CEO Pay Redux

Managerial power theory holds that structural flaws in corporate governance, such as board defenses, enable opportunistic managers to extract excessive pay. While this theory has proven highly influential, this Article argues that it fails to answer important questions. For example, how does managerial power theory relate to the prevailing economic paradigm of CEO pay as reflecting competition for scarce managerial talent? Further, how can one reconcile the theory’s negative account of board protection with recent empirical studies showing that such protection is value increasing?

In investigating these and other questions—both theoretically and empirically—this Article makes four contributions. First, it shows that adopting defensive measures (such as the staggered board) is not associated with significant changes in CEO pay. Second, it documents that greater competition for managerial talent is positively associated with CEO pay. Third, it shows that higher CEO pay is associated with higher firm value, especially in firms with a staggered board. Fourth, it provides plausible causal evidence that the decline in stock options (i.e., high-powered incentives) that followed the 2005 mandate to expense options is associated with increased firm value.

These results suggest that high executive pay serves to attract talented managers, rather than reflecting managerial opportunism. They also suggest that board protection might be beneficial to prevent market pressure from introducing value-reducing distortions in executive pay, such as an excessive use of high-powered incentives emphasizing short- over long-term performance. The Article concludes by discussing the policy implications of the analysis.

During the highly conflictual 2016 presidential race, the candidates agreed on at least one issue: the need to curb excessive executive pay. Then-candidate Donald Trump described CEO pay as “disgraceful . . . [and] a total and complete joke.”[1] Along similar lines, Hillary Clinton lamented that it “just doesn’t make sense” that today’s CEOs make 300 times more than the typical worker.[2]

The current political hostility toward CEO pay is unsurprising when considering the rising public outrage over executive compensation, especially after the 2007–2009 financial crisis. General discontent with executive pay is also not a recent trend; rather, “scrutinizing, criticizing, and regulating high levels of executive pay has been an American pastime for nearly a century.”[3] Since the early 2000s, however, this trend has found a systematic theoretical framework in the “managerial power theory” of executive compensation, espoused most prominently by Harvard law professors Lucian A. Bebchuk and Jesse M. Fried.[4]

Managerial power theory views the typical CEO pay package as a reflection of managerial moral hazard. Managerial moral hazard is the risk that managers may fail to exert sufficient effort and abuse their corporate power for personal gains.[5] In response to this risk, corporate law grants ultimate control over corporate affairs to the board of directors, as the institution charged with monitoring management decisions in the interest of shareholders.[6] Managerial power scholars, however, argue that structural flaws in corporate governance, such as board insulation from shareholder discipline through the use of defensive measures, make boards largely beholden to managers.[7] As a result, among other inefficiencies, managers can extract excessive pay or pay that is not tied to performance—in economic terms, “inefficient rents.”[8]

Managerial power theory has now become the dominant view in the law and economics literature.[9] It has also led to major regulatory changes promoting shareholder empowerment, which managerial power scholars defend as the most effective remedy to address excessive executive pay.[10] Most notably, in 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act yielded a series of new executive-compensation rules that, among other requirements, mandated that all U.S. public companies introduce nonbinding shareholder votes on CEO pay.[11]

Notwithstanding the far-reaching success of managerial power theory, this Article argues that this theory fails to convincingly answer crucial questions about executive compensation. In the first place, managerial power scholars fail to explain how one should reconcile their view with what this Article refers to as the “managerial talent theory” of executive compensation. The latter theory is the prevailing economic paradigm of executive compensation, pursuant to which CEO pay reflects compensation for scarce managerial talent in competitive markets.[12] Managerial talent theory thus challenges the view that the executive-compensation process is isolated from competitive pressure, as managerial power scholars seem to assume.

Further, managerial power theory is premised on a static, one-period model of executive compensation, where the manager initially makes decisions, and then investments are liquidated, gains or losses are realized, and the manager gets paid within the end of the single period.[13] In the real corporate world, however, the relationships between managers, boards, and shareholders tend to be “dynamic,” as investments typically play out along multi-period horizons and top executives hold their positions for several years.[14] Consequently, we raise the question of how moving from a static to a dynamic setting affects the positive or normative conclusions of managerial power theory.

Still, recent empirical work on the value impact of defensive measures documents that temporary board protection from shareholder interference, such as the protection granted by a staggered board,[15] is associated with increased firm value.[16] But if board protection can serve a positive governance function, how can it also be the main culprit for inefficient executive pay, as claimed by managerial power scholars?

In investigating these and other questions—both theoretically and empirically—this Article makes four basic contributions. First, it shows that the data do not support the managerial power claim that defensive measures are a source of distortions in CEO pay, as the adoption of such measures is not associated with significant changes in CEO pay levels or structure. Second, the Article documents that greater competition in the market for managerial talent is associated with statistically and economically significant increases in CEO pay, consistent with the predictions of managerial talent theory. Third, it documents that higher CEO pay is associated with higher firm value, especially in firms with a staggered board. Fourth, it provides plausible causal evidence that firms were overusing option-based pay (that is, high-powered incentives) in the early 2000s.

Overall, our analysis challenges the view that high executive wages generally constitute inefficient rents, indicating that such wages are instead often necessary to attract talented executives. It also suggests that protecting boards from short-term market and shareholder interference may promote a more positive relationship between CEO pay and firm value. This is because board protection makes it less likely that market forces introduce distortions in incentive schemes, such as an excessive use of high-powered incentives that inefficiently emphasizes short- over long-term performance.

The Article proceeds in five parts. In Part I, we provide the background necessary to understanding the context and importance of the executive-compensation debate, discussing the legal and economic foundations of the main theories of executive compensation.

Next, in Part II, we attempt to understand what difference a dynamic approach to executive compensation makes for the theoretical validity of managerial power theory.[17] As a positive matter, we argue that the more realistic assumption of a multi-period relationship between managers, boards, and shareholders produces several complexities for the analysis of managerial incentives, which managerial power theory fails to incorporate. In particular, in a dynamic setting, managers may develop incentives for engaging in inefficient intertemporal tradeoffs. The result is that shareholders not only are exposed to the risk of suboptimal managerial effort, but to the additional agency problem of short-termism (or managerial myopia).[18] This problem arises because managers—especially those compensated with high-powered equity incentives, such as option grants—may prefer investments that boost short-term returns (and a manager’s current pay) at the expense of losses only occurring in the future, which the manager discounts.

At the same time, a multi-period horizon enhances the opportunities for efficient incentive design, also challenging the normative conclusions of managerial power theory. When the board–manager relationship develops along multiple periods (as is commonly the case), the board can spread rewards for good managerial performance over time, while periodically reviewing the manager’s performance. This dynamic context allows the board to exploit a manager’s “continuation value,” that is, a manager’s expected payoffs from future employment periods.[19] Indeed, these expected payoffs provide a powerful bonding mechanism to ensure that exerting long-term effort is in the manager’s interest, as the manager anticipates that exerting suboptimal effort or engaging in myopic strategies increases the risk of being terminated and, therefore, losing the continuation value.

This conclusion offers a plausible explanation for the positive governance function of board protection documented in recent empirical studies, while warning against the potential costs of increased market pressure, whether coming from enhanced shareholder power or intense product competition.[20] When managers are subject to such market forces, they will rationally anticipate a greater risk of being removed in the near future and, therefore, substantially discount their expected continuation value. By preventing market forces from interfering with a manager’s continuation value, board protection might accordingly facilitate the design of pay schemes that promote long-term shareholder wealth.

