A “Green New Fed”: How the Federal Reserve’s Existing Legal Powers Could Allow It to Take Action on Climate Change

“When you’re in a hole, stop digging.” – Denis Healey

Much ink has been spilled about the threat climate change poses to life on earth. Over the past few years, the climate change conversation has grown increasingly active in a new sector—the global financial community. Financial regulators and key participants in financial markets have started to discuss the enormous risks that climate change presents to the stability of global financial systems. But, just as climate change is a major threat to global financial systems, global financial systems can be a solution for combatting climate change. Any transition to a green world will require massive capital investments, and financial markets and government regulators are well-positioned to restructure market incentives to facilitate and expedite this shift. One potential player in the financial fight against climate change is the Federal Reserve (“the Fed”), the central bank of the United States. The Fed is tasked with conducting monetary policy and regulating the world’s largest financial system for risk, making it an intuitive fit to regulate the Unites States’ financial market based on risks related to climate change. Some commentators and government officials assert as much, but there has been little-to-no analysis on the Fed’s legal authority to do so. This Note aims to fill that gap.

This Note first examines the Fed’s statutory authority in its two key areas of responsibility—conducting monetary policy and monitoring the financial system for risk—and discusses how regulations aimed at addressing climate change might fall under these enumerated powers.

Next, it takes those potential powers and proposes a novel solution to combatting climate change—(A) designing a system to calculate and mandate disclosure of the “financed emissions” that Fed-regulated financial institutions hold on their balance sheets; and (B) using its emergency authority under Section 13(3) of the Federal Reserve Act to establish a climate “Bad Bank” that would be funded by banks who contribute the most to climate change. The Note also examines the common trope that unelected central bankers should not “pick winners” in the real economy by influencing climate change policy, and uses historical, legal, and normative analysis to provide counterarguments to that line of thinking.

I. Why Climate Change Matters for the Fed

During the Fall of 2020, financial regulators in the United States took big steps toward regulating the United States’ financial system based on the risks posed by climate change. In September 2020, a subcommittee sanctioned by the Commodity Futures Trading Commission issued a comprehensive report regarding the risks climate change poses to the U.S. economy and financial sector (the “CRMRS Report”).[1] In November 2020, for the first time, an official report from the Board of Governors of the Federal Reserve System (the “Board” or, more broadly, the “Fed”) mentioned climate change as a threat to the financial stability of the United States.[2] In the first half of 2021, the Board further demonstrated that it takes the climate change threat seriously—it created a Supervision Climate Committee to “strengthen [its] capacity to identify and assess [microprudential] financial risks from climate change” among individual firms, and a Financial Stability Climate Committee to do the same but from a macroprudential perspective across the entire financial system.[3] These actions are a start, but they are not enough.

To begin, it is helpful to understand why climate change is a threat to the United States’ financial stability. Economic shocks caused by climate change present complex and interrelated risks for the U.S. financial system.[4] While these risks are spread across a breadth of financial markets and asset classes, they are best divided into two buckets: physical and transition risks.

Physical risks “arise[] from material, operational, or programmatic impairment of economic activity and the corresponding impact on asset performance from the shocks and stresses attributable to climate change.”[5] In other words, physical risks are negative impacts to the financial system caused by rising temperatures or climate-change-induced extreme weather events.

Transition risks are risks “associated with the uncertain financial impacts that could result from a transition to a net-zero emissions economy” based on “changes in policy, technological breakthroughs, and shifts in consumer preferences and social norms.”[6] Take carbon taxes as an example—if the United States suddenly enacted a carbon tax, high-emitting products such as gasoline might no longer be economically feasible.[7] This would lead to financial losses for producers of those products and increased risks for lenders and investors with exposure to those producers.[8]

The U.S. financial system overvalues assets that are intertwined with physical and transition risks of climate change.[9] As a result, existing capital flows and investments are too heavily weighted toward high-emitting industries.[10] This increases the risk of future climate-change-induced financial shocks because, by funding these high-emitting industries, investors and banks increase the overall emissions that the U.S. economy produces, which threatens to warm the earth to unsustainable temperatures.[11] What’s more, banks are somewhat blind to the exposure they have to emissions, and this threatens to cause a “Minsky moment”—a financial crisis caused by hidden risk on banks’ balance sheets—if and when transition risks manifest.[12]

What does this all mean for the Fed? The central point of this Note is that the risks that climate change poses to the U.S. economy and financial system trigger statutory commands for the Fed to act. The Fed’s two main functions are conducting monetary policy and monitoring the largest banks in the world to prevent the type of risk buildup that nearly collapsed the global financial system in 2008. Climate change should set off alarms for the Fed in both of its key areas of responsibility. Projections of “moderate” climate damage given current global emissions-reduction policies forecast about a 2% annual GDP loss in the United States from 2080–2100.[13] In context, that would be an annual GDP loss of about half the entire loss the subprime mortgage market caused the economy in the 2008 financial crisis.[14] And while the most dire projections are well into the future, there is reason to believe that climate change is already beginning to threaten the financial stability of the United States.

For example, 2019 was the second-hottest year on record for the earth[15] and the wettest year on record for the United States.[16] That year, California’s largest utility, PG&E, was forced to declare bankruptcy after it caused $30 billion in damages through wildfires that were bourgeoned by prolonged droughts.[17] In 2020, climate change led to California experiencing five of its ten largest wildfires ever recorded.[18] Furthermore, climate change has been strengthening hurricanes, such as August 2021’s Ida[19]—which experts project will alone lead to tens of billions of dollars in insurance claims.[20] These early manifestations of physical risks have had a meaningful economic impact and helped cause tens of billions of dollars in damage.

Even when accepting the risks discussed above, a common pushback against the Fed fighting climate change is that this is not an area unelected technocrats should butt into. Elected leaders should take charge. But our elected leaders have failed to put the United States on a stable emissions path. While the legitimacy of elected leaders taking significant actions like the ones needed to fight climate change is preferred, it is still incumbent upon the Fed to carry out its mandates. And as will be discussed later, the Fed has a history of undertaking monumental, economy-shifting actions with political ramifications when doing so was necessary to avoid catastrophe. Climate change should be the next monumental task the Fed takes on.

It is not uncommon to see calls for the Fed to act on climate change,[21] but little effort has been put into actually examining its legal authority to do so. This Note aims to fill that gap. Part II provides background on the Fed’s role in the U.S. government and its history. It then examines the Fed’s statutory authority in the two key areas of supervising the overall financial system for risk and conducting monetary policy and explains how regulations to address the risks of climate change may fall under these authorities.

Part III proposes a path forward for the Fed. The suggested policy is for the Fed to use its supervisory authority to require its member banks to calculate and report their “financed emissions”—carbon emissions by borrowers that are assigned back to the lenders. With a system to calculate financed emissions in place, the Fed could then set up a climate “Bad Bank” using its emergency authority under Section 13(3) of the Federal Reserve Act.[22] The Bad Bank would be used to provide support to financial markets and businesses in the real economy that are negatively impacted by climate change. To fund the Bad Bank, the Fed would set an annual cap on financed emissions and require its member banks to pay an annual assessment in proportion to how much they exceed the cap. This “Pigouvian” policy would help combat the negative externalities of loans that fund carbon emissions. It would help realign incentives to transition the U.S. economy to net-zero in time to avoid the dire impacts of climate change and allow the Fed to better achieve its dual mandate of maximum employment and stable prices.

II. What Can the Fed Do?—Considering the Fed’s Enumerated Powers and Whether They Cover Climate-Change-Related Actions

While it is not novel to say the Fed should try to influence climate change policy through goals like reducing carbon emissions, discussions of the Fed’s actual legal basis for doing so are lacking.[23] This poses two main questions. Number one: Does the Fed’s supervisory authority allow it to regulate banks based on the level of financed emissions the banks hold on their balance sheets? The theory here being that the more a bank holds these assets, the higher exposure that bank, and consequentially the financial system as a whole, has to transition risks.

