Encouraging Surcharge: Toward a Market-Driven Solution to Supracompetitive Credit Card Interchange Fees

In America, credit cards constitute one of the most important payment systems for consumer transactions. The financial institutions that issue credit cards generate only part of their revenue from interest paid by card holders. Fees charged to merchants who accept credit cards, called interchange fees, make up another important source of income. Credit card issuers use their advantageous market position to impose supracompetitive interchange fees.

The simplest response to these conditions would be for merchants to impose a point-of-sale surcharge on credit card transactions. In many jurisdictions, laws that previously would have prohibited this practice have gone off the books. But pressure from the major credit card networks and the inertia of long-standing tradition have conspired to prevent widespread adoption of merchant surcharging. Evidence suggests that instead, merchants have responded by raising price levels to offset at least some of the transaction fees they expect to incur in the near future.

Credit card issuers funnel much of the revenue generated by interchange fees into rewards programs for the benefit of their customers. Since consumers who hold credit cards and use them most frequently tend to be wealthier and have higher incomes—on average—than consumers who use mostly or exclusively cash, any increase in overall consumer prices to offset interchange fees creates a regressive wealth transfer.

Congress should address this problem by passing legislation that creates an incentive scheme by which merchants will have the requisite motivation to impose surcharges on customers who pay by credit card, subjecting interchange fees to downward pressure as consumers move purchases to less costly payment methods. Such a scheme would constitute a procompetitive regulatory intervention that would ultimately inure card holders to a new status quo, eliminate the regressive wealth transfer in place under the current system, and benefit nearly all consumers—except for the small fraction of card holders who expend tremendous energy to extract maximum value from rewards programs to the detriment of nearly all other consumers.

Introduction

Today, the dominance of the credit card as a means of payment for both individual consumers and businesses makes it difficult to imagine a world without plastic. Commentators have extolled the perceived benefit: the provision of accessible and convenient credit to those who might otherwise struggle to obtain financing in the form of traditional bank loans.[1] Critics have derided the business model as fundamentally oriented toward preying upon the economically vulnerable.[2] And countries like Japan demonstrate that high levels of credit card spending need not characterize every thriving, modern economy.[3] Still, the pervasiveness of advertising campaigns for credit card products[4] and the appearance of credit cards in American popular culture[5] reinforce the cultural cachet of this payment method. In spite of its current dominance as a payment method, the credit card could just as easily have vanished before it ever achieved commercial viability. But for the incompetence of Bank of America’s accounting department, however, the first payment card resembling a modern-day credit card likely would have been the last.[6]

In the beginning,[7] payment cards targeted travelers and were marketed by pioneering firms like Diners Club.[8] These cards aimed to solve a common problem faced by the growing number of traveling businessmen in the highly mobile, post-war American economy: paying for travel expenses without carrying large sums of cash.[9] Travelers often had difficulty paying by check because merchants would not honor an instrument drawn on a far-flung bank whose reputation did not extend across the country.[10] Like many issues related to financial-system stability during the nineteenth and much of the twentieth centuries, these geographical limitations often imposed on payment by check resulted from America’s highly fragmented, unit-bank-focused financial system—one dominated by state-chartered banks, which typically existed as stand-alone businesses without branches.[11] The first payment cards aimed to facilitate transactions via extension of short-term credit by an intermediary with nationwide reach. By the terms of the arrangement, the accountholder repaid the balance at the end of each month.[12] Thus, “carrying a balance” constituted a default.

In 1958, Bank of America boldly took the next leap forward by introducing the BankAmericard, which bundled the payment capabilities of an American Express or Diners Club card with the extension of revolving credit.[13] Competitors like Chase Manhattan Bank soon followed suit but lost interest in the product almost as quickly.[14] Chase abandoned its program, even after a substantial initial investment, because it concluded that profitability would not follow fast enough to justify continued support of the product.[15] Faulty accounting at Bank of America, however, resulted in the incorrect belief that its credit card program had turned profitable sooner than it actually had, leading it to continue its efforts to develop the product that ultimately became Visa.[16]

This history suggests that the dominance of credit cards is nothing more than a mere accident. In fact, the full history of credit cards in America is a story of repeated perseverance in the face of a series of seemingly insurmountable headwinds.[17] For example, a patchwork of state usury laws often impeded issuers from charging interest rates high enough to offset losses. But, this changed with the Supreme Court’s decision in Marquette National Bank of Minneapolis v. First of Omaha Service Corp.,[18] which held that a bank could charge customers throughout the country the highest rate permitted in its home state.[19] In response, Congress undertook serious consideration of imposing nationwide rules governing the rates that credit card issuers could charge at a level much lower than the highest rates permitted under Marquette National.[20] Yet the credit card issuers remained resolute, successfully blocking the most promising attempt at such legislation at the eleventh hour.[21]

The tenacity of credit card issuers continues unabated to the present day. The major issuers have, over the past twenty years, discerned methods to derive profit even from those customers who use credit cards primarily for transacting and never or rarely pay interest.[22] Issuers have accomplished this not only through increasingly sophisticated application of mathematical methods to vast data sets[23] but also by maximizing the revenue generated by transactional fees. Perversely, they use a portion of this cash flow to reward consumers, reinforcing the behavior. Despite its inauspicious beginnings, the credit card industry has grown to behemoth proportions and imposes costs on society in a variety of ways.[24] At the risk of coming off as an ersatz John Lennon, perhaps the time has come for us to imagine a world in which credit cards play a less prominent role and in which the American payment system landscape more closely resembles peer economies in Europe and Asia.

My argument unfolds in three parts: Part I of this paper explains the credit card payment ecosystem and argues that the major credit card issuers have taken advantage of their market power to impose supracompetitive interchange fees, thereby extracting rents from merchants and consumers alike. Part II examines the feedback effect created by this revenue stream—issuers funding generous rewards programs from interchange revenue—and argues that this perverse incentive suppresses substitution to less expensive, but equally efficient, payment methods. Part III departs from the conventional view advocated by other commentators, drawing on economics and game theory to argue that the proper solution to the problem of high interchange fees and the resulting regressive wealth redistribution requires not only permitting merchants to pass interchange fees to consumers via transaction surcharges but will also require legislation adopting an incentive scheme to ensure that a new, more efficient equilibrium actually obtains.

I. Credit Card Interchange Fees Are Likely Supracompetitive

A. The Complex Structure of Credit Card Processing Systems Insulates Transactional Fees from Direct Market Pressure

The complex structure of a typical credit card transaction insulates interchange fees from negotiation by the two parties—the card holder and the merchant—who would otherwise have an interest in attempting to bargain for better terms with respect to these fees. Issuers unilaterally set interchange fees (along with other contract terms) and then offer their product to merchants (and, indirectly, consumers) on a take-it-or-leave-it basis. Only very large merchants can influence the level of the fees they will pay under this system. On the consumer side, the status quo obscures the cost of credit card payment processing, and therefore, card holders lack motivation to demand lower interchange fees—from which the majority of consumers would actually benefit.

