A Theory of Mandatory Rules: Typology, Policy, and Design

Introduction

In a perfectly competitive market, the law should simply give effect to the parties’ agreements (assuming, that is, that efficiency is all we care about). Real-world markets and real people are often a far cry from this ideal. Market failures (including behavioral ones) call for serious consideration of regulation. For decades, market regulation has focused on disclosure duties.[1] However, mounting evidence suggests that such duties are often ineffective. Alongside endless attempts to make disclosures more effective—driven in part by ideological aversion to other modes of regulation, and in part by regulatory capture—there is growing disillusion about this path, which is shared by some law-and-economics scholars.[2] In the past decade or so, there has been much enthusiasm about the use of nudges—“low-cost, choice-preserving, behaviorally informed approaches to regulatory problems”[3]—as a non-intrusive way to influence people’s behavior in desirable ways.[4] However, there are increasing doubts about the effectiveness of nudges as well,[5] especially when suppliers have an incentive to counter their effects.[6]

In response to these realizations, some are inclined to conclude that regulation (or much of it) should be abandoned altogether, leaving the scene to market forces of reputation and competition.[7] An alternative conclusion is that the failure of disclosure duties and the limited efficacy of nudges call for more serious consideration of the use of mandatory regulation of the content of transactions. This Article focuses on such measures, which we dub “substantive mandatory rules.” Other regulatory means, such as disclosure duties and cooling-off periods, are also often nonwaivable. But these other means, which we dub “procedural mandatory rules,” regulate the process by which contracts are formed.[8] Regulation of the substantive content of transactions is unique in the sense that it does not content itself with improving the conditions under which people make contracts, but rather intervenes in their content. Examples of substantive mandatory rules include usury laws, minimum-wage statutes, and statutes that set minimal liability of construction firms for building defects. Substantive mandatory rules sometimes respond to procedural defects in contracts, such as information problems, and sometimes aim at other goals. Some mandatory rules respond to defects in both the process of contracting and the substance of contractual provisions. A case in point is the doctrine of unconscionability, which limits enforcement where there is an improper admixture of procedural and substantive unconscionability.[9]

But what do we know about the design of mandatory rules? Since the late 1980s, when new theories of default setting appeared,[10] many studies have analyzed default rules in contract law and beyond, and even larger bodies of literature have dealt with ways to improve disclosure duties[11] and construct nudges.[12] In contrast, relatively little scholarly attention has been given to the questions of when to deploy and how to design mandatory rules. With a few exceptions,[13] only recently have scholars started to address questions associated with the design of such rules,[14] and no attempt has been made to tackle the relevant issues in a comprehensive manner.

This gap in contract scholarship (broadly conceived) may stem from the law’s fragmentation: scholars interested in U.S. contract law tend to disregard or only marginally address statutory state and federal material (with the exception of the Uniform Commercial Code), as well as topics such as real estate transactions.[15] Since mandatory rules are often statutorily, rather than judicially made (and apply to specific transactions such as residential leases, rather than to contracts in general), they can easily be overlooked.[16] Whatever causes this gap, this Article strives to fill it. The choice to make a contractual rule mandatory and the manifold choices, which we will analyze, in designing, implementing, and enforcing mandatory law, should be based on a sound theoretical and policy foundation.

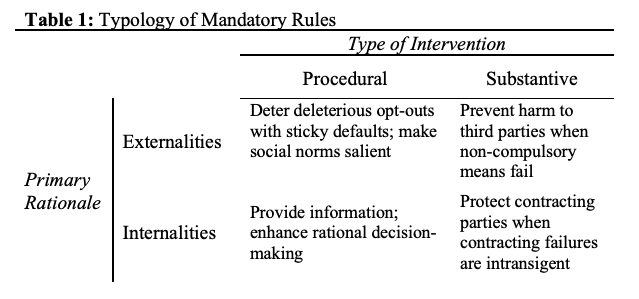

To provide the necessary background, the Article opens with normative and descriptive overviews. The normative analysis (Part I) offers a typology of procedural and substantive mandatory rules and theorizes about the circumstances in which substantive mandatory rules are likely to be superior to merely setting defaults or using other procedural rules. The analysis establishes that substantive mandatory rules are sometimes the most appropriate means of meeting the goals of contract law. Substantive mandatory rules can be appropriate when the law is trying to protect people outside or inside the contract (what we dub externality and internality concerns, respectively), especially where procedural mandatory rules are likely to be ineffective. Clarifying when such rules are necessary is essential to examining how to design them.

The descriptive analysis (Part II) then surveys existing substantive mandatory rules. It demonstrates that such rules are already ubiquitous in several fields, yet less prevalent in U.S. law than in most legal systems. While our survey is not exhaustive, we present sufficient evidence to conjecture that, contrary to common wisdom, virtually every area or field of U.S. law is a mixture of default rules, procedural mandatory rules, and substantive mandatory rules. The main purpose of this survey is to show that even if the use of substantive mandatory rules should not be expanded, studying the optimal design of these rules is important for reassessing—and possibly improving—the existing ones. Such a study is all the more important if further mandatory rules are called for, as we believe they are.

Having established that substantive mandatory regulation of the content of contracts is sometimes warranted, the main contribution of this Article lies in analyzing various issues surrounding the design of such rules. Thus, Part III focuses not on whether, but on how, the content of transactions should be regulated. To this end, it offers a systematic analysis of ten choices involved in the design of mandatory rules, concerning who imposes the mandate, the scope of mandate, the possible interaction with procedural mandatory rules, and the enforcement of the mandate. Specifically, mandatory regulation of contracts’ content may be: (1) conducted by the legislature, administrative agencies, or courts; (2) formulated as rules or as standards; (3) applied to an untailored range of transactions (“one-size-fits-all”), or tailored to more specific categories of contracting parties, or even customized or “personalized” to individual cases. Mandatory rules may or may not (4) be opted out of or somewhat modified under more or less strict substantive or procedural conditions, and may (5) prohibit any deviation from them, or merely limit the types of possible deviations (e.g., unidirectional mandates only allow deviations that favor one party, but not the other). Another important choice is (6) whether to invalidate or impose certain substantive arrangements without prohibiting or requiring the inclusion of certain clauses in the contract document, or whether to prohibit or mandate such inclusion. Relatedly, the law should determine the outcomes of the inclusion of forbidden clauses or the noninclusion of required ones—in particular (7) whether to impose criminal, administrative, or other sanctions for such violations. Subtler choices then pertain to (8) the framing of mandatory rules, that is, whether to formulate the mandatory rule as invalidating or prohibiting a certain contractual arrangement or as mandating or requiring the insertion of such a complementary arrangement. Finally, when invalidating or prohibiting certain arrangements, the law should determine (9) what arrangements should substitute the voided or prohibited ones, and (10) how the unenforceability of a given clause should affect the validity and content of the remainder of the contract.

While some of the abovementioned choices have been examined sporadically in the context of mandatory rules or in other contexts,[17] most have not been studied in any detail. Discussing the various issues within a comprehensive framework, rather than in isolation, yields new insights. For example, once it is realized that substantive mandatory rules may be formulated as vague standards (whose application is subject to judicial discretion); that they may be unidirectional rather than bidirectional; and that they need not be absolute (that is, may offer some leeway for deviations)[18]—the assertion that substantive mandatory rules are ill-suited for the heterogeneity of parties’ preferences loses much of its cogency.[19] Similarly, a comprehensive examination reveals how various techniques may be used to attain a single goal. For example, the goal of deterring suppliers from using certain clauses in their contracts could be advanced by setting criminal, administrative, or civil sanctions for such inclusion; by replacing the invalid term with a term that favors the customer (rather than a balanced one); and by precluding the adjustment of the remainder of the contract after invalidating the errant clause.[20] Considering each measure in isolation may thus result in over- or under-deterrence.