The second question is whether there is a more deliberate role for the Fed to play under its monetary policy authority. If climate change poses the immense risk that an ever-growing number of scientists, governments, NGOs, and corporate leaders now say it does, and if the current emissions path of the U.S—the second largest emitter in the world[24]—threatens to cause the level of warming that will make those risks a reality, is it incumbent on the Fed to step in? Could the Fed use its statutorily granted monetary policy tools to alter the financial incentives for banks to make loans based on the emissions of the borrower?

Part II begins to answer these questions by exploring what the Fed’s legal authority actually is. Subpart II(A) gives a brief overview of the role central banks play in modern governmental structures and describes the Fed’s role within the U.S. government. Subpart II(B) looks at two relatively recent developments in the Fed’s statutory authority that bear on the answers to these questions. Subpart II(C) discusses the Fed’s authority to supervise individual banks and the overall stability of the U.S. financial system and explores how the Fed might be able to regulate banks’ exposure to high-emitting borrowers. Finally, subpart II(D) discusses the Fed’s statutory authority to conduct monetary policy. It concludes that while the Fed’s “conventional” monetary policy tools are not well-suited to take aggressive action on climate change, its emergency authority under Section 13(3) of the Federal Reserve Act may provide a path forward.

A. Background on Central Banks and the Federal Reserve System

The Federal Reserve System is the central bank of the United States. At the highest level, central banks can be thought of as government-operated “banks for banks.”[25] In general, central banks do not make loans to businesses or individuals;[26] instead they conduct “monetary policy,” which means they direct “the availability and cost of money and credit to promote a healthy economy.”[27] They do this by making loans to other banks, controlling the overall money supply (the amount of money circulating in the economy), setting interest rates (the cost of borrowing money), and managing inflation (the cost of goods and services).[28] Central banks also help ensure that their member banks have adequate liquidity to pay off loan obligations, often acting as a lender of last resort.[29]

Setting interest rates is a key tool for central banks to influence economic activity; when interest rates are lower, individuals and businesses, in theory, will take out more loans to do things like buy houses or make capital investments (e.g., building a factory).[30] Furthermore, central banks are often assigned other tasks, such as monitoring banks and the overall financial system for risk or issuing banknotes and currency systems.[31]

Congress passed the Federal Reserve Act of 1913 and established the Federal Reserve System.[32] The Federal Reserve System is an “independent agency” within the U.S. government; while it technically falls under the Executive Branch,[33] its chairman and six other “Governors” on its controlling “Board” are not represented in presidential cabinets or necessarily appointed by the president serving at the time, and they can only be removed for cause.[34] Moreover, the Fed’s independence is unique within the federal government because it “is the only truly autonomous budgetary entity.”[35] The Fed literally has the ability to create U.S. dollars to fund its policies, whereas other government entities, Congress and other executive agencies included, must spend dollars that (1) are raised by taxes or borrowing; and (2) are appropriated by Congress to fund their actions and policies.[36]

B. Recent Historical Developments of the Federal Reserve

While several other works provide a detailed examination of the Fed’s history,[37] this Note will key in on two specific developments after 1970 that are pertinent to the Fed’s ability to address climate change.

1. The “Dual Mandate” and the “Volcker Shock”: 1977–1985.—

The Federal Reserve Reform Act of 1977 was passed during a decade of economic hardship, and added a new section to the Federal Reserve Act, stating:

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.[38]

This provision has been interpreted to prescribe a “dual mandate” for the Fed and command it to conduct monetary policy in a way that will maximize the employment capacity of the United States, while simultaneously ensuring that inflation remains at a stable and predictable level.[39] The “duality” of this mandate was tested in its infancy. When Paul Volcker was appointed as Chairman of the Board in 1978, the United States was in the midst of a dreaded period of “stagflation,” where it simultaneously experienced high unemployment and high inflation.[40] By 1980, inflation peaked at 13% while unemployment hovered around 7%.[41] In response, Volcker put in motion what is now termed the “Volcker Shock”—he aggressively set out to decrease inflation by reducing the money supply and raising interest rates.[42] This was in essence a self-induced recession, with conventional economic theory dictating that the reduced money supply and higher interest rates would lead to a period of high unemployment, and this, combined with the low borrowing power of consumers, would lead to deflationary pressures.[43]

Volcker’s tactics had their intended effects. Interest rates soared to 19% by 1981, and unemployment reached almost 11%, the highest on record since the Great Depression.[44] Opponents pushed back that Volcker was ignoring half of the “dual” mandate by using unemployment as a means of reducing inflation, but he defended his policies by arguing that reaching a desirable unemployment rate in the short term was impossible, and the deflationary policies now were needed to achieve the goals of the dual mandate in the future.[45]

2. Dodd–Frank Wall Street Reform Act of 2010.—

The financial crisis in 2008 brought the global financial system to the brink of collapse. In the aftermath, the Dodd–Frank Wall Street Reform Act of 2010 was passed, and it statutorily and philosophically changed the Fed’s role as a financial regulator and government entity.

Dodd–Frank fundamentally reformed the way that the Fed oversees risk in the financial system. Congress told the Fed it could no longer view financial stability as a broader means of achieving its monetary policy goals[46] and instead made systemic financial stability an explicit command. Dodd–Frank, with the stated overall purpose of “promot[ing] the financial stability of the United States,”[47] required the Fed to (1) establish certain “enhanced . . . prudential standards” and liquidity requirements for any Bank Holding Company (BHC)[48] that has consolidated assets of $50 billion or more;[49] (2) conduct annual “stress tests” of these same BHCs;[50] and (3) charged the Board with establishing “policies for the supervision and regulation of depository institution holding companies.”[51] Dodd–Frank also amended the BHC Act of 1956 (12 U.S.C. § 1844(c)(1)) to give the Fed new examination and enforcement authority over BHCs.[52]

Another lasting legacy of the ’08 crisis was dissatisfaction with the Fed’s use of its Section 13(3) emergency powers to “bail out” companies like Bear Stearns and AIG through direct lending and purchasing of troubled assets with public money.[53] Section 1101 of Dodd–Frank tamped down this power and outlawed some of the tactics the Fed used during the ’08 crisis to acquire the assets of a single firm on the brink of bankruptcy.[54]

C. The Fed’s Supervisory Authority over Individual Firms and the Whole Financial System Likely Allows It to Regulate Climate Risks

The subsequent paragraphs discuss some of the specific statutory provisions that give the Fed the ability to supervise individual banks and the financial system as a whole for risks and how regulations targeted at reducing transition risks caused by financed emissions might fall under the scope of these statutes.[55]

1. The Board’s General Authority to Examine Records and Require Reports: 12 U.S.C. § 248(a).—

As part of the Board’s “enumerated powers” listed in the Federal Reserve Act, the Board “shall be authorized and empowered . . . [t]o examine at its discretion the accounts, books, and affairs” of “each member bank and to require such statements and reports as it may deem necessary.”[56] The Board has used this general delegation of authority to, for example, enact rules requiring every depository institution under its regulatory authority to file a “report of deposits,”[57] and define “deposits” through an exhaustive list of examples.[58] Furthermore, the Eighth Circuit determined that § 248(a)(1)’s “general” grant of authority could be used to review the loan records of a member bank because the review was done “in order [for the Board] to exercise its specific authority to supervise” the actions of that bank.[59]

A prerequisite to any meaningful financial regulation aimed at reducing emissions and/or transition risks is to enact a system of accounting and reporting of the “financed emissions”[60] contained on banks’ balance sheets.[61] Section 248(a)(1) could be used along with the Board’s other statutory authorities to require firms to calculate and disclose their financed emissions.