1. The Typical Open-Loop System Prevents Merchants from Directly Negotiating Interchange Fees

A so-called open-loop system, the type operated by Visa and Mastercard, involves five[25] distinct parties: the card holder, the merchant, the network, the issuing bank, and the acquirer.[26] The networks are firms like Mastercard, Visa, Discover, and American Express (in fact, those four pretty much cover the field), who sell to banks and merchants the ability to process credit card transactions. Visa and Mastercard are not in the business of providing credit. The banks, whose logos also appear on credit cards, actually have a relationship with the consumer and extend credit (Discover and American Express are different in that they serve issuer and network functions). The process necessarily begins before any transaction occurs, when the card holder applies for the credit card, and the issuer approves that customer for a line of credit.[27]

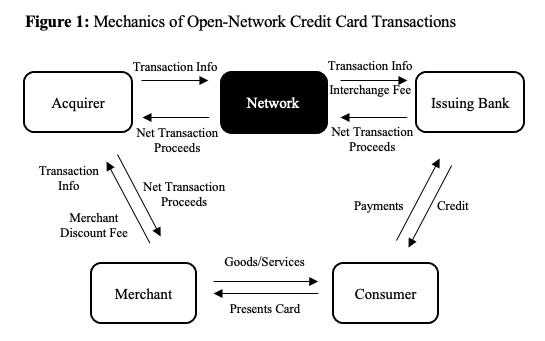

Figure 1: Mechanics of Open-Network Credit Card Transactions

The card holder presents her credit card to a merchant that accepts credit cards on that network. Having accepted the card in exchange for goods or services, the merchant passes information related to the card and purchase to its acquirer.[28] Just as the customer chooses the issuer to which she will apply for a credit card, the merchant chooses and enters into a contract with an acquirer whose services it will employ with respect to cards of a given network.[29]

The acquirer passes the transaction information along to the issuing bank (the bank whose logo actually appears on the card: Chase, Citi, Bank of America, etc.).[30] The network processes and facilitates this flow of information and the return remittance of funds from the issuer to the acquirer.[31] When the issuing bank sends money to the acquirer for the transaction, it withholds the interchange fee that the acquirer has agreed to pay with respect to a transaction of this type (fee levels vary based on which card the consumer presented and the merchant’s classification) from the amount paid on the claim.[32] The credit card networks and issuers make much of the fact that the interchange fee is negotiated for and paid by the acquirer, not the merchant.

The acquirer then passes the payment along to the merchant, subtracting an amount called the merchant discount fee.[33] Merchants do have the capacity to negotiate the level of the merchant discount fee that they will pay.[34] Acquirers exist to turn a profit, and therefore, the interchange fee sets the lower bound for the merchant discount fee.[35] The fee paid to the acquirer represents its sole source of revenue for providing the service, and this fee must exceed the interchange fee or the acquirer will not profit by processing the transaction.[36] Thus, while merchants will have an opportunity to negotiate lower merchant discount fees and seek out competing acquiring institutions who will offer more competitive fee levels, this negotiation cannot directly influence the interchange fee itself.

In the marketing materials that they publish to attract merchants, the major open-loop networks tend to emphasize that acquirers pay the interchange fee.[37] This statement is factually true but lacks critical context: The flow of funds in the transaction ensures that the entire interchange fee (plus more) will ultimately reduce the amount paid to the merchant.[38]

Finally, while this discussion of the mechanics of a card transaction has focused on an open-loop system, the conclusions remain generally valid for closed-loop systems like American Express or Discover.[39] In a closed-loop system, the network, American Express for example, is the issuer and acquirer.[40] This type of network includes only a single fee.[41] However, the fees charged by the closed-loop networks have also been subject to legal challenge similar to the ongoing antitrust litigation aimed at Visa and Mastercard.[42]

2. Merchants Generally Lack Bargaining Power to Meaningfully Influence the Terms Offered by the Networks

Most merchants are too small to directly influence interchange levels, since the card networks set these fees unilaterally.[43] Therefore, only a merchant that can negotiate with the network to strike a sweetheart deal can directly influence the level of interchange that it pays. A merchant’s freedom to refuse to join the network, foreclosing the merchant’s ability to accept that network’s cards, provides the only real leverage in these negotiations.[44] The threat imposed by the refusal of a small or even mid-sized merchant to accept the cards of a particular network is not likely to pose a substantial enough threat to the network’s attractiveness to consumers to inspire the network to negotiate.[45] And credit card networks market to these small and medium-sized businesses by pointing to data suggesting that credit card users on their networks spend more money to imply a net benefit to merchants.[46] It bears notice, however, that these claims often rely on spending figures derived from studies that do not generally control for factors like income and credit score that could independently explain the higher spending activity identified.[47]

Large retailers, on the other hand, can negotiate reductions in the standard interchange fees by threatening not to accept a network’s cards.[48] Despite a paucity of publicly available information on the magnitude of any such deals, circumstantial evidence indicates that even major retail players lack substantial leverage in their negotiations with the major card networks. The efforts of some of the most recognizable names in brick-and-mortar and online retail to challenge the major credit card networks’ policies through litigation evidences mounting dissatisfaction with the available terms. For example, major retailers have played a substantial role in antitrust litigation related to credit card network practices.[49] Many household names have opted out of the approved settlement in the hopes of pushing litigation forward in pursuit of stronger concessions along even more dimensions.[50] The collective action that even some of the most recognizable names in retail have chosen to pursue, extending litigation over these practices at great up-front cost, buttresses the inference that none can, individually, negotiate interchange fees down to levels which could be obtained in a competitive market. These titans of retail have identified the high interchange fees associated with premium credit cards that offer generous rewards as most problematic and hope to extract a concession from Visa and Mastercard that would allow them to stop accepting certain cards.[51]

B. Lack of Consumer Insight into the Costs of Processing Credit Card Transactions Limits Consumer Motivation to Fight for Lower Interchange Fees

1. Merchants Who Accept Credit Cards Have Two Options to Respond to the Costs of Processing These Transactions, Neither of Which Are Transparent to Consumers

When a merchant accepts a credit card as a payment method for goods or services, the costs associated with the merchant-discount and interchange fees must land somewhere.[52] Either the merchant must absorb the cost, keeping prices for goods and services the same.[53] Or, if the market will permit, the merchant can raise its prices and offset the costs associated with accepting credit cards.[54]

The first option is problematic if the fees charged to process credit card transactions exceed the sum of the social and economic values of accepting credit cards as a payment system.[55] For if this is the case, then the fees charged in exchange for processing a credit card payment constitute rents[56] accruing to a small number of firms in an oligopoly market structure.[57] Empirical evidence suggests that these rents constitute an inefficiency that reduces total economic output.[58] Therefore, where merchants must bear the cost of processing credit card transactions, the reduction in profits constitutes a drag on the whole economy.

Where the market will bear higher prices for goods and services, merchants may pass the costs of accepting credit cards on to all consumers. As where merchants absorb the costs of accepting card payments, rents accrue to the credit card networks,[59] but this possibility is especially pernicious in its effect.[60] By raising overall price levels, non-credit card users who pay with cash or debit cards—both much cheaper payment methods than credit cards[61]—subsidize part of the costs imposed by those consumers who choose to use credit cards.

Raising prices to offset high credit card processing fees results in a regressive wealth transfer.[62] Consumers who use payment methods other than credit cards, especially those who use exclusively cash, tend to be poorer than consumers who primarily use credit cards.[63] Where higher consumer prices compensate for the relatively higher cost of processing credit card transactions, the increased revenue paid to merchants pass through to the acquirers and issuers in the form of the fees charged for credit card transactions. The bulk of the fee paid by merchants consists of the interchange.[64] Since interchange fees largely go to funding valuable rewards for credit card accountholders,[65] the higher consumer prices effect not only a cross-subsidization but actually create a regressive wealth transfer.

2. Consumer Ignorance of Interchange Fees Prevents a Market-Derived Equilibrium

Where overall consumer prices rise to offset the processing fees associated with credit card payments, the purchasers who choose to use credit cards and create the costs reflected in higher prices lack awareness of what has happened. Since everyone pays the same price at the check-out counter,[66] consumers who pay by cards remain unaware of the effect of their choice on prices. Moreover, even if consumers could appreciate the cost increases associated with processing credit card transactions, credit card payers lack a strong incentive to seek lower interchange fees because these consumers benefit from cross-subsidization by non-credit card users.