In addition to providing criteria for an assessment of existing mandatory rules and guidelines for the design of new ones, the analysis in Part III will reflect back on the ongoing debate surrounding the desirability and legitimacy of mandatory rules, as reviewed in Part I. Once we realize that the choice is not dichotomous—i.e., substantive mandatory rules, yes or no—but rather covers a huge variety of rules that differ in numerous respects, blanket opposition to mandatory rules is hardly tenable. Thus, the inquiry into the question of how to regulate the content of transactions will shed new light on the question of whether to do so.

The Article focuses on transactions between commercial providers of products and services, including retailers, insurers, lenders, landlords, and employers (collectively labeled “suppliers”) and consumers, insureds, tenants, borrowers, employees, etc. (collectively labeled “customers”). However, the analysis is relevant to all spheres where mandatory rules govern contractual relations—be it commercial, consumer, or private. Furthermore, the analysis is applicable, mutatis mutandis, to other spheres where contractual or consensual relationships may be governed by mandatory rules, such as corporate and family law—although the normative landscape in those spheres is more complex. Finally, many of the arguments carry over to noncontractual spheres, such as mandatory restrictions on the freedom of disposition in the law of wills and testaments, as well.

I. Mapping the Normative Landscape

A. Procedure Versus Substance; Externalities Versus Internalities

Mandatory rules restrict freedom of contract either by imposing procedural requirements or by restricting the set of substantive provisions that can be obtained. Procedural mandatory rules establish prerequisites for achieving certain substantive contractual outcomes. Substantive mandatory rules limit the range of contractual arrangements that can be agreed upon (regardless of the contracting procedures).

Procedural and substantive mandatory rules aim to protect people either inside or outside the contract. These two groups span the entire space of humans who could be negatively impacted by unrestricted contractual freedom. As a matter of nomenclature, we will say that mandatory rules that strive to protect people outside the contract are driven by externality concerns. For example, mandatory rules prohibiting conspiracies to assassinate elected officials or prohibiting cartel agreements are easily justified by their negative external effects on the general public.[21] The same is true of contracts imposing unreasonable costs on the judicial system, such as entitling the parties to specific performance, whatever the costs it entails for the state enforcement mechanism. In contrast, mandatory rules that attempt to protect people inside the contract are driven by concerns of internal protection (or internality). The nonwaivable option of a person to void any contract she entered as a child might, for example, be justified by internal-protection concerns.[22] Some mandatory rules might be justified by a mixture of externality and internality concerns. For example, mandatory bankruptcy rules that restrict the freedom of borrowers to use their craft tools as loan collateral not only benefit borrowers but also protect the general public from an increased risk of having to provide welfare support for default borrowers.[23]

Paying attention to whether procedural mandatory rules aim at protecting people inside or outside the contract is important because procedural mandatory rules motivated by concerns of internal protection tend to rely on different methods than procedural mandatory rules motivated by externality concerns. Procedural mandatory rules motivated by internality concerns operate by helping contracting parties protect themselves. These forms of mandatoriness aim to improve rational decision-making by the contracting parties. For example, disclosure mandates often operate by trying to educate imperfectly informed people so that they can make better contracting choices.[24] Default and altering rules have a procedural mandatory aspect because the drafting party must procedurally do something—insert some additional words in the draft—to displace the default.[25] Contracting around the default is a kind of mandated disclosure that can educate the non-drafter about the substantive provisions of the contract. The information-forcing effect of penalty defaults might help non-drafters protect themselves by making them better informed. A host of procedural interventions that might help contracting parties overcome cognitive biases that lead to suboptimal decisions have been recently proposed by Richard Thaler, Cass Sunstein, and other behavioral-law-and-economics scholars.[26]

These procedural mandates attempt to help people protect themselves by enhancing their ability to make better, more rational, contracting choices. But these rationality-enhancing interventions are likely to be ineffective when the central goal is to protect people outside the contract.[27] When the joint interests of the contracting parties diverge substantially from the external interests, increasing rationality is unlikely to negate externalities. Accordingly, when externalities are the primary concern, procedural interventions will more likely rely on methods that discourage harmful contracting. For example, simply setting public-regarding defaults (as recommended by § 207 of the Restatement (Second) of Contracts),[28] in some contexts, can dampen externalities.[29] The inertial effect of default settings can be enhanced with the use of altering rules that impede opt-out and make the default stickier.[30] However, the ambit and efficacy of procedural rules that respond to negative externalities are limited. The more the interests of the parties diverge from the interests of society, the more likely the parties are to contract for socially deleterious provisions. Table 1 provides a schema of the four different types of mandatory rules and the circumstances when they should be deployed.

Mandatory procedural rules motivated by internalities are thus appropriate if they can usefully enhance rational, free, and informed decision-making, while mandatory procedural rules motivated by externalities may be appropriate if they can usefully deter deleterious opt-out.[31] Substantive mandatory rules are appropriate when there are contracting failures that are intransigent to procedural interventions. Substantive mandatory rules are ordinarily justifiable in two circumstances: (1) when the rule is necessary to protect people outside the contract; and (2) when procedural mandatory rules are likely to be ineffective at helping contracting parties protect themselves because the costs of overcoming their information problems are prohibitive, their cognitive failures are intransigent, or their bargaining power is extremely unequal.

Neither proponents of freedom nor champions of efficiency oppose in principle mandatory rules motivated by externalities. Liberals generally recognize a moral constraint against harming other people (as those others, too, must be respected), and hence they would not oppose the invalidation of agreements that harm third parties. And economists accept that adversely affecting third parties is often inefficient because the negative externalities may exceed the parties’ joint surplus.[32] The main dispute—to which we now turn—therefore revolves around substantive mandatory rules whose justification is not primarily grounded in the protection of third parties.

B. The Normative Debate

This section maps the normative debate about substantive mandatory rules, beginning with the liberal perspective (or the will theory of contract), moving on to economic efficiency, and finally touching upon distributive and paternalist arguments.

1. The Liberal Perspective

According to the liberal ideal, the law should respect the parties’ freedom by letting them design their contractual rights and obligations as they see fit.[33] Advocates of substantive mandatory rules often endorse this ideal yet contend that standard-form contracts (SFCs), which are unilaterally drafted by suppliers,[34] do not reflect the free will and true intentions of customers.[35] This concern is further exacerbated by modern technologies that facilitate contracting without true consent of the customers to the content of contracts, coupled with judicial relaxation of the rules of contractual assent.[36] In the present economic and legal environment, therefore, substantive mandatory rules may actually reflect customers’ expectations more accurately than the formal contract.[37]

One response to this argument is that if the SFCs available in the market are sufficiently heterogeneous, the very fact that customers do not take part in their formulation does not negate the customers’ choice.[38] Another response is that even if substantive mandatory rules reflect customers’ intentions more accurately than SFCs, they do not reflect suppliers’ preferences—and from a liberal perspective, there are no grounds for prioritizing the former. According to a possible counterargument, whenever the supplier is a firm, liberalism does not rule out substantive mandatory rules because human rights (such as freedom and autonomy) do not extend to firms.[39] More fundamentally, the law need not content itself with respecting people’s negative liberty by refraining from placing constraints on one’s actions. Rather, it should arguably enhance people’s positive liberty as well, by providing them with the means of taking control of their lives and realizing their fundamental purposes.[40] Hence, limiting the negative liberty of suppliers may be necessary to promote the positive liberty of the customers.

