Will Tenure Voting Give Corporate Managers Lifetime Tenure?

Introduction

In the past decade, many household-name companies have sold their shares to public investors while using dual-class voting structures to maintain management control over the company.[1] For example, technology companies, including Alibaba, Facebook, and Google (now Alphabet, Inc.), have all adopted dual-class voting structures.[2] These management-friendly voting systems have been justified as giving their executives the freedom to operate their companies with a goal of long-term value maximization. However, powerful institutional investors dislike these structures because they insulate managers from shareholder monitoring and create impenetrable obstacles to change-of-control transactions.[3] In reaction to pressure from these large shareholders, the S&P 500 recently decided to bar newcomer companies with multiple classes of shares from its flagship index.[4]

In an attempt to find an alternative voting system that might appeal to both groups, prominent legal practitioners and academics recently have advocated that Silicon Valley companies should consider adopting tenure voting systems, i.e., a structure that awards greater voting power to shares held for a longer duration,[5] in lieu of using dual-class voting structures.[6] Attracted by these efforts, well-known Silicon Valley investors have petitioned the SEC to let them create a new Long-Term Stock Exchange (LTSE), all of whose members will use tenure voting.[7] In the next few months, the LTSE intends to seek regulatory approval to become the newest stock exchange in the United States.[8]

Tenure voting may represent an alternative voting system that could satisfy corporate managers’ desire for greater control and simultaneously give long-term investors—insiders or institutional investors with long-term investment horizons—a greater role in these firms’ governance than at firms with dual-class equity structures. Tenure voting, also known as time-phased voting, has been around for many years. While there are relatively few public companies in the United States that employ it, several European jurisdictions have enthusiastically embraced tenure voting to a far greater extent.[9]

Is tenure voting a better choice than dual-class stock for both corporate management and shareholders? In this Essay, we make two main findings that shed light on this question. First, we show that when corporate management holds a large block of company stock prior to the implementation of tenure voting and retains at least 20%–30% of the total number of company shares on a long-term basis, then tenure voting will ensure that corporate managers maintain control of the company even in the face of an attempted change-of-control transaction by a highly motivated dissident shareholder who owns the maximum amount of stock permitted by most poison pills.[10] From institutional investors’ perspective, giving corporate management control while forcing it to maintain a substantial stake in the company (and thereby keeping a continuing strong financial incentive to maximize shareholder value) as the price of control is likely to be preferable to dual-class voting systems in which public shareholders enjoy low or virtually no votes because dual-class exclusively allows corporate management to maintain control even at negligible ownership levels.[11]

Our second important finding is that if corporate management chooses to sell off its large initial block of the company’s stock over time, so that inside ownership levels eventually drop down to a low percentage level with the majority of ownership held by institutional shareholders with different investment horizons, then the use of tenure voting systems does little to protect management control in a proxy contest for corporate control. Moreover, it is likely to lead to a transfer of voting power to passive shareholders who tend to delegate their vote to Institutional Shareholder Services (ISS), a third-party proxy voting advisory service, and therefore cause ISS to “sway” even more votes than it does today.[12] This finding is robust to a wide variety of assumptions about stock ownership levels, shareholder voting preferences, and the degree of influence of third-party voting advisors. In other words, tenure voting will preserve management control only if managers continue to hold a substantial block of shares over time. Otherwise, tenure voting will give long-term (often time passive) institutional investors a greater role in these companies’ corporate governance at the expense of management control over the firm.

We conclude that tenure voting does indeed represent an intermediate form of voting control from a managers’ perspective: it does not guarantee management control, as dual-class share structures do, but it does give control to management who maintain large equity stakes in the firm. Institutional investors are likely to see it as an improvement over dual-class stock structures in terms of giving them corporate governance rights, although it is less advantageous to these shareholders’ rights than a one share/one vote voting system.

Tenure voting could also be a preferable compromise to recent proposals for time-limited dual-class voting schemes. One of these proposals would limit the life of dual-class voting structures in order to ensure that companies were required to hold a second shareholder vote to extend the life of a dual-class structure.[13] While this approach has the advantage of requiring fresh shareholder input on whether to continue the existence of a dual-class system, it also significantly weakens management’s control rights and potentially limits its ability to engage in long-term management practices. Tenure voting with a committed large management block would preserve management control and give shareholders the benefit of a well-aligned controlling shareholder.

This Essay proceeds as follows. In Part I, we examine the legal underpinning of tenure voting, including its statutory and common law basis under Delaware corporate law, as well as the constraints imposed by the stock exchange listing rules and the practical barriers resulting from stockholders’ widespread practice of holding their shares in “street name.”[14] However, the proposed creation of the LTSE and recently enacted Delaware legislation authorizing the creation of blockchain voting systems may well solve the latter problems.

Part II discusses the scant prior empirical and theoretical research on tenure voting. The best-known empirical study is by Professors Dallas and Barry.[15] They found that tenure voting empowers preexisting long-term shareholders but does not strongly encourage long-term shareholding. They also found that companies typically presume most institutional investors are short-term holders because they do not hold their shares in record name.[16]

Part III discusses our data collection and provides an analysis of the average shareholder composition of current American public companies. Since the 1990s, the average annual portfolio turnover rate[17] of all institutional investors was rising until 2007, followed by a steady decline to the long-term average (median) of 60%–65% (30%–35%). Hedge funds are the only category of investors whose investment horizon has been consistently below one year. By comparison, banks, trusts, insurance companies, pension funds, and endowments/foundations will qualify as “long-term” investors using the three-year average holding horizon as the metric. The rest (mostly mutual funds and asset management companies) are intermediate-term holders. In a typical public company, short-term investors tend to hold about 10%–15% of the equity over time, while long-term investors’ stake has shrunk from about 40% in 1990 to less than 20% in recent years.

Part IV presents our model of tenure voting and shows how its adoption impacts control rights within the corporation. Using the data that we created in Part III, and building on earlier work, we simulate corporate voting in two situations: first, when management holds a large block of shares; and second, when there is dispersed ownership. Central to our analysis is the importance of third-party proxy voting advisors in influencing the segment of long-term shareholders who benefit from any tenure voting scheme. In each of these situations we consider how tenure voting affects the likelihood of a

pro-management vote. From our model it becomes clear that the distribution of shares between those long-term shareholders who closely follow the advice of a proxy advisor and those who do not is critical to understanding tenure voting’s effect.

Our model shows that tenure voting is an effective way for management to retain control even in the face of negative recommendations from a proxy advisor. However, this benefit decreases as the total number of long-term shares increases. When management holds only a small stake, tenure voting does little to protect management from a hostile proxy battle, and what little advantage there is depends more on the distribution of shares among the

long-term shareholders than on the actual amount they hold in total.

We finish in Part V with some brief concluding remarks and a discussion of the policy implications of our results. We include a short technical appendix that contains the important details on how our voting model is constructed.