2. The Board’s Authority to Require Reports from BHCs: 12 U.S.C. § 1844.—

The Bank Holding Company Act, 12 U.S.C. § 1841 et seq., “vests broad regulatory authority in the Board over bank holding companies.”[62] Part of this authority, under Section 5 of the Act, has long included the ability for the Board “‘to issue such regulations and orders as may be necessary to enable it to administer and carry out the purposes’ of the Act,” and to “‘require reports under oath to keep [the Board] informed’ regarding compliance with the Act and the Board’s duly promogulated regulations.”[63] Dodd–Frank amended Section 5 of the Act (12 U.S.C. § 1844) and gave the Board additional regulatory oversight over BHCs, including the authority to “make examinations of a [BHC] and each [of its] subsidiar[ies]” in order to “inform the Board of . . . the financial, operational, and other risks within the [BHC] system that may pose a threat to [(a)] the safety and soundness of the [BHC or any of its subsidiaries]; or [(b)] the stability of the financial system of the United States.”[64]

The BHC Act would seem to allow the Board to require BHCs to report their financed emissions to the Board. As discussed above, it gives the Board the responsibility of monitoring: the “financial condition” of BHCs; the “nature of the[ir] operations”; and their “financial, operational, and other risks” that “may pose a threat” to the financial safety of the BHC itself or to the “stability of the financial system of the United States” as a whole.[65] And it expressly gives the Board the ability to require “reports” to fulfill its monitoring requirement.[66]

While “report” is not defined in § 1844, its plain meaning is “‘something that gives information’ or a ‘formal account of the results of an investigation.’”[67] Under this definition, the Tenth Circuit in CBC, Inc. v. Board of Governors of the Federal Reserve System[68] upheld a regulation promogulated by the Board requiring BHCs of a certain size to submit to the Board annual financial statements audited by an independent public accountant.[69] The Tenth Circuit noted that these audits fell under the definition of report, and that § 1844(c) does not “limit the types of reports the Board could require.”[70]

The Board could use § 1844(b) and (c) to institute regulations requiring BHCs to calculate and report their financed emissions to the Board. Quantifying the financed emissions of BHCs is necessary for the Board to understand the transition risks that each BHC individually faces and how transition risks among all BHCs may affect the overall stability of the U.S. financial system. For example, a policy change like the implementation of a carbon tax risks substantial credit losses for banks with large credit exposure to high emitters, and the Board should be aware of where those risks may emerge.

Annual accounts of a BHC’s financed emissions submitted from the BHC to the Board fit well within the definition of a “report” used by the Tenth Circuit in CBC, Inc.[71] Furthermore, the growing consensus—among the Fed, other financial regulators, NGOs, and banks themselves—that transition risks pose threats to the U.S. financial system and individual financial firms[72] would support the Board’s determination that the financed emissions of a BHC are “risks” that “may pose a threat to” the safety and soundness of individual BHCs or the U.S. financial system as a whole.[73]

D. The Fed’s Conventional Monetary Policy Tools Offer Little Opportunity to Try and Reduce Financed Emissions, but Its 13(3) Emergency Powers Are a Potential Option

A brief overview of monetary policy was given supra in subpart II(A), while a specific example of the Fed using monetary policy tools during the Volcker Shock was given supra in section II(B)(1). To refresh, monetary policy impacts “the availability and cost of money and credit to promote a healthy economy.”[74] Central banks use various tools to alter the amount of money in the economy (money supply) and the cost that financial institutions charge borrowers when lending money (interest rates).[75]

So, “monetary policy” deals with the Fed pulling levers to affect the availability of money in the U.S. economy. And the Fed’s mandated goals when conducting monetary policy are to maximize employment and maintain stable rates of inflation.[76] The question here is whether the Fed can use monetary policy to specifically impact the capital available to companies based on the amount of carbon they emit. If we were in a vacuum, and you believed the assertions by scientists, governments, NGOs, etc., that at the current rate of emissions average temperatures on earth will reach unsustainable levels and cause catastrophic economic harm, you might think the answer is yes.

But we are not in a vacuum. Legal, political, and philosophical forces shape the Fed’s monetary policy actions.[77] Congress assigned the Fed specific powers that govern the tools it has to achieve the dual mandate, and shoehorning climate change policies into this authority is not straightforward. Furthermore, the Fed stepping in to mitigate climate change and “picking winners” threatens central banking norms established in the twentieth century—when neoliberal, “free market” economic theory became mainstream among monetary policy setters.[78] In a similar vein, there is a strong sentiment that the kind of active policymaking a central bank would need to engage in to take on climate change in this way would be an overstepping by unelected technocrats into an area that elected politicians should be addressing.[79]

Nonetheless, this subpart examines only the statutory levers Congress gave the Fed to conduct monetary policy. It examines the Fed’s primary “conventional” monetary policy tool of open market operations. It concludes that the tool is not well-suited for addressing climate change but provides valuable context for the nature of the Fed and how it exercises its monetary policy power. It then discusses the Fed’s Section 13(3) emergency authority and concludes that the “Bad Bank” advocated for in this Note might be reasonably permissible under Section 13(3).

1. The FOMC and Open Market Operations.—

The Board has a controlling majority of the Federal Open Market Committee (FOMC).[80] The FOMC directs “open market operations” (OMO), which is the buying and selling of government securities in the domestic securities market.[81] The purchase or sale of these securities has several functions. First, when the Fed purchases government securities in the open market, the Fed buys them from its member banks.[82] The banks can then use that money to make loans to participants in the real economy.[83] Increasing the money banks have available to loan to customers decreases interest rates and leads to more money circulating through the economy.[84] Second, since 2008, the Fed has vastly increased its purchases of long-term government securities (such as thirty-year treasury bonds) in its OMO.[85] By purchasing more of these securities, the Fed drives down the interest rate investors can earn by parking their money in these long-term securities and supports economic activity in the shorter term.[86] Finally, the Fed purchases mortgaged-backed securities (MBS) issued by government agencies (such as Fannie Mae) as a means of increasing the availability of credit in the home-mortgage market.[87]

The statutory authority and guidance from Congress for conducting the activities described above is rather limited. Section 12A of the Federal Reserve Act dictates basic guidelines about the structure of the FOMC and states that OMO “shall be governed with a view to accommodating commerce and business and with regard to their bearing upon the general credit situation of the country.”[88] Furthermore, the FOMC is subject to the otherwise-undirected dual mandate of achieving maximum employment and stable prices.[89]

Section 14 of the Federal Reserve Act enumerates the types of purchases the Fed can make in OMO. The Fed is authorized in 12 U.S.C. § 355 to purchase on the open market: (1) state and local government debt secured by revenue-generating activities; (2) foreign government debt; (3) any bonds, notes or other direct or fully guaranteed obligations of the U.S. government; and (4) any direct or fully guaranteed obligations of a U.S. government agency.[90] Noticeably absent are private sector assets such as corporate bonds, commercial paper, and equities.[91]

In summary, other than setting guidelines of the FOMC’s membership and its meeting schedule, giving it an extremely broad mandate to focus on maximum employment and stable inflation, and specifying the types of securities that the Fed may purchase, Congress does not exercise any direct control over OMO. Under this broad mandate, the FOMC has full discretion to, and does, make crucial asset-purchasing decisions using money it creates by itself.[92]

The growth in the Federal Reserve’s balance sheet over the past fifteen years is helpful to illustrate just how autonomous it is in conducting OMO. In 2005, the Fed held just under $1 trillion in assets such as government bonds and agency MBS.[93] Today, that number is over $8 trillion, a gain of over 700%.[94] And, remarkably, this $7 trillion balance sheet expansion has been almost entirely funded by dollars the Fed created itself.[95] In other words, since 2008 the Fed has used OMO to engage in extreme quantitative easing (QE), fundamentally altering its approach to supporting the economy through monetary policy, and none of this necessitated a change in its legal authority or appropriations from Congress.[96]

What does this mean for using OMO to address climate change directly? Unfortunately, not much. While the Fed’s purchasing power in OMO seems to be functionally unlimited,[97] this power only extends to government bonds, agency-backed debt, and short-term municipal debt. The ability to, as suggested by some commentators, perform a “green QE” by purchasing debt or securities of “green” companies is simply not part of the Fed’s OMO capabilities.[98]

Nonetheless, this unbridled power that the Fed exercises in OMO demonstrates just how far it can go when conducting monetary policy in pursuit of achieving its dual mandate and provides a foundation for how the Fed could use its Section 13(3) authority to address climate change.