Against this analytical background, Part III moves to the empirical investigation of the relationship existing between corporate governance and market forces, on the one hand, and CEO pay levels and structure, on the other. We begin by examining the relationship between the use of defensive measures and CEO pay. If the predictions of managerial power theory were accurate, we would expect to find that the adoption of such measures increases the likelihood that managers obtain higher pay or pay that is not sufficiently tied to performance. For example, pursuant to the claims made by managerial power scholars, we should find that CEO pay arrangements include larger portions of non-equity pay (e.g., cash, salary, and the like), which fail to directly align manager and shareholder interests.[21] Similarly, we would expect to find a greater use of restricted stock grants, which according to managerial power theory inefficiently provides managers with lower-powered incentives than the use of option grants.[22] In contrast with these predictions, we find no evidence that the adoption of defensive measures results in higher levels of executive compensation or changes in pay structure (neither before nor after the Dodd-Frank Act’s introduction of new compensation rules).

Next, we examine the effect on CEO pay of various forms of competition. These forms include labor-market competition for managerial talent, product-market competition, and competition through merger and acquisition (M&A) activity, which we interpret as a proxy for an industry’s shareholder pressure (as operating through the takeover channel).[23] Consistent with managerial talent theory, we document that competition for managerial talent has a substantial effect on both CEO pay levels and structure, as greater talent competition is positively associated with higher CEO pay levels and a larger proportion of restricted stock grants. This evidence suggests that the increase in CEO pay due to managerial talent competition largely comes from a greater use of restricted stock. On the contrary, greater product-market competition and M&A competition are associated with an increase in the option component of CEO pay and a decrease in the restricted stock component, indicating that boards tend to respond to stronger market discipline with more high-powered incentives.

Our analysis of the relationship between corporate governance, market forces, and CEO pay thus indicates that managerial talent competition is a critical source of increased CEO pay. Yet, the ultimate question, which we address in Part IV, is how current executive-pay levels and structure affect firms’ financial performance. Contrary to the predictions of managerial power theory, we find that higher CEO pay is associated with higher firm value.[24] Combined with our result that greater managerial talent competition is associated with higher CEO pay, this finding seems to suggests that, in general, high executive pay is not “excessive” in the sense described by managerial power scholars (that is, in the sense that it dissipates shareholder value). Rather, high executive pay seems to ensure that the most talented CEOs are allocated to the most valuable firms.

Further, we document that CEO pay is more strongly positively associated with firm value in firms that adopt defensive measures and, especially, a staggered board. Conversely, greater product-market competition and higher M&A competition interacted with CEO pay are associated with lower firm value. Taken together, these results support our theoretical predictions about the positive role of board protection in the executive-compensation process and the corresponding costs of market and shareholder pressure, indicating that boards that are temporarily protected from such market forces are better positioned to design value-increasing CEO pay arrangements.

Nevertheless, it could be argued that the results of our value analysis are subject to endogeneity concerns—the ever-present risk that correlation might be mistaken for causation.[25] For example, it could be that enhanced CEO effectiveness or expectations of future positive performance result in higher CEO pay, rather than higher pay causing better performance. To mitigate such concerns, Part IV also considers an event study that focuses on the 2005 introduction of Financial Accounting Standard (FAS) regulation 123(R).[26] FAS123(R) mandated that all public firms expense stock options, eliminating the prior privileged accounting treatment of options relative to restricted stock. As the product of regulatory intervention, this event can be regarded as independent from firm-specific circumstances and, therefore, as plausibly inducing exogenous changes in both the levels and structure of CEO pay (that is, changes that are outside a firm’s direct control). It follows that examining the subsequent performance of firms that were and were not affected by the introduction of FAS123(R) can plausibly provide causal evidence about the impact of modifications in CEO pay levels and structure on firm value. In particular, as FAS123(R) leveled the playing field between the use of options and restricted stock from an accounting perspective, we expect such an event study to provide us with additional insights into the relative efficiency of more versus less powered incentives.

We show that FAS123(R) led to a significant reduction in the option component of executive pay for affected firms that had outstanding options. More importantly, we also show that the more firms reduced option grants in favor of restricted stock grants in the two years after the rule change, the greater the increase in firm value. Combined with our finding that greater market and shareholder pressures are associated with a larger use of option grants, these results confirm the above interpretation of our value analysis that market forces might introduce distortions in optimal incentive design, such as an excessive use of high-powered incentives that overemphasize short-term performance at the expense of long-term firm value.

From a normative perspective, as discussed in Part V, our analysis provides important insights for the social welfare implications of the executive-compensation debate. Our central results are that high executive pay is generally efficient in attracting talented managers, while enhanced market and shareholder pressure may produce value-reducing distortions in executive-pay schemes. Based on these results, we defend the traditional deference paid by Delaware courts to board decision-making in executive-compensation matters as normatively desirable. We likewise defend temporary board protection as a means to promote, rather than jeopardize, the efficiency of executive-compensation plans—including by mitigating the risk that boards might overuse high-powered incentives in response to excessive market pressure. More broadly, we argue that policymakers would do well to reconsider the case for enhanced shareholder power in the executive-pay process,[27] as this case emerges as both theoretically and empirically wanting.

I. Theories of Executive Compensation

This Part assesses the major theories of executive compensation, as developed in both legal and economic models. The agency problem between shareholders and managers is the common departure point of these theories. Indeed, as first famously espoused by Berle and Means,[28] and later formalized by Jensen and Meckling,[29] the separation of ownership and control in the public corporation creates the risk that managers may engage in moral hazard, taking “hidden actions” in their own self-interest and at the expense of shareholders. The question, however, is whether executive compensation provides a means to address this quintessential agency problem or, rather, is part of it.

As explained in the discussion of what is commonly referred to as “optimal contracting theory” in subpart A below, executive-compensation research initially developed on the agency-theoretic premise that compensation plans provide an efficient contractual mechanism to mitigate managerial moral hazard. However, as discussed in subpart B, managerial power theory, which first emerged in the early 2000s, has challenged this premise, arguing that compensation plans reflect managerial moral hazard rather than mitigating it. Partially in response to this criticism, more recent “managerial talent theory” studies, which we discuss in subpart C, have proposed an expansion of the traditional agency model of executive compensation, moving beyond the bilateral contracting framework and emphasizing additional dimensions, such as competitive forces in the labor market for managerial talent.

1. Law.—The classic theory of executive compensation—referred to as “optimal (or efficient) contracting theory”—posits that compensation arrangements are designed by the board of directors to provide executives with incentives to refrain from moral hazard and maximize shareholder value.[30]

From a corporate law perspective, optimal contracting theory captures the central role served by the board of directors as the organizational body charged with mitigating the shareholder–manager agency problem.[31] Indeed, corporate law separates “decision management” and “decision control,” delegating business decision-making to managers, while vesting the board with the authority to ratify and monitor management actions on behalf of shareholders.[32] To this end, directors are granted a vast array of powers, including the power of selecting and removing the CEO and other top executives, as well as the power of setting executive-compensation arrangements.

Reflecting the assumption that executive compensation is a matter efficiently delegated to board discretion, corporate law also provides for minimal judicial review of executive-compensation decisions, extending to such decisions the protection of the business judgment rule.[33]

2. Economics.—From an economic perspective, optimal contracting theory frames executive compensation as a remedy to reduce the moral hazard costs faced by shareholders.[34] Such costs arise because the principal (the shareholders) faces the problem of inducing effort by the agent (the managers)—or, put differently, avoiding the agent’s moral hazard, for example in the form of private-benefits extraction[35]—despite being unable to observe all of the actions the agent takes.[36] The fundamental insight from the principal–agent model is that incentivizing effort requires giving the agent a monetary payoff, an agency rent, such that the exercise of effort is in the agent’s own interest.[37]

Therefore, the board’s essential problem is designing a contract that can maximize managerial effort, while minimizing the costs of providing incentives (the agency rent awarded to the manager). More specifically, the optimal contract maximizes shareholder value subject to two constraints. The first is the manager’s participation constraint, which requires shareholders to pay the manager her reservation utility, that is, the value of her next-best employment opportunity available (also referred to as “outside option”).[38] The second is the manager’s incentive constraint, which requires shareholders to compensate the manager for choosing actions that maximize shareholder value rather than pursuing opportunities that the manager privately prefers but result in lower shareholder value.