I. The Legal Basis for Tenure Voting Structures

Most major American public companies are incorporated in the state of Delaware, generally because they believe that its corporate law is beneficial to them.[18] The Delaware courts have interpreted the Delaware General Corporation Law (DGCL) to allow tenure voting provisions to be inserted in the corporate charter. Further, a company’s decision to adopt tenure voting, pursuant to a shareholder vote, is subject to business-judgment review by the Delaware courts.

However, stock exchange rules provide a greater check on publicly listed companies’ adoption of tenure voting. Furthermore, there are practical problems that make it quite difficult to track ownership length for shareholders who hold their shares in “street name,” through banks and brokers. Proponents of tenure voting have argued that blockchain technology could be used to address these problems, but we show that even with the newly passed Delaware legislation, it may be difficult to effectively implement such a system. We explore these issues more fully in this Part.

A. Delaware Law on Tenure Voting

1. The Delaware General Corporation Law.—Shareholder advocates have long maintained that investors’ voting rights should closely track their economic interest in the company to ensure that the investors’ incentives are properly aligned with those of the company and other investors.[19] In order to be certain that this alignment occurs, commentators generally have argued that companies should use one share/one vote systems for shareholder voting.[20]

The common law mandatory rule of one share/one vote[21] was short-lived in Delaware. Prior to 1897, shareholder voting rights could be altered in corporate bylaws.[22] However, in the Delaware Constitution of 1897, Article 9, § 6 guaranteed the common law mandatory one share/one vote rule.[23] In 1901 and 1903, Delaware constitutional amendments removed this provision.[24]

The DGCL favors one share/one vote as a matter of policy but tolerates alternative voting structures. Section 212(a) establishes one share/one vote as the default rule unless the company provides otherwise in its certificate of incorporation.[25] Management can unilaterally adopt an alternative voting scheme before the sale of stock.[26] Following the sale of stock, a

board-recommended charter amendment that is approved by a shareholder vote can alter the corporation’s voting structure.[27]

Early challenges to similar alternative voting schemes upheld tenure voting. While § 151(a) requires that all stocks in the same class have uniform “voting powers,”[28] in Providence & Worcester Co. v. Baker,[29] the Delaware Supreme Court found that a scaled voting structure did not create disparate voting powers in a class of stock.[30] In that case, the voting scheme awarded greater voting power to stocks based on the size of the share bloc.[31] The court reasoned that the quantity requirements were a restriction on voting rights, not voting powers, because all shares enjoy the same opportunity to attain more votes.[32] “The voting power of the stock in the hands of a large stockholder is not differentiated from all others in its class” because other stockholders exercise the same voting rights by attaining the threshold number of shares.[33] The scaled voting structure in Providence & Worcester is analogous to tenure voting, simply substituting the limiting factor of holding duration for holding size.[34]

2. Unilever and Williams v. Geier.—Prior to Williams v. Geier,[35] the decision of the U.S. District Court for the Southern District of New York in Unilever Acquisition Corp. v. Richardson-Vicks, Inc.[36] was the only decision addressing tenure voting under Delaware law. In Unilever, the Richardson–Vicks board of directors voted for the issuance of a stock dividend to common stockholders consisting of one “preferred stock” for every five shares of common stock.[37] The preferred stock was a superior voting share entitled to cast twenty-five votes on all issues that common stock could vote on; however, if the preferred stock was transferred, then it reverted to five votes until held for thirty-six months.[38] Unilever, a potential acquirer, challenged the stock dividend as an illegal interference with stockholder voting rights.[39]

The federal district court found that the stock dividend was impermissible under Delaware law because the board exceeded its authority granted by the corporate charter.[40] The charter allowed the board to issue new series of stock with identical voting rights, and the court held that the preferred stock with tenure voting created separate classes of stock.[41] The Unilever court distinguished the board’s action from Providence & Worcester, because the alternative voting scheme in Providence & Worcester was in the company’s charter for a century.[42] Second, the court held that issuance of tenure voting stock constituted a restriction on transfer under DGCL § 202, requiring the approval of affected stockholders.[43]

In Williams, the Delaware Supreme Court rejected Unilever, holding that a board’s recommendation of a charter amendment to adopt tenure voting is subject to business-judgment review.[44] The facts of the case showed that the defendant-corporation, Milacron, was a controlled corporation, dominated by the Geier family.[45] The board recommended to shareholders a charter amendment that created a high–low tenure voting structure, known as the Recapitalization Plan.[46] It granted existing stockholders ten votes per share.[47] Shares sold or transferred after the effective date would revert to one vote per share, and newly issued shares would have one vote per share initially.[48] After thirty-six consecutive months of ownership, the shares would be entitled to ten votes.[49] The Chancery Court analyzed the claim that the directors’ recommendation breached their duty of loyalty under the Unocal Corp. v. Mesa Petroleum Co.[50] standard, categorizing the Recapitalization Plan as a defensive measure and finding the plan was reasonable given the threat.[51] On appeal, the plaintiff–shareholder claimed the more onerous standard in Blasius Industries, Inc. v. Atlas Corp.[52] applied to the board’s recommendation.[53]

The Delaware Supreme Court found neither the Unocal nor the Blasius standard applied.[54] The court held that only unilateral, defensive board action triggers the higher Unocal standard.[55] It reasoned that the shareholder vote approving the amendment precluded Unocal analysis.[56] The even stricter Blasius standard applies “only where the primary purpose of the board’s action [is] to interfere with or impede exercise of the shareholder franchise,” and when shareholders “are not given a full and fair opportunity to vote.”[57] The court held the record lacked evidence that the purpose of the charter amendment was to disenfranchise shareholders and further held that the shareholders had been given a full and fair opportunity to vote.[58] After Williams, there remains no doubt that Delaware law permits tenure voting systems.

B. Stock Exchange Listing Requirements

For public companies, the stock exchange listing rules provide a second layer of regulation that governs alternative voting schemes. In July 1988, the SEC enacted Rule 19c-4, which prohibited stock exchanges from permitting dual-class equity in listing standards amid fears of shareholder disenfranchisement.[59] Passing Rule 19c-4 effectively required exchanges to keep the one share/one vote rule by barring listed companies from issuing shares carrying more than one vote.[60] However, shortly thereafter, the D.C. Circuit struck down Rule 19c-4, stating that it regulated an issue of corporate governance that did not further the purposes of the Exchange Act.[61]

Within a few years of that decision, the New York Stock Exchange (NYSE) (and other exchanges) adopted a voting rights policy that had some similarities to the now-defunct SEC Rule 19c-4.[62] The NYSE listing standards state: “Voting rights of existing shareholders of publicly traded common stock registered under Section 12 of the Exchange Act cannot be disparately reduced or restricted through any corporate action or issuance.”[63] The NASDAQ has its own similar rule.[64] The NYSE standard, based on Rule 19c-4, is more flexible than the earlier, defunct SEC rule: the NYSE policy permits publicly listed companies to adopt alternative voting schemes, such as tenure voting, when issuing stock in an initial public offering (IPO).[65]

The NYSE voting rights policy precludes companies from adopting tenure voting plans for existing shares. The standards list “adoption of time phased voting plans” as an example of corporate action or issuance that would “disparately reduce[] or restrict[]” voting rights.[66] Time-phased voting includes “plans that restrict the voting [rights] of shares based on the length of time the shareholder has held the stock,” which is the equivalent of tenure voting.[67] Therefore, most commentators agree that listing rules allow the adoption of tenure voting at only the IPO stage.