2. “Emergency” Lending Authority Under Section 13(3).—

In the past decade plus, the Board has increasingly turned to an unconventional monetary policy tool—its authority under Section 13(3) to loan directly to the private sector and purchase private sector financial assets during “unusual and exigent circumstances.”[99] Using this tool has been controversial, so much so that Congress amended Section 13(3) after the Fed’s—potentially unlawful—use of it to “bail out” firms like Bear Stearns and AIG during the ’08 crisis.[100]

In its current form, Section 13(3) allows the Board, in “unusual and exigent circumstances” and with the approval of the Secretary of the Treasury, to enact programs that provide emergency liquidity directly to private sector companies.[101] The rest of this section will examine the language of Section 13(3) and programs enacted under this provision in the past, and discuss how the Fed (assuming cooperation with the Treasury) could use it to institute the program recommended infra in subpart III(B). A brief explanation of that program is given here to add context to the discussion of the statute.

In short, this Note recommends that the Fed use Section 13(3) to set up a “Bad Bank” that supports companies and banks impacted by climate change. The Bad Bank could engage in a variety of activities—such as lending directly to businesses suffering from physical climate damage, purchasing distressed financial assets from banks in those same areas, or purchasing stranded assets that lose value due to the manifestation of transition risks. As a means of funding the Bad Bank, member banks would calculate their financed emissions annually and pay an assessment if their financed emissions exceed a target set by the Board. As a result, banks rather than taxpayers would shoulder the load of the program, and the system itself would act like a Pigouvian tax to incentivize banks to reduce their financed emissions.[102] Whether that program would be legal if enacted under Section 13(3) is discussed below.

a. “Unusual or Exigent Circumstances.”—

The legality of this program depends on what constitutes “unusual or exigent circumstances” under Section 13(3). The term is not defined in the statute.[103] Accordingly, it is assigned its plain meaning absent clear legislative intent to the contrary.[104] “Unusual” means “[e]xtraordinary; abnormal”[105] while “exigent” means “[r]equiring immediate action or aid.”[106] The Fed rarely uses Section 13(3), and precedent of when the Fed has deemed circumstances to be “unusual or exigent” under Section 13(3) is limited to the Great Depression, scattered incidents between 1937–2008, the ’08 crisis, and the COVID-19 crisis.[107]

There are multiple ways to determine that climate change is an “unusual or exigent circumstance” under the plain meaning of the term. First, the climate crisis is an “exigent circumstance” because it requires immediate action to avert disaster. The longer the United States—the earth’s second largest emitter at 15% of global emissions in 2020[108]—waits to begin rapidly decarbonizing, the more likely it is that (1) the earth reaches key “tipping points” that would cause irreversible disruption to the global climate system;[109] (2) the carbon that is already present in the atmosphere will cause calamitous warming and weather events in the latter half of the 21st century, regardless of whether emissions are reduced in the future;[110] and (3) a haphazard and disorderly shift toward net-zero emissions occurs to make up for lost time, and the ensuing shocks to the economy and financial system are intensified.[111]

Second, physical risks and transition risks of climate change are present today and are an exigent circumstance requiring immediate action. In 2019, it was simultaneously the wettest and second-hottest year on record for the U.S.—this led to the bankruptcy of a major corporation and billions in flood damage in U.S. communities.[112] On the transition risks front, anti-emissions policies are becoming more common: for example, California recently announced a ban on the in-state sale of combustion engine cars by 2035,[113] and the Biden administration has expressed the desire to take action against climate change.[114] With the U.S. economy already on unstable footing due to COVID-19, action is needed to decrease the likelihood that manifestations of these risks snowball into a full-blown financial crisis in the near future.

b. “Broad-Based Eligibility.”—

Any program under Section 13(3) must have “broad-based eligibility.”[115] This term is not defined directly, but the statute does say that a program designed “to remove assets from the balance sheet of a single and specific company” or help a “single and specific company avoid bankruptcy” is not a program with broad-based eligibility.[116] This language was added by Dodd–Frank to ban the Fed’s use of special purpose vehicles (SPVs) to “bail out” individual companies.[117] In 2008, the Fed used Section 13(3) to: (1) set up an SPV; (2) loan money to that SPV as an entity that “need[ed] assistance” (required by the statute at the time); (3) have the SPV purchase illiquid assets directly from Bear Stearns using the loaned money; and (4) have the SPV use those illiquid assets as collateral for the original loan to satisfy Section 13(3)’s collateral requirement.[118] This was all done through Section 13(3) because the Fed’s OMO authority likely does not extend to private commercial assets.[119]

Following Dodd–Frank’s amendment to Section 13(3), the Board instituted new regulations defining programs as having broad-based eligibility if they provide liquidity to an identifiable sector of the financial system, would be accessible to five or more entities, and are not targeted at helping an individual company avoid bankruptcy or aiding a failing financial company (like Bear Stearns in the example above).[120] Under Section 13(3) and the accompanying regulations, the Board enacted programs during the COVID-19 crisis, including programs that purchased corporate bonds directly from private-sector corporations and in the open market (titled the Secondary Market Corporate Credit Facility or SMCCF), made loans backed by consumer credit (such as student loans and auto loans) as collateral (titled the Term Asset-Backed Securities Loan Facility or TALF), and made loans directly to small- and medium-sized businesses (titled the Main Street Lending Program).[121]

Interestingly, some of the programs used a nearly identical structure as the Fed’s bailout of Bear Stearns—for example, SMCCF created an SPV that the Fed loaned money to, and that SPV purchased private corporate bonds in the secondary markets and posted those bonds as collateral for the original loan.[122] This indicates that the broad-based eligibility requirement is not to be taken so literally as to prevent the use of an SPV that technically is the only recipient of funds from the Fed. Instead, the identities of the ultimate beneficiaries of the Section 13(3) program are what matter for determining if the program is one of broad-based eligibility. Given that the Bad Bank program would apply to a wide array of firms, it should be considered one of broad-based eligibility. Additionally, the SPV technicality is key for allowing the Bad Bank to function as required. Otherwise, the Bad Bank would be able to make loans to the private sector but could not directly purchase assets as envisioned. The discussion below explains why that is.

c. “Discount.”—

Section 13(3) allows the Fed to “discount . . . notes, drafts, and bills of exchange” for any participant in a Section 13(3) program.[123] Notably, a “discount” as used in Section 13(3) is best read to mean a loan and not an asset purchase.[124] The Fed’s own actions line up with this interpretation—when it has used Section 13(3) to purchase assets, like in the Bear Stearns and SMCCF examples, it has only done so by lending to an SPV and having the SPV actually purchase the assets.[125]

With that understanding of “discounting,” the use of the SPV workaround is the only way the Fed can purchase assets under Section 13(3), and not just accept them as collateral for loans. Therefore, the Bad Bank could be established by creating a program under Section 13(3) designed to provide credit to and purchase assets from companies impacted by climate change, establishing the “Bad Bank” as an SPV, and loaning the SPV the funds it requires to make asset purchases. As discussed later, these funds will be collected from member banks based on their financed emissions or could also be created by the Fed if the money collected from the members would not cover the full asset purchase.[126]

d. Incidental Powers Clause.—

Finally, although it is not part of the Fed’s authority under Section 13(3), Section 4(4) of the Federal Reserve Act states that the Fed may exercise “all powers specifically granted by the provisions of this chapter and such incidental powers as shall be necessary to carry on the business of banking within the limitations prescribed by this chapter.”[127] The use of this clause is crucial for the Bad Bank program because the ability to collect an annual assessment based on financed emissions is (obviously) not explicitly provided for in the Federal Reserve Act and would need to be considered a means of achieving the Fed’s other explicit statutory commands.