The contracts that solve this optimization problem involve compensation schemes that tie CEO pay to shareholder value,[39] thus providing the theoretical justification for the current prevalence of equity-based compensation (such as stock options and restricted stock) over fixed compensation in CEO pay packages.[40] The intuitive case for equity-based compensation is straightforward: when financial rewards are guaranteed, managers are assumed to have no reason to avoid self-serving behavior. In contrast, when pay is anchored to increased shareholder value, managerial incentives are aligned with the interests of shareholders, mitigating moral hazard.

A simple example helps illustrate the economics of optimal contracting theory. We assume that a Board needs to set the compensation plan of a Manager who has an outside option valued at $5.[41] The Manager can take a project that generates revenues of $1,000 with probability 80% or revenues of $0 with the remaining 20% probability. To stylize the possibility of moral hazard, we assume that the Manager has the possibility of extracting a private benefit of $4, in which case the probability of the project’s success drops to 60%.[42] This means that in order to maximize the project’s chances of success, the Manager has to bear a cost of $4, which corresponds to the “disutility” of effort[43] of giving up private-benefit extraction.

Under these assumptions, the problem for the Board[44] is twofold. On the one hand, the Board needs to prevent the Manager from extracting the private benefit of $4, as this is detrimental to shareholder value.[45] On the other hand, under standard asymmetric information assumptions, the Board cannot observe whether the Manager engages in private-benefit extraction and therefore cannot make the Manager’s payoff schedule contingent on her actions. Otherwise, assuming symmetric information, the Board could simply write a state-contingent contract under which it would pay the Manager $4 if she does not engage in private-benefit extraction.

In order to solve these problems and make the Manager’s contract incentive compatible, the Board will need to provide the Manager an agency rent that awards the Manager part of the project’s returns. Specifically, the efficient agency rent to be left to the Manager is the minimum amount of the project’s returns that can satisfy both the Manager’s participation constraint (PC) and incentive constraint (IC). Under the Manager’s PC, the Manager needs to receive at least the value of her outside option ($5). Under the Manager’s IC, the Manager must be at least as well off when she exerts effort as when she does not (that is, when she extracts the private benefit of $4).

In our setting, the Board can satisfy both these constraints by promising a percentage (%)of the project’s returns to the Manager, so that the Manager’s IC can be written as: (0.8) [% ($1,000)] (0.6) [% ($1,000)] + $4.[46] This condition implies that the Manager’s IC is satisfied for 0.02 (or a percentage of at least 2%); that is, by promising the Manager an agency rent of $20 in case of the project’s success (i.e., 0.02 $1,000). This compensation schedule also satisfies the Manager’s PC as (0.8) ($20) = $16 $5, therefore providing the Manager with incentives to exert optimal effort.[47]

1. Law.—Managerial power theory conceives of typical executive-compensation packages as part of, rather than a remedy to, the moral hazard problem arising in the public corporation. Conceptually, this theory—expounded in a series of studies by Lucian A. Bebchuk and Jesse M. Fried[48]—relies on negating a central assumption of optimal contracting theory. The negated assumption is that the board is able to act as a faithful guardian of shareholder interests and, hence, to take an adversarial position against management in negotiating efficient compensation arrangements.[49] Instead, managerial power theorists argue, the delegation of “decision control” from shareholders to directors results in its own set of agency costs, which largely mirror those arising between shareholders and managers.[50]

Further, neither competitive forces outside the firm nor corporate law rules could mitigate directorial moral hazard costs. First, managerial power scholars argue, boards are largely immune from the forces arising from product- or labor-market competition as well as insufficiently interested in any financial benefits from M&A deals.[51] Therefore, market forces can impose at best light constraints on executive compensation.[52] Second, fiduciary rules provide only weak deterrence against directorial moral hazard especially in the executive-compensation context, due to both the traditional reluctance of courts to intervene in compensation matters and excessively high enforcement costs.[53] Third, and most importantly, the shareholders’ power of removing directors (and their appointed officers, the managers) is “largely a myth”[54] as a result of managerial entrenchment and board capture.

Under the managerial power view, entrenchment arises when directors gain protection from the threat of removal through the adoption of defensive measures that make it difficult for shareholders to replace incumbents.[55] Classic examples of such measures include poison pills and staggered boards.

A poison pill (also called a shareholders’ rights plan) is a defensive measure that, when implemented, so dilutes a bidder’s economic rights that the only way to complete a hostile takeover is to first appoint a new majority of directors who can remove the pill.[56] When a board is staggered, however, a bidder’s ability to do so is reduced because directors are grouped into different classes—usually three—serving staggered terms where each class stands for reelection in successive years. This requires a prospective hostile bidder to endure the costly delay of waiting through two election cycles before being able to replace a majority of the board. As a result, the adoption of a staggered board, in addition to a poison pill, provides directors with a very potent defense against hostile takeovers.[57]

Likewise, for managerial power scholars, entrenchment is favored by incumbents’ exclusive access to the corporation’s proxy machinery, which raises prohibitive procedural costs for prospective challengers.[58]

By weakening the disciplining effect of the threat of removal, entrenchment would allow top executives—who control the flow of information from lower corporate layers to the board and, more importantly, the board-appointment process—to capture directors, making them subservient to management.[59] As a result, managerial power scholars argue that directors are unable to engage in arm’s-length compensation negotiations on the shareholders’ behalf, while managers can exploit the power they hold over boards to extract excessive remuneration.[60]

For these scholars, the cost of excessive CEO pay also is substantial and reaps a significant portion of shareholder wealth.[61] Further, managers’ ability to influence the executive-pay process results in weak or even perverse incentives. That is, managers are able to obtain compensation plans that are decoupled from firm performance or even promote results misreporting, the suppression of bad news, and the undertaking of projects that are not transparent.[62]

2. Economics.—In economic terms, the central claim underpinning managerial power theory is straightforward: board capture enables executives to extract “entrenchment rents,” that is, returns above the executives’ agency rents.[63] This account of executive compensation would explain why a substantial part of executive compensation is provided in the form of non-equity components, which are not, or only poorly, tied to performance—including cash salary, bonus plans, signing bonuses, split-dollar life insurance policies, and severance payments.[64]

Accordingly, a managerial power theorist would claim that the Board in our example above would not just grant the Manager an agency rent equal to 2% of the project’s expected returns. Rather, the Manager would be able to influence the Board’s decision-making process to obtain additional pay—for example, in the form of a fixed bonus of $10 to be paid on top of the 2% agency rent. This bonus would correspond to an entrenchment rent, providing the Manager with value beyond what is needed to preserve the Manager’s incentives to exert effort and hence decreasing shareholder value.