Overall, there is little disagreement that the NYSE rules constitute a ban on tenure voting for existing publicly listed companies, although some question whether the rule should be amended.[68] Recently, Berger et al. have argued that high–low tenure voting plans (such as the Recapitalization Plan in Williams) do not violate the NYSE voting rights policy and can be adopted by public companies for existing shareholders.[69] They claim that a high–low plan does not disparately reduce or restrict the voting rights of existing shareholders.[70] Although the Delaware Supreme Court in Providence & Worcester described alternative voting arrangements as “restrictions” on “voting rights,”[71] Berger et al.’s reasoning is that the restriction is not disparate, which tracks the reasoning used by the Providence & Worcester court to permit scaled voting under DGCL § 151(a): tenure voting grants all shareholders equal opportunity to gain additional voting rights.[72] To the best of the authors’ knowledge, no public company has yet attempted to adopt tenure voting in this situation.

C. The Beneficial Ownership Problem and Blockchain Technology

Prior to the 1970s, the United States had a “paper system” of stock ownership where all the intricacies of transfer were completed manually by clerks at brokerage firms.[73] A clearing crisis occurred from backlogged transfers in the 1970s that prompted the shift to a centralized, depository model.[74] A centralized system was advocated for by leaders of finance because keeping shares in one place and in one name dramatically simplifies transfer of stock.[75] Thus, several entities were created to manage a true depository system, eventually culminating in the Depository Trust Company (DTC)[76]—the designated central securities depository.

Under the indirect holding system, the vast majority of stock is owned by Cede & Co., eliminating the paper problem and resulting in almost dematerialization of stock.[77] Cede & Co. is a New York City-based partnership founded in 1996 to hold substantially all of the stock in the United States on behalf of the DTC. While stock is owned by Cede & Co., it is registered in the broker’s name.[78] When stock is purchased by a stockholder, the stock is registered under the name of the broker facilitating the transaction, which is known as street name holding.[79]

Corporations are generally required to maintain a list of stockholders to allow stockholders to exercise their rights, such as voting and inspecting the books. Section 219(a) of the DGCL requires the officers of Delaware corporations to create and update a stockholder list.[80] A shareholder is defined as those registered on the annual stockholders list.[81] The process of compiling a stockholder list is arduous. At least twenty business days prior to the record date of the shareholder meeting, the corporation must contact the DTC to specify the participant firms—otherwise the entire stockholder list could only contain one name, “Cede & Co.”[82] This request is often called the “Cede breakdown.”[83] Following this initial request, there are a series of communications between brokers and banks, the DTC, and the issuer to establish the beneficial owners of the issuer’s stock. Unsurprisingly, this process is ripe for error.[84]

Because of these difficulties, companies that use tenure voting frequently have difficulty determining which of their shareholders are entitled to receive higher voting power on their shares if the shares are held in street name.[85] The reason for this problem is that only record holders of corporate shares are statutorily entitled to cast their votes, and when a shareholder holds their stock through a bank or broker, the company has difficulty determining who the beneficial owner is and how long they have held the stock.[86] The rapid increase of high frequency trading in the past fifty years has made ownership murkier.[87] Companies therefore commonly treat all shares held in street name as low-vote stock.[88] Thus, stockholders who own shares in street name are disparately impacted by tenure voting plans. They do not share an equal opportunity to gain increased voting rights by long-term ownership because the company is not accurately tracking the duration of these holdings.[89]

Recent legislation in Delaware permitting companies to adopt blockchain (also called distributed ledger) technology may solve this problem.[90] Blockchain technology allows for stock ownership to be digitally tracked, so all shareholders would own stock in their names.[91] Clearing and settlement of securities transactions could be instantaneous through digitization of securities and blockchain technology.[92] In December 2016, after receiving approval from the SEC in December 2015, Overstock became the first public company to offer digital securities.[93] According to the Overstock proxy statements, the digital securities could be held in the purchaser’s name directly.[94] The great advantage of this process for tenure voting systems would be that it would make it easier for companies to trace the identity of their shareholders and therefore more accurately assign high and low voting rights.[95]

Delaware’s response to the blockchain trend could foreshadow its mainstream success. Former Delaware Governor Jack Markell launched the Delaware Blockchain Initiative that committed the state to the use of blockchain and requested legislators to clarify whether Delaware corporate law permits use of blockchain to track share issuances and transfers.[96] On July 21, 2017, current Governor John C. Carney Jr. signed into law amendments to the DGCL that allow companies to keep shareholder information on blockchain distributed ledger technology and communicate with investors via blockchain.[97] The amendments took effect immediately.[98]

The amendments allow corporations to issue stock using blockchain and maintain stock ledgers through blockchain technology. Section 219 of the DGCL, which requires a corporation’s stock ledgers be used to determine voting entitlements, was amended to expressly define “stock ledger.”[99] Now “stock ledger” is defined as “[one] or more records administered by or on behalf of the corporation in which the names of all of the corporation’s stockholders of record, the address and number of shares registered in the name of each such stockholder, and all issuances and transfers of stock of the corporation are recorded in accordance with § 224 of this title.”[100] Maintenance of corporate records by use of electronic networks or databases is now permitted expressly by § 224.[101] In addition, §§ 151(f), 202(a), and 364 were amended to allow notice required by statute to stockholders to be delivered by electronic transmissions.[102]

Delaware’s express allowance of blockchain paves the way for modernizing securities transactions, but blockchain presents a new set of challenges as well as a solution to the trackability problem. Blockchain promises a myriad of benefits for shareholders: lower cost of trading, more transparency in ownership records, and real-time observation of ownership transfers that could facilitate shareholder activism.[103] Blockchain could allow activists to buy shares faster and cheaper than the current system that makes locating stockowners for an outsider arduous.[104] In addition, “[c]orporate voting could become more accurate, and strategies such as ‘empty voting’ that are designed to separate voting rights from other aspects of share ownership could become more difficult to execute secretly.”[105]

The potential downsides of blockchain are also manifold. First, the gatekeeper—the party with authority to encode new transactions into blockchain—has an enormous amount of power that could be abused: “The gatekeeper can restrict entry into a market, assess monopolistic user fees, edit incoming data, treat some users preferentially, limit users’ access to market data, and possibly share user data with outsiders.”[106] Further, the security of blockchain has posed challenges. High-profile bitcoin heists have made headlines. While hackers have been unable to breach the security of Coinbase, the most trusted cryptocurrency intermediary, its individual users are frequently hacked.[107] Experts claim that the primary security risk of blockchain is hacking of individual user accounts rather than system hacks.[108] Lastly, the length of the phasing-in period and complexity of blockchain may give some onlookers pause. Commentators have questioned whether blockchain was making a mountain out of a mole hill and suggested that there may be simpler ways of keeping a ledger.[109] Some experts estimate that the phase-in period may take many years.[110] This timeline dampens hopes that blockchain would provide an immediate, fix-all solution for the trackability problem.

