money transfers.[144]

After receiving a consumer complaint, the agency confirms that the consumer is actually a client of the financial institution in question, that the complaint has not been filed already, and that the complaint was submitted by the consumer. However, the agency does not take steps to verify whether the complaint has merit. Complaints are forwarded to the appropriate company and/or regulatory agency,[145] and the company has an opportunity to respond.[146]

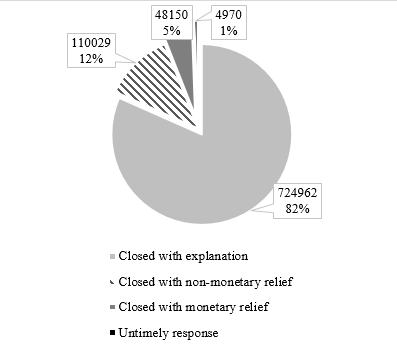

In Figure 6, we show the number of complaints by product type from January 2015 to July 2019.[147] These graphs reveal an upward trend in complaints by each product type, with the exception of mortgages.

Figure 6: CFPB Complaints by Product Type

What to make of these results? CFPB complaints are distinct from SAR filings in an important way: they are voluntary reports made by consumers who believe themselves to be victims of crimes and other misconduct, rather than mandatory reports by bank employees. Thus, the endogeneity concern detailed above—that the increase in SAR reporting reflects changes in the enforcement regime—is irrelevant in this context. Instead, with respect to the CFPB database, a competing explanation for the uptick in consumer complaints is that the increase in reporting is driven by an increase in consumers’ likelihood of reporting and not a change in the underlying level of malfeasance. Although there certainly is some learning at play in the data, as evidenced by the large spike in the first two months of our dataset, we would expect uniform increases in complaint counts across all product types if this were the only operative effect. The steady decrease in mortgage complaints after 2016 suggests that the database may be picking up on something else.

Why do we observe a decrease in mortgage complaints? Several possibilities exist. The fall in mortgage complaints is consistent with increased scrutiny from the federal government about mortgage practices in the years following the financial crisis, as new regulations and regulatory oversight helped eliminate abusive practices.[148] This is not the only possible explanation—it could be attributable to a fall in mortgage delinquencies, for example[149]—but in any event, we think that it helps debunk the view that the increase in other types of complaints is solely attributable to an increase in consumer familiarity with the consumer complaint resource.

In related work, Kaveh Bastani, Hamed Namavari, and Jeffrey Shaffer study in greater detail the narratives that consumers report to the CFPB when they file complaints.[150] They too document interesting shifts in topic popularity over time, which experienced substantial volatility over their year-long sample.[151] It is hard to see how shifts in consumers’ ease of reporting could drive these results. In fact, the authors suggest that regulators should do more to use the CFPB data to aid enforcement efforts, such as by applying machine-learning techniques to consumer complaints to identify problems in consumer financial markets more quickly.

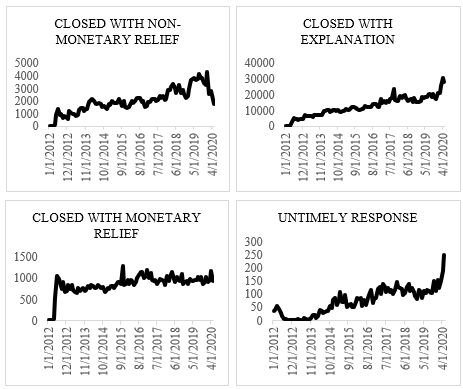

There is an additional concern that consumer reports are not appropriate proxies for financial institution misconduct because consumers can report annoyances (e.g., “the late fee charged by my credit card company is high”) alongside crimes (e.g., “I was defrauded”). Indeed, the database does not distinguish between “major” and “minor” complaints, nor does it verify the accuracy of each complaint lodged before making it publicly available.[152] However, analysis of the CFPB complaints data suggests that a nontrivial amount of these complaints tracks misbehavior. Although the majority of complaints are closed by companies with an explanation, 17% are closed with some type of relief, including “monetary relief” or “non-monetary relief,” the latter of which includes “changing account terms, correcting submissions to a credit bureau, or coming up with a foreclosure alternative.”[153]

Figure 7: CFPB Resolved Complaints by Resolution Type (2014–2019)

In addition, we studied time trends for consumer complaints in each of these four categories. If the underlying uptick in consumer complaints is driven by an increase in grievances rather than corporate malfeasance, we would expect to see an increase in reports closed without relief or closed with explanation. We would not necessarily expect to see an increase in instances of misconduct that firms have difficulty responding to, nor would we expect to see increases in misconduct that require monetary relief. Instead, as Figure 8 reveals, we see complaints trend upward in each category. And although the vast majority of cases are closed with explanation or with non-monetary relief, a substantial portion falls into the more severe categories.