Of course, this is just one trivial representation of the many ways through which managers can extract entrenchment rents according to managerial power scholars. For example, another way managers could extract rents is by bargaining for equity-based compensation in the form of restricted stock rather than stock options.[65] Both restricted stock and stock options tie managerial pay to stock-price performance and shareholder value. Restricted stock, however, does so in a linear way, moving dollar for dollar with the firm’s share price. Therefore, the gains or losses of a manager that is compensated with restricted stock are the same as those of shareholders. Conversely, stock options (which are technically call options) deliver managers asymmetric payoffs. A call option is only valuable to managers if the share price at the option’s exercise date is higher than the option’s strike price. This makes managers highly sensitive to even small changes in share value above the option’s strike price, while they are relatively insensitive to changes in share value below the strike price. It follows that option-based pay produces more high-powered incentives per dollar of compensation expenses than stock-based pay and, therefore, is seen as a less costly way of paying out necessary agency rents.[66]

A further modification of our example is useful to clarify this point. Recall that the Board’s essential problem in designing the Manager’s contract is that it cannot observe whether the Manager exerts effort or extracts a private benefit of $4. In order to stylize the use of restricted stock versus options, we assume that at the time the Board sets the Manager’s compensation plan, each company share is worth $1. We further assume that if the Manager exerts effort, within a year the share value will increase to $1.2 with probability 80%, while it will drop to $0.8 with probability 20%. Under these assumptions, the expected value of the company’s share price equals $1.12. Conversely, if the Manager does not exert effort, within a year the share value will increase to $1.2 with probability 30%, while it will drop to $0.8 with probability 70%. With the lack of managerial effort, the expected value of each share thus decreases to $0.92.

Let’s now assume that the Board decides to pay the Manager’s agency rent using restricted stock, granting a number (# Shares) that can satisfy the Manager’s incentive constraint (again, IC). Assuming, for simplicity, that the Manager is risk-neutral and does not discount future income (such that she is indifferent between receiving $4 now versus later), the Manager’s IC can be written as: [(# Shares) ($1.12)] – $4 [(# Shares) ($0.92)]. Therefore, the incentives to be left to the Manager under a restricted stock plan are equal to $20 ($4/0.2) shares, which translates into an expected cost for the shareholders equal to $20 $1.12 = $22.4.[67]

On the contrary, should the Board decide to pay the Manager’s agency rent through call options with a $1 strike price, the option would give the Manager the following payoff: Max[Stock Value at Exercise – $1, 0]. This means that the Manager will only exercise her option when Stock Value at Exercise exceeds $1, which materializes with probability 80% when the Manager exerts effort and with probability 30% when she does not exert it. Therefore, the option’s expected value to the Manager equals 80% [$1.2 – $1] = $0.16 when the Manager exerts effort, and 30% [$1.2 – $1] = $0.06 when she does not. The Manager’s IC under the option plan can thus be written as: (# Options worth $0.16) (# Options worth $0.06) + $4.[68] Consequently, the Manager needs to receive at least 40 options to exert effort ($4/0.1 = 40), with an expected cost to the company of ($0.16) (40) = $6.4.

For managerial power theorists, then, the difference of $16 between restricted stock costing $22.4 and options costing $6.4 would be the entrenchment rent captured by the Manager.[69]

1. Law.—What we refer to as the “managerial talent” theory of executive compensation[70] broadens the optimal contracting approach to account for additional dimensions, including market forces operating in a competitive equilibrium.[71] Thus, while for expositional convenience we treat these theories separately, managerial talent studies could also be regarded as part of optimal contracting theory.[72] Indeed, from a legal perspective, the assumptions underpinning optimal contracting theory continue to remain valid for managerial talent theory, which also conceives of compensation as a matter efficiently delegated to the central authority of the board. As explained below, however, managerial talent theory considers optimal board contracting in the executive-compensation process as not just resulting from bargaining between boards and shareholders, but as influenced by exogenous market forces as well.

2. Economics.—Economically, managerial talent studies employ competitive equilibrium models, maintaining that the models of bilateral contracting employed in optimal contracting theory cannot capture the complexities of actual CEO-employment relationships.[73] These complexities arise from the fact that the incentives to be provided to executives are not determined “in a vacuum,” as if boards and CEOs were insulated from market competition. Rather, such incentives reflect a competitive equilibrium in the market for scarce managerial talent, where “it may be optimal to pay high wages to attract talented CEOs, and implement high effort from them even though doing so requires paying a premium.”[74] Under this view, high executive pay would thus reflect the high agency rents to be paid to preserve managerial incentives in a competitive labor market with a limited supply of managerial talent rather than entrenchment rents. For expositional clarity, we refer to such high but efficient executive rents as “market rents” to distinguish compensation premiums driven by competitive market forces from “pure” agency rents.[75]

A further modification of the basic example introduced above can serve to clarify the concept of market rent. As a stylized representation of a competitive market context, we add an additional corporation (Corporation II), referring to the board of our initial corporation (Corporation I) as Board I and the board of this additional corporation as Board II. As is standard in competitive labor-market models, we assume that there is scarcity of managerial talent and that our Manager has rare talent, such that both Board I and Board II are interested in hiring the Manager. Specifically, we assume that Board II is willing to pay the Manager a compensation package of $40.

Under these circumstances, the original expected compensation of $16 no longer suffices to satisfy the Manager’s participation constraint,[76] which has now increased to $40 because of Board II’s employment offer. Therefore, in order for Board I to retain the Manager, Board I will need to pay the Manager not just the pure agency rent of (0.8) ($20) = $16, but also a market rent of $24 to match the offer of Board II.[77] Importantly, under the assumption of scarce managerial talent, it is reasonable to pose that should Board I not pay the Manager this market rent, the Manager would join Corporation II, while Board I would be forced to hire a less talented manager with lower productivity, resulting in a loss in shareholder wealth.[78]

II. Towards a Dynamic Approach

Part I has outlined the essential elements of the main theories of executive compensation. It has not, however, surveyed the empirical literature that examined whether the different predictions generated by each theory are confirmed by the data because space constraints would force us to omit many important contributions. We thus refer the reader to the excellent surveys by John Core, Wayne Guay, and David Larcker,[79] and Carola Frydman and Dirk Jenter.[80]

As documented by these surveys, the empirical literature on executive compensation has generally yielded mixed results, failing to identify a consistent relationship between one set of theoretical predictions and the data.[81] For example, while board capture constitutes an essential element of managerial power theory, the available empirical evidence seems not to support the existence of systematically passive and captured boards.[82] On the contrary, indicators of board independence have steadily improved since the 1980s,[83] and CEO turnover rates have also increased,[84] thus suggesting that boards do not refrain from disciplining poorly performing executives. Conversely, the data generally confirm that the CEO labor market has become increasingly more competitive[85]—consistent with the assumptions of managerial talent theory. Yet, it remains empirically uncertain whether growing competitiveness in the managerial labor market can fully explain the increase in executive-pay levels and the changes in the structure of executive pay that have occurred over the past decades.

As a matter of fact, however, managerial power theory has largely gained the upper hand in recent years, proving very influential in both academic and political circles and leading to major regulatory changes, especially in the United States. In 2006, for example, the Securities and Exchange Commission (SEC) mandated increased disclosure of compensation policies, requiring, among other things, that companies specifically address the role of executives in the pay-setting process.[86] Further, and explicitly taking into account the concern of managerial power scholars, the SEC also required a more detailed articulation of compensation items that might potentially constitute a perquisite.[87] Most notably, in 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act introduced a series of new executive-compensation rules affecting all public companies, including rules designed to bolster the independence of compensation committees and mandating that companies introduce nonbinding shareholder votes on executive compensation.[88]

These reforms share one common feature: they all embrace the call for shareholder empowerment that managerial power scholars have long defended as the necessary remedy to what they see as the widespread problem of excessive executive pay.[89] Underpinning that call is these scholars’ belief that only by strengthening the governance rights of shareholders can directors be trusted to faithfully serve shareholder interests, rather than be captured by opportunistic managers. To this end, in addition to favoring an enhanced role of shareholders in the pay-setting process, managerial power scholars defend the need to remove the barriers that insulate directors from shareholder discipline, such as defensive measures.[90]

This claim notwithstanding, recent work on the value impact of defensive measures, including our own research, does not support the view that stronger shareholder rights are an all-purpose remedy in corporate governance.[91] In particular, two of us have showed elsewhere that the adoption of a staggered board is associated, on average, with increased firm value, while not being associated with a lower CEO turnover.[92] This evidence poses a challenge to managerial power theory. Under this theory, one would expect to find, on the one hand, that the adoption of takeover defenses decreases firm value. On the other hand, such measures should be associated with a lower CEO turnover, as managerial power scholars argue that insulated boards are more likely to be captured by executives and hence less likely to fire them in case of poor firm performance.[93] In contrast, both these theoretical predictions are rejected by the data.