Where merchants internalize the cost of processing credit card transactions, accepting these fees as an unavoidable cost of doing business in the modern marketplace, consumers remain broadly unaware of the costs of their choices. While strict network-imposed rules preventing the disclosure of credit card processing costs designed to prompt consumers to consider a cheaper payment method—or at least use a cheaper credit card—have eroded as a result of class action settlements, one such antisteering policy remains in effect at one of the four major credit card networks after the U.S. Supreme Court upheld the legality of the rule in 2018.[67] Rules preventing merchants from discriminating against the most expensive credit cards or steering customers toward cheaper cards remain at the heart of the legal attack that several large retailers have mounted against the approved settlement between merchants and Visa and Mastercard related to interchange fees.[68] Because the rules lack uniformity, the practice of attempting to disclose costs imposed on the merchant by a customer’s election to pay by credit card is not widespread. And since merchants large and small typically do not disclose the costs they will bear as a result of the consumer’s choice to pay by credit card, even a consumer who would change to an equally efficient but cheaper payment method for the benefit of a favored business will often lack the full information needed to prompt this change in behavior.[69]

II. Interchange-Funded Credit Card Rewards Programs Disincentivize Consumers from Making the Socially Beneficial Substitution to Less Costly Payment Methods

A. Credit Card Rewards Programs Are Widely Popular and Likely Motivate Cardholders to Shift More of Their Spending to Credit Cards

Credit card rewards programs play an important role in the consumer credit card market, and rewards likely drive card holder behavior. Rewards-linked credit cards have come to dominate the general-purpose credit card market.[70] These programs, featuring airline miles, points-based systems managed by the issuer, or cash-back rewards, have become ubiquitous.[71] And these rewards programs have proven highly popular with consumers. Over the past decade, annual surveys of credit card accountholders indicate that rewards programs feature prominently in both the consumer’s choice of credit cards and their satisfaction with the product.[72] Moreover, these consumers report that the presence of rewards linked to their credit card accounts influence their choice of credit card.[73] The American Bankers Association has also reported a link between rewards-linked credit card accounts and higher monthly spending.[74] Perhaps most importantly of all, the most informed parties in this market—the credit card issuers themselves—believe that rewards drive consumer spending on credit cards.[75] All this is to say that rewards programs feature prominently in consumer thinking about credit cards and have been linked with higher spending, suggesting a link between this popular feature of many credit card accounts and consumer choice of payment method.

B. Issuers Primarily Fund Rewards Programs Using Interchange Fee Revenue

Supposing that credit card issuers fund rewards programs out of their own profit margins, these incentives may represent nothing more than evidence of a highly competitive market in which a handful of well-capitalized participants sacrifice short-term profitability in order to usurp competitors’ market share for the long run. Available evidence, however, suggests that issuers instead primarily fund rewards programs out of the interchange fee revenue they collect.[76] Some commentators have noted that identifying the “source” of some item of an issuers’ expenses is difficult because the various components of credit card issuers’ revenue streams are fungible.[77] Other various pieces of evidence, however, suggest a clear link between interchange fees and credit card rewards. For example, many credit card issuers report rewards program expenses as interchange contra-revenue in financial statements.[78] Nearly all spending on transacting credit card accounts involves rewards-linked cards, and transactional fees represent the primary income stream associated with these cards.[79]

While the repurposing of interchange revenue into rewards programs in some sense constitutes a reduction in profitability,[80] transactional fee revenue has never represented a “core” profit center for issuers, such as Visa and Mastercard, offering cards on the traditional open-loop networks.[81] One piece of evidence supporting the link between credit card rewards programs and interchange fee revenue is the fact that the cards carrying the most robust rewards tend to consistently carry the highest interchange fees.[82] As far back as the mid-2000s, Visa and Mastercard introduced new credit card categories that charged merchants higher interchange fees and offered more generous rewards to consumers.[83] In this framing of the narrative, credit card issuers, far from foregoing a traditional stream of revenue, have simply pushed supracompetitive interchange fees to new levels in order to fund new or expanded rewards in an effort to remain competitive.

C. Substitution from Credit Cards to Cheaper Payment Methods Is, on the Whole, Desirable

The modern retail transaction presents the consumer with a choice between several, nearly universally accepted payment methods: cash, check, or card-based payment. Online, the options expand to include electronic payment via web-based intermediaries (like PayPal) and sometimes even direct ACH transfer. All of these payment methods have costs and benefits relative to one another, and a fulsome discussion lies outside the scope of this paper.[84]

The work of several scholars tends to indicate that credit card transactions impose higher social costs than alternative payment methods. One study estimated that credit card transactions cost “six times as much as cash transactions and twice as much as checks or PIN-based debit cards.”[85] Surveying studies of payment systems in other countries, a researcher at the Federal Reserve Bank of Kansas City concluded that credit cards are likely the costliest payment method.[86] The same researcher used this conclusion to suggest that regulations limiting interchange fees on debit cards—implemented pursuant to the Durbin Amendment to the Dodd-Frank Act[87]—could actually result in efficiency losses if the new rules resulted in banks doubling down on credit card rewards to push consumers from transacting with debit cards to credit cards.[88] Yet another commentator argues that an effort by large banks to push consumers away from debit and toward credit cards did in fact follow the implementation of these regulations.[89]

Debit cards bundle cheaper payment processing with the transactional efficiency of credit cards, making them an ideal candidate for substitution from credit cards.[90] Like credit card transactions, payments made with debit cards boast increased speed compared to paper-based payments, a benefit to both merchants and consumers. And, where PIN-based transaction processing is employed, debit cards exhibit better overall security performance than payments processed over the traditional credit card networks.[91]

When it comes to consumer choice of payment method, the status quo exhibits clear symptoms of dysfunction. The consumer—the party who makes the choice to pay by credit card—does not bear the full cost of her decision, at least under the current system where surcharging remains rare. Even if merchants raise prices to compensate for the processing costs they anticipate from credit card transactions, all consumers pay the higher prices. Only if a merchant passes along all of the expected processing costs of credit card transactions and processes only credit card transactions will credit card users pay the full cost of their choice of payment. Even this model simplifies too much: the premium credit cards offering the most generous rewards tend to carry the highest interchange fees, meaning that credit card users with less generous or even no rewards will likely end up cross subsidizing the holders of the highest end cards.[92] The scenario thus described perfectly illustrates a third-party problem in which one party’s action imposes negative externalities.[93] Not only do rewards card holders avoid paying the full cost of their chosen payment method, the card issuer compensates them in the form of cash-back or other semi-pecuniary rewards.

Excluding for a moment the different legal protections afforded credit and debit cards, the extension of revolving credit associated with a credit card constitutes the primary difference between the two payment systems. While the credit allows a consumer who pays off her statement in full each month to benefit from the float facilitated by the card’s grace period, borrowing on the card introduces the possibility of troublesome debt accumulation.

The literature addressing the dangers associated with overspending and overborrowing on credit cards touches on everything from the centrality of borrowing and consumer distress in the credit card issuer business model[94] to the psychological shortcomings that likely influence observed patterns of non-optimal credit card user behavior.[95] The welfare costs of financial distress reach far beyond the troubled borrower.[96] The key factor differentiating debit cards from credit cards—the extension of revolving credit—renders the payment method more likely to facilitate financial distress for the borrower.[97] Thus, at least based on a comparison limited to these characteristics, debit cards should generally be preferred to credit cards as a payment method and any regulatory action expected to drive such a substitution viewed favorably.[98]

D. Stronger Legal Protections for Credit Card Transactions—When Compared to the Protections Afforded Payments by Debit Card—Should Not, in and of Themselves, Deter Policymakers from Pursuing Regulations That Will Drive Substitution from Credit to Debit Cards

Federal law fails to provide uniform legal protections for transactions conducted on a credit card versus those made by debit card. The Truth In Lending Act (TILA) limits card holder liability for unauthorized purchases made by credit card to fifty dollars, and then only if the card issuer fulfills several requirements designed to (1) reduce the burden on the card holder to report a lost or stolen card and (2) provide notice to the card holder that he may be subject to liability for an instance of unauthorized use.[99] By contrast, TILA does not apply to debit card transactions because debit card purchases do not involve an extension of credit.[100] Debit card users do not, however, want for protection entirely; “[debit card] transactions are treated as electronic fund transfers and are subject to the less robust protections offered by the Electronic Fund Transfer Act (EFTA).”[101] Unauthorized debit card users who report the transaction within two business days enjoy a $50 limit on liability. Failure to report an unauthorized usage so promptly, however, results in potential liability increasing to $500.[102] Because a credit card transaction deploys the issuing bank’s money, credit card users have an additional layer of security created by the right to refuse payment to the issuer if the merchant fails to render the goods or services.[103] In a world in which internet commerce continues to gain in overall retail market share,[104] the attractiveness of such a feature to card holders continues to grow. The enhanced legal protections afforded to credit card transactions make this payment method preferable to debit cards from the consumer’s point of view.