Figure 8: CFPB Complaints by Disposition

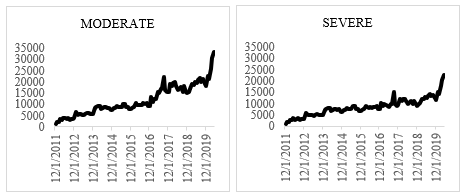

As a final check, we manually classify complaints into three categories: petty, mild, and severe. We determine severity by studying the “issue” and “sub-issue” categorizations that the CFPB provides.[154] Our assessment of severity is based on two factors: (1) assuming the allegations are true, how serious is the underlying corporate misconduct, and (2) how likely is it that the allegations are true? There is inherently ample discretion in this manual categorization exercise. Since we are focused on measuring trends in corporate criminality, we are conservative and tend to exclude categories of complaints where the possibility of underlying criminal activity is uncertain.

As Figure 9 reveals, we observe that across the “non-petty” consumer categories (“moderate” and “severe” on our scale), there is a substantial uptick in both moderate and severe cases. This data supports the notion that there has been an uptick in consumer reports of troubling corporate misconduct, rather than simply petty grievances.

Figure 9: Trends in Non-Petty Consumer Complaints

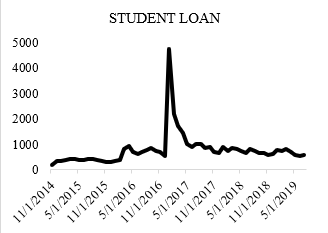

Further support for the view that our data are picking up on overall rates of illegal behavior comes from analyzing the raw student loan data shown in Figure 10. In late February 2016, CFPB updated its complaint form to capture information about federal student loan servicing, in addition to private student loan servicing.[155] That precipitated an immediate increase in the count of student loan complaints, suggesting that learning effects flow through relatively quickly. The large spike in early 2017, on the other hand, reflects the criminal behavior underlying the CFPB’s major enforcement action against Navient, the largest student loan company in the United States, alleging illegal practices that thwarted borrowers’ ability to make accelerated repayments.[156] Again, the spike is immediate and short-lived. Taken together, these pieces of evidence suggest that learning about the existence of the consumer complaint database is unlikely to be the sole driver of increased traffic across the database’s many categories of financial products. To the extent that learning—about the database as a resource or about potential criminal behavior that a customer has fallen victim to—drives the decision to seek recourse, this occurs immediately.

Figure 10: Raw CFPB Complaints for the Student Loan Category

However, we recognize that complaints of misconduct do not correlate perfectly with complaints involving crime. Nonetheless, the more severe the misbehavior, the more comfortable we are suggesting that the uptick in misconduct we observe correlates with an uptick in crime. Further, anecdotal evidence supports the notion that there is a relationship between consumer use of the complaint database and financial crime. Between October 2016 and December 2016, credit card complaints by customers of Wells Fargo increased by nearly one hundred percent relative to the same period the year prior, an increase contemporaneous with the bank’s fake accounts scandal.[157]

Therefore, while we do not believe that there is a one-to-one correlation between the number of complaints filed and aggregate crime levels, we do believe that consumer complaints can serve as a useful proxy for overall misconduct committed by consumer-facing financial institutions.[158]

In sum, two distinct proxies for financial institution misconduct—consumer complaints to the CFPB and SAR reports filed by banks themselves—document an increase in complaints that are indicative of crime by financial institutions. This evidence suggests that the federal enforcement regime, which in the past decade has prioritized entity liability and fines over individual liability, may not be adequately deterring financial crime.