II. Prior Research on Tenure Voting

In spite of the concern about the short-term orientation of corporate shareholders, there has been remarkably little written on how to provide the appropriate incentives to them to extend their time-horizons. One way would be to reward them for holding their shares for an extended time. This approach, essentially providing call-options to shareholders that vest over time, has been explored by Bolton and Samama.[111]

The alternative we explore, tenure voting, rewards shareholders with extra influence in the decisions of the corporation if they retain their shares. The best-known study of tenure voting is by Professors Lynne Dallas and Jordan Barry, who examined twelve U.S. companies employing tenure voting (referring to it as time-phased voting) to determine its effect on corporate governance and managerial myopia.[112] Dallas and Barry found that tenure voting empowers preexisting long-term share owners but does little to encourage long-term shareholding.[113] Despite a small and homogenous sample size that inhibits drawing causal inferences, the study sheds light on trends associated with tenure voting plans. The Dallas and Barry article makes two basic points. First, the authors provide a policy perspective on tenure voting, analyzing it in the context of corporate law and dual-class equity scholarship.[114] Second, the authors investigate their hypotheses by studying twelve American companies with tenure voting.[115]

Dallas and Barry begin by examining three potential justifications for adopting tenure voting to reduce management myopia. First, since tenure voting gives long-term shareholders more control over management, management will presumably focus on pleasing long-term shareholders.[116] Second, tenure voting should encourage long-term shareholding by awarding greater voting power based on duration of holdings.[117] Lastly, it could change firm culture toward a focus on long-term value maximization.[118]

The validity of these claims is difficult to measure, particularly because their sample size was small and comprised substantially similar companies. Unfortunately, this seems unavoidable due to the limited pool of American companies employing tenure voting.[119] Ten of the twelve publicly listed companies adopted tenure voting between June 1984 and June 1987, during the brief window after the NYSE abolished mandatory one share/one vote and before the current NYSE rule barring adoption of tenure voting post-IPO, and which still remained on the NYSE.[120] Ten of the twelve companies were family-controlled, and their plans had features summarized in the note below.[121]

The authors found that for these plans, tenure voting did not reduce managerial myopia by increasing long-term shareholding. Instead, the concentration of insider ownership decreased when companies adopted tenure voting.[122] Moreover, tenure voting had no significant impact on ownership by institutional investors, nor did it increase long-term ownership.[123] Long-term shareholder ownership actually decreased throughout the course of tenure voting.[124]

The Dallas and Barry study revealed that, like dual-class equity, tenure voting provided for an increased wedge between ownership and control by allowing insiders to partially sell their holdings while maintaining voting power. The resulting increased agency costs might be offset if there was increased external long-term ownership or a cultural shift in management toward long-term value. However, they found no evidence to support these conclusions. Importantly, six of the twelve companies studied subsequently rescinded their tenure voting structures, primarily because it was not in accordance with the “basic tenet of corporate democracy” that prevails in U.S. companies.[125]

More recently, tenure voting was the focus of a paper by David Berger, Professor Steven Davidoff Solomon, and Aaron Benjamin that advocated for its adoption. Berger et al. propose tenure voting as a more desirable alternative than dual-class equity to address the problem of short-termism.[126] Managerial myopia is rising, they claim, for two reasons. First, Berger et al. argue that holding periods have shortened even among institutional investors.[127] Second, they claim that increased shareholder activism has propelled management to be short-sighted.[128] Taken together, they view these things as a threat to the health of the economy.[129]

As a solution, the authors argue that tenure voting is a preferable option to dual-class equity. The authors claim tenure voting increases investors’ incentive to hold, reduces myopic bias, attracts patient capital, and improves firm culture.[130] However, the claim that shareholders will increase their holding due to the promise of greater voting rights has not been supported by any empirical evidence. The other proposals, that tenure voting will reduce myopic bias, attract patient capital, and improve firm culture, also rely on the assumption that tenure voting will prompt increased long-term ownership and that ownership is not passive. The structure of the tenure voting plans that Berger et al. propose are very similar to the structures adopted by the companies in the Dallas and Barry study.[131]

While all analysts agree that tenure voting can entrench management, no research has analyzed the impact of tenure voting on the likely success of a shareholder activist in a voting contest, such as a vote on a shareholder proposal and short slate proxy contest. Obviously tenure voting reduces an acquirer’s ability to take over the board relying on their own voting rights because not only would they need to acquire a control bloc, they would also have to wait for the stock to mature. Less clear is how tenure voting will affect the outcome taking into account the stances of outside investors with different holding periods. This will be the focus of our theoretical modelling exercise using a weighted-voting model in Part IV below.

To set the stage, in Part III, we discuss how we compiled the data for our weighted-voting model. Surprisingly, we found that no prior academic work has had a focused presentation of investor holding horizons, so we also describe our data collection process for the benefit of future scholars.

III. Data Collection

In order to ground our assumptions in our weighted-voting model firmly in reality, we gathered data on portfolio turnover by different groups of institutional investors as well as the investor composition of these firms. Our data on investor holdings comes from the Thomson Reuters Ownership 13F database, a comprehensive database of quarter-end holdings of public equity by institutions that exercise investment discretion over U.S. publicly traded securities with an aggregate value over $100 million.[132] The sample used for our study spans the period of 1990 to 2015.

A. Portfolio Turnover of Institutional Investors

One important question for tenure voting systems is how frequently investors turn over their shares. If a tenure voting system awards more votes to shares that have been held for three years or more, for example, who are these long-term investors and how likely is it that investors will hold the stock for that length of time (or longer)? In order to come up with some estimates of these values, we apply two methods to classify institutions into

“long-term,” “intermediate-term,” and “short-term” investors.

In the first method, we impute each individual investor’s annualized portfolio turnover rate based on their inter-quartile holdings changes.[133] More specifically, the annual portfolio turnover rate is compounded from the quarterly turnover rates, whereas the latter is calculated as the lesser of “purchases” and “sales,” divided by the average portfolio size of the last and the current quarters.[134] Because we do not directly observe purchases and sales, they are proxied by the total value of increase (decrease) holdings in a quarter-end relative to the previous quarter-end. Therefore, the annualized turnover rate imputed this way is a lower bound for the actual turnover rate because it does not include trades that were reverted within the same quarter.