These limitations on consumer liability found in TILA and the EFTA serve only to allocate losses from fraudulent activity. Optimal policy related to card safety should focus on minimizing total costs from payment card fraud. Yet, the evidence suggests that credit card payments are less secure than payments made with PIN-enabled debit cards.[105] The risk of bearing losses from fraudulent activity may prompt credit card issuers to invest heavily in software that can quickly detect unauthorized activity. This conclusion, however, conflicts with the reality that card issuers can often pass along these costs by “charging back” a transaction against the merchant.[106] In this way, the enhanced benefits for credit card purchases create costs that are borne by merchants[107] for the benefit of the consumers who carry the highest protection premium cards.[108] Much like with interchange fees, merchants typically must accept this part of the arrangement with the card networks on a take-it-or-leave-it basis. At the very least, the mere fact that consumers might prefer credit cards because of the relatively robust protections granted in TILA as compared to the more modest measures applicable to debit card transactions afforded by the EFTA should not affect the view of policy makers motivated by a desire to enhance total economic welfare. On the whole, debit cards are preferable from a public policy perspective. Other levers available to legislators should tilt in favor of debit cards, even if—for whatever reason—altering the consumer protections currently in place is not practicable.

III. The Optimal Policy Solution Involves Legislation to Permit Merchants to Impose Surcharges Nationwide Coupled with a Tax-Incentive Scheme to Motivate Merchants to Impose Surcharging Programs

The evidence gathered suggests that (1) market dysfunction has permitted credit card networks to set supracompetitive interchange fees for the benefit of their issuers and (2) issuers then primarily draw on this stream of revenue to fund credit card rewards that reinforce the status quo. To address this market failure, I propose legislation to preempt all remaining state laws prohibiting merchant surcharging and banning credit card networks from enforcing any restriction on surcharging against merchants who join the network.

In order to ensure that market forces restore order to the market for credit card interchange fees, however, the law enabling merchants to impose surcharges should be supplemented with a tax-incentive scheme designed to prompt merchants in highly competitive industries to implement surcharging policies. Ensuring that interchange fees respond to market forces requires opening them up to direct pressure to the greatest extent possible. If merchants fail to adopt surcharges once permitted to do so, the direct influence that would result from the consumer response to the forced internalization of the costs of processing credit card transactions will likely not occur. In order to achieve widespread transaction surcharging, the structure of the incentive should vary by industry to ensure that the incentive offered is most generous in industries where the competitive landscape will work against widespread adoption of credit card surcharge policies.

A. Ensuring Widespread Adoption of Merchant Surcharging Requires a Short-Term Incentive Program to Ensure Widespread Adoption of Credit Card Transaction Surcharging

The proposed scheme involves a deduction from taxable income of some portion of the surcharge revenue collected by a merchant in a given year. Because delegations of authority that allow the Internal Revenue Service to instigate substantive changes to tax rates are extremely limited, the mechanism of legislation would necessarily unfold in two steps.[109] First, Congress would impose by enactment a requirement that the Federal Trade Commission (FTC) identify key retail and service industries and arrive at conclusions as to the overall level of competition in each industry within some (relatively) limited window of time. Given the limited delegations of taxing authority, Congress would then need to enact the substantive legislation constituting this program by altering the tax code—accepting or rejecting the FTC’s findings as it sees fit.[110] In other jurisdictions where regulation has permitted credit card surcharging, market structure has proven predictive of whether merchants will avail themselves of the opportunity to impose surcharges.[111] Thus, the scheme aims to counteract the effect of underlying market structure by offering retailers facing the stiffest price competition the strongest incentives to surcharge credit card transactions.

1. In the Absence of a Calibrated Incentive Scheme, Uniform Adoption of Transaction Surcharging Will Not Occur

Robust marketplace competition in many critical industries will work against the widespread adoption of merchant surcharging. Some of the most common merchants, like grocery store chains and big box retail chains, operate in highly competitive industries in which low profit margins prevail.[112] Barriers to entry are often low, allowing new entrants to further suppress price levels by raising the supply curve. This pushes overall price levels down, toward the theoretical equilibrium point of marginal cost.[113]

Firms in low-margin industries will therefore face a difficult choice regarding whether or not to implement credit card transaction surcharging. Since the participants in highly competitive industries generally cannot undercut competitors on price without eroding their entire profit margin,[114] the move to impose credit card transaction surcharges risks handing a competitor a rare price advantage.[115] Merchants will likely hesitate before imposing surcharges for fear that doing so will cause customers to shift quickly to competitors who do not follow suit.

This is an example of a collective action problem.[116] In the most price-competitive industries, merchants have less flexibility to pass along the costs of processing credit card transactions to consumers in the form of higher overall price levels.[117] As a result, especially where marketplace competition is most fierce, merchants will absorb much (perhaps all) of the cost imposed by interchange fees. All of the participants in such a market would benefit by surcharging credit card transactions, since the practice would improve each merchant’s net profit margin.

Unfortunately, each firm can control only its own behavior. Merchants will perceive the benefit of imposing surcharges but will fear handing their competitors a price advantage: should these competitors not adopt a surcharging policy, they could offer lower net prices. In the worst-case scenario, this hypothetical merchant will lose market share as a result of noncooperative behavior by competitors. This scenario exemplifies a stag-hunt game from the field of game theory.[118] The players (merchants) would benefit by cooperating, but anxiety that other players will defect pushes the result toward a lower-utility equilibrium.[119] Instituting some mechanism to improve the assurance of cooperation can overcome this problem and achieve the higher-utility equilibrium resulting from cooperation.[120] Changing the law to ensure that merchants can impose surcharges only permits cooperation but does not solve the assurance problem. In competitive markets, without a mechanism to engender mutual trust, widespread surcharging would likely not obtain.

At the other end of the spectrum, firms in the least competitive markets would not face the same type of cooperative game problem.[121] Firms with greater market power have more latitude to raise price levels to offset the cost of processing credit card transactions. Thus, permitting surcharging would enable firms in this position to supplement their revenues by adding an additional fee to their transactions.

Evidence from another country that has regulated interchange fees and permitted surcharging provides evidence that the bifurcated outcomes predicted by game theory play out in practice. In Australia, where regulatory reforms aimed at interchange fees have been adopted and tweaked over much of the past twenty years,[122] merchants in more competitive industries appear less willing to impose credit card surcharges. On one hand, the Reserve Bank of Australia concluded in a 2010 report that almost thirty percent of merchants imposed surcharges on at least one card that they accept, demonstrating a non-negligible level of surcharging in that country.[123] However, a report funded by Mastercard argued that implementation of surcharge policies skews toward merchants who have substantial market power imposing surcharges that exceed the cost of credit card acceptance as a means of supplementing their own revenues.[124] Mastercard claimed that this practice had become pervasive among merchants with “dominant geographic, market or channel positions.”[125] Mastercard cited the example of a ten-percent surcharge applied to credit card payments made in taxis as one example of what it considered price gouging.[126] Australian consumers have also registered dissatisfaction with the surcharging practices of airlines in particular.[127]

2. Consumers Will Not Fully Adapt to Credit Card Surcharging in the Absence of Widespread Merchant Adoption of the Practice

The experiences of other countries that have regulated payment methods in ways comparable to the change proposed by this paper, along with concepts from the field of behavioral economics, help explain why widespread adoption of surcharging must occur for this policy to succeed. Accordingly, evidence from an analogous regulatory change shows that consumers react strongly to new fees imposed at the point of sale associated with particular payment methods.[128] Responding to new fees on credit card transactions, consumers could either change their payment method or take their business to an alternative merchant who does not impose surcharges. Given the level of attachment of many card users to the rewards tied to their credit cards, it is not a stretch to imagine that many will opt for the latter choice. Indeed, those merchants who operate in highly competitive markets and face a price-sensitive customer base would rightly worry that their customers will move on to a competitor who declines to impose surcharges.[129]

Complicating this picture, research in behavioral economics indicates that consumers may exhibit an anomalous attachment to no-cost credit card transaction processing that could drive a more extreme reaction than would otherwise be predicted by economic theory alone.[130] For this reason, the consumer-psychology component of the likely reaction by consumers to credit card transaction surcharging merits further consideration. Merchant restraints that have created a status quo in which credit card transactions are typically “free” are associated with a behavioral phenomenon that one economist has framed as an example of the endowment effect.[131] However, other research has shown that adaptation to analogous events (a reduction in personal income, for example) occurs within a short time, less than five years.[132] This suggests widespread experience with paying surcharges for credit card transactions would quickly wipe out the psychological attachment to “free” credit card payments as a new status quo emerged. Sophisticated merchants taking a long-term view should prefer a world in which customers accept that they will pay the increased costs associated with costlier payment methods.[133] After all, the choice of payment system belongs to the consumer. Therefore, assuming satisfactory mutual assurance, rational merchants should adopt a strategy of imposing surcharges, given that consumer psychology should adapt to a new status quo relatively quickly.