C. SEC Whistleblower Tips

In addition to creating the CFPB, Dodd–Frank amended the Securities and Exchange Act of 1934 to create Section 21F, which directs the SEC to make monetary awards available to individuals who provide original information that leads to successful enforcement actions against perpetrators of financial fraud.[159] To implement this program, the SEC created the Office of the Whistleblower.[160] The whistleblower program went into effect in 2011, and as Figure 11 reveals, the number of tips received has increased in nearly every year since the program’s inception.[161] Most of these tips involve allegations about improper corporate disclosures and financial statements, offering fraud, or market manipulation.[162] Whistleblowers have also helped the SEC bring enforcement cases “involving an array of securities violations, including offering frauds, such as Ponzi or Ponzi-like schemes, false or misleading statements in a company’s offering memoranda or marketing materials, false pricing information, accounting violations, internal controls violations, and Foreign Corrupt Practices Act (FCPA) violations, among other types of corporate misconduct.”[163]

Figure 11: SEC Whistleblower Tips Over Time

Whistleblower tips may be filed whenever individuals observe violations of the law, and therefore, the more violations, the more tips we would expect to see. However, many factors could confound the results. As with the CFPB data, the increase could be due to changes in reporting practices, and specifically, an increase in reporting due to a heightened awareness of the program and the awards that successful whistleblowers can reap. Whistleblowers can receive 10% to 30% of any recovery in excess of $1 million, and headlines of multimillion dollar victories could encourage reticent employees to come forward (indeed, this is the goal of the program).[164] In addition, law firms anxious to capitalize on the bounties have begun to advise whistleblowers to file complaints in the past few years. This increased awareness of potential awards could contribute to the increase that we observe.

Another confounding factor is the SEC’s effort to remove barriers to whistleblowing imposed by employers. For example, in 2015, the SEC began pursuing companies that used confidentiality agreements in employee contracts to discourage employees from filing whistleblower complaints. In one such case, an employee contract required departing employees to forfeit their severance if they filed a complaint with the SEC.[165] The SEC has since secured cease-and-desist orders and financial penalties against several companies with such language in their employee contracts, which caused law firms to advise companies with similar language to eliminate it.[166] The removal of barriers to whistleblowing could be a partial cause of the increase that we observe. We doubt, however, that it would be the sole cause—lawyers had been advising whistleblowers long before the SEC enforcement actions that such clauses were not enforceable.[167]

As in the previous two datasets, it is likely that the tips we record include false positives. Indeed, in light of the massive awards that are possible, the incentive to file an unsubstantiated whistleblower tip might be quite high.[168] However, the SEC does put some barriers in the way of frivolous tips—to be eligible for the SEC’s anti-retaliation protection, tippees must have a “reasonable belief” that the action they are reporting reveals a legal violation.[169] In addition, anonymous tips are ineligible for awards (unless the anonymous tippee works with an attorney).[170] More than that, there are many negative consequences for employees who report workplace misconduct, such as isolation at work and job loss. Indeed, most whistleblowers go to great lengths to report and attempt to resolve wrongdoing internally to avoid the negative repercussions that come from whistleblowing.[171] Therefore, we believe that these features of the enforcement environment somewhat check the rate of false positives.

* * *

To summarize, each of our proxies indicates that reported misconduct has risen in the past decade. We recognize that reported misconduct does not correlate perfectly with actual misconduct: regarding whistleblower tips and SAR reports, employees may underreport known criminal behavior in order to avoid enforcement agencies’ attention. By contrast, disgruntled employees may report petty grievances. With respect to consumer complaints, much of what is reported falls under the category of grievances (e.g., consumers are struggling to pay their mortgage, or financial institutions are spamming with repeated advertising calls) rather than misconduct (e.g., credit reporting companies misusing consumer data or fraudulently opening accounts). Therefore, we do not suggest that these data provide an accurate measurement of overall crime rates; indeed, we find it likely that other factors affect the upward trends that we observe.

In particular, these data are necessarily responsive to the enforcement regime that governs these filings. For SAR data, for example, it is possible that we are capturing an increase in reporting because institutions are more carefully policed after the financial crisis of 2008. Likewise, whistleblowers may be responding to increased financial incentives for reporting criminal behavior, rather than any uptick in criminality. We understand there are reasons to believe that our results conflate levels of crime with an increase in incentives for reporting bad behavior, but we suspect that our results are at least partially explained by an uptick in underlying levels of criminality. Importantly, we observe volatility in each of our data series—levels of malfeasance ebb and flow over time in a way that is inconsistent with a one-time shock to reporting incentives. In sum, although we do not claim to provide a measure of overall crime rates, we do believe that in the aggregate, the data indicate that corporate crime has been trending upward over our sample period.