More generally, this evidence raises several questions about the explanatory power of managerial power theory. First, if boards that are protected from short-term shareholder interference seem better placed to promote long-term shareholder wealth, how can board protection be the main source of allegedly inefficient executive pay, as argued by managerial power scholars? If, on the other hand, board protection does not hamper the executive-pay process, perhaps it can serve a positive function within this process? Further, is there any link between the results we obtain on board protection and managerial talent theory? The attempt to answer these questions provides the motivation for the analysis we develop in this Article. Our interest lies in these questions’ theoretical implications, which we discuss in this Part, as well as their empirical implications, which we explore in Parts III and IV below.

Theoretically, these questions point to a complex relationship between corporate governance, market forces, and executive compensation. In analyzing this complexity, we draw on some critical analysis that Bengt Holmström, 2016 Nobel laureate in economics, offered on incentive design about a decade ago.[94] First, Holmström observed that the right economic framework for studying executive compensation is that of “[d]ynamic models, where commitment problems and implicit incentives arise out of incomplete contracting and renegotiation.”[95] This remark emphasizes that the nature of the relationship between managers, shareholders, and boards is not that of a static, one-shot transaction as envisioned within managerial power theory. Rather, such a relationship tends to develop along a multi-period horizon, with managers typically holding their positions for several investment periods.[96] As we argue in subpart B below, taking into account the dynamic nature of executive-compensation contracts sheds new light on the relationship existing between agency rents, entrenchment rents, and market rents.

Second, and relatedly, Holmström argued that the claim “that shareholders know what is best for them breaks down in a world where commitment to an ex post inefficient course of action is valuable ex ante.”[97] As explained in subpart C, this analytical framework suggests that attempts at reducing moral hazard costs ex post (that is, after a manager’s hire) by strengthening shareholder governance rights might impair a board’s ability to design efficient incentive schemes ex ante (that is, upon a manager’s hire), in turn calling for a novel evaluation of the respective costs and benefits of shareholder empowerment and board protection.

B. Dynamic Compensation Contracts

Convenience and tractability issues explain why scholars often prefer static settings to dynamic ones. The study of executive compensation is no exception. After all, so the common argument goes, as long as using a more tractable single-period setting does not change the general conclusions of the analysis, there is no need to overly complicate executive-compensation discussions.[98] However, the more recent economic literature on executive compensation emphasizes that taking into account the complexities of dynamic, strategic, and repeated interactions between executives, firms, and markets may lead to significantly different conclusions about whether executive-compensation theories can accurately predict observed compensation practices.[99] In other words, the risk is that static models may be not just simple, but ultimately simplistic.

Drawing on this recent literature, we argue that once the relationship between managers, boards, and shareholders is more realistically represented as taking place in a dynamic and competitive setting, several important implications follow—regarding both managerial incentives and the opportunities of boards and shareholders to design efficient compensation schemes.

1. Dynamic Incentives.—On the incentives side, a dynamic setting can incorporate essential features of executive-compensation contracts as they are negotiated and implemented in the actual corporate world. First, real-world settings show that the relationship between incentives, rents, and competition can be more complex than described in Part I. We can again use the example we introduced above to better illustrate this point. For simplicity, in that example we considered only a single period, where at the beginning of the period, in “the present,” the board implements the compensation schedule and the manager makes investment decisions, and at the end of the period, in “the future,” gains or losses are realized and the manager gets paid. In this static setting, competitive market forces only operate in “the present,” causing an increase in the manager’s reservation utility and, accordingly, requiring that the manager be paid market rents, in addition to agency rents.[100] However, once one allows for multiple investment periods and hence the availability of interim information based on the realization of interim payoffs, increased competition for managerial talent produces additional complexities.

On the one hand, shareholders will be interested in both the manager’s current contribution and those arising from her continued employment. On the other, initially optimal incentives may lose power over time. Indeed, if interim payoffs are positive, the manager’s reservation utility will likely increase over subsequent periods, as positive interim payoffs can be expected to make the manager more appealing to competitors.[101] Accordingly, competition may produce a negative externality, rendering the initial compensation contract no longer apt to satisfy the manager’s participation constraint in future periods.

In the context of our example, this means that paying the Manager a market rent of $24 in addition to an agency rent of $16 might not be sufficient to provide the Manager with long-term incentives to exert optimal effort in Corporation I.[102] This is because a successful Manager might have additional employment options available after the positive realization of interim payoffs, with such offers likely exceeding the current Manager’s total rent of $40.

Further, a dynamic setting also accounts for a manager’s ability to engage in inefficient intertemporal tradeoffs, which potentially exposes shareholders to an additional agency problem: short-termism (or managerial myopia).[103] In a static setting, the main concern for shareholders is that a manager may fail to exert optimal effort. The provision of equity incentives, which tie CEO pay directly to shareholder wealth, is the standard solution to this problem.[104] In a dynamic setting, however, a manager compensated through equity-based pay may develop incentives for investments that boost short-term returns (and thus a manager’s pay), at the expense of lower gains or even losses occurring in the longer-term and which, therefore, the manager discounts.[105]

Excessive risk-taking provides a classic example of short-termism, as it became evident during the 2007–2009 financial crisis, when the huge underlying risks associated with U.S. banks’ investments in the highly remunerative subprime market finally materialized.[106] Another classic example includes cutting specific investments—for example, investments in R&D or employee training—that would pay off later on. Importantly, increased competition may exacerbate short-termist incentives. Indeed, a manager who can depart to a new employer before any long-term loss materializes will be naturally more inclined to engage in short-termist strategies. In this environment, improving short-term performance at the expense of long-term value will not only boost a manager’s current pay, but also her chances at upward mobility, at once increasing the value of the manager’s outside option and the likelihood of sidestepping losses arising in the future.[107]

2. Dynamic Pay and Committed Managers.—In addition to the above challenges, a dynamic setting simultaneously offers additional avenues for efficient incentive design, as it allows boards to spread the rewards for good managerial performance over time while periodically reviewing the manager’s performance. In other words, in a dynamic setting, the board can “exploit” a manager’s continuation value—that is, a manager’s expected payoffs from future employment periods (assuming that the manager is not fired for poor performance)—as a powerful bonding mechanism to commit the manager to the creation of long-term firm value.

This dynamic approach to executive-pay design sheds new light on the function served by allegedly inefficient entrenchment rents—that is, compensation premiums that exceed a manager’s total rent, as given by the sum of agency rents and market rents. Contrary to the assumptions of managerial power scholars, this approach shows that such rents can help to commit executives to the exercise of long-term effort.