According to Puckett and Yan, who compare 13F data with full trading data by some institutional investors (most mutual funds), intra-quarter

round-trip trades (which are missed from our imputation due to data limit) “account for approximately 20% of a typical mutual fund’s trades.”[135] The gap is smaller for other institutions that trade less frequently (e.g., pension funds and insurance companies) than the average mutual funds and vice versa for more actively trading institutions such as hedge funds.[136] Therefore, measures based on inter-quarterly position changes preserve the order among different types of investors in terms of their actual portfolio turnover rates. We classify a 13F institution to be long-term, intermediate-term, or short-term if its imputed annualized portfolio turnover rate is below 33% (corresponding to an expected holding horizon of three years or longer), between 33% and 100%, or over 100% (corresponding to an expected holding horizon of shorter than one year). The horizons of individual institutions, though time-varying, are highly persistent.

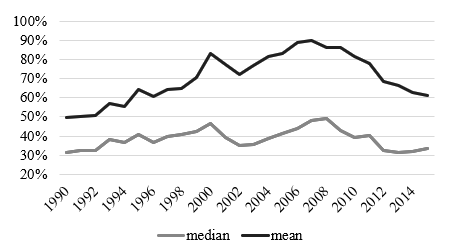

In the full sample of pooled institution-year panels, the mean (median) annual turnover rate is 73.5% (38.3%), with an inter-quartile change from 19.5% to 82.2%. Figure 1 shows the average/median turnover of all 13F institutions by year. The figure shows that turnover peaked in the years before the last two recessions and has been on a downward trend since 2008.

Figure 1. Mean and Median Investor Portfolio Turnover

This figure shows the average and median annual turnover rate of all 13F institutional investors from 1990 to 2015. Each investor’s annual portfolio turnover rate is compounded from quarterly turnover rates. The latter are calculated as the lesser of “purchases” and “sales,” divided by the average portfolio size of the last and the current quarters.

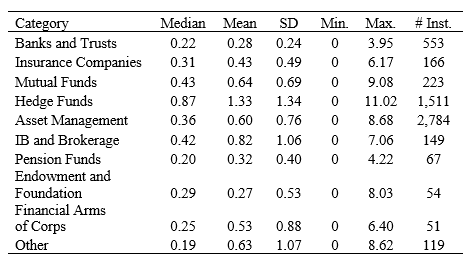

In the second method, we classify an institution’s investment horizon by the category of institutional investors. Based on data shared by Agarwal, Jiang, Tang, and Yang[137] and Agarwal, Fos, and Jiang,[138] we are able to sort all 13F institutions into one of the following broad categories: banks and trusts; insurance companies; asset management companies that are primarily mutual funds; asset management companies that are primarily hedge funds; other asset management companies; investment banks and brokerage; pension funds; endowments and foundations; corporations; and other. The summary statistics of portfolio turnover of all categories are reported in Table 1.

Table 1. Portfolio Turnover by Investor Category

This table displays the turnover summary statistics by investor category. Based on data shares by Agarwal, Jiang, Tang, and Yang[139] and Agarwal, Fos, and Jiang,[140] we classify all 13F institutions into one of the listed broad categories.

Based on the mean turnover rate, we consider hedge funds to be short-term investors; banks and trusts, pension funds, and endowment and foundations to be long-term investors; and the rest to be intermediate-term investors. Such a classification conforms to the common perceptions of market participants.[141]

B. Investor Composition of Companies

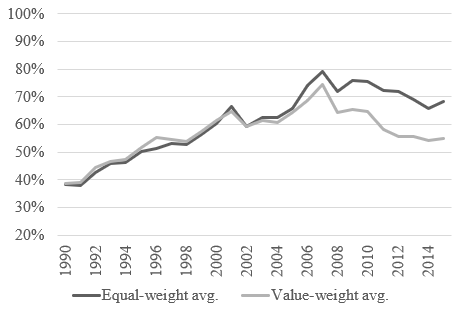

Next, we focus on investor composition at the issuer (company) level with regard to investment horizon. This will be important in our weighted-voting model. For each company-year, we compute the average shareholder turnover by calculating the equal- or value-weight average of portfolio turnover rates of all equity investors in a given company-year. The value weights are proportional to each investor’s equity holdings in the company at the year-end. Figure 2 plots the time trend. It shows that the average shareholder turnover in a given company has been on the rise up to 2007, followed by a steady decline. The patterns are similar whether we equal- or value-weight investors in the companies. The fact that the value-weight graph stays significantly below the equal-weight graph post-financial crisis indicates that large shareholders in public companies are turning over their shares slower than before.

Figure 2. Investor Turnover in an Average Company

This figure shows the average of the shareholder turnover in publicly listed companies. We compute the shareholder turnover of each company by calculating the equal- or value-weighted average of shareholder turnover rates. The value weights are proportional to each investor’s equity holdings in the company at the year-end. The black series indicates the equal-weighted average shareholder turnover, and the gray line indicates the value-weighted average.

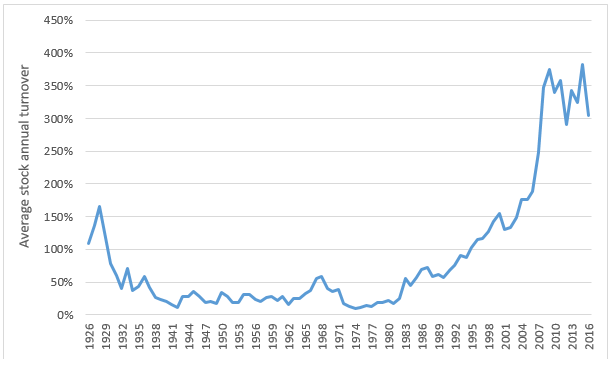

The pattern poses a curious contrast to the common perception that shares are changing hands faster and faster over time. Indeed, we find that at the issuer (share) level, annual turnover has been on the rise all the time since the early 1980s, from an average of 50% annual turnover rate to 300% in the most recent years. That is, during the past three-and-a-half decades, the average share of stock changes hands from every two years to every four months. Thus, it is tempting to deduce that companies are held by increasingly transient shareholders. This is not the case, as shown in Figure 2. The seeming discrepancy is due to the fact that large shareholders in most companies have slowed down their portfolio turnover rates over the last decade, while a small set of investors (e.g., high-frequency traders) are driving up the trading volume.

Figure 3. Annual Turnover Rate (1926 to 2016)

Figure 3 plots the annual turnover rate, averaged over all stock with equal weights, in each year from 1926 to 2016. The annual turnover rate is defined as the ratio of annual trading volume during the year to the average of the number of shares outstanding at the year-beginning and year-end. The data are taken from the Center for Research in Security Prices (CRSP). The annual turnover rates at the stock level started to trend up in the 1980s and then increased dramatically around the mid-2000s, coinciding with the rise of algorithmic trading. However, it is important to note, as illustrated by Figures 1 and 2, that increasing turnover rates at the stock level do not imply that the typical or most institutional investors are churning their portfolio faster, nor do they suggest that companies are increasingly held by short-term investors.