The evidence that crime has increased in the past eight years is consistent with what theory predicts would happen in response to the changes in enforcement that we observe: fines have risen, but the overall number of prosecutions and individual penalties have fallen. These trends are even starker when we focus in on financial institutions. In the wake of the financial crisis, only one guilty executive was sent to jail, and very few employees were prosecuted.[172] In addition, enforcement against institutions was sporadic, and certain crimes—including violations of the Bank Secrecy Act—were ignored altogether. In light of these trends, our results are not surprising. Criminals weigh the individual benefits of crime against the costs of bad behavior. Once the costs of offending are lowered, the benefits are more likely to outweigh them.

Of course, the DOJ did secure a handful of large fines against corporate criminals during the period we studied. Were these fines large enough to make up for sporadic enforcement and the lack of individual penalties? The next subpart describes our study of corporate criminal recidivism and the evidence that supports our interpretation that even these record-breaking fines were still too low to deter future instances of misconduct.

D. Recidivism and Fines

To study corporate recidivism, we relied on public company enforcement data from Brandon Garrett. Garrett has studied recidivism by financial institutions, noting that federal prosecutors repeatedly settle criminal cases with the same banks over a short period. These financial institution recidivists include AIG (which was the subject of enforcement proceedings in 2004 and again in 2006), Barclays (2010, 2012, and 2015), Credit Suisse (2009 and 2014), HSBC (2001 and 2012), J.P. Morgan (2011, 2014, and 2015), Lloyds (2009 and 2014), the Royal Bank of Scotland (twice in 2013 and again in 2015), UBS (2009, 2011, 2012, 2013, and 2015), and Wachovia (2010 and 2011).[173] He suggests that this evidence of recidivism casts doubt on whether prosecutors take financial institution misconduct seriously and whether corporate penalties are sufficiently deterring corporate actors from engaging in crime.[174]

Anecdotal evidence provides a further glimpse into the scope of the recidivism problem. To take just one example, in 2012 HSBC admitted to helping launder money for South American drug cartels. It received a record $1.9 billion fine and secured an agreement with prosecutors that would defer criminal sanctions.[175] The year after that agreement expired, HSBC entered into another do-not-prosecute agreement with prosecutors, this time for fraud in the foreign exchange market.[176] As part of this agreement, HSBC paid $110 million dollars, and no individuals were charged.[177] And in 2019, before this second agreement expired, the bank entered into yet a third agreement deferring charges for helping American clients evade taxes.[178] No individuals were charged, and the bank again paid a fine—this time of $192 million.[179] In at least this case, the do-not-prosecute agreements and accompanying penalties did not appear to deter future misdeeds. As Brandon Garrett put it in his article studying bank recidivism: “They are recidivists, but they do not receive harsher penalties despite their growing criminal records. . . . Individual criminal defendants are not so lucky.”[180]

We expand on Garrett’s inquiry more systematically by studying recidivism by all publicly traded corporations over the last two decades, focusing on the relative size of the penalty for recidivist firms versus one-time offenders.[181] We define a corporate recidivist to be a public company that was prosecuted more than once between 2001 and 2018. We begin with a list of 384 corporate prosecutions naming publicly traded corporate defendants. We identify any fines paid by the corporations, including restitution, forfeiture, disgorgement of profits, and other monetary penalties and payments to enforcers in parallel civil suits. We normalize fines by three measures of firm size—assets, revenue, and employee headcount—each of which is available from Compustat. We normalize this variable because we believe that fine size should scale with firm size, although we recognize that this will not always be the case. In general, larger firms have the ability to commit crimes that cause greater social harm because of their larger size and scale of operations. Consider the Volkswagen cheating scandal as an example. In that case, the company had sold millions of cars across the globe that misled regulators about their environmental emissions.[182] Quite obviously, a similar violation committed by a smaller company without global reach would have a less socially harmful impact simply by virtue of the smaller scale of its operations. In addition, the larger the company, the higher the costs of compliance, indicating that a larger fine would be necessary to induce a large company to spend adequate resources to root out socially harmful behavior across the organization. Again, this generalization is not necessarily true in all circumstances—a small company could in theory commit a crime that is more socially harmful than the crime committed by a much larger company—but in general, we believe that social harm of crime should scale with firm size.