There is little case law on the breadth of this “incidental powers” clause. But in a concurring opinion in 2017, Judge Wallach on the Federal Circuit examined how Section 4(4) coincides with Section 13(3) to determine if the Fed acted legally when it made an $85 billion loan to AIG under Section 13(3) and accepted an equity stake in AIG as collateral.[128]

Although Section 13(3) does not explicitly allow the Fed to accept equity as collateral for a discount, Judge Wallach determined doing so was an incidental power authorized by Section 4(4) used to “enable [the] lending” explicitly authorized by Section 13(3).[129] He found that Section 4(4) “expands upon the [express] powers” in the Federal Reserve Act, so long as an incidental power does not create powers that are expressly or by reasonable implication withheld, and merely “carr[ies] into effect those which are granted.”[130]

The use of annual assessments calculated from financed emissions to fund the Bad Bank could be considered an incidental power authorized under Section 4(4), and there are several “granted” powers this system would “carry into effect.” First, the annual assessment, like the SPV structure, would be the incidental means by which the Fed carries into effect a Section 13(3) program. Nowhere in Section 13(3) does it say that the Fed can establish an SPV to institute a program or facility.[131] Nonetheless, the Fed has used this method for Section 13(3) programs and could similarly use the annual assessments to fund the Bad Bank.

Second, the annual assessment is the necessary means for the Fed to carry out its statutory dual mandate. The dual mandate requires that the Fed conduct monetary policy to achieve maximum employment and stable inflation.[132] As will be discussed in section III(B)(2), the annual assessment would not only fund the Bad Bank, but act like a Pigouvian tax on capital flows into high-emitting companies and a Pigouvian subsidy for capital flows into green investment.[133] This would presumptively lead to higher employment and stable prices by accelerating the inevitable shift to a net-zero economy, thus reducing the likelihood that physical risks manifest long-term, or that a sudden and disorderly shift to net-zero causes an economic crisis.[134]

Another look at how the Fed conducts OMO in pursuit of its dual mandate demonstrates that the annual assessment would not be a creation of new powers, but an application of the Fed’s existing monetary policy tactics in an alternative form. Similar to how the Fed buys mortgage-backed securities to increase incentives for lending in the housing market,[135] it would use the annual assessment to decrease incentives for lending to high-emitting borrowers. And while it could be argued that enacting what essentially amounts to a tax on polluters is the “creation” of a new power that Section 4(4) prohibits, the Fed’s extreme quantitative easing in the last few years acts like a similar behavior-altering tax on investing in longer-term treasuries—if not in such an outwardly admitted matter.[136]

e. Conclusion.—

This section argues that the Fed could institute the Bad Bank program under Section 13(3). Nonetheless, there are legitimate critiques to the combined use of emergency and incidental powers in such a way. Part III will further explain how the Bad Bank program would function. It will also argue that, despite the legitimate uncertainty of the legality of the program, the Fed should still enact it because the urgency of the climate crisis requires immediate action and the Fed has taken an “act now, ask questions later” approach to emergencies in the past.

III. What Should the Fed Do?—Reporting Financed Emissions, the Bad Bank Program, and the Need for a New Paradigm in Central Banking with Regard to Climate Change

Given the general polarization in our government and the heightened polarization of the climate change issue specifically, the fact that the Fed has legal and extralegal guarantees of political independence and budgetary autonomy[137] make it a great fit to take the lead on climate change. The Fed is also well-suited to deal with climate change because its authority over the vast majority of commercial banking assets in the United States means that its regulations can reach virtually the entire U.S. economy.[138] Therefore, this Note calls for the Fed to act as soon as possible to enact programs that will reduce the risk of climate-change-induced financial crisis.

I recommend that the Fed require all member banks to report their financed emissions to the Board on an annual basis. With a reporting system in place, the Fed could also establish a climate Bad Bank that collects an annual assessment from member banks based on whether the bank exceeds financed emissions targets set by the Fed, and uses those funds to make loans and purchase financial assets as necessitated by the manifestation of climate change risk.

Part III will give additional details about how these programs would actually work and discuss the normative rationales behind them. Subpart III(A) will explain how carbon emissions are commonly classified and calculated in the general economy, discuss how emissions-reduction activities are quantified, outline how member banks would be required to calculate their own “financed emissions” on an annual basis, and discuss the benefits mandatory reporting might provide for the financial system regardless of whether it is used in conjunction with a Bad Bank program. Subpart III(B) will provide additional details of how the Bad Bank program would function, discuss why its Pigouvian structure is the best way to alter financial incentives to combat climate change, and argue that even if this program rests on uncertain legal grounds and breaks central banking norms, the Fed should still implement it because of the urgency of the climate change crisis.

A. Mandatory Reporting of Financed Emissions

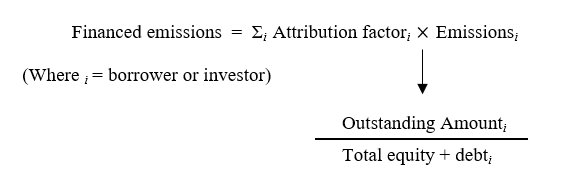

Financed emissions are the greenhouse gas (GHG) emissions financed by the loans and investments held in a financial firm’s portfolio.[139] For a bank to measure the financed emissions of a loan, it must first figure out the total emissions of the company it loans to. Then, the bank must determine how much of those emissions it is responsible for based on the percentage that loan makes up of the borrower’s total financial holdings. Repeat that for every loan or financial asset in a bank’s portfolio at a set time and you can calculate the total financed emissions of the bank at that set point in time.[140]

This Note will only scratch the surface of explaining financed emissions, and I recommend that anyone interested in the topic read full efforts like The Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (GHG Protocol)[141] or the Partnership for Carbon Accounting Financials’ (PCAF) The Global GHG Accounting & Reporting Standard for the Financial Industry (PCAF Reporting Standard).[142]

1. The GHG Protocol and Three Scopes of Emissions.—

The GHG Protocol is a joint program established by the World Resource Institute and the World Business Council for Sustainable Development to create a global framework for measuring greenhouse gas emissions from private- and public-sector operations.[143] It is used in some capacity by about 90% of all Fortune 500 companies, countries and cities throughout the world,[144] and government agencies like the U.S. EPA.[145] The following breaks down the three categories of emissions classified by the GHG Protocol.

a. Scope 1 Emissions.—A company’s Scope 1 emissions are direct GHG emissions that occur from sources owned or controlled by the company.[146] This would include emissions generated by a powerplant when it combusts fuels; manufacturing and chemical processes such as making cement or aluminum; and combustion of fuels in company-owned vehicles.[147] So, for example, the emissions generated by the combustion of jet fuel during a Delta flight would be part of Delta’s Scope 1 emissions.

b. Scope 2 Emissions.—A company’s Scope 2 emissions are indirect emissions associated with the generation of purchased electricity consumed by the company.[148] While these emissions are generated offsite from the company, they are often among the biggest contributors to a company’s carbon footprint. Playing off the same example above, the emissions generated from the production of electricity consumed by Delta at its corporate headquarters would be part of Delta’s Scope 2 emissions.