Consider, for example, the use of fixed compensation, which managerial power scholars describe as the quintessential form of “pay-without-performance” and, hence, as primary evidence of inefficient rent extraction.[108] In contrast with this view, in a multi-period setting, fixed compensation can provide efficient incentives, as long as the manager’s expected gains from future employment periods offset her disutility cost of effort. A rational manager anticipates that low effort increases the likelihood of poor interim performance[109] and, therefore, that she might be removed in the near future. Because managerial removal triggers the loss of continuation payoffs, the manager will then have incentives to exert effort.[110]

Fixed compensation may likewise provide a mechanism to mitigate the negative externalities that competition may introduce in incentive schemes. Consider again our example. Recall that in a competitive, dynamic setting, paying the Manager the total rent of $40 (that is, the $16 agency rent plus the $24 market rent) is no longer sufficient to satisfy the participation constraint of a talented Manager over time. In this context, paying the Manager more than the $40 total rent—for example, by granting the Manager an additional fixed bonus of $10 to be paid out each period the Manager continues to be employed—should thus be regarded as an efficient, rather than inefficient, rent. Under this compensation arrangement, the Manager will trade off any potential future increase in her reservation utility against her expected continuation payoffs, including expected future bonuses. It follows that providing the Manager with extra compensation may help promote the Manager’s long-term commitment to Corporation I and, ultimately, long-term shareholder wealth.

Similar considerations apply to the use of restricted stock instead of stock options to compensate executives. As discussed above, managerial power theorists are critical of restricted stock, arguing that providing incentives through this compensation component is more costly to shareholders than doing so through options.[111] When considered from a dynamic perspective, however, the use of restricted stock can serve a positive function, as the higher expected value that restricted stock provides to managers—relative to option grants—might help secure the long-term commitment of talented managers. Thus in our example above when the Manager is compensated through restricted stock she expects to receive a value of $22.4, which is considerably higher than the expected value of $6.4 the Manager receives under an option plan.[112] What managerial power scholars generally do not consider, however, is that in a dynamic, competitive setting, the higher value accruing to the Manager increases the likelihood that a successful Manager will stick to Corporation I over time.

Designing executive pay dynamically can similarly help mitigate myopic managerial incentives, as long as a manager’s pay package is designed to ensure that the manager’s expected payoffs from future employment periods offset the gains she might obtain out of a short-termist strategy today. Our example is again helpful to clarify this point. As a stylized representation of a dynamic setting, we assume that after “the present,” there are two periods, where in each period $1,000 can be generated with some probability. For simplicity, we pose that the Manager cannot engage in private-benefit extraction in this modified setting, so that, under the assumption that the Manager will exert effort, the project she undertakes has an 80% probability of success in each period.

Here, however, the Manager can make a myopic choice, meaning that she can boost the payoff from the first investment period at the expense of the payoff from the second period. In particular, assume that the Manager can choose an investment strategy (e.g., cutting long-term investments in R&D) that increases the probability of a successful first-period realization from 80% to 85%, but simultaneously reduces the likelihood of a successful second-period realization from 80% to 60%. In our example, this choice is clearly inefficient, as it decreases the shareholders’ expected returns. Nevertheless, for the Manager, such behavior is the most profitable choice when she does not expect to receive a continuation payoff. Assuming market rents away—for simplicity, but with no loss of generality—when the Manager only expects to receive her agency rent, she can increase her expected first-period compensation from (0.8) ($20) = $16[113] to (0.85) ($20) = $17 by behaving myopically. Further, a successful first-period performance will also enhance the Manager’s chances for improved outside mobility and, therefore, for sidestepping the longer-term losses arising from a short-termist choice.

Conversely, if the Manager expects to receive a continuation value in the form of an additional rent of $10 per period, the Manager will trade off the short-term increment from the myopic strategy against the higher likelihood of losing her continuation value. In the case of myopic managerial behavior, the Manager reduces the likelihood of receiving the second-period rent of $10 from 80% to 60%. By undertaking a myopic strategy, the Manager can thus expect to lose $2 in the second period, which is more than what she gets out of the myopic strategy in the first period. Accordingly, a rational Manager will not engage in myopic behavior.

Lastly, it is important to emphasize that any form of compensation above a manager’s total rent can be used to provide managers with efficient incentives to mitigate the risk of managerial myopia. In particular, results analogous to those described above for the use of fixed compensation can be achieved by using restricted stock instead of stock options. As is extensively discussed in the executive-compensation literature, especially after the recent financial crisis, the asymmetric payoff of options may give managers greater incentives to opportunistically exploit intertemporal tradeoffs—particularly in the form of excessive risk-taking.[114] This is because the sensitivity of option-compensated managers to even small changes in the share price around a call option’s strike price tends to exacerbate a manager’s incentives to undertake strategies that boost short-term stock prices.[115] Conversely, the linear payoff of restricted stock, combined with the instrument’s vesting-period restrictions, anchor a manager’s payoff to long-term shareholder value, therefore mitigating managers’ incentives for short-termism.

C. Commitment, Competition, and Shareholder Power

The above discussion has shown that under the realistic assumption of a dynamic setting with competition for scarce managerial talent, boards can design a manager’s expected rents from future employment periods to commit talented managers to the long-term exercise of effort, as well as to mitigate the risk of managerial myopia. Nonetheless, a managerial power theorist could object that this conclusion rests on the wrong conceptualization of the shareholders’ power of removal. Indeed, the design of dynamic compensation contracts rests on a board’s ability to both reward successful managers and remove poorly performing managers. According to managerial power scholars, however, in the real corporate world, the use of defensive measures and other barriers undermines the shareholders’ own power of removing directors, which would produce entrenched boards beholden to top executives.[116] Consequently, the assumption that boards would fire an underperforming manager is misplaced. Thus, even under a dynamic approach one should conclude that efficient executive pay requires shareholder empowerment, as only in this way could directors and managers be held accountable for poor firm performance.

The above argument, however, neglects to consider that the creation of long-term firm value presupposes a bilateral commitment, from both managers and shareholders. This requires, on the one hand, providing managers with rents that make it in a manager’s self-interest to exert long-term effort. On the other hand, it requires overcoming what we have referred to in prior work as the shareholders’ “limited commitment problem.”[117]

This problem arises because, upon the realization of a disappointing firm outcome (that is, low short-term earnings), shareholders always have the option to challenge the board and its appointed officials, the managers. They can do so in several ways—for example, supporting activist hedge funds, submitting shareholder proposals,[118] voting against management, or selling their shares in a hostile takeover attempt. However, under the conditions of informational asymmetry existing in the real corporate world, a disappointing firm outcome might be only temporary and reflect an investment whose value will materialize only later on. Put differently, the assumption that an opportunistic manager is generally more likely to be associated with disappointing firm outcomes in the short term[119] breaks down once one considers that directors and managers have private information that cannot easily be shared with outside shareholders. Therefore, as market prices may fail to capture the implications of private information until those implications begin to show up in cash flows over time, shareholders would benefit from supporting, rather than challenging, board actions in the short term.[120]

This analytical framework suggests that the benefits of shareholder empowerment—and, more generally, increased market discipline—need to be evaluated alongside their costs, while also indicating that temporary board protection might serve a positive governance function within the executive-pay process. When shareholders are empowered to intervene in corporate affairs “at all times”—as advocated by managerial power scholars—they are unable to provide a credible ex ante commitment not to challenge the board and managers in the short term. This problem is likely to be exacerbated in firms operating in markets with intense product competition. This is because in a context where managerial performance is evaluated in relative terms over fairly short periods of time and under the imperative of “beating competitors,” shareholders might become even more impatient. In turn, they will be even less willing to support current board and managerial actions when faced with disappointing short-term firm performance, regardless of whether this outcome might be only temporary.