Failure to promote truly widespread credit card transaction surcharging will result in a failure to spur this adaptation of consumer expectations. For proof of this, look no further than Australia, where uneven merchant surcharging has been the norm and consumers continue to complain about the practice. Instead of adaptation to uniform surcharging, consumers—perhaps rightly—conceive of surcharging as an additional way for companies operating in uncompetitive industries to fleece consumers.[134] If the overall level of credit card surcharging begins and stays too low, appearing concentrated only where the competitors hold substantial market power or where payment alternatives are non-existent, resistance to the practice will likely remain. Under such circumstances, consumers could be forgiven for suspecting that surcharges constitute a form of price gouging. Where, on the other hand, surcharging takes hold and consumers come to expect the imposition of surcharges, adaptation should occur fairly rapidly.[135]

B. The Proposed Incentive Scheme Directly Addresses the Headwinds to Merchant Surcharging

In order to overcome the hurdles that might otherwise limit merchant implementation of credit card surcharging, I propose a tax-based incentive scheme that addresses these headwinds directly: the policy should be (1) tailored to offset the reasonably expected near-term profit loss associated with imposing the surcharge in the absence of an incentive, (2) industry specific, and (3) limited in duration to five years. Congress should delegate to the Consumer Financial Protection Bureau the responsibility to assess the state of credit card surcharging two years after the law comes into effect so further calibration of the incentives can be undertaken if necessary.

1. A Scheme Carefully Tailored in Magnitude Will Achieve Its Objective Without Unnecessary Loss of Tax Revenue

The proposed tax incentive aims to make the average market participant in each market segment of every identified industry indifferent between imposing surcharges or electing not to do so over a short-term time horizon (two to three fiscal years). This means that the expected incentive resulting from adopting a surcharging policy would equal the reasonably expected reduction in profit from a loss of market share if eighty percent of market participants elected not to impose credit card surcharges.[136] Narrow tailoring will help avoid over-incentivizing less competitive sectors where merchants will likely adopt surcharging even without a financial incentive. This will reduce the lost revenue and help make the legislation more politically palatable.

2. Industry Specificity Will Ensure That the Scheme Meets the Demands Imposed by the Structure of Each Market

Setting the size of the proposed tax incentive on an industry-by-industry basis will perform two functions. First, it will ensure that the incentive offered fits the competitiveness of each market landscape. Second, this structure will help prevent waste by minimizing the incentive offered where market forces will not likely impede firms from imposing surcharges.[137] Targeting specific industries makes sense because it addresses the market-based challenges that will impede or allow rapid adoption of credit card surcharging. The level of segmentation involved in such a scheme will require careful study.[138] Because widespread adoption of surcharging is an important objective of the policy proposal, subcategorization may be necessary in some niche markets to ensure that the size of the incentive can overcome competitive pressures working against adoption of surcharging, especially among the large retailers who account for a great deal of total credit card purchases by transaction count, if not by sales volume.

3. An Incentive Lasting Only for an Intermediate Duration Will Suffice to Achieve the Desired Effect on Interchange via Market Forces

The incentive program developed to ensure widespread adoption of merchant surcharging of credit card transactions need only last for an intermediate term of a few years; I propose such a program may properly sunset after five years.[139] This conclusion rests on two premises.

First, once consumers begin to bear the primary responsibility for paying the processing costs of credit card transactions, substitution away from credit cards should drive down interchange fees. The available research indicates that consumers would have a strong reaction toward substitution into alternative payment methods as a response to point-of-sale fees.[140] A widespread substitution to alternative payment methods would shift the demand curve downward, placing downward pressure on credit card interchange fees.[141] The mechanics of processing a credit card transaction closely resemble the mechanics of processing a debit card transaction.[142] To the extent that the interchange fee purports to compensate the issuer for the actual marginal costs of processing the transaction, interchange fees for debit cards and credit cards should not differ as radically as they do today.

Even after debit card interchange fees became subject to regulation under the Durbin Amendment, Visa and Mastercard have continued to process debit card transactions over their networks,[143] and large financial institutions continue to make debit cards a standard feature of their checking account products.[144] From this, it may be surmised that even at regulated levels, these fees provide income substantial enough for banks to justify continuing to issue debit cards and process transactions undertaken by card holders. The major cognizable change effected by the Durbin Amendment came in the form of a reduction in the debit card rewards programs that banks had begun rolling out.[145] A similar change would likely accompany a market-driven reduction in credit card interchange fees. With rewards programs curtailed, consumers would lack the same incentive to use a credit card over a debit card in the first instance.

Further, the competitive advantage for merchants to elect not to pass on the costs of the transaction would fall as the size of the transactional costs fall. Assuming that direct market pressure on credit card interchange fees would drive them toward current levels of debit card interchange fees, the benefit to any merchant who attempted to undercut competitors by offering no-surcharge processing of credit card transactions would be smaller than today. Once market forces drive the cost of processing a credit card transaction to the actual marginal cost, the need for surcharging will fall away completely.

Second, the behavioral economic justification for why consumers likely overvalue the benefit of free credit card transaction processing, coupled with the evidence of a strong consumer reaction to point-of-sale fees, can help to further explain why a reversion to non-surcharging would not likely occur before the market-equilibrium objective of this proposal is achieved. Once a new status quo emerges in which merchants routinely subject credit card transactions to surcharges, the perception of an entitlement to cost-free credit card transactions processing would abate.[146] Assuming that consumers do exhibit behavior consistent with an entitlement effect related to credit card surcharging, they should be willing to pay more (in frictional costs of, for instance, seeking out a different merchant) to avoid paying a surcharge than they would later prove willing to pay to switch to a merchant who does not impose surcharges. Theory suggests that the relative size of the perceived value (of a non-surcharged transaction) would change once the status quo shifted due to widespread adoption of merchant surcharging.

C. Encouraging Merchant Surcharging Is Preferable to Alternative Proposals

Encouraging widespread merchant adoption of credit card transaction surcharging aims ultimately to fix a broken market structure by fostering a state of affairs in which the party responsible for choosing the payment method must internalize the higher costs of the choice to use a credit card. Admittedly, not all commentators agree that this market suffers from dysfunction[147] or, in any event, demands regulation.[148]

Yet the available evidence tends to more strongly suggest that dysfunction in the market for credit card interchange imposes costs and demands at least some regulatory solution. Even the prominent libertarian[149] economist Tyler Cowen has recently characterized as “objectionable” the transfer effected by credit card rewards programs.[150] As a solution, Cowen would allow merchants to pass along costs, albeit in the form of a discount rather than a surcharge, in order that the effect on consumer choice of payment method address the regressive transfer created by credit card rewards.[151]

To be sure, commentators whose default outlook favors non-intervention would likely disagree with the extent of the incentive involved with the proposal offered in this paper. The fact remains, however, that the market dislocation and attendant costs of the current system of credit card interchange is widely perceived as problematic.[152] Theory helps explain why the simplest intervention—passing a law that makes surcharging allowable across-the-board—will fail to stimulate adequate levels of merchant surcharging such that interchange fees respond fully to market discipline.[153] The Australian experience with credit card surcharge provides evidence that the theoretical shortcomings of a regulation that allows surcharge without actively encouraging its implementation will bear out in practice if repeated in the United States.[154]

On the other hand, a relatively robust incentive program that aims ultimately to achieve a market solution to the interchange problem provides a more palatable approach than strongly paternalistic solutions.[155] Professor Natasha Sarin, for example, has proposed banning credit card rewards programs outright.[156] Attacking rewards programs directly helps to cut off the cycle of card holder incentives that drive increased credit card spending. Sarin notes one feature of consumer behavior with respect to credit card rewards programs that perhaps merits such a strong regulatory response—the substantial time and energy expended by the most committed credit card users.[157] Imposing substantial costs on merchants and the vast majority of consumers so that a niche subset of “point chasers” can maximize rewards on dozens of cards, sometimes for no purpose other than “gaming the system” and “screwing the airline” seems “hard to view . . . as socially desirable.”[158]

Sarin concedes, however, that the direct, paternalistic approach would likely meet substantial resistance.[159] The deadweight loss occasioned by a small niche community of point chasers does not justify a heavy-handed ban. A program designed to make the practice of surcharging widespread would have the effect of eroding the generosity of rewards programs, perhaps into nonexistence. Since rewards program funding has been linked to interchange revenue,[160] market pressure forcing interchange levels down would inevitably result in credit card issuers reducing the rewards offered, as the large banks did with debit card rewards following the implementation of the Durbin Amendment.