A company calculates its Scope 2 emissions by figuring out the total electricity it purchased and applying an emissions factor to that number based on either data received from suppliers, or based on regional or power-grid emissions factors.[149] To try and put that simply, a company could ask its electricity provider for data on the emissions associated with its purchased electricity, and if that is unavailable, the company could make an estimate based on an emissions or unit rate available for the applicable power grid(s) as a whole.

c. Scope 3 Emissions.—Scope 3 emissions are essentially any other source of indirect emissions generated by a company; they are consequences of activities of the company, but they are created by sources not owned or controlled by the company.[150] The GHG Protocol breaks Scope 3 emissions into fifteen categories that span across a company’s value chain—from the upstream emissions generated in the supply chain (such as production of purchased materials) to the downstream emissions that occur from using the organization’s products or services.[151]

As an example, take a car manufacturer like Ford. The emissions generated by a third-party manufacturer of sheet metal used in the body of Ford cars would be part of Ford’s upstream Scope 3 emissions, as would the emissions generated by a third-party’s trucks transporting that sheet metal to Ford factories across the United States.[152] When Ford’s finished cars are brought to dealerships across the country, the emissions generated by the trucks transporting the cars are part of Ford’s downstream Scope 3 emissions.[153] And if those cars are gas powered, the emissions generated by consumers driving the cars are part of Ford’s downstream Scope 3 emissions as well.[154]

2. Project Accounting and Emissions Reductions.—

Not all activities generate greenhouse gases. In fact, some reduce greenhouse gases either by pulling them out of the atmosphere or making sure they don’t get emitted in the first place. The GHG Protocol has a separate accounting system devoted to “project accounting” that aims to quantify and account for the emissions reduction attributable to “climate change mitigation projects.”[155] A climate change mitigation project is any “specific activity or set of activities intended to reduce GHG emissions, increase the storage of carbon, or enhance GHG removals from the atmosphere.”[156] Examples of reduction projects are a manufacturer purchasing more fuel-efficient equipment or a powerplant installing a “carbon capture” device.[157]

To calculate the emissions reductions attributable to a project, you first calculate a “baseline scenario,” which is expected emissions in the absence of any action being taken.[158] Then, you can (1) make an ex ante projection of the emissions the project will prevent as compared to the baseline; or (2) make an ex post calculation of the emissions in fact prevented by the project as data becomes available.[159]

3. Financed Emissions Accounting Standard.—

Financed emissions are Scope 3 emissions attributable to financial institutions through their capital investments.[160] There is no set standard for calculating financed emissions under the GHG Protocol, but banks are increasingly starting to do so as they further accept the reality that climate change presents a material source of risk to their balance sheets.[161] In an effort to standardize the process for emissions accounting among financial institutions, the Partnership for Carbon Accounting Financials—a private-sector-led initiative—released a report in November 2020 that outlines how financial institutions can calculate their financed emissions (“PCAF Standard”).[162] This section will break down the basics of the PCAF Standard and reiterate how the Fed could use a similar system to mandate annual disclosure of financed emissions by its member banks.

a. The PCAF Standard.—

In its current form, the PCAF Standard establishes measurement and reporting standards for six asset classes: (1) listed equity and corporate bonds; (2) business loans and unlisted equity; (3) project finance; (4) commercial real estate; (5) mortgages; and (6) motor vehicle loans.[163] A financial institution reports its financed emissions at a fixed point in time that aligns with its traditional financial accounting periods (like the end of a fiscal year).[164] It examines each of the loans and assets on its balance sheet and calculates any financed emissions attributable to the assets that fall within one of the six categories listed above.[165] Calculations within the asset classes vary, but in essence they each amount to a formula where the emissions attributable to the borrower are multiplied by an attribution factor for how much of those should be assigned to the bank.[166]

The method of calculating the attribution factor varies within each asset class. For example, for listed equity or corporate bonds, the numerator of the attribution factor is the “outstanding amount” of the equity or debt held by the financial institution, while the denominator is the “enterprise value including cash” (EVIC) of the borrower for listed companies or the “total equity plus debt” for unlisted companies.[167] What this means is that at the end of a reporting period, if Bank A holds Company B’s corporate bonds with $1 million of debt outstanding (based on book value), and Company B has an EVIC of $100 million, then the attribution factor would be .01, and Bank A’s financed emissions attributable to its bond holdings in Company B is .01 multiplied by Company B’s emissions in that reporting period.[168] For an individually financed project, the attribution factor is the total debt or equity provided by the bank (numerator) divided by either the total financing for the project in the beginning year or the total value of equity and debt remaining in subsequent years (denominator).[169] The attribution factor for commercial real estate, mortgages, and automobile loans is similar, with tailored features for each specific asset class.[170]

To determine which asset class a particular loan falls under, a financial institution is required to “follow the money” of its investments as far as possible.[171] This is relatively straightforward for real estate and auto loans. For the more general categories of (1) listed equities or corporate bonds; (2) business loans or unlisted equities; and (3) project finance, the key factor is whether the bank knows what activity a given loan is funding. If the bank owns a corporate bond or loans to a company and it does not know what activity the loan is funding, then it falls within category (1) or (2); however, if the bank knows what specific activity the loan is funding (for example, proceeds for building a particular factory), then it falls under category (3)—project finance.[172]

The calculation of emissions also varies by asset class. For categories (1) and (2), a company’s emissions are the sum of the entire company’s Scope 1 and Scope 2 emissions and, where applicable, the entire

company’s Scope 3 emissions.[173] For category (3) project finance, the relevant emissions are the Scope 1, 2, and relevant Scope 3 emissions of just the project.[174] For commercial real estate, residential mortgages, and motor vehicle loans, the relevant emissions are the Scope 1 or Scope 2 emissions of the individual building or vehicle at issue.[175] One obvious obstacle is that banks do not have this data on their own. It oftentimes is not publicly available, and for various reasons, the borrower will not disclose the information to the bank. Accordingly, when specific emissions data is unavailable, PCAF calls for firms to use estimates based on known physical-activity data of the borrower or revenue-based estimates for the industry sector the borrower is in.[176]

Finally, any avoided emissions from the funding of renewable energy generation fall within the project finance category.[177] In a very similar process as above, the “avoided emissions” that a project produces are calculated, and then are multiplied by an attribution factor to determine how much of those are attributable to the bank’s financial investment.[178]

b. A Standard for the Fed.—

Using the statutory and rulemaking authority discussed in subpart II(C), the Fed should require its member banks to report their financed emissions on an annual basis. The Fed should use its rulemaking power to establish a standard that largely resembles PCAF’s and create a rule-based, standardized accounting system for financed emissions. As part of that system, the Fed would allow banks to “offset” their financed emissions with avoided or reduced emissions financed by the bank.

In enacting the program, the Fed should avoid any attempt to require borrowers to disclose their emissions data to banks. This would be an extension of the Fed’s reporting power past the actual entities it has authority over and would seem an easy avenue to invite legal challenges. Nonetheless, there are ample ways for the Fed to incentivize borrowers to disclose their emissions data. As discussed below, the Bad Bank program would set an annual cap on financed emissions and require an assessment for banks who are above the cap. Banks could use any offsets to reduce their own financed emissions number, and banks already below the cap would be able to sell their excess offsets to others. Thus, the Fed could deny any company the ability to be eligible for offsets unless it discloses its overall emissions to its bank. Since banks would presumably want to loan more to companies who are eligible for offsets, this would incentivize disclosure by the companies.

4. Normative Support for Mandatory Reporting of Financed Emissions.—

The Fed should require annual reporting of financed emissions because it would help reduce the likelihood and potential impact of transition risks. This is true even if the recommended Bad Bank program is not adopted. The concept of a Minsky moment has been mentioned in this Note.[179] A good way to combat a financial crisis caused by the buildup of hidden risk is to make those risks unhidden.[180] Pulling back the emissions curtain will allow banks to understand the exposure they have to transition risk on their balance sheet and self-correct to a more efficient asset allocation. It will also make banks and the Fed aware of where problems might arise when transition risks do manifest.