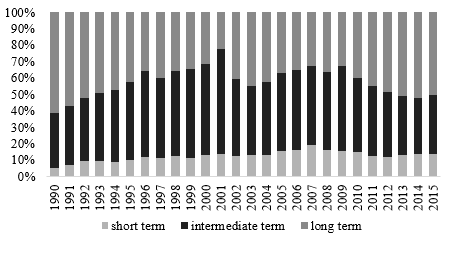

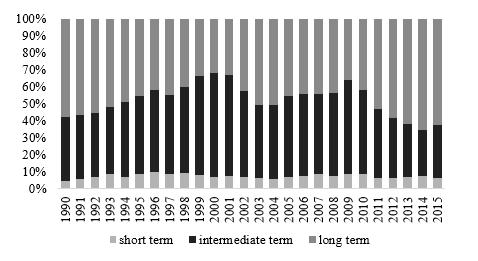

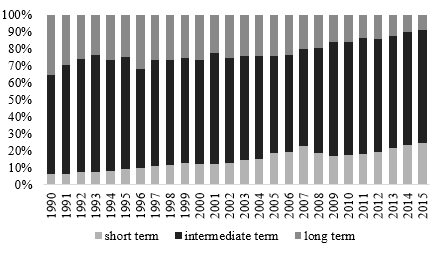

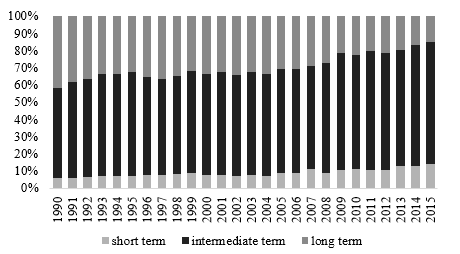

In addition to the summary statistics, such as average investor horizon in given companies, it is also important for our purposes to explore the relative composition of shareholders with different horizons, e.g., what percentage of ownership stakes are held by investors with short- or long-term investment horizons. Figure 4 demonstrates the pattern from different angles.

Figure 4. Investor Composition in Publicly Listed Companies

The following panels show the composition of shareholder horizons in publicly listed companies over time. Investor composition is calculated as the percentage stake of each type of investor and is then averaged (using equal-weights or market-cap weights) over all companies. We use the following classification for investor horizon: short-term (less than one year), intermediate-term (one to three years), or long-term (three or more years). Panels A and B classify each investor by its turnover rate, while Panels C and D classify each investor by its investor category horizon using Table 1 (e.g., hedge funds have a mean turnover rate of 1.33 so are classified as short-term). Panels A and C use equal-weights to average over all companies, while Panels B and D use market-cap weights.

Panel A: By individual investor classification; equal-weights for companies

Panel B: By individual investor classification;

market-cap weights for companies

Panel C: By investor category classification; equal-weights for companies

Panel D: By investor category classification;

market-cap weights for companies

Panels A and B of Figure 4 show investor composition over time. First, we compute the percentage stakes by each type of investor and then average (using equal-weights or market-cap weights) over all companies in a given year. There has been an increasing number of short-term shareholders in an average company over time; however, the trend is absent if we weigh companies by their market caps. Such a combination suggests that short-term investors have taken increasing stakes in relatively small companies.

Long-term shareholders experienced a clear “U”-shaped trend whether

equal- or value-weighted: They were shrinking until about the early 2000s and then have been on a steady rise since. By 2015, long-term investors held 50% to 60% of the shares in companies by equal- and value-weighted averages.

Panels C and D show plots analogous to those in Panels A and B except they classify the time horizon by investor categories. For example, all insurance companies are treated as long-term investors regardless of their individual portfolio turnover rates, and all hedge funds are treated as

short-term investors regardless of their individual trading strategies. They show that hedge funds, the only category of short-term investors, have seen their ownership on the rise, while stakes by long-term investors (banks, trusts, pension funds) have been retreating at a comparable pace, leaving the intermediate category mostly stable over time.

IV. Modeling Tenure Voting

To gain some appreciation for the effect that tenure voting may have on the outcome of corporate contests, we will employ a weighted-voting model. We have used this model earlier to investigate takeover contests[142] and to analyze the effect of lowering the size of poison pill triggers on takeovers.[143] It is a simulation model that estimates the probability of votes favoring management given the distribution of shares among various constituencies with different investment horizons and assumptions of the influence of third-party proxy services on those constituencies.

A. Background to the Model

Following the methodology of an earlier paper by two of the authors here,[144] we partition the corporation’s shareholders into seven different constituencies: Management, Dissident, four different institutional groups (Institutions I–IV), and the Public. For each of these groups, we make some baseline assumptions about its bias toward management as well as how closely it follows a signal from a third-party proxy advisor (who, for convenience, we identify as ISS). For this Essay, we further subdivide the institutions into those who are long-term shareholders and those who are short-term holders of stock. The long-term holders of stock will hold the high-vote shares from tenure voting, while the short-term shareholders will be able to vote only the shares that they own.

To keep things manageable, we will consider only the situation in which a dissident has acquired a substantial stake in the corporation and is pursuing a proxy contest. For this application, we construct four institutional blocks in the following way:

Institutions I and II are the long-term institutional investors. Institution I, including most passive long-term investors, largely follows the advice of ISS. Institution II is the long-term investors who act independently. Most of our results assume that neither of these groups has a preexisting bias toward or against management’s position. Given our interest in the possibility of management entrenchment, we feel that this is the most conservative position to take, and for the most part there is little difference in the results if we assume a pro-management bias. We will comment separately on those situations where it matters.

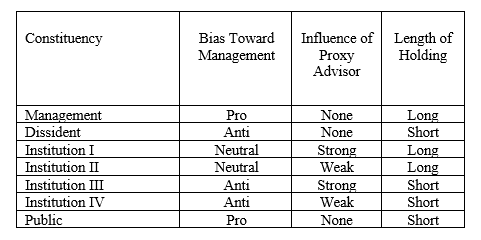

Institutions III and IV are the short-term institutional investors. We assume that the former follows the advice of ISS and the latter acts independently. In either case we will assume that they exhibit a bias against management’s position. We think that this assumption is consistent with the observed behavior of hedge funds and arbitrageurs taking positions in companies around the time of a corporate event, often with the intention to facilitate the change. While this assumption affects the overall size of the probabilities we report, it does not affect the relative sizes and hence does not qualitatively change any of our conclusions. Table 2 gives a qualitative explanation of our assumptions about the behavior of the constituencies and the nature of their holdings. Details of how these assumptions are implemented in our model can be found in the Appendix.

Table 2: Behavioral Assumptions for Major Shareholder Groups

We are also able to examine how different ways of allocating extra votes in tenure voting might alter the outcome. We consider both 3–1 and 10–1 tenure voting schemes. The former is at the low end of one reform proposal.[146] The latter is the most common scheme currently in use.[147]After we specify the distribution of shares among the constituencies, we can begin our simulation. We consider two cases: first, when there is a substantial block held by management, and second, when there is a significant dispersal of shares. The former case is particularly important because it is the most common situation in which tenure voting has actually been employed.[145] The latter situation is more speculative as to the potential significance of allowing tenure voting in a dispersed ownership firm. We will investigate how the use of a tenure voting regime changes the likelihood of a management victory. As we will see, the role of the proxy advisor is significant in this analysis.