Conclusion

Credit card networks have succeeded in taking advantage of their market power to impose supracompetitive interchange fees on merchants. This has permitted credit card issuers (the beneficiaries of interchange revenues) to extract an economic rent from both merchants and consumers.

Credit card issuers have deployed a substantial portion of the revenue collected from interchange fees to fund credit card rewards programs. These programs, according to both consumers themselves and industry insiders, influence consumers to do more of their spending on credit cards rather than use less costly alternative payment methods. Since the implementation of regulations limiting interchange fees on debit cards, large banks have worked to push consumers toward credit cards and away from debit cards. Rewards programs play a leading role in this effort, and it is problematic because debit card usage likely imposes lower social costs than does credit card usage.

In order to address the problem, Congress should implement a policy designed to incentivize widespread merchant adoption of credit card transaction surcharging. Such a policy would pass the costs of processing a credit card transaction directly to the party responsible for choosing the payment method. Doing so should lower interchange fees as consumers shift away from credit cards to less expensive alternatives, thereby placing downward pressure on the fees that networks can impose.

In order to bring about this market solution, however, the practice of surcharging credit card transactions must become widespread, at least for a time. Ideas from the field of game theory can help explain why merchants in highly competitive industries would not likely adopt surcharges while firms in less competitive markets might impose excessive surcharges that price gouge consumers. Experience in Australia following the adoption of credit card regulations bears this out. Further concepts from behavioral economics suggest that widespread adoption will be critical to consumer adaptation to a new status quo. Crucially, the incentive scheme developed must be tailored along several key dimensions in order to prevent undue loss of tax revenue and ensure that merchant surcharging proliferates while stopping merchants in uncompetitive markets from charging excessive fees.

Though such a scheme requires fairly dramatic federal government intervention, the program aims ultimately to subject interchange fees to market discipline. In this way, the proposal represents a pro-competitive solution to a market failure. For this reason, the incentive scheme contemplated is preferable to alternative, paternalistic proposals to solve the problems concomitant with high interchange fees.

- .See, e.g., Todd J. Zywicki, The Economics of Credit Cards, 3 Chap. L. Rev. 79, 98–99 (2000) (explaining how credit cards have enabled low-income consumers to obtain access to previously unavailable credit on more competitive and attractive terms). ↑

- .See, e.g., Oren Bar-Gill & Elizabeth Warren, Making Credit Safer, 157 U. Pa. L. Rev.

1, 46–52 (2008) (discussing the different ways in which credit cards are designed to exploit consumers’ imperfect information and imperfect rationality); Ronald J. Mann, Bankruptcy Reform and the “Sweat Box” of Credit Card Debt, 2007 U. Ill. L. Rev. 375, 379 (2007) (maintaining that bankruptcy laws incentivize credit card issuers to rely increasingly on business models that depend on distressed borrowing). ↑ - .See Ronald J. Mann, Charging Ahead: The Growth and Regulation of Payment Card Markets 77–78 (2006) (showing that both credit card transactions per capita and credit card debt as a percentage of annual credit card volume are much lower in Japan than in the most highly developed commonwealth countries—the United Kingdom, Canada, and Australia—and the United States). ↑

- .Over twenty years after the first television advertisement aired, Mastercard continues to

use the “priceless” theme in its advertising. Kristina Monllos, Why Mastercard Is Adding

a Charitable Aspect to Its Long-Running ‘Priceless’ Campaign, Adweek (Jan. 19,

2018), https://www.adweek.com/brand-marketing/why-mastercard-is-adding-a-charitable-aspect-to-its-long-running-priceless-campaign/ [https://perma.cc/BJ4K-HSP5]; see also Kai Ryssdal, Coming Up with a Billion Dollar Ad Campaign? Priceless, Marketplace (Mar. 21, 2014), https://www.marketplace.org/2014/03/21/coming-billion-dollar-ad-campaign-priceless/ [https://

perma.cc/5BTE-X25R] (discussing the cultural impact of the long-running Mastercard ad campaign). ↑ - .For example, the American Express Centurion Card (often referred to as the Black Card because of its appearance) has proven to be a particular fascination, appearing frequently in rap and hip-hop lyrics and in references made by characters in hit television shows. See generally List of Black Card Mentions in Media and Entertainment, LuxuryPlastic, http://www

.luxuryplastic.com/black-card-in-popular-culture/media-and-entertainment/ [https://perma.cc/

UY35-HZ6Q] (listing the numerous Centurion Card references in culture, media, and entertainment). ↑ - .See Mann, supra note 3, at 89 (noting that one academic’s study indicates that “Bank of America’s decision to maintain its commitment to the product that ultimately became Visa” resulted from “a faulty accounting process that did not make decision makers aware of the true costs of the program”). ↑

- .Prior to the advent of general-purpose cards, merchants offered charge cards to customers as well as installment credit; these systems, however, were inherently limited by their merchant-specific nature. See id. at 87 (explaining how banks transformed the payment card into a general-purpose card by combining some distinct features of existing proprietary store cards and lines of credit). ↑

- .Id. at 81. ↑

- .Id. ↑

- .See id. (describing how merchants were reluctant to accept nonlocal checks due to the difficulty of making informed assessments of travelers’ banks). ↑

- .See Charles W. Calomiris & Stephen H. Haber, Fragile by Design: The Political Origins of Banking Crises and Scarce Credit 183 (2014) (maintaining that the instability of the U.S. banking system in the nineteenth century resulted from the fragmented structure of the system, which was composed of thousands of geographically isolated unit banks). ↑

- .Mann, supra note 3, at 81. ↑

- .Id. at 86–87. ↑

- .Id. at 89. ↑

- .See id. (describing how one academic’s study shows that Chase Manhattan Bank gave up on its credit card product after concluding that it would not become profitable quickly enough to justify further investment). ↑

- .Id. ↑

- .As Professor Mann notes, “In truth, the question is not why the revolving credit card has been slow to catch on outside the United States, but how it ever managed to succeed in the United States.” Id. at 86. ↑

- .439 U.S. 299 (1978). ↑

- .Id. at 301. ↑

- .Vincent D. Rougeau, Rediscovering Usury: An Argument for Legal Controls on Credit Card Interest Rates, 67 U. Colo. L. Rev. 1, 11, 11 n.36 (1996). ↑

- .Id. at 12. ↑

- .See Mann, supra note 3, at 128 (describing numerous conversations with people who boast about having outsmarted the credit card companies and noting that the author had not yet come away from such a conversation without concluding that the person is a profitable customer). ↑

- .For an illuminating discussion of the ramifications of the growing reliance on algorithms in the market for consumer credit, see generally Cathy O’Neil, Weapons of Math Destruction: How Big Data Increases Inequality and Threatens Democracy 141–60 (2016). ↑