While PCAF is an example of the private market taking steps toward addressing the aforementioned problems on its own, the urgency of the crisis and recent history indicate that the natural “unraveling” process will be too slow.[181] Additionally, normative theories of profit-maximizing firms and their incentives to disclose information indicate that climate change is a mixed bag, and the free market will not lead to consistent disclosure absent a regulatory push.[182] Furthermore, it is normatively theorized and has been positively shown that requiring accounting of pollution, even absent any other regulations, can reduce pollution due to a “shame” component or because easily cut-out emissions are readily identified.[183]

B. The Bad Bank Program

An underlying tenet in this Note is that climate change is a market failure requiring major regulatory action. External costs of emissions are not borne by emitters, and external benefits of “green” activities are not enjoyed by those actors.[184] Thus, too much and too little of each happen, respectively.[185] Over the past few years, there has been remarkable growth in the central banking community toward the idea that central banks are well-suited to correct this market failure through regulation.[186] It is time for another leap. The Bad Bank program would allow the Fed to take the lead on climate change and use Pigouvian policies to alter market incentives and facilitate the United States’ shift to a net-zero economy. While this breaks with central banking norms and has legitimate questions regarding the legality of the effort, the Fed should do as it has done in past times of crisis—act now, ask questions later.

Subpart III(B) will explore how the Bad Bank would function through setting a financed emissions cap and requiring banks that exceed it to pay an annual assessment, while allowing banks to offset their financed emissions with “green” investments. Next, it will discuss the normative justifications for this program and how it would mitigate climate risks. Finally, it will explore how the Fed’s role in the government and the economy is often extralegal and shaped by independent forces rather than its rote statutory commands. It will highlight how the Fed has taken monumental, society-changing action in the past in the face of crisis and should do the same in response to climate change.

1. The Function of the Bad Bank Program.—

The use of a “Bad Bank” is not unprecedented for the U.S. government. Most notably, the Troubled Asset Relief Program (TARP) established by Congress during the ’08 crisis was an example of a “Bad Bank.”[187] Essentially, Bad Banks are used to segregate and hold troubled, illiquid assets from a company’s balance sheet in order to “decontaminate” the company’s overall portfolio and restore its ability to borrow, lend, and raise capital.[188] The Bad Bank this Note advocates for would also extend to performing the Fed’s traditional role as a lender of last resort[189] and make loans to banks or directly to businesses impacted by the effects of climate change.

The Bad Bank program would be established under the Fed’s Section 13(3) emergency lending powers and would thus need approval—but notably, not funding—from the Secretary of the Treasury.[190] It would be used both as a means to limit the impact of climate risks that actually occur (through its asset purchases and loans) and as a means to limit the probability that climate change occurs at all (through the annual assessment). How the annual assessment would function and the types of financial activities the Bad Bank would perform are described below.

a. The Annual Assessment and Offset Trading.—

Each year, the Fed would set a financed emissions cap, and any bank over the cap would have to pay an assessment to the Fed. The main questions this presents are: (1) What should the cap be?; and (2) How much should a bank have to pay for exceeding it?

The actual cap should be set based on a target for total financed emissions in the economy aligned with a decarbonization goal like the Paris Agreement, or a weighted emissions limit that ensures that the ratio of a bank’s financed emissions as compared to total loans is not above a certain level.[191] A purely numerical limit of “x metric tons of CO2” could not work given the massive disparity in the size and asset holdings of the banks within the Fed’s regulatory scope. But, the Fed could account for size disparity by, for example, setting the limit as a ratio of financed emissions to total assets that would be applicable to all firms—regardless of size. The actual targets are beyond the scope of this Note. However, the Fed should work with climate scientists, bankers, and economists to establish financed emissions targets that align with emissions-reduction and risk-reduction goals in the economy and can be phased in over time.

The price for exceeding the cap would not be a fixed “pay-or-don’t-pay” fee. Instead, the Fed would assign a dollar amount for each unit of emissions over the cap a bank is in a given year, functioning like a “luxury tax” seen in certain professional sports leagues.[192] What that price should be depends on some central question—how much does Bank A financing above its “share” of emissions cost society? What price would alter incentives for the financial system to direct its capital flows toward a sustainable emissions path? What price accurately reflects the risk that an “overweighted” portfolio poses to the financial system due to transition risks? These questions are not mutually exclusive, and the price for exceeding the cap could factor in all of them. This calculation is once again outside the scope of this Note. However, the goal for the emissions cap, and the price for exceeding it, is to achieve the Fed’s supervisory and monetary policy mandates by shifting incentives in the financial sector in a way that decreases the U.S. economy’s vulnerability to climate change and leads to maximum employment and stable prices in the long term.

Finally, as part of the program, banks would have the ability to offset their financed emissions with any emissions-reduction or avoided-emissions projects they finance.[193] This would literally be a subtraction of a bank’s financed emissions by the financed “negative” emissions on the bank’s balance sheet. If a bank was already under the emissions cap in a given year and did not need an offset for itself, it could sell its “negative emissions” to other banks that are above the cap. The number of offsets a bank could buy in a given year would be capped, but there would be no limit on the number of offsets a bank could sell. Thus, even if a bank was in no danger of exceeding the emissions cap, it would still have incentives to make loans to green companies.

b. The Actions the Bad Bank Would Take.—

The legal means through which an SPV could be established to purchase financial assets and make loans to the private sector were discussed in section II(D)(2). The Bad Bank would have a broadly defined task of providing financial support to areas of the market under stress due to climate change. A typical example would be if a hurricane caused physical destruction, and businesses in the area struggled to obtain credit from the private market, the Bad Bank could provide emergency lending directly to them.[194] Or similarly, if banks with preexisting loans to companies and homeowners in this area faced financial stress due to heightened risks of default following the natural disaster, the Fed could purchase these financial assets from the banks. Another example might be helping municipal- and state-owned utilities shut down their existing fossil-fueled powerplants and build new renewable energy powerplants through the purchase of “stranded cost securitization” bonds if the market is not adequately funding the effort.[195]

Furthermore, to the extent the Bad Bank is used as a means for banks to offload financial assets from high-emitting companies if and when transition risks manifest, I would recommend that the Fed restrict the banks offloading these assets from making future loans to similar companies to prevent moral hazard and avoid the perceptions of a climate-focused bailout.[196]

The last point to make is that much of the future impacts of climate change are uncertain.[197] However, having funds earmarked to address these risks will help the Fed more rapidly respond to climate risks as they emerge. In this way, the Bad Bank resembles the emergency facilities established at the onset of the COVID-19 financial crisis that collected funds preemptively to deal with potential financial risks of a developing and uncertain crisis.

2. Pigouvian Policies to Price the Externalities of Emissions or Emissions-Reducing Activities Are the Best Way to Foster the Transition to a Net-Zero Economy.—

Some economists suggest that the best way to transition to a net-zero economy is to create a price for carbon emissions and subsidize the development of green energy and technology. These concurrent policies would foster the transition while creating a wealth of new jobs in the green energy sector. The Bad Bank program would replicate these goals by altering financial incentives for financing emissions and relying on the private market to duplicate the intended effects.