B. Results of the Model

1. Concentrated Ownership.—As discussed earlier, tenure voting is currently limited to firms with large management holdings, usually arising from family-owned firms. Our baseline case consists of Management holding 30% of the stock and Dissident holding 10%. The latter assumption is consistent with the work of Fos and Jiang, who show that in proxy contests, the average dissident stake is close to 9.6%.[148] We assume also that Public retail investor’s holding is 10% and their vote is biased toward Management. These assumptions are consistent with the estimates given by Broadridge.[149] We will vary the holdings of the institutional investors. Based on our simulations, our conclusions are:

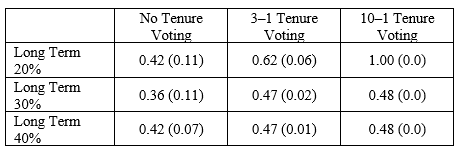

Tenure voting is a very effective way for concentrated ownership to entrench itself against aggressive dissidents. However, this benefit decreases as the size of the long-term institutional stake increases. In addition, as the percentage of long-term shares increases there is little added benefit to having tenure voting at a 10–1 ratio over a 3–1 ratio.

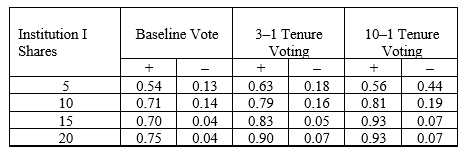

Table 3: Average Likelihood of a Pro-Management Vote Given an ISS

Anti-Management Recommendation

At a typical external long-term holding amount of 20%, we see that management can vastly improve its likelihood of a friendly vote by instituting tenure voting, and the more generous the tenure supplement the better. Interestingly, as the size of the long-term holding increases, this benefit decreases. There is still an advantage to management, but it drops by as much as half while the difference between a 10–1 supplement and a 3–1 supplement disappears. The intuition for this outcome is that as long-term holdings increase, the number of institutions that take proxy advice increase, and so a negative recommendation from the advisor has a larger impact on the outcome. We can see in Table 4 the opposite side of this effect by considering the likelihood of a pro-management outcome given a pro-management recommendation by ISS.In Table 3, we show the effect of tenure voting on the average likelihood of a pro-management vote in the face of an anti-management recommendation from ISS.[150] The rows show the total amount of stock held by the long-term institutions. The number is the average of the probability of a pro-management outcome given an anti-management recommendation by ISS, where the average is taken over all the ways to share that amount of stock between the two types of long-term investors. The number in parentheses is the standard deviation of those probabilities.

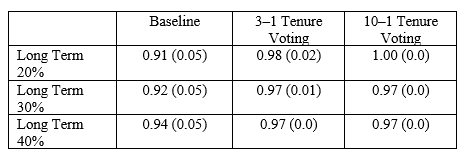

Table 4: Average Likelihood of a Pro-Management Vote Given a

Pro-Management Recommendation

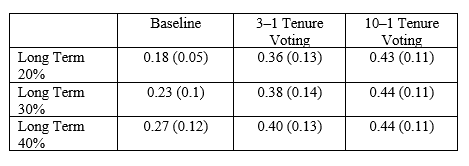

As management’s share drops, one still observes a benefit of tenure voting and, on a relative basis, the advantage of tenure voting actually increases. As an example, Table 5 shows the results if management holds only 20% of the stock. As one would expect, the likelihood of management success is less when its holding is smaller. But when the external long-term holdings are large, the advantage of tenure voting over the baseline stays significant. For example, when long-term holdings are 40%, our baseline no-tenure voting estimate gives management a 27% chance of winning, but with tenure voting that increases to between 40% and 44% depending on the bonus. Indeed, the likelihood of success in this instance is nearly identical to that shown in Table 3 when management holds 30% of the stock.Of course, this pro-management effect is much more limited because management was already likely to win a contest.

Table 5: Likelihood of a Pro-Management Vote Given an ISS

Anti-Management Recommendation with

Small Management Holding

Note that in Tables 4 and 5 the implementation of tenure voting decreases the standard deviation of the probability. That is, the importance of the distribution of the shares between long-term shareholders is less important under tenure voting than regular voting.Hidden in these tables is the importance of how the long-term shares are allocated between those institutions that follow ISS and those that do not. How the distribution of long-term shares, between those that follow ISS and those that do not, affects the likelihood of management success is captured by the standard deviation—the number in parentheses in each cell of Tables 4–6. Each cell represents an average over the way the long-term shares are divided between Institution I and Institution II, so the standard deviation measures how much variation in the probability of management success there is among those different allocations. As an example, in Table 3 we see that under our baseline method of voting, the larger the long-term holding, the smaller the standard deviation (from 0.11 to 0.11, to 0.07, reading down the column), so we conclude that the actual distribution of the long-term shares matters less as the size of that holding increases.

This effect reverses in Table 5. The distribution of long-term shares between the two types of institutions becomes more significant with tenure voting than with regular voting. For example, under the baseline method with long-term shares at 20%, there is a standard deviation of 0.05, whereas with a 3–1 tenure vote the standard deviation is 0.13, more than double.

Thus, if management instituted tenure voting while holding 30% of the shares with the expectation that they will divest themselves of some of those shares in the future, the result will be to significantly increase their risk in two ways. First, just shrinking their stake lowers the likelihood of winning a proxy contest. We see this clearly by comparing the values in Table 3, where management holds 30%, and Table 4, where management holds only 20%, although the effect is moderated in the case of a 10–1 bonus.

The second source of risk is in the distribution of the long-term shares. We see that the standard deviation of the outcomes varies more with tenure voting than regular voting. Since we do not know, a priori, what that distribution might look like in a counterfactual world of tenure voting and small management holding, management will take on all of that risk. As we will see now, this is even more important in the case of dispersed shareholding.[151]

2. Dispersed Ownership.—For analyzing the use of tenure voting in dispersed ownership, we will assume that Management holds 3% of the shares and the hostile Dissident still holds 10%. We will consider two cases, one in which the long-term institutions hold a total of 21% and a second case in which they hold 31%.[152] We assume the remaining shares are divided equally between the short-term institutions with the Public holding 10%. Based on our simulations, our conclusions are:

In the dispersed shareholder setting there is little advantage to management to implement tenure voting in light of a negative ISS recommendation. There is some benefit to management in light of a positive ISS recommendation. What benefit there is depends more on the distribution of the shares between the long-term shareholders than on the amount that the long-term shareholders own. Often there is little or no benefit at all.