- .See infra notes 56–58. ↑

- .The primary open-loop networks, Visa and Mastercard, are in some sense newly “unique” counterparties in this arrangement in that both were organized as associations of member banks until they became public during the 2000s. MasterCard Incorporated Prices Initial Public Offering, Mastercard (May 4, 2006), https://investor.mastercard.com/investor-news/investor-news-details/2006/MasterCard-Incorporated-Prices-Initial-Public-Offering/default.aspx [https://perma

.cc/ZTB5-E25K]; Visa Inc. Prices Initial Public Offering, Visa (Mar. 18, 2008), https://usa

.visa.com/about-visa/newsroom/press-releases.released.7636.html [https://perma.cc/76U4-SEN8]; see also Alan S. Frankel & Allan L. Shampine, The Economic Effects of Interchange Fees, 73 Antitrust L.J. 627, 628, 628 n.1 (2006) (noting that prior to their IPOs, Visa and Mastercard operated as associations of member banks). ↑ - .Mann, supra note 3, at 20. ↑

- .Id. at 21. ↑

- .Id. at 25. ↑

- .See Samuel J. Merchant, Merchant Restraints: Credit-Card-Transaction Surcharging and Interchange-Fee Regulation in the Wake of Landmark Industry Changes, 68 Okla. L. Rev. 327, 339 (2016) (noting that merchants’ only opportunity to reduce fees is through negotiations with potential acquirers during this selection process). ↑

- .Mann, supra note 3, at 26. ↑

- .Id. ↑

- .Id.; Merchant, supra note 29, at 332–33, 336. ↑

- .Merchant, supra note 29, at 333. ↑

- .See Mann, supra note 3, at 25 (explaining that a merchant who wishes to accept cards on a network must contract with an acquirer linked to that network and noting that “the market for acquisition is competitive, in the sense that a large number of acquirers compete for merchants based on [merchant discount fee level]”). ↑

- .Id. at 26. ↑

- .See id. at 27 (explaining that, viewed on a transaction-by-transaction basis, the acquirer must be able to make a profit based solely on the merchant discount fee charged). ↑

- .See, e.g., Understanding Interchange, Mastercard, https://www.mastercard.ca/en-ca/about-mastercard/what-we-do/interchange.html [https://perma.cc/8KQW-M4NZ] (explaining that “[i]nterchange is a small fee paid by a merchant’s bank (acquirer) to a card holder’s bank (issuer)” and that “Mastercard does not earn revenue from interchange”); see also The Visa System: Rates, Fees and Rules, Visa, https://usa.visa.com/support/small-business/regulations-fees.html [https://perma.cc/4BWZ-FC2V] (defining interchange fees as “transfer fees between acquiring banks and issuing banks” and noting that “[m]erchants do not pay interchange reimbursement fees”). ↑

- .See Mann, supra note 3, at 26 (explaining that issuers deduct the non-negotiable interchange fee when paying the acquirer and that the acquirer must deduct more when paying merchants to be profitable). ↑

- .See Merchant, supra note 29, at 335 (explaining that a closed loop is only different in that one party serves as both acquirer and issuer). ↑

- .Id. ↑

- .Id. ↑

- .Id.; see also In re Payment Card Interchange Fee & Merch. Disc. Antitrust Litig., 986 F. Supp. 2d 207, 215 (E.D.N.Y. 2013) (noting that the DOJ has previously filed related antitrust litigation against American Express). ↑

- .See Adam J. Levitin, Priceless? The Economic Costs of Credit Card Merchant Restraints, 55 UCLA L. Rev. 1321, 1333, 1333 n.29 (2008) (noting that while most merchants were unable to negotiate the interchange rate “[s]ome very large merchants are able to negotiate their own interchange fee categories or rebates on interchange”). ↑

- .There are at least some notable examples of holdouts. Costco famously, or infamously, accepted only American Express cards until recently switching to exclusively honoring Visa cards. E. Scott Reckard, Javier Panzar & Shan Li, Costco Picks Visa and Citigroup as New Credit Card Partners, L.A. Times (Mar. 2, 2015, 8:02 PM), https://www.latimes.com/business/la-fi-costco-visa-20150303-story.html [https://perma.cc/G2FR-ZJNM]. The terms of these arrangements are not public, but it is reasonable to assume that Costco achieved a price advantage through its exclusivity agreements. See id. (explaining that Costco is known to use its size to extract favorable deals). However, a membership-based business like Costco has an idiosyncratic customer base, perhaps explaining why this model has not been adopted by other large retailers. See id. (pointing out that other large retailers, like Wal-Mart, had not taken similar steps and that Costco enjoys an “affluent” customer population). ↑

- .Levitin, supra note 43, at 1333. ↑

- .See, e.g., Accept American Express Card, Am. Express, https://www.americanexpress

.com/us/merchant/accept-the-card.html?inav=merch_acceptthecard#hero [https://perma.cc/E2J5-3HRC] (claiming that average annual expenditures of American Express card holders exceed that of non-card holders by three times). ↑ - .For example, American Express cites to an edition of The Nilson Report, and American Express’s explanation of that Report implies that the authors simply used “[non]individual consumer-level data,” took aggregate credit card spending for 2018 for each consumer, divided the amount by the number of cards held by the consumer, and differentiated those consumers who held only American Express cards from those who held at least one non-AmEx card. See id. (explaining that the Report compares total Amex spending over total Amex credit cards to total non-Amex spending over total non-Amex credit cards). ↑

- .Levitin, supra note 43, at 1333 n.29. ↑

- .See, e.g., Wal-Mart Stores, Inc. v. Visa U.S.A., Inc., 396 F.3d 96, 101 (2d Cir. 2005) (serving as a named plaintiff, Wal-Mart challenged network policies related to the acceptance of debit card products). ↑

- .Josh Barro, Are Other People’s Credit-Card Rewards Costing You Money?, N.Y. Mag. Intelligencer (Oct. 16, 2018), https://nymag.com/intelligencer/2018/10/are-other-peoples-credit-card-rewards-costing-you-money.html [https://perma.cc/D67A-XAJ5] (noting that the list of firms known to have opted out of the settlement includes Amazon, Target, and Home Depot, among others); Dennis Green, Stores and Credit-Card Companies Are in an All-Out War over Fees, Bus. Insider (Sept. 27, 2018, 9:39 AM), https://www.businessinsider.com/stores-credit-card-companies-battle-fees-2018-9 [https://perma.cc/66HG-UHTV]. ↑

- .Barro, supra note 50. ↑

- .Merchant, supra note 29, at 335. ↑

- .Id. ↑

- .Id. ↑

- .It could certainly be the case that merchant acceptance of credit cards is widespread even though the costs of processing the transaction outweigh the benefits to the merchant because of information asymmetries: the costs of any given transaction will be fairly clear, yet the merchant will have difficulty estimating the total costs (what percentage of customers will begin paying with this network’s cards?) and the benefits (will accepting the cards bring in new customers or induce current customers to spend more?). ↑

- .Adam Levitin, Interchange Theory: Simultaneous Rent-Extraction from Both Merchants and Consumers, Credit Slips (June 23, 2010, 1:32 AM), https://www.creditslips.org/

creditslips/2010/06/interchange-theory.html [https://perma.cc/4RGE-RYFT] (arguing that supracompetitive interchange rates create economic rents that are extracted from both merchants and consumers). ↑ - .John Authers, MasterCard and Visa’s Priceless Business Model, Fin. Times (Mar. 19, 2014), https://www.ft.com/content/693ba6b8-aebd-11e3-a088-00144feab7de [https://perma.cc/

A975-94MD] (identifying the credit card industry “as well-protected an oligopoly as it is possible to imagine”). ↑ - .Richard L. Carson, Economic Growth and the Exchange of Political Support for Rent 1 (Carleton Econ. Papers, Paper No. 09-10, 2017), https://carleton.ca/economics/wp-content/uploads/cep09-10.pdf [https://perma.cc/N4N8-SQBP] (“Empirical studies strongly suggest that rent seeking lowers economic growth by reducing efficiency and total factor productivity.” (citations omitted)). ↑

- .Levitin, supra note 56. ↑

- .See Merchant, supra note 29, at 338, 369 (arguing that the “brilliance” behind credit card networks imposing high interchange fees is that credit card issuers can then stimulate higher credit card purchasing volume through rewards programs while externalizing the costs and noting that research from the Federal Reserve Bank of Boston isolated a $1,282 transfer from cash buyers to card purchasers each year). ↑