In an environment with increased shareholder power or intense product-market competition, a rational manager will accordingly anticipate a much higher risk of being removed in the near future. Under this risk, the manager will substantially discount her expected continuation payoff. The manager will also be more likely to develop short-termist incentives, as positive short-term results can be expected to reduce the risk of future managerial removal. As a result, a manager’s expected continuation value might no longer be sufficient to offset her current cost of effort, or her future reservation utility increases, or, still, near-term gains from myopic investments—all circumstances that jeopardize a board’s ability to design effective pay schemes under the dynamic approach described above.

By limiting the impact of short-term shareholder and market pressure on board decision-making, temporary board protection may help preserve a manager’s continuation value and thus the ability of boards to design efficient pay schemes. When a board is protected from short-term shareholder interference and, more broadly, market pressure, managers will rationally anticipate a lower risk of being removed in the short term. It follows that it will be easier for boards to efficiently design a manager’s continuation payoff to promote long-term managerial effort.[121]

This does not mean that board protection should be perpetual. On the one hand, market prices can be expected to better incorporate uncertainty about current projects and a board’s strategy over time, as the implications of directorial decisions materialize into actual cash flows. On the other hand, perpetual board protection would make the threat of removing underperforming managers no longer credible, which would likewise sabotage incentive schemes. However, in contrast to what is argued by managerial power scholars, most defensive measures are not perpetual. A staggered board, for example, does not permanently limit market discipline, but rather provides a longer time frame for shareholder evaluation of board and managerial performance. This is consistent with our conclusion that temporary board protection might increase the efficiency of compensation plans by ensuring that shareholder and market discipline take place periodically, rather than “at all times.”

III. Organizations, Markets, and CEO Pay

In this Part, we seek to incorporate the above theoretical insights in the empirical investigation of the relationship between corporate governance features—and in particular board defenses—and competitive market forces, on the one hand, and CEO pay levels and structure, on the other. Our primary interests are the two issues that any explanation of executive compensation is called to address: the increase in executive-pay levels over time and the changes in the structure of pay over time.[122]

In developing our empirical investigation of CEO pay, we proceed through the following steps. In subpart A, we present our dataset. In subpart B, we provide a brief description of the time trends in average CEO pay over the past twenty-three years. In subpart C, in order to better understand the implications of board protection for incentive design, we focus on the relationship between defensive measures and executive pay. Lastly, in subpart D, we turn to examine the relationship between different forms of competition—namely, competition in the product and labor markets, as well as competition arising out of M&A activity—and executive pay.

Our universe of firms includes all firms in the ExecuComp database for the years 1993–2015, [123] excluding firms with dual-class stock and firms in regulated industries. Our final dataset consists of 18,511 firm-year observations for a total of 1,929 firms.

In examining executive compensation, we focus on four measures: CEO Pay, Equity Portion, Option Portion, and Stock Portion.[124] CEO Pay is measured as the natural logarithm of total CEO pay as reported in ExecuComp and is a proxy for the overall compensation payments received by the firm’s top executives—whether in the form of salary, bonuses, other annual compensation components, restricted stock grants, long-term incentive plans, option grants, or any other form of compensation. Equity Portion is the percentage of the CEO’s total compensation that is equity-based, including both restricted stock and option grants. Option Portion is the percentage of executive pay that is provided in the form of option grants, and Stock Portion is the percentage of executive pay that is provided in the form of restricted stock grants, where the sum of Option Portion and Stock Portion equals Equity Portion.

Further, we use two proxies for the equity-based incentives of the CEO’s current stock and option holdings: Pay-Performance Sensitivity (PPS) and Pay-Performance Volatility (PVS).[125] PPS measures the sensitivity of the CEO’s total equity holdings,[126] including both stock holdings and all options currently owned, to stock price.[127] That is, PPS measures how much the CEO’s wealth increases upon a 1% increase in stock value (or, alternatively, how much it decreases upon a 1% decrease in stock value). Accordingly, this measure can be interpreted as capturing the degree of alignment between shareholder and manager interests, so that a higher PPS indicates a closer alignment of interests between shareholders and managers.

PVS measures the sensitivity of the CEO’s current total option holdings to stock-return volatility. That is, PVS measures how much the value of the CEO’s total portfolio of stock options increases with a 1% increase in the annualized stock-return volatility (or, alternatively, how much the CEO’s wealth decreases with a 1% decrease in the firm’s annualized stock-return volatility). Accordingly, PVS can be interpreted as capturing the “power” of executive incentives or, more practically, the level of “optionality” of incentives.[128]

For the data on corporate governance features, we use several sources. Data on defensive measures—Staggered Board and Poison Pill—for 1993–2015 come from RiskMetrics, SharkRepellent.net, and hand collection. Staggered Board is an indicator variable equal to one if the firm has a board that is staggered (zero otherwise). Similarly, Poison Pill is an indicator variable equal to one if the firm has a poison pill in place (zero otherwise).

In addition to investigating defensive measures, we also examine Institutional Ownership, which measures the percentage of outstanding shares held by institutional investors. Indeed, institutional investors could potentially play an important role in monitoring the executive-pay process.[129] We obtain data for Institutional Ownership from Thomson Reuters (for institutional ownership data) and from the Center for Research in Security Prices (CRSP) database (for the number of outstanding shares).

For investigating the effects of competition, we use several proxies and several sources. As a proxy for the level of labor-market competition for managerial talent, we use Talent Competition. This measure is based on the research of Xavier Gabaix and Augustin Landier, who show that general matching models (explaining which CEOs end up at which firms) imply that executive compensation is increasing with both the size of the CEO’s firm and the general size of other firms in the economy.[130] On the one hand, CEO talent becomes more valuable to the firm as the firm becomes larger; on the other hand, as other firms become larger, stronger competition for scarce managerial talent bids up compensation for the most talented managers. Accordingly, Talent Competition is measured as the natural logarithm of the market capitalization of the outstanding shares of the 250th ranked firm in terms of market capitalization,[131] with data obtained from CRSP. Increases in the market capitalization of this reference firm indicate increased competition for managerial talent.[132]

To capture product-market competition, Product Competition, we use the Herfindahl–Hirschman concentration index, with data obtained from the Compustat annual data file. The Herfindahl–Hirschman index is a measure of industry concentration[133] based on sales (using all publicly traded firms in the industry).[134] For convenience, we present Product Competition as the negative of the Herfindahl–Hirschman concentration index, so that a lower Herfindahl–Hirschman index indicates a lower industry concentration and hence higher Product Competition.

Further, we also employ M&A Competition, which is a proxy for the level of M&A activity per industry.[135] We retrieve data for M&A Competition from the SDC Platinum database offered by Thomson Reuters, which provides comprehensive information on all M&A activity in the United States. The rationale behind the use of this measure is that the level of M&A activity captures the level of an industry’s shareholder pressure as operating through the takeover channel.[136]

Lastly, we add a set of standard controls, including leverage (Leverage), the ratio of capital expenditures over the book value of total assets (CAPX/Assets), the ratio of research and development expenditures over sales (R&D/Sales), an indicator variable for whether the firm is incorporated in Delaware (Delaware Incorporation), and the firm’s profitability (Profitability). Appendix Tables A–B provide a brief definition of all our variables,[137] while descriptive statistics are presented in Appendix Table C.