Of the 384 prosecutions, we matched defendants from 372 of them to firms in Compustat. We were also able to match five prosecutions to public corporations not in Compustat; we pulled assets, revenue, and headcount data for these firms from SEC filings via EDGAR.[183] Where possible, subsidiary firms were matched to parents, as long as the parent had acquired the subsidiary at the time of settlement. For international firms, annual assets, revenue, and headcount data were pulled from Compustat’s Global Daily database;[184] for U.S. listed firms, from Compustat’s North American Daily database.[185] As Compustat reports international data in local currencies, we converted size data to dollars using end-of-year conversion factors from FRED’s daily foreign exchange series.[186] International firms were queried via ISIN numbers; U.S. listed firms, via CUSIPs where possible and CIK numbers otherwise. All dollar figures were converted to 2018 dollars using the CPI series from FRED.

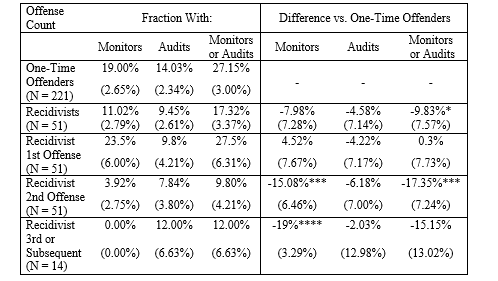

We maintain three different Boolean measures of procedural toughness. The first indicates whether an agreement required a corporate monitor; the second, periodic audits of compliance programs; and the third, either of the first two. In other words, we ensure that a company is not more likely to be a recidivist because the enforcement agency has greater knowledge about the company and its operations as a result of penalties secured in the first enforcement action. We observe in Table 1 that a recidivist is as likely as a one-time offender to have a corporate monitor or audit imposed, and in subsequent offenses, is actually less likely to have either imposed.

Table 1: Boolean Measures of Procedural Toughness

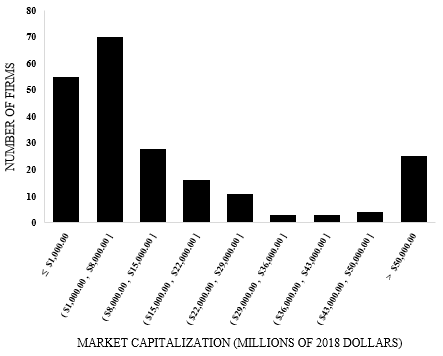

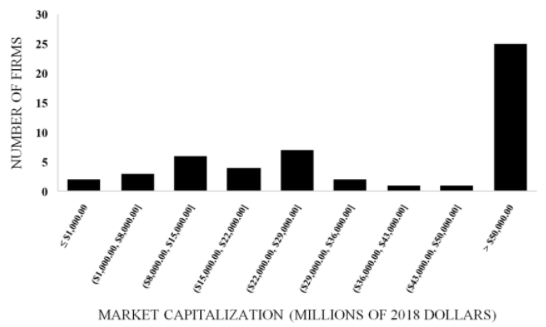

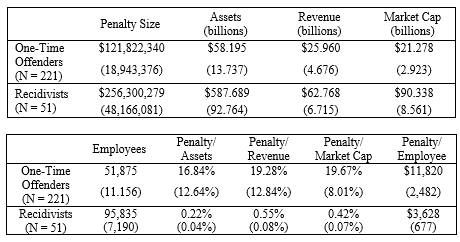

Table 2 summarizes the fines, data, and characteristics of recidivist and non-recidivist firms. Recidivists face larger penalties on average ($256 million versus $122 million for non-recidivists), but recidivist firms are also much larger than non-recidivist firms when measured by assets and revenue, as well as market capitalization, which is shown in Figures 12 and 13.[187]After normalizing fines, we construct a measure of recidivism to gauge whether the increase in fines operates as a deterrence mechanism. First, we sorted the resulting public corporation database by unique parent entity and date. For each firm, we manually cross-referenced prosecutions settled within one year of each other against filings provided by the Corporate Prosecution Registry (CPR); if multiple prosecutions in the CPR cited the same underlying malfeasance, we counted this as a single prosecution and summed the associated penalties. This procedure reduced the number of prosecutions from 372 to 348, implicating 272 parent entities. Of these, 221 unique firms were one-time offenders, and 51 unique firms (or 18.7%) were recidivists.