- .See infra note 86 (providing empirical data evaluating the total social cost per transaction of various payment methods and finding credit cards to be the costliest form of payment in four different countries, except for Australia where check was the costliest form). ↑

- .Natasha Sarin, Making Consumer Finance Work, 119 Colum. L. Rev. 1519, 1570–71, 1571 n.268 (2019); see also Barro, supra note 50 (quoting economist Tyler Cowen for the proposition that the transfer effected by credit card rewards is “almost certainly regressive in its impact”). ↑

- .Sarin, supra note 62, at 1570. ↑

- .Mann, supra note 3, at 26–27 (identifying an example of a 2% merchant discount fee from which 75% of the total is retained by the issuer as interchange as a “typical allocation”). ↑

- .For a third-party estimate of the break-down of how issuers allocate interchange fee revenue, see Amy Dawson & Carl Hugener, Diamond Mgmt. & Tech. Consultants, Inc., A New Business Model for Card Payments 9 (2014), http://c0462491.cdn.cloudfiles.rackspacecloud

.com/Diamond.pdf [https://perma.cc/X3LW-VMM9]. ↑ - .Frankel & Shampine, supra note 25, at 632 (stating that retailers tend to charge the same price irrespective of payment method, even though cash discounts have been permitted for some time). ↑

- .See Ohio v. Am. Express Co., 138 S. Ct. 2274, 2280 (2018) (holding that American Express’s policy of imposing an antisteering contractual provision on merchants who accept Amex cards does not violate federal antitrust law). ↑

- .Barro, supra note 50. ↑

- .See Frankel & Shampine, supra note 25, at 646 (emphasizing that while buyers choose the form of payment, sellers bear the direct costs of that payment form). Large retailers with high degrees of customer loyalty—with respect to whom this consideration might apply most strongly—have attempted clever workarounds to avoid paying or to reduce the burden of interchange. Starbucks’s mobile-application-based loyalty program illustrates one successful example. Using the application to make purchases allows for the seamless accrual of loyalty points, but the application requires payment for these purchases via a pre-loaded, virtual gift card. When a member’s balance runs low, the app prompts the consumer to reload the card, reducing the number of individual transactions for which Starbucks must pay interchange fees, even if consumers use credit cards to reload their accounts. Jennifer Surane, Retailers Embrace Payment Apps to Sidestep $90 Billion in Swipe Fees, Bloomberg News (Dec. 6, 2018, 4:00 AM), https://www.bloomberg.com/news

/articles/2018-12-06/retailers-embrace-payment-apps-to-sidestep-90-billion-in-swipe-fees [https://

perma.cc/R3LJ-TWKA] (subscription required). Astoundingly, Starbucks had accrued $1.6 billion of “stored value card liabilities” as of the third quarter 2019; one commentator’s analysis suggested that after accounting for permanent loss of some of the stored value, these funds carry an implied negative ten percent interest rate. J.P. Koning, Starbucks, Monetary Superpower, Moneyness (Aug. 21, 2019), https://jpkoning.blogspot.com/2019/08/starbucks-monetary-superpower.html [https://perma.cc/V34J-HSSA]. ↑ - .Consumer Fin. Prot. Bureau, The Consumer Credit Card Market 99–100, 100 fig.1 (2019), https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2019.pdf [https://perma.cc/LD66-8B9V] (showing that over half of all credit card transaction volume in 2018, for every credit tier, occurred on a rewards-linked card); Nessa Feddis, American Bankers Association, Comment Letter Regarding the Consumer Credit Card Market 6

(May 18, 2015), https://www.aba.com/-/media/documents/comment-letter/cl-cardact2015.pdf

?rev=a97891bb10a2478d84b50154d0557297 [https://perma.cc/PRW8-VLQ4] (noting that as of the end of 2014, nearly 90% of total credit card spending involved a rewards card). ↑ - .Consumer Fin. Prot. Bureau, The Consumer Credit Card Market 208–09

(2015), https://files.consumerfinance.gov/f/201512_cfpb_report-the-consumer-credit-card-market

.pdf [https://perma.cc/SS22-A9AY] [hereinafter CFPB 2015 Report] (explaining that “credit card rewards programs have become a central and ubiquitous feature of the credit card industry” and identifying the types of rewards commonly issued by these programs). ↑ - .J.D. Power Reports: Attractive Rewards and Benefits Drive Credit Card Selection, Satisfaction and Spend, J.D. Power (Aug. 20, 2015), https://www.jdpower.com/sites/

default/files/2015137_U.S._Credit_Card_Study_PR_Final.pdf [https://perma.cc/WC2F-KUGS] [hereinafter Attractive Rewards]; see also Credit Card Rewards Battle Continues as Customers Seek Better Programs, J.D. Power Finds, J.D. Power (Aug. 16, 2018), https://www.jdpower.com/

sites/default/files/2018135_u.s._credit_card_study_v2.pdf [https://perma.cc/CDV5-8ELY] (noting that credit card customers are switching cards based on the rewards program offer); Many Customers Are Carrying the Wrong Credit Card, J.D. Power Study Finds, J.D. Power (Aug. 18, 2016), https://www.jdpower.com/sites/default/files/2016153_us_credit_card_study.pdf [https://

perma.cc/2DGC-PPFU] (noting the importance of rewards program in customer satisfaction). ↑ - .Attractive Rewards, supra note 72. ↑

- .Feddis, supra note 70, at 8. ↑

- .Levitin, supra note 43, at 1346 (quoting H. Michael Jalili, New Approaches Advised to Cure ‘Rewards Fatigue,’ Am. Banker (May 21, 2007, 1:00 AM), http://www.americanbanker

.com/issues/172_100/-312658-1.html [https://perma.cc/3ZF7-EF2K]) (identifying a Chase executive as remarking, “rewards are obviously a key determinant in customers’ use of the credit cards”). ↑ - .See, e.g., Fumiko Hayashi, Do U.S. Consumers Really Benefit from Payment Card Rewards?, Fed. Res. Bank of Kan. City: Econ. Rev., First Quarter 2009, at 37, 37 (noting that rewards come from fees that are passed on to consumers in the form of higher retail prices). ↑

- .CFPB 2015 Report, supra note 71, at 210 n.6; see also Claire Tsosie, Where Does the Money for Credit Card Rewards Come From?, NerdWallet (May 19, 2020), https://www.nerdwallet.com/blog/credit-cards/money-credit-card-rewards/ [https://perma.cc/BJ28-UBVW] (emphasizing that consumers are unaware of interchange fees because they are paid by merchants). ↑

- .CFPB 2015 Report, supra note 71, at 210 n.6. ↑

- .Id. ↑

- .One third-party estimate of the components of interchange revenue suggests that this income stream consists largely of profit to issuers, consistent with the hypothesis that interchange fee levels are supracompetitive. Dawson & Hugener, supra note 65, at 9. ↑

- .Mann, supra note 3, at 21–22 (“Traditionally and predominantly, the profit for the typical card issuer comes from the interest that the issuer earns . . . .”); see also Joe Resendiz, How Credit Card Companies Make and Earn Money, ValuePenguin (Dec. 12, 2019), https://www

.valuepenguin.com/how-do-credit-card-companies-make-money [https://perma.cc/NB28-RLE9] (showing that for the quarter ending September 30, 2017, the majority of income for all major issuers, with the exception of American Express, came from interest and not from interchange fees). ↑ - .Hayashi, supra note 76, at 43 (pointing out that “merchants consistently pay higher interchange fees for cards with more generous rewards”); see also Barro, supra note 50 (discussing recent litigation by Amazon, Target, and other retailers aimed at preventing Visa and Mastercard from enforcing honor-all-cards rules so that the retailers can avoid particularly high fees associated with premium rewards cards). ↑

- .Hayashi, supra note 76, at 43. ↑

- .For a succinct overview of retail payment systems, see generally Mann, supra note 3, at

9–19 or Hal S. Scott, The Importance of the Retail Payment System, Harv. L. Sch.