Finally, once people choose to make legally enforceable contracts, they are no longer engaging in a purely private activity, since enforcing contracts involves the exercise of the state’s power. Hence, the real issue is not whether the state should interfere with private relationships—as such interference is inherent in legal enforceability—but rather what are the circumstances in which the state’s authority should be put at the disposal of one party against the other.[41]

2. Economic Efficiency

From an economic perspective, in a perfectly competitive market, unregulated contracts maximize aggregate social utility—but most markets are imperfectly competitive, and some are blatantly noncompetitive. Market failures may relate to the objective characteristics of a given market—such as the assumptions of full information, low transaction costs, and numerous sellers and buyers.[42] Market failures may also stem from prevalent and systematic deviations from the premise that market players are rational in the economic sense.[43] In the light of traditional and behavioral market failures, enforcing unilaterally drafted SFCs is at times less efficient than subjecting them to mandatory regulation.

To be sure, the existence of market failures, in and of itself, does not warrant regulatory intervention, since the costs of intervention may surpass its benefits—and even if regulation is warranted, the most efficient regulation need not be through substantive mandatory rules. In a competitive market, suppliers who wish to maximize their profits would respond to customers’ preferences. For instance, if the expected cost to the customer of bearing a given risk is higher than the expected cost to the supplier, rational suppliers would undertake the risk and charge a price for doing so, thereby making both parties better off. Even in a monopolistic market, it makes no sense for the supplier to allocate such risk to the customers. Rather, a profit-maximizing monopoly would bear the risk and exploit its monopoly power by charging a supracompetitive price for it.[44] Proponents of regulation concede this argument as long as the pertinent issue is something that customers are aware of. However, this argument does not apply to most contractual terms in SFCs, which are practically invisible for most customers.[45] Consequently, sellers may have an incentive to include shrouded terms that reduce the joint gains of trade but simultaneously increase the seller’s profits.[46]

In the past, law-and-economics scholars would respond to the latter claim by arguing that, even if most customers do not read SFCs, it is enough that some of them do for suppliers to respond to customers’ preferences, since suppliers compete over the marginal customers.[47] However, this informed minority hypothesis rests on the questionable assumptions that customers’ preferences are homogenous, and that suppliers cannot discriminate between readers and nonreaders.[48] Furthermore, the available empirical data indicates that even in transactions concluded online—where reading the SFC is particularly convenient—practically nobody reads SFCs before concluding the transaction.[49] For all practical purposes, therefore, the informed-minority hypothesis may be disregarded, at least in routine transactions.[50]

Another argument against the need for substantive restrictions on contracting relies on the market forces of competition and reputation. It has been argued that in a competitive market, suppliers are expected to inform clients about the excessive invisible terms in their competitors’ SFCs.[51] However, even in competitive markets suppliers may not have an incentive to spread this information,[52] and one hardly sees such an effect in practice.[53]

It has further been argued that even if customers do not read SFCs (or become informed about their content otherwise), and even if those contracts contain one-sided and oppressive terms, those terms are irrelevant as long as reputational forces ensure that suppliers treat their customers fairly.[54] While customers may not care much about their reputation, suppliers who are repeat players in the market do. Hence, customers sometimes behave opportunistically and make unreasonable complaints. In contrast, suppliers treat their customers fairly, regardless of the one-sided disclaimers that presumably allow them not to do so. They only rely on those disclaimers to handle opportunistic customers who make unreasonable complaints.

One response to this important argument is that even if suppliers do not ordinarily rely on oppressive contract terms, market forces are not perfect and hence courts do occasionally face the question of whether to enforce such terms to the detriment of customers. Legal norms may be important to instill commercial norms even if in most cases they are self-imposed by virtue of reputational forces. A greater difficulty with reliance on reputational forces is that they are much more likely to favor large, recurring, and sophisticated customers—whose goodwill the supplier values highly—than weak, occasional, and unsophisticated customers—whose goodwill is less appreciated.[55]

Economists (and free-will proponents) tend to prefer procedural mandates (such as disclosure duties) over substantive mandatory rules, since the former aim to rectify the market without restricting the freedom of parties to contract for particular substantive provisions, while the latter replace the market with centralist decision-making.[56] Such regulation almost inevitably precludes certain mutually beneficial transactions.[57] It may also fail to maximize overall social utility because regulators are often captured by organized interest groups who induce self-interested government officials to advance the interests of those groups in return for various benefits.[58]

These concerns militate against the use of substantive mandatory rules and in favor of procedural ones, primarily disclosure duties. However, there is a growing recognition—including by some law-and-economics scholars—that disclosure duties are often ineffective.[59] While disclosures make the information available to customers, they cannot force customers to use it.[60] Given the multiple demands on people’s time and attention, it is often rational to ignore the disclosed information, especially if it pertains to low-probability risks. To avoid information overload (the deterioration of the quality of decisions once the amount of information people try to perceive and process surpasses their cognitive abilities),[61] people adaptively ignore most of the information available to them. Other causes for ignoring information are the herd effect (if others purchase the product without heeding the additional information, why shouldn’t I?);[62] and escalation of commitment and the confirmation bias (once one has spent time and effort on choosing a product, one tends to seek information supporting that decision and avoid unfavorable information about the product or the contract terms).[63] Additional reasons include the availability heuristic (which prompts people to underestimate the probability of events that they do not easily recall);[64] self-serving biases (which make people overly optimistic about future contingencies);[65] and people’s myopia (which causes them to excessively discount future risks and rewards).[66]

Yet another reason for skepticism about disclosures is the sheer complexity of many transactions. Making an optimal transaction often requires professional expertise that customers—including commercial ones—lack, and is typically prohibitive to acquire.[67] Even customers who understand the meaning of a given contract term may fail to make a rational decision if they do not know the probability that the contingency triggering the term would occur, the probability that the supplier would actually rely on the term, the probability that a court would enforce that term, or the expected loss to themselves from that contingency if the term is enforced.[68] Another difficulty with disclosure duties is that suppliers may display the information and design the transaction in a manner that maximizes their profits, rather than optimize customers’ decision-making.[69] Behaviorally informed, smart disclosures may overcome some of these difficulties,[70] but the impact of disclosure duties often remains limited.[71]

To be clear, our argument regarding the necessity of substantive mandatory rules does not hinge on the claim that disclosure duties are generally futile. Disclosure duties serve important goals, and their effectiveness varies from one context to another.[72] For our purpose, suffice it to acknowledge that disclosures are often ineffective. Just as regulators set minimal standards for the safety of physical products—such as toys, drugs, and cars—rather than content themselves with the imposition of disclosure duties, they should set such standards for the safety of contractual products, which may be just as risky.[73]

Along with disclosure duties, other choice-preserving means rely on behavioral insights to steer customers’ decisions in the desirable direction—for their own good and for the good of society. Such nudges include altering the default, forcing people to make choices, setting deadlines, and informing people about other people’s behavior (thereby triggering social norms).[74] However, while nudges are effective in other contexts—such as the default effect in the promotion of posthumous organ donations—they tend to be ineffective with regard to market transactions whenever suppliers are able and motivated to contract around defaults,[75] and to counteract other nudges.[76] Indeed, suppliers regularly employ behavioral insights to take advantage of customers’ heuristics and biases.[77]

To be sure, while the drawbacks of disclosures and nudges make substantive mandatory rules more attractive, the latter are also not free of difficulties. In addition to the concern about regulatory capture mentioned above, legal policymakers, like customers, may be vulnerable to information problems and all sorts of cognitive biases.[78] However, that claim appears to be overstated: while policymakers may have incomplete information and are susceptible to cognitive biases, legislators and administrative agencies can rely on objective data and professional expertise that are unavailable to individuals, and typically consider the options in a calmer and less hasty manner.[79] For all these reasons, the very need and the appropriate design of substantive mandatory rules must be examined very carefully, and be subject to oversight and review.