Figure 12: Distribution of Non-Recidivist Firms by Market Capitalization

Figure 13: Distribution of Recidivist Firms by Market Capitalization at First Offense

As a share of assets, revenue, and total employees, recidivists in fact face less stringent penalties (0.22% of assets for recidivists, versus 16.84% of assets for one-time offenders, or approximately 1/80th the size; 0.55% of revenue for recidivists, versus 19.28% for one-time offenders, or approximately 1/35th the size; 0.42% of market capitalization for recidivists, versus 19.67% for one-time offenders, or approximately 1/40th the size). Therefore, although big public companies pay large fines, those fines are much smaller relative to the size of fines paid by smaller public companies (when normalized to account for their different size). Of course, this could be because smaller public companies commit more socially harmful crimes relative to larger institutions. But as mentioned, there are reasons to suspect that is not the case. First, somewhat mechanically, the ability to perpetuate harm against one’s customers is a by-product of the size and scope of the company’s operations. For crime by a consumer-facing financial institution, the severity of the harm should scale upwards by the number of employees or customers. For example, if Wells Fargo had just a few customers—rather than their estimated 70 million[188]—then the scope of their criminality with respect to the fake accounts scandal would have been much more limited. Further and relatedly, the most socially harmful crimes are less likely to be perpetuated by small firms, which generally lack the scale and scope to create systemic harm. For example, a bribe by a small company is surely less likely to “undermine the integrity and stability of governments and harm our relations with other countries,” whereas bribes paid by a prominent company could.[189] Likewise, if only small banks had originated fraudulent mortgages during the crisis, there would not likely have been the same degree of harm to the global economy.

As with much of the descriptive data that we present, it is impossible to rule out that smaller firms are simply committing larger crimes. But the more likely interpretation of the data is that they show an upper bound on corporate fines—for example, it might not be politically feasible to levy an $81 billion fine on Volkswagen (or 16% of the company’s assets).[190] More importantly, it might not be legally permissible because fines are often limited by statute.[191] And even if they could secure massive fines, prosecutors may have little incentive to do so when a smaller fine will garner substantial fame and attention: for example, Wells Fargo’s $1 billion settlement was celebrated as the most aggressive bank penalty of the Trump era, despite representing only 0.1% of firm assets.[192]

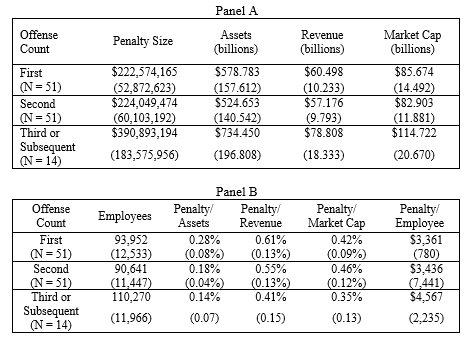

Table 3 shows the same data for recidivist public companies by offense count. As one might expect, dollar fines increase with offense count; however, fines are more lenient (when measured as a percentage of assets or revenue) for second and subsequent offenses than for first offenses.[193] In other words, this evidence suggests that prosecutors treat recidivist firms more leniently than non-recidivists. What explains this behavior? Perhaps these later crimes are unrelated to the first and the DOJ is levying fines that scale appropriately with the social cost of the crime. Another possibility is that criminal enforcement is a repeat game, and the companies get better at negotiating for leniency the more times that they interact with prosecutors as defendants. Or, again, perhaps an upper bound exists (at least in the mind of prosecutors) that restricts the aggregate amount of fines that can be levied on any one firm.

Table 2: Penalties and Measures of Firm Size for Public Corporations

Table 3: Penalties and Measures of Firm Size for Recidivist Public Corporations by Offense Count