B. Time Trends in CEO Pay Level, Structure, and Incentives

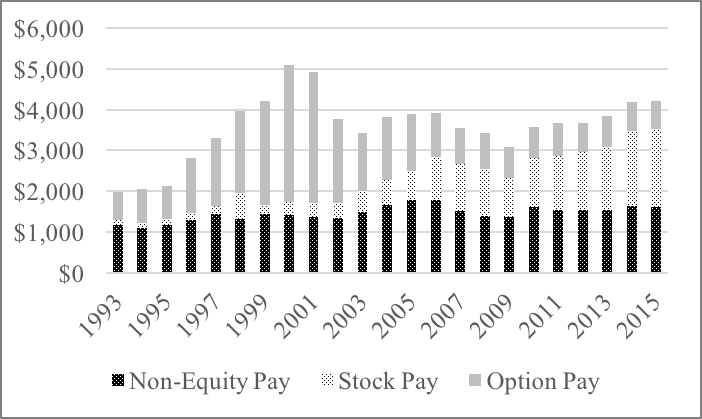

We begin our empirical investigation by providing a description of the time trends in average CEO pay over the past twenty-three years. To this end, Figure 1 below shows the level and composition of average CEO pay in S&P 1500 firms for the period 1993–2015.[138] In particular, for each year, the figure shows the average level of three different components of executive compensation. The first is Non-Equity Pay, which includes salary, bonuses, and other forms of deferred compensation—essentially capturing the fixed component of executive compensation. We then have Stock Pay, which reflects the value of restricted stock grants, and lastly, Option Pay, which provides the average value of annual option grants.

Figure 1

Average CEO Pay 1993–2015

As shown in Figure 1, most of the dramatic increase in the level of CEO pay from the early 1990s to the early 2000s can be attributed to an escalation in Option Pay. The average Option Pay grew from $0.69 million in 1993 to $3.22 million in 2001, amounting to an increase of $2.53 million. In contrast, Non-Equity Pay only registers a growth of $0.21 million over the same nine-year period.

Notably, what caused the growth in the use of stock options is a challenging, and multifaceted, question. Commentators, however, tend to agree that the modification by the Clinton Administration, in 1993, of the tax code (which ironically was meant to reduce the level of CEO pay) offers at least a partial explanation, as the introduction of a $1 million deductibility cap for executive compensation with the exception of stock options[139] helped to provide a favorable tax treatment for options.[140]

Beginning in 2003, and even more since 2004, we observe a substantial shift away from Option Pay to Stock Pay, which progressively increases in the years afterward, with average Option Pay falling to $0.70 million and average Stock Pay swelling to $1.9 million by 2015.

This trend away from Option Pay to Stock Pay can partly be attributed to the introduction of a new, and less favorable, accounting treatment of options.[141] Indeed, the corporate scandals of the early 2000s renewed pressures for changing old accounting rules that permitted avoiding option expensing.[142] Under this pressure, many companies began voluntarily to transition to a regime of option expensing.[143] In response, in December 2004, the Financial Accounting Standards Board (FASB)—the private regulator responsible for standards of financial accounting and reporting in the United States—introduced a new accounting standard, FAS123(R) (revising rule FAS123),[144] under which the expensing rule for stock options became similar to that in place for restricted stock since 1972.[145] The new rule requires all U.S. public companies to recognize an accounting expense corresponding to the grant-date value of the shares amortized over the period when the options are not exercisable.[146] This change “significantly leveled the playing field between stock and options from an accounting perspective,”[147] plausibly inducing companies to increasingly substitute Option Pay with Stock Pay.

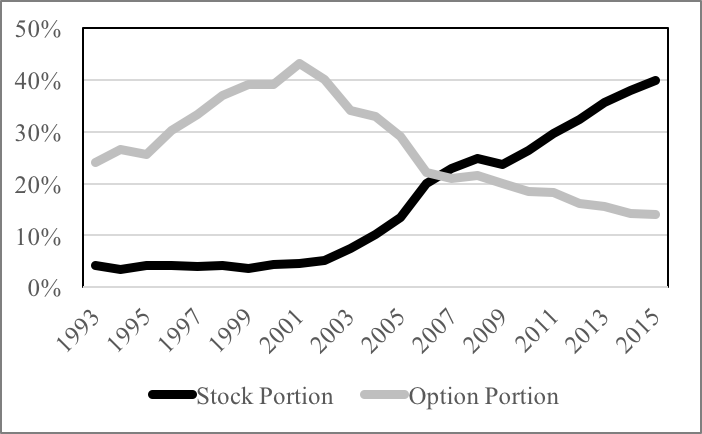

Next, we more closely examine the changing structure of equity-based compensation in Figure 2, which presents the proportions of stock-based executive pay and option-based executive pay (called, respectively, Stock Portion and Option Portion) in CEO compensation each year for all S&P 1500 companies in our sample for 1993–2015.

Figure 2

Stock Portion and Option Portion

Figure 2 confirms that companies have been increasingly replacing options with stock grants in recent years. While Option Portion increased from about 24% in 1992 to 43% by 2001, it then fell to 22% in 2005 and then further to 14% in 2015. Conversely, the percentage of Stock Portion remained stable at around 5% from 1993 to 2002, then began to slowly increase in 2003 (when it went up to 8%) and more so in the years afterwards, reaching a percentage of 20% in 2006 and then surpassing the percentage of options in 2007 (i.e., 23% versus 21%). The gap in the use of Stock Portion relative to Option Portion further increased in the following years, with Stock Portion swelling to 40% and Option Portion declining to below 15% of total CEO pay by 2015.

Moving to the core of our empirical analysis, in this subpart we examine the relationship between corporate governance features—focusing on board defenses—and executive-compensation levels, structure, and incentives. As discussed above, under managerial power theory, such defenses provide the central means through which directors are insulated from the shareholders’ power of removal and hence captured by managers.[148] Conversely, under our dynamic approach to executive compensation, temporary board protection from shareholder discipline serves a positive governance function. This function is mitigating the risk that the shareholders’ limited commitment problem might strengthen a manager’s incentives toward short-termism and impair a board’s ability to design pay schemes that can efficiently induce managers to focus on long-term value creation.[149]

These opposite views of the relationship between board protection and executive compensation yield contrasting predictions. Under managerial power theory, one would expect to find that the adoption of defensive measures increases the likelihood that managers may extract inefficient entrenchment rents. This could happen, for example, through the overuse of fixed compensation or through a lower pay-for-performance sensitivity of the CEO pay package, which could take the form of a preference for the use of restricted stock grants over option grants.

On the contrary, under our dynamic approach to executive compensation, board protection is instrumental to efficient bargaining. As a result, our approach does not necessarily predict any change in the CEO pay packages of firms depending on their level of defensive measures. In other words, the dynamic approach suggests that whether or not we observe changes in these firms’ CEO pay packages, such changes (or lack thereof) should be generally regarded as the result of optimal contracting and hence, on average, as value increasing.

Therefore, our empirical investigation in this subpart is more concerned with the explanatory power of managerial power theory, while we will empirically investigate our theoretical predictions about board protection in Part IV below, which focuses on financial value analysis. We also note that prior studies have challenged managerial power theory from an empirical perspective; for example, as discussed above, documenting an improvement in the indicators of board independence or an increase in CEO turnover rates.[150] However, very few studies have directly examined the relationship between the use of defensive measures and executive compensation.[151]

Empirically, we proceed, in Table 1 below, by investigating the time-series association between Staggered Board and Poison Pill and the proxies described above for, respectively, the level (CEO Pay) and the structure (Equity Portion, Stock Portion, and Option Portion) of annual executive compensation, as well as the cumulative incentives of the executive’s current total holdings of stocks and options (PPS and PVS). As is well known in the literature, the advantage of using a time-series analysis is that of capturing intertemporal variation within the same firm—rather than across firms, as in cross-sectional analysis—with the result that time-series analysis is better placed to mitigate endogeneity concerns.[152]