3. Redistribution and Paternalism

Respect for free will and the maximization of aggregate social utility are not the only conceivable goals of contract law and market regulation. Mandatory rules may also be attractive for their distributive effects. Admittedly, as means of redistributing wealth, tax-and-transfer mechanisms are superior to substantive mandatory private-law rules,[80] and the latter may actually have a regressive effect.[81] However, the very existence of the tax-and-transfer welfare system induces people to take excessive credit risks, which may in turn justify substantive mandatory rules that deter such risk-taking (such as usury laws).[82] Moreover, redistributive private-law rules are superior to tax-and-transfer mechanisms in two important respects. First, they can promote the welfare of the underprivileged by giving them entitlements that objectively improve their well-being—such as fair and respectful treatment by lenders, landlords, and insurers—even if these are not the entitlements they would have purchased otherwise.[83] Second, by setting the “rules of the game,” redistributive private-law rules empower customers, whereas redistribution of money through tax-and-transfer mechanisms implicitly conveys a message of failure, or even humiliation.[84] Moreover, compared with tax-and-transfer mechanisms, setting decent norms of conduct in contractual relationships is much less likely to arouse resentment among the privileged, as they are unlikely to feel that something is being taken from them.[85]

Another possible, though controversial, justification for substantive mandatory rules lies in protecting people from imprudent decisions due to their limited cognitive abilities and biases.[86] Elsewhere, one of us (Zamir) has argued that given people’s bounded rationality, legal paternalism is sometimes economically efficient,[87] and consistent with respect for people’s freedom and autonomy.[88] But, of course, there are powerful countervailing arguments, which we could not discuss in detail here.

To sum up, while there are weighty considerations for and against substantive mandatory rules, sometimes they are the only effective—or the most appropriate—means of overcoming market failures, promoting customers’ freedom, and achieving other important goals. Concomitantly, the costs and limitations of such rules must be heeded when deciding whether to lay down such rules and when designing them, as further elaborated in Part III.

II. The Absolute Prevalence and Relative Paucity of Mandatory Rules

Having highlighted the main arguments for and against mandatory rules, this Part demonstrates that substantive mandatory rules (hereinafter, for brevity’s sake, mandatory rules) are already prevalent in many spheres, although they may be used much more extensively. To begin with, several general doctrines authorize courts to invalidate contract clauses that are deemed oppressive, unconscionable, or contrary to public policy. These include the unconscionability doctrine embodied in § 2-302 of the Uniform Commercial Code,[89] and the exclusion of terms in SFCs when the drafter has reason to believe that the other party would not have assented to the contract had she known that it contained them.[90] Excessive contract terms might also be found “unfair and deceptive” under federal and state Unfair and Deceptive Acts and Practices (UDAP) statutes.[91] Similar results are often attained through less overt techniques, such as preventing people’s reliance on a given contract term on the grounds that they have not acted in good faith;[92] and strictly construing certain types of terms, such as disclaimers in consumer contracts, forfeiture clauses, and limitations of liability for negligence.[93] More specific rules of contract law render unenforceable unreasonable restraints of trade;[94] invalidate unreasonably large liquidated damages as penalty;[95] deny specific performance of an obligation to provide personal service;[96] and more. An even more specific rule invalidates contractual restrictions of the dissemination of information by customers, such as through customer reviews.[97] At the most general level, while parties may determine the standards by which their obligations are measured, the basic duty to perform contractual duties in good faith is immutable.[98]

Many more mandatory rules apply to specific types of contractual transactions. Plausibly, the most heavily regulated contracts are insurance policies. In part, this is due to the complexity of insurance contracts, the legal or practical necessity of purchasing certain types of insurance, the special vulnerability of the insureds to insurers’ opportunism (given that the latter handle insurance claims after they have already collected the premiums), and the great risk of insurers’ insolvency.[99] However, the prevalence and general acceptability of mandatory rules in insurance contracts may also have to do with the fact that, at least initially and at least in New York, the impetus for standardizing fire insurance policies came from the insurance companies themselves in the wake of their difficulties in settling claims involving several insurers.[100] This legislation then served as a model for other states.[101]

Mandatory regulation of the content of insurance policies takes various forms. At the extreme, the entire policy is mandated by the law (sometimes allowing for extended coverage)[102] or subject to approval by the pertinent regulatory agency.[103] Such standardization offers various advantages to the insureds (who can more easily compare between insurers based on price and service)[104] and the insurers (who, among other things, benefit from the increased certainty generated by judicial interpretation of the uniform clauses).[105] Rather than dictating the entire policy, the regulator may require that it include specific provisions,[106] or—less intrusively—prohibit the inclusion of other clauses.[107] Finally, the regulator (including the courts) can refrain from supervising the wording of the policy, while enforcing mandatory rules that override any conflicting contractual clauses.[108] While the regulation of insurance policies varies across jurisdictions, time, and type of insurance, it involves almost all aspects of the contract, including scope of coverage and premium rates.[109] A notable example is the requirement of minimum liability coverage in auto insurance, as mandated by state legislatures.[110] Some of these mandatory provisions protect third-party beneficiaries.[111]

Moving from the field of insurance to consumer credit, even after the subprime mortgage crisis, the scope of regulation of the content of loan contracts in the United States is rather limited. Thus, while state usury laws set caps on interest rates, they have been rendered largely ineffective by the ruling that banks are subject to the usury laws of the state where their headquarters—rather than the borrowers—reside (and direct federal preemption undermines state regulation of other aspects of loan contracts, as well).[112] Apart from interest rates, mandatory rules apply to specific aspects of consumer-credit transactions. Thus, the federal legislation on residential mortgage loans prohibits the inclusion of terms that require the borrower to pay a penalty for prepayment,[113] and the same holds for private educational loans.[114] The FTC further declared that a nonpossessory security interest in household goods, other than a purchase money security interest, is unfair and deceptive within the meaning of § 5 of the Federal Trade Commission Act.[115] Another example can be found in the California statute pertaining to lenders and providers of consumer credit who have been involved in the arrangement of credit disability insurance to the debtor. Such creditors must not invoke any remedy against the debtor because of nonpayment during the disability claim period.[116]

Various mandatory rules apply to credit-card agreements pursuant to the Credit Card Accountability, Responsibility, and Disclosure Act of 2009.[117] Here are three examples: While credit-card issuers may increase the annual percentage rate upon the expiration of a specified period of time, the increased rate must not apply to transactions that were executed prior to the increase.[118] Then, an over-the-limit fee may be imposed only once during a billing cycle.[119] Finally, issuers cannot, as a rule, charge a violation fee (primarily for late payment) of more than $25—or $35 for a recurring violation.[120]