The International Monetary Fund (IMF) issued a study in October 2020 recommending that governments enact policies designed to transition to net-zero emissions in time to avoid the harmful impacts of climate change.[198] The IMF recommends a dual approach: for governments to raise the price of carbon-intensive activities through a carbon tax, while making low-carbon energy sources cheaper and more widely available through a “green fiscal stimulus” with heavy government investment in renewable energy projects and infrastructure.[199]

According to the study, in the first several years of this policy, the large growth and investment in green technology would more than offset economic losses within the carbon-intensive sector and lead to GDP growth globally.[200] But even more crucial are the massive long-term economic savings after 2050 due to the avoided costs of calamitous effects of climate change.[201] The Bad Bank program aims to duplicate these effects. By assigning a cost to banks for their financed emissions, these will likely be passed on to their borrowers in the form of higher interest rates and less supply of capital proportionate to the borrower’s emissions.[202] And the policy should work the same in reverse—because offsets can be used to reduce a bank’s assessment fee or be sold for profit, this reduces a bank’s costs of making loans to green companies and should lower interest rates and make funding more available.[203] As a result, carbon-emitting activities will become more expensive, while green activities will become less expensive, draw more investment, and lower the cost of green energy or substitutes.[204]

Additionally, the structure of the Bad Bank program is conducive to having the market itself push for green development. For example, a major emissions contributor for many businesses will be their Scope 2 purchased electricity. Because the businesses themselves will pay some costs for these emissions (in the form of higher interest rates on capital), they will be incentivized to lobby local and state governments to transition power grids from coal and natural gas to renewables, thus reducing their Scope 2 emissions.[205] Likewise, as businesses are forced to pay costs of emissions in their supply chains, they can be expected to search for ways to reduce their Scope 3 emissions totals.[206] This can drive demand for new technologies—such as long-haul, industrial-scale transportation that runs on renewable energy—that replace high-emitting supply chain processes.[207] The profitability of developing one of these new technologies will now factor in a component of the spillover benefits they provide to other companies in the form of Scope 3 emissions reductions, and this should lead to even more investment in these areas.[208]

What’s more, the IMF recommendation is, though not overtly stated, a Pigouvian policy. According to many economists, the optimal form of regulating firms that produce negative externalities is a Pigouvian tax—which forces firms to internalize the cost of the externality.[209] The classic example is a polluting factory. If the factory causes $100 in external costs per unit of pollution, then a tax of $100 should be assessed per unit of pollution to ensure the manufacturer will only pollute as much as the value of the activity exceeds the post-tax harm.[210] A Pigouvian subsidy does the same by subsidizing activities with positive external benefits.[211] The IMF-recommended system of taxing carbon and subsidizing green investment is Pigouvian because it aims to restructure financial incentives by pricing in the externalities of activities, and the Bad Bank program effectively would do the same.

3. The Fed Has Taken Emergency Actions That Were Legally and Philosophically Uncertain Throughout Its History.—

A common trope among politicians and bankers themselves is that the Fed shouldn’t “pick winners.”[212] Furthermore, there is a cohort of influential central bankers who disfavor any central bank taking the kind of “political” action the Bad Bank program calls for.[213] But, these are largely philosophical debates, not legal restrictions on the Fed’s authority. And history shows us that the Fed has repeatedly picked winners and taken actions that had political, society-changing implications. Thus, the “neoliberal” and “apolitical” Federal Reserve is either a false construct or disappears in times of crisis. Either way, addressing the climate crisis—when failing to do so could lead to enormous economic losses—is the type of situation that warrants the Fed dropping its neutral attitude as it has done when faced with previous crises.

Nonetheless, there are legal forces that make the Fed’s intervention at the level of the Bad Bank program uncertain. To regulate financed emissions, the Bad Bank program would rely on emergency and incidental powers and a broad congressional mandate.[214] And for the Bad Bank program to have the impact this Note calls for, it would have to impose a somewhat significant price on financed emissions while facilitating a meaningful subsidy for financed reductions. The use of broad enabling statutes by regulatory agencies to enact policies that will have a significant economic impact arguably goes against Supreme Court canon:

When an agency claims to discover in a long-extant statute an unheralded power to regulate “a significant portion of the American economy,” we typically greet its announcement with a measure of skepticism. We expect Congress to speak clearly if it wishes to assign to an agency decisions of vast “economic and political significance.”[215]

These forces, coupled with the fact that there is very little case law on the extent of Federal Reserve power, make it uncertain whether the Fed’s legal authority extends so far as to allow the Bad Bank program. Despite these legitimate concerns, scholarship examining the Fed’s authority points out that the Fed’s role within the government cannot be understood by looking only to the text of its enabling statutes.[216]

In this way, the stay-out-of-politics attitude and the idea that the Fed should not “pick winners” might matter. Regulating financed emissions would mean stepping into a controversial area that is political. It also would create a clear economic preference for low-emitting activities over high-emitting activities. However, the key difference between these philosophies and legal mandates is that philosophies don’t have any binding force—they are just preferences for how the world should work. To the extent that an old paradigm exists—that central bankers should not take the lead on combatting climate change—it is time for a new paradigm. The Fed’s dual mandate and responsibility to ensure the stability of the financial system make this so. If the Fed believes that the United States is on an unstable emissions path and must rapidly shift to a net-zero economy, and that elected officials are not acting fast enough, then its duty to effectuate its mandates should triumph over preconceived notions about the role of central banks in society.

Moreover, the Fed has a long history of taking the very kinds of political actions during times of crisis that are supposedly outside the proper scope of what unelected technocrats should do. The Volcker Shock stands out; Volcker used monetary policy in a way that plunged the United States into a recession, subjected millions of Americans to unemployment, dealt a deathblow to the organized labor movement, and disproportionately impacted the unionized industrial workers in the Midwest heartland.[217] His justification—that doing so was necessary because of cripplingly high inflation—might very well be true, but it does not get around the fact that the Fed picked winners and made decisions with massive economic and political ramifications. The Fed’s decisions during the ’08 crisis to bail out AIG and Bear Stearns are similar. These decisions were cloaked in legal uncertainty and arguably were outright illegal.[218] The politics of “too big to fail” banking were also contentious, and the Fed picked winners by taking these actions.[219] Nonetheless, the Fed acted because it felt it was necessary to avert a larger crisis and meltdown of the financial system.[220]

It’s time for the Fed’s own “whatever it takes” moment on climate change.[221] This Note argued that the legal structures in place can be reasonably interpreted to give the Fed the ability to regulate the financed emissions of its member banks in a way that will fundamentally alter the financial incentives for capital flows within the economy. With President Biden intent on fighting climate change, and a Treasury Secretary in Janet Yellen, who has said failing to address climate risks will be “devastating”[222] and favors using financial regulation as a tool to do so,[223] the time is ripe for cooperation between the Fed and the Treasury on this issue. It is time for a Green New Fed.

Conclusion

I am certainly not the first to argue that the Federal Reserve should use its power to address climate change. However, the existing literature has failed to meaningfully discuss whether the Fed has legal authority to do so. This Note aimed to fill that gap.

I provided background on the risk climate change poses to the financial sector and explained why it is an important area for regulatory intervention by the Fed. I then examined the Fed’s statutory authority to conduct its two most important functions—setting monetary policy and monitoring the financial system for financial stability—and explained how regulating climate change might fall within those powers.

I also recommended a set of policies for the Fed to pursue. The first is to mandate annual reporting of “financed emissions” by member banks. The second is to establish a Bad Bank that would provide emergency support for businesses adversely impacted by climate change. The Bad Bank would fund

itself through collecting annual assessments from member banks that exceed a certain level of financed emissions as determined by the Fed. The annual assessments would act as a Pigouvian tax on financed emissions and help realign financial incentives in the United States to build a sustainable economy and financial system.

- .Climate-Related Mkt. Risk Subcomm., Mkt. Risk Advisory Comm. of the U.S. Commodity Futures Trading Comm’n, Managing Climate Risk in the U.S. Financial System (Leonardo Martinez-Diaz, Jesse M. Keenan & Stephen Moch eds., 2020) [hereinafter CRMRS Report], https://www.cftc.gov/sites/default/files/2020-09/9-9-20%20Report%20of%20

the%20Subcommittee%20on%20Climate-Related%20Market%20Risk%20-%20Managing%20

Climate%20Risk%20in%20the%20U.S.%20Financial%20System%20for%20posting.pdf [https://