A variety of mandatory rules apply to employment contracts. Most notably, federal and state (and occasionally even local) laws set minimum wages.[121] The Family and Medical Leave Act of 1993 requires employers to provide employees with job-protected and unpaid leave for qualified medical and family reasons.[122] Title VII prohibits discrimination upon a number of grounds with regard to the terms and conditions of employment.[123] Another example is state laws that invalidate non-compete clauses—namely, contractual provisions that prohibit employees from working for a competitor after the end of the employment relationship.[124] In the absence of such legislation, courts use general doctrines to police noncompete clauses.[125]

In the sphere of residential leases, all states apply mandatory rules. The most important doctrine is the warranty of habitability, first developed in the celebrated case of Javins v. First National Realty Corp.,[126] and then incorporated in the Uniform Residential Landlord and Tenant Act (URLTA) of 1972 and in dozens of state acts. According to this doctrine, landlords are subject to immutable obligations to maintain the premises in habitable conditions and to comply with the applicable housing codes. The doctrine further entitles tenants to withhold rent when this obligation is breached.[127] In the same spirit, landlords cannot disclaim their liability for personal injury or property damage resulting from their negligence.[128] Also, to protect tenants’ rights to complain to governmental agencies about violations of housing codes and to organize or join tenants’ unions, landlords must not retaliate for such actions by increasing rent, decreasing services, or threatening to repossess.[129] Many other mandatory rules offer further protection of tenants’ rights.[130]

Yet another sphere in which several states have introduced detailed regulation of suppliers’ liability is builders’ liability for defects in new homes. In some instances, this statutory liability is fully mandatory; in others, disclaiming it is subject to formal and substantive requirements.[131] A number of state laws impose a mandatory obligation on sellers of new manufactured homes that the homes materially comply with the applicable statutory standards of safety or quality, and with implied warranties of merchantability.[132]

In the legal services market, statutory and judicial mandatory norms apply to lawyers’ contingent fees. Many states set statutory caps on the rates of such fees; and in the absence of statutory caps, courts review the reasonableness of such fees on a case-by-case basis.[133]

Like any other transaction, consumer contracts are subject to the general doctrines of contract law that facilitate the policing of contracts, such as unconscionability. Beyond these doctrines and the specific regulation of particular types of contracts mentioned above, relatively few mandatory rules apply to consumer transactions in goods and services. With very few exceptions, Article 2 of the U.C.C. (dealing with the sale of goods) comprises default rules.[134] The Magnuson–Moss Warranty Act does restrict the ability of sellers to disclaim liability for the quality of consumer goods;[135] but these restrictions pertain only to the formulation and saliency of the disclaimers—thus allowing sellers to avoid any liability whatsoever, provided that they comply with the pertinent procedural mandatory rules.[136] More to the point, so-called state Lemon Laws give purchasers of defective new vehicles an unwaivable right to rescind the contract and receive a full refund, or a comparable replacement vehicle (as well as indemnification for their reasonable costs), if a specified number of attempts (e.g., four) to repair the defect have failed, or if the vehicle has been out of service for repairs for a minimal number of days (e.g., thirty) in the first year after delivery.[137] Then, on the borderline of contract and torts, sellers’ liability for harm caused by defective products under the products-liability doctrine is nondisclaimable.[138]

Finally, some mandatory rules apply to commercial transactions. For example, the Automobile Dealers’ Day in Court Act imposes a mandatory duty of good faith in the termination and nonrenewal of a franchise and allows the franchisee to sue the manufacturer for breach of that duty wherever the latter has an agent.[139] Even when a franchise contract prescribes arbitration for dispute settlement, arbitration may be used only if all parties consent to it once the dispute has arisen.[140]

Although far from complete, this list of examples is sufficient to demonstrate the prevalence of mandatory rules in U.S. contract law. The existence of such rules in the contractual sphere should not come as a surprise. Vast swaths of U.S. law can be described as combinations of default and mandatory rules. Scholars have extensively analyzed the default/mandatory mixture with regard to corporate law,[141] environmental law,[142] civil procedure,[143] property,[144] intellectual property,[145] torts,[146] and conflicts of interest in attorney–client relationships.[147] Indeed, while an exhaustive examination is beyond the scope of this Article, we conjecture that every area of law is a combination of default and mandatory rules. Areas that are thought of as primarily consisting of default rules have some mandatory rules, and areas that are thought of as primarily mandatory are found to have some default rules.[148] The prevalence of default and mandatory rules in so many different domains counsels toward pedagogic attention to whether particular rules are contractible or not.

It should be emphasized, however, that the relative proportions of mandatory and default rules do vary substantially in different substantive areas of law as well as in different geographic areas. Mandatory rules are significantly less common in the United States than in many other countries. This relative paucity is particularly evident in the area of labor and employment law, where U.S. law provides employees with considerably fewer immutable rights than European and other legal systems.[149] Similarly, other countries regulate the content of loan contracts considerably more extensively than U.S. law.[150] More generally, U.S. law still largely addresses unfair clauses in SFCs through general, vague, and not very effective doctrines, such as unconscionability and interpretation against the drafter. In contrast, other Western countries have long since enacted special laws for SFCs that establish black lists of invalid provisions in such contracts, and gray lists of provisions that are presumed to be invalid, pending judicial (or sometimes administrative) scrutiny.[151]

Against the backdrop of the key arguments for and against intervention in the content of contracts (as discussed in Part I), this Part has demonstrated the absolute prevalence—yet relative scarcity—of mandatory rules in American law. The upshot is that mandatory rules are often necessary to attain the fundamental goals of contract law—including respect for people’s liberties and the maximization of social welfare—and that given their relative scarcity compared to other countries, mandatory rules might plausibly be used even more extensively. However, one need not agree with these conclusions to acknowledge the importance of theoretically informed guidelines for the design of mandatory rules. For even if no new rules as such are promulgated, the vast body of existing mandatory rules calls for reassessment based on systematic and sound policy analysis.

III. Designing Mandatory Rules

This Part examines various dimensions of the design of mandatory rules. This examination provides guidelines for assessing and reforming existing rules and for formulating new ones. As elaborated below, designing mandatory rules involves a long list of issues, including the identity of the regulator and the choice between rules and standards; determination of the incidence of rules, the degree to which they are immutable, and whether to impose bidirectional or unidirectional immutability; the decision whether to complement substantive rules with duties and prohibitions about the wording of contracts (and determining the outcomes of noncompliance with said duties and prohibitions); the use of positive or negative formulations of the legal norms; and determining which arrangement should substitute invalid contractual clauses, and how such invalidity should affect the remainder of the contract. Optimal design often requires considering many of these dimensions simultaneously.

While this examination is more comprehensive than any previous examination of the design of mandatory rules that we are aware of, it is still incomplete because it does not cover indirect means that may be used to undermine the immutable nature of mandatory rules. These include “choice of law” clauses that subject transactions to a more lenient legal regime than would otherwise apply;[152] the restructuring of transactions (for example, of employment contracts as the hiring of an independent contractor, or the creation of security interest as a lease or a sale) to bypass mandatory rules;[153] and the inclusion of arbitration clauses that potentially shield the supplier from judicial enforcement of mandatory rules.[154] Such attempts to circumvent mandatory rules (which under existing law are sometimes successful) are troubling. However, to keep the discussion manageable, we shall not discuss them here.[155]

A. Functionaries and Forms

This section addresses the interrelated questions of which functionaries—legislative, executive, or judicial—should be entrusted with the creation of mandatory norms, and what should be the form of these norms: rules or standards. These two choices determine the division of labor among governmental branches in this sphere and may thus have considerable practical implications.

1. The Regulator

Mandatory rules may be established by the legislature, by the courts, or by administrative agencies. This tripartite distinction partially overlaps with the distinction between legislative and judicial lawmaking, where administrative bodies may fulfill both legislative and quasi-judicial functions. This distinction is, however, schematic since there are various possible combinations of legislative, administrative, and judicial elements. For example, throughout the United States, insurers are required to submit policies for approval by insurance regulators, which may actively approve, reject, or merely fail to disapprove, policies or specific terms therein.[156] In such cases, the question arises as to what impact an administrative authority’s active approval or passive failure-to-disapprove a policy might have on the authority or discretion of a law court to invalidate policy clauses that are unconscionable or at odds with the reasonable expectations of the insured.[157] Plausibly, the more rigorous the scrutiny applied by the regulator, the more the court should defer to the regulator’s decision—especially if it is an active approval (in part because people feel greater responsibility for active decisions than for passive ones).[158] However, the assumption that active approval is the product of greater scrutiny of the policies in question by the regulator compared with a failure-to-disapprove, is debatable.

At times, nongovernmental organizations adopt mandatory terms that apply to the contractual relations between their members and their customers. For example, in the 1970s, the National Association of Home Builders (NAHB) launched a voluntary program for builders—the Home Owners Warranty—which obliged construction firms who joined the program to provide purchasers with warranties for building defects for a period of up to ten years, depending on the type and severity of the defect.[159] Similarly, in the sharing economy, internet platforms such as Uber and Airbnb, which intermediate contracting between buyers and sellers, often mandate contractual provisions used in such agreements.[160] Strictly speaking, while such arrangements are not mandatory rules, one can imagine circumstances in which they would function as such—which further complicates the map of possible lawmakers.

Focusing on governmental lawmaking, a preliminary question has to do with the legitimacy of judicial lawmaking, given that judges are not democratically elected. Delving into this question exceeds the scope of the present discussion.[161] Suffice it to say that, besides the fact that judges in state courts are usually elected,[162] the alleged illegitimacy of judicial lawmaking primarily refers to constitutional and statutory interpretation, rather than to the development of the common law—which is generally perceived as the province of courts.[163]

Putting aside the question of legitimacy, the main issue is one of institutional competence. Some mandatory rules reflect deeply held moral values, such as respect for human dignity and honesty. Examples include the unavailability of specific performance of an obligation to provide personal service and liability for fraudulent behavior. In designing rules of this sort, legislators (including administrative agencies engaged in legislation) have no particular advantage over the courts. Professional judges—who regularly make normative judgments in interpersonal disputes—may even have an advantage in this regard. In contrast, mandatory rules that aim to tackle market failures may require macroeconomic data and economic expertise, and rules that aim to mitigate people’s cognitive biases require expertise in human psychology. Potentially, at least, legislators and their supporting apparatus can collect and analyze such economic and psychological data better than courts. For example, issues such as determining which competition-reducing clauses should be invalidated, setting a minimum wage, and capping interest rates in consumer loans, should presumably be the preserve of the legislature.[164] Similarly, determining which terms in standard-form contracts are affected by market competition, and which are not, requires empirical investigations that courts cannot pursue. While judges are presented with the facts of particular disputes, legislators can see the broader picture.[165] The flipside of the coin is that legislative regulation might be overinclusive, while courts can tailor their decisions to the specific circumstances of the case at hand.[166]

Admittedly, however, legislators do not always take advantage of the available empirical data, and when empirical analyses already exist, the courts—with the help of expert testimonies—may overcome at least some of their limitations in this regard. In fact, when it comes to mandatory regulation in spheres involving specific expertise, such as the language of insurance policies, professional agencies may have an advantage over generalists—be they judges or legislators.[167] Professional agencies are also much more qualified than the legislature to closely follow market innovations and respond to them quickly.[168] Establishing specialized courts can mitigate the expertise problem, but not the other limitations of judicial lawmaking.

Compared with elected policymakers, one important advantage that the courts have in regulating the content of contracts is that they are typically less susceptible to lobbying by powerful interest groups and other forms of regulatory capture. Various studies have demonstrated that the policies adopted by the legislature reflect the preferences of organized interests, rather than those of the general public.[169] However, here, too, there is no bright line distinction between elected politicians and judges—especially when the latter are appointed by the former, or must stand for reelection. Courts may also cater to the interests of powerful stakeholders when they compete with one another.[170]

These and other institutional differences between the governmental branches[171] also affect the form and substance of regulation—hence the present distinction is closely associated with some of the choices discussed below. Specifically, given the considerable costs of adjudication, judicial oversight of the content of contracts is more appropriate for low-probability, high-magnitude harms and losses than for high-probability, low-magnitude ones.[172] In the latter case, legislative regulation—coupled with administrative or criminal sanctions for noncompliance—appears to be more appropriate.[173] More generally, the legislature can use any combination of rules and standards (the latter delegating some of the lawmaking task to those who implement the standards, primarily the courts); determine the precise incidence of its norms; and bring about major changes at once. In contrast, the meaning and incidence of judicial precedents are often unclear; judge-made law develops more incrementally; and courts may use various doctrines and techniques to police the content of contracts without openly declaring that they do so (thereby attracting less opposition).[174]

2. Rules Versus Standards

Mandatory rules may be formulated as rules or standards. Rules typically make legal outcomes contingent upon the existence of a limited number of easily ascertainable facts. Conversely, standards embody substantive objectives and values, and their implementation requires consideration of the entire set of circumstances of the case, and assessing these in light of the values that the standard embodies.[175] A mandatory norm may provide nothing more than a very general standard. Pertinent examples include the unenforceability of unconscionable contract terms;[176] the exclusion of terms in standardized agreements that the drafter “has reason to believe” that the other party would not have assented to “if he knew that the writing contained” those terms;[177] and the interpretation of contracts in a manner that is unfavorable to the drafter.[178] More concrete mandatory norms may use bright-line rules (e.g., a construction firm’s liability for construction defects that become apparent within 24 months) or vaguely worded standards (such as liability for construction defects that become apparent within “a reasonable time”). Rules and standards may be used not only to delineate the substantive norm, but also to prescribe its incidence[179] and the conditions under which the parties may opt out of it, if at all.[180] In fact, mandatory norms that regulate the content of contracts can lie anywhere on a spectrum between very vague standards and very concrete rules, and may include any combination of the two.[181]

Rules and standards differ in terms of the costs of their ex ante formulation and ex post implementation,[182] influence on future behavior,[183] impact on legal certainty and predictability,[184] risk of under- and over-inclusiveness,[185] adaptability to changed circumstances,[186] and the relationships between form and substance.[187] Rather than abstractly restating these well-known (if sometimes controversial) differences, we focus on their implications for mandatory regulation of the content of transactions.

Compared with standards, rules are relatively more costly to formulate ex ante, but easier to implement ex post. In fact, given the endless variety of contracts and contract clauses, regulating the content of contracts exclusively through concrete statutory rules is practically impossible. This is particularly true of unique and constantly changing contract terms.[188] Hence, no matter how detailed statutory mandatory rules might be, there would always be a need to complement them with standards such as unconscionability.[189]

Standard economic analysis ordinarily assumes that individuals are risk averse. On the one hand, since rules presumably produce greater certainty and predictability than standards, it follows that the contracting parties, and society at large, are better off under a rule-based regime.[190] On the other hand, it may be argued that if the goal is to deter the use of unfair and oppressive clauses by suppliers, the uncertainty involved in vaguely worded standards can be more effective in deterring risk-averse suppliers—perhaps even overly so.[191] However, the latter argument is doubtful in the present context, for several reasons. First, more often than not, the addressees of mandatory rules are commercial firms, which may or may not be risk averse. Second, in addition to rendering certain clauses unenforceable, the law may or may not impose civil, administrative, or criminal sanctions for their very inclusion in the contract.[192] Imposing such sanctions requires that the norms prescribing these duties be as clear and concrete as possible. Third, it is doubtful that suppliers—or, more precisely, the people who make decisions on their behalf—are perfectly rational in the economic sense. Empirical evidence suggests that self-serving biases are likely to distort the incentives created by legal norms: it is easier to convince oneself that one is complying with vague standards even when one is not, compared with bright-line rules.[193] Consequently, vague standards are more likely to produce underdeterrence rather than overdeterrence.

Another behavioral factor that arguably militates against the use of standards in the present context is that legal rights that are defined by a simple, bright-line rule are likely to produce a stronger sense of entitlement, and hence to induce a higher valuation of the rights by customers due to the endowment effect.[194] A lower sense of entitlement, and the difficulty of ascertaining one’s legal position, likely decrease consumers’ inclination to stand up for their rights. These concerns exacerbate other causes for the under-enforcement of consumer law—both rational (such as the small losses typically caused by suppliers’ breach, compared with the high costs of litigation), and less rational (such as the omission bias).[195] Furthermore, inasmuch as people’s behavior is influenced by social norms and their educational effect, and by the conformity effect, clear and simple rules are more likely than general standards to shape social norms, and thereby to affect behavior.[196]

The advantages of rules over standards in terms of their certainty and predictability—and hence their stronger influence on people’s behavior and the more effective enforcement by customers—should be qualified, however, when it comes to highly complex rules. When the system of rules is complex, involving numerous reservations, distinctions, exceptions, etc., its complexity likely diminishes rather than enhances the law’s clarity and predictability.[197] That said, it remains true that concrete mandatory rules are generally more effective than flexible standards in influencing the formulation of contracts and their subsequent performance.

B. Degree of Tailoring

Along with the choice of “who is the best regulator,” design of mandatory rules requires choosing “who is to be regulated.” General contract law applies to innumerable types of private, commercial, and consumer contracts pertaining to goods, services, real property, and intellectual property. While specific rules apply to particular contracts, the general doctrines of contract law apply to all types of contracts. This is possible because much of contract law consists of default rules, which are subject to trade usages and to the agreement between the parties. In contrast, strictly mandatory rules apply irrespective of conflicting usages or agreements. Unsurprisingly, one major critique of mandatory norms is that they apply an untailored, “one-size-fits-all” regulation to diverse transactions between people and firms with heterogeneous needs and preferences—thus undermining efficiency and fairness, leading to perverse distributional outcomes, and inhibiting creativity.[198]

However, there is no necessary correlation between the incidence of legal norms and whether they are mandatory or merely default rules. Just like defaults, the incidence of mandatory rules may be broad or narrow. Some mandatory norms—such as the denial of specific performance of personal services, and the right not to be defrauded—apply across a broad range of transactions. Yet, even mandatory norms with a broad incidence are not necessarily uniform and rigid. Vague standards are hardly vulnerable to these charges because their application in specific cases is discretionary.[199] And non-absolute rules, by their very nature, are less rigid than absolute ones, since they allow for some deviations when certain conditions are met.[200] Given the diverse degrees of immutability of mandatory rules, there is no clear demarcation—if any—between partly mutable mandatory rules and so-called sticky defaults.[201]

Moreover, even mandatory rules that are concrete, bidirectional, and preclude any contracting around them, vary in terms of their incidence. Mandatory rules are often tailored to specific transactions, such as insurance and residential leases. Similarly, they distinguish between standard-form and individually negotiated contracts, between consumer and non-consumer transactions, and so forth. Theoretically, at least, just as it is possible to create personalized default rules,[202] mandatory rules may even be personalized.[203] Designing a complex set of rules can mitigate the problem of overinclusiveness (although it involves higher formulation costs and decreased predictability).

Unless one adheres to an extreme libertarian position, the very fact that mandatory rules sometimes apply to transactions that ideally should have been left out of their incidence does not mean that they are undesirable. It may well be that the benefits of mandatory rules in the great majority of cases to which they apply outweigh the costs in the minority of cases in which they result in inefficient, unfair, or regressive distributional outcomes. That said, legal policymakers should pay close attention to the incidence of mandatory rules, as well as to the possibility of leaving some leeway for flexibility in their application.

C. Strictness of Regulation

Mandatory norms vary in terms of their strictness. Specifically, they sometimes set substantive or procedural conditions under which the parties may opt out of them, and they may either prohibit any deviation from them, or merely limit the types of possible deviations. We discuss these two choices in turn.

1. Degree of Immutability

The dichotomy between default rules and mandatory rules is somewhat misleading, since absolutely mandatory rules and absolutely default rules lie at either end of the same spectrum. Elsewhere, one of us (Zamir) has surveyed a long list of contract-law doctrines that make it difficult to contract around seemingly nonmandatory rules, thereby blurring the line between default and mandatory rules.[204] This list includes umbrella doctrines such as unconscionability and public policy; “motivated” implementation of the rules of duress and mistake, offer and acceptance, and the requirement of consideration; strict enforcement of formal requirements; and purposive implementation of various interpretative devices (such as interpretation against the drafter and interpretation favoring the public). These legal tools enable courts “explicitly and tacitly, to avoid contractual terms that are inconsistent with legal rules and trade usages, thus turning the latter into quasi-mandatory norms.”[205] These tools are examples of “altering rules” that impede the ability of the parties to achieve disfavored contractual outcomes.[206]

Turning from legal doctrine to the parties’ actual behavior, a large body of economic and behavioral literature has offered various explanations for the notable “stickiness” of presumably default rules. These include the costs of contracting around default rules; the role that default rules play in shaping people’s preferences; the endowment effect created by default rules; the parties’ fear of misunderstandings and uncertainty when contracting around established rules; and the gap between the formal contract and the parties’ subsequent behavior.[207]

From the other direction, many mandatory rules actually contain built-in leeway that makes it possible to contract around them, subject to various substantive or procedural requirements. For example, § 9-602 of the U.C.C. contains a long list of Article 9 sections that “the debtor or obligor may not waive or vary” to the extent that they give them rights or impose duties on the secured party.[208] This section, however, is followed by § 9-603(a), which states that the parties “may determine by agreement the standards measuring the fulfillment” of said rights and duties “if the standards are not manifestly unreasonable.”[209] To cite another example from state law, the Connecticut Landlord and Tenant Act details the landlord’s duties concerning repair and maintenance of dwelling units.[210] While these duties are mandatory, the Act allows the parties to agree that some of them will be performed by the tenant. In the case of multiple family residences, such an agreement is valid if it pertains to “specified repairs, maintenance tasks, alterations or remodeling” and “if (1) the agreement of the parties is entered into in good faith; (2) the agreement is in writing; (3) the work is not necessary to cure noncompliance with [the relevant housing codes and the warranty of habitability]; and (4) the agreement does not diminish or affect the obligation of the landlord to other tenants in the premises.”[211]

As these examples demonstrate, default rules are often quasi-mandatory, and mandatory rules are sometimes quasi-default. Policymakers can therefore set the degree of immutability in each particular case, taking into account the aims of the rule and the typical characteristics of the parties, the transaction, and the contracting process.

Thus, if the primary goal of the altering rules (that is, the rules governing the conditions for opting out of a default rule) is to overcome typical flaws in the contracting process, it would make sense to set procedural requirements that guarantee the informed and considered consent of both parties. Such requirements may foster thoughtful decision-making[212] and clearer communication of information.[213] In contrast, if the main goal of a rule is to protect the interests of third parties, improving the contracting process does not make much sense.

One notable hybrid arrangement is safe harbors—an altering rule which assures that a particular contractual outcome is achievable if particular conditions are followed. Any deviation from the safe harbor conditions triggers enhanced scrutiny, thus strengthening its mandatory nature.[214] For example, the U.S. Consumer Financial Protection Bureau has issued guidelines for lenders, which, if followed, provides them with a presumption of compliance with the statutory requirement to make a reasonable, good-faith determination of borrowers’ ability to repay loans that are secured by a dwelling.[215]

There are important interrelations between the degree of immutability and other aspects of designing mandatory norms, including the identity of the regulator and the form of the norm. Statutory mandatory rules may have any degree of immutability, including an absolute one. In contrast, judge-made rules tend to be less conclusive, since courts retain the power to distinguish past rulings. Vague standards, by their very nature, allow for flexibility in their implementation, while concrete rules may or may not be absolutely compulsory. The trade-off between certainty and predictability on the one hand, and consideration of the circumstances of the particular case in light of the pertinent values on the other—as discussed in the context of the choice between rules and standards[216]—is relevant here too: the greater the leeway to evade a rule, the less predictable its implementation.

2. Bidirectional Versus Unidirectional Immutability

Some mandatory rules impose bi- or omni-directional restrictions, such that no deviation from them in any direction is allowed. Other mandatory rules, however, only impose unidirectional restrictions—that is, they let the parties deviate from them in favor of one party (e.g., the tenant or employee) but not the other (e.g., the landlord or employer).[217] Unidirectional immutability is an inherent feature of mandatory standards (as opposed to rules) that set minimal—rather than maximal—standards of conscionability, reasonableness, good faith, and the like. But many concrete rules are unidirectionally immutable, as well. Thus, for example, the Family and Medical Leave Act of 1993 explicitly states that “[n]othing in this Act . . . shall be construed to diminish the obligation of an employer to comply with any collective bargaining agreement or any employment benefit program or plan that provides greater family or medical leave rights . . . .”[218] Similarly, § 9-602 of the U.C.C. lists more than twenty sections in Chapter 9 that the debtor and obligor may not waive or vary, to the extent that they give them rights or impose duties on the secured party (although, according to § 9-603, the parties may agree on the standards for measuring the fulfillment of those rights and duties).[219] These rules set minimum floors. At other times, unidirectional rules establish maximum ceilings—for example, concerning the maximum allowable duration for a covenant not to compete.[220]

As these examples demonstrate, the distinction between bidirectional and unidirectional immutability intersects with other aspects of the design of mandatory rules, such as the degree of immutability, its scope of incidence, and its framing.[221] Unidirectional immutability—be it in the form of vague standards or bright-line rules—somewhat mitigates concerns about the overinclusiveness of mandatory norms, because it allows for deviations from the minimal legal standard. Unidirectional immutability therefore leaves some room for innovation and for tailoring contractual arrangements to heterogeneous and changing transactions and preferences.

Unidirectional restrictions may be well suited to respond to internal-protection concerns as they preclude one-sided—unfair and possibly inefficient—clauses. Even if they do not ensure desirable distributive effect in terms of wealth, they may level the playing field in terms of power, dignity, and more.[222] In contrast, when mandatory rules are prompted by externality concerns, bidirectional immutability may be warranted. For example, it has been argued that the rule that excludes insurance coverage when the insured has committed suicide within a certain period from buying life insurance belongs to this category.[223]

One drawback of unidirectional immutability is that it may adversely affect the norm’s certainty because it is not always clear whether a given divergence from a mandatory rule positively or adversely affects the protected party. This may be the case, for example, when a contractual clause is multidimensional, and it benefits the protected party in some respects, but adversely affects her in others. Imagine a rule that imposes a mandatory two-year liability for building defects on the seller of new residential units, provided that the purchaser notifies the seller about the defects within four months of their discovery. Does a contractual clause that extends the liability to six years, but requires notifications within two months, favor the purchaser? Should it be allowed? The answer may depend on the rule’s rationale. If the rationale is primarily distributive, one might conclude that the contractual clause is valid, since by and large it benefits the purchaser more than it burdens her. If, however, a primary goal of the rule is paternalistic—that is, there is a real concern that the purchaser might miscalculate the costs and benefits of deviations from the rule ex ante, and miss the notification deadline ex post—one might conclude that any deviation whatsoever from the rule to the detriment of the protected party—in the present example, the shortening of the notice period from four to two months—renders the clause invalid. In that case, a further question arises, which is whether it is possible to use the doctrine of partial enforcement—namely, to uphold the extension of liability from two to six years but annul the shorter notice requirement. While employing the doctrine in such circumstances may be regarded as unfair to the seller, it may be justified as a means of deterring the use of such contract clauses.[224]

The rule’s certainty is particularly important when the regulator is not content with merely setting substantive rules, but also mandates that certain terms should, or should not, be included in the contract—and backs this directive with administrative or criminal sanctions.[225] Such sanctions are likely to be less effective if drafters can reasonably claim (or sincerely believe) that their contracts do not violate the law.

Compared to unidirectional immutability, bidirectional immutability enhances the uniformity of contracts in a given market. Such uniformity may appear undesirable, since it prevents the tailoring of the contract to the parties’ particular needs. However, it may be a second-best solution to certain problems. For one thing, when customers suffer from acute information and expertise problems—which limit their ability to compare between contracts that vary on numerous dimensions—limiting the number of aspects in which such variations exist may improve customer choice, thereby enhancing market competition.[226] Enhanced uniformity may also be beneficial when the performance of several (or many) contracts and the resolution of disputes pertaining to them affect—or are affected by—other contracts. Thus, one key motivation for unifying fire-insurance policies has been the need to resolve insurance claims that stem from a single event involving several property owners, insurance policies, and insurers.[227] Similarly, uniformity may be beneficial when a construction firm sells apartments in a single condominium project to many purchasers whose rights and remedies vis-à-vis the firm are interrelated, or when an insolvent debtor owes money to several contractual creditors.[228]

D. Regulation of the Contract’s Wording

Some mandatory rules merely lay down substantive arrangements, while others require or prohibit the inclusion of certain clauses in the contract document. When the regulator does not content itself with substantive rules, but interferes with the wording of the contract as well, a secondary question arises, namely what sanctions to impose, if at all, for violating those rules. This section tackles these two issues.

1. Substantive Rules and Wording Rules

The designer of mandatory rules should decide whether to merely specify the substantive law that governs the transaction, irrespective of the contractual terms, or rather supervise the wording of the contract as well—either by prohibiting the inclusion of invalid clauses, or by mandating the inclusion of valid ones. The unconscionability doctrine exemplifies the former option—that is, a substantive rule that does not interfere with the wording of the contract.[229] An example of the latter option—interference in contract wording—can be found in the Consumer Review Fairness Act of 2016, which prohibits the use of SFCs containing a provision that restricts customers’ right to publicly review goods, services, or the conduct of people.[230] Wording rules are also common in the regulation of insurance contracts.[231]