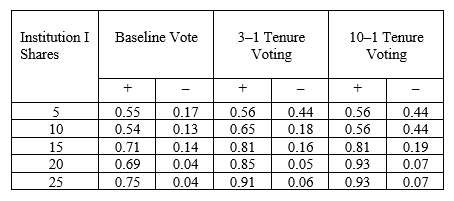

Table 6: Likelihood of Pro-Management Vote with Long-Term

Holding 21% Given the Amount Held by Institution I Shareholders

What do we observe in this table? When the number of shares held by Institution I investors, those that follow ISS, is small, there is little difference between the results of a regular vote and one with a tenure voting rule of 3–1, in the face of a negative ISS recommendation. As the number of shares held by Institution I increases, there is some, though limited, benefit to management of a 3–1 bonus if the ISS recommendation is positive.[153]In Table 6 we show the likelihood of a pro-management vote when the long-term shareholders have a total of 21% of the shares. The rows are indexed by what share of that 21% is held by Institution I investors—those who follow the advice of the proxy-advisor. We have listed only five of those cases, but the amounts not listed are consistent with the pattern shown. For each situation, we show the probability of a pro-management vote given a pro-management recommendation from ISS (the + column) or an anti-management recommendation (the – column).

A similar pattern emerges when the tenure voting is 10–1. The difference is that when Institution I holds little stock, a 10–1 tenure voting scheme can be quite helpful to management in the face of an anti-management recommendation, e.g., if Institution I has 5% of the stock, then we get an improvement from 0.13 to 0.44 in the probability of winning. But as Institution I’s holdings increase (from 5% to 10%, etc.) this advantage all but disappears: the 10–1 voting bonus probabilities decrease from 0.44 when Institution I has 5% to 0.19 when it holds 10% and then down to 0.07 when Institution I holds 20% of the shares. The 0.07 probability of management success under 10–1 tenure voting is little better than the 0.04 probability under standard voting.[154]

Table 7: Likelihood of Pro-Management Vote with Long-Term

Holding 31% Given the Amount Held by Institution I Shareholders

When Institution I is the dominant long-term shareholder, there is only a modicum of benefit to management of initiating tenure voting. While the likelihood of success given a pro-management recommendation increases a little (from 0.75 to between 0.90 and 0.93 for 3–1 and 10–1 schemes, respectively), there is little improvement for management if the recommendation is negative (from 0.04 to 0.07 in the 10–1 scheme).When the long-term shareholders combine to hold 30% of the shares, the advantage of tenure voting is more robust, as can be seen in Table 7. The effect of tenure voting is most important when the long-term shareholders who follow the proxy advisor hold very few shares relative to the other long-term shareholders. Here the likelihood of a pro-management vote in the face of a negative recommendation is over twice the baseline in both the 3–1 and 10–1 tenure voting schemes (0.17 versus 0.44 for both when Institution I holds 5%). This advantage persists in the 10–1 scheme, even when Institution I holds 10% of the shares.

Conclusions

Tenure voting systems have been the subject of great attention in recent years. As the flaws of dual-class recapitalizations have become more apparent to institutional investors, tenure voting has emerged as a potential alternative that could be beneficial to both corporate management and shareholders. Tenure voting, in theory, gives all investors equal access to superior voting power as long as they are willing to hold the shares for the long-term, and hence it is not considered a natural entrenchment device for the insiders.

In this Essay, we use a weighted-voting model to show that when corporate management holds a large block of company stock prior to the implementation of tenure voting and retains at least 20%–30% of the total number of company shares on a long-term basis, then tenure voting will ensure that corporate managers maintain control of the company even in the face of an attempted change-of-control transaction by a highly motivated dissident shareholder. The net beneficial effect is tempered if long-term ownership should increase significantly. However, if corporate management chooses to sell off its company stock over time, so that its ownership levels drop down to a low percentage level, then the use of tenure voting systems does little to protect management control in a proxy contest for corporate control.

Tenure voting has some preferable features to dual-class voting systems as those systems permanently (or until a sunset kicks in, usually a long time down the road) insulate corporate management so long as they control the high-vote stock because the other investors cannot remove them. Tenure voting, by comparison, preserves management’s power only if it maintains a large equity investment in the company, which also better aligns its interests with those of investors. In this regard, we perceive the tenure voting system as an improvement over a dual-class system in balancing managerial control and shareholder rights. However, there are many other costs and benefits of the two systems that we have not compared, such as the negative effect that tenure voting has on the liquidity of trading markets. In light of these factors, we cannot definitively conclude that one system is clearly preferable to the other.

Technical Appendix

In this appendix, we give a few more details about the voting model used in this Essay. We have employed this model in two earlier papers to investigate the effect of the distribution of shares among institutions on outcomes in corporate proxy contests.[155] The details of the model can be found in these earlier papers.

The model is designed to incorporate two important aspects of voting in corporate governance. The first is that there are blocs and not just single shares being voted, and the second is that there is an external signaler advising at least some of the participants on the vote. The model itself is a probabilistic version of a standard weighted-voting model from the theory of cooperative games.[156] Each bloc will vote for management with a certain probability. For some of the blocs, that probability is a function of a signal from a third-party advisor. The advisor’s signal is, itself, probabilistic in nature. Based on these probabilities and share percentages, we compute the likelihood of a pro-management vote.

To specify the model fully, we have to choose a distribution of shares among the voters and, for each voter, specify the likelihood that he will vote for management given a signal from the third party. In Part IV we specified the share distribution for each of our scenarios. What is left for us to describe is how the voters cast their votes in each of the two contests we describe.

For our investigations, we will make the following assumptions: Management always votes for itself and Dissident always votes for itself. Of the two long-term holders, Institution I votes according to the recommendation of ISS,[157] while Institution II is insensitive to the advisor but is without any management bias.[158] For the short-term holders, Institution III follows ISS and has an anti-management bias,[159] while Institution IV is insensitive to ISS but also has an anti-management bias.[160] The Public votes randomly with a pro-management bias.[161] For a discussion of the sensitivity of the model to various parameters, the reader should look at our earlier paper.

- .Dual-class offerings usually create two classes of stock—offering low-voting stock to public shareholders, while increasing the number of votes for insiders’ stock. See, e.g., Kishore Eechambadi, The Dual Class Voting Structure, Associated Agency Issues, and a Path Forward, 13 N.Y.U. J.L. & Bus. 503, 513 & n.40 (2017) (discussing the strategic use of dual-class voting structures by several companies, including Google, before their initial public offerings). ↑

- .Matt Orsagh, Dual-Class Shares: From Google to Alibaba, Is It a Troubling Trend for Investors?, CFA Inst.: Mkt. Integrity Insights (Apr. 1, 2014), https://blogs.cfainstitute.org/marketintegrity/2014/04/01/dual-class-shares-from-google-to-alibaba-is-it-a-troubling-trend-for-investors/ [https://perma.cc/ZQU8-7DQY]. ↑

- .See Chris Dieterich et al., Stock Indexes Push Back Against Dual-Class Listings, Wall St. J. (Aug. 2, 2017), https://www.wsj.com/articles/stock-indexes-push-back-against-dual-class-listings-1501612170 [https://perma.cc/Q24Q-TZAN] (describing investors’ resistance to multiple classes of shares because they enable early investors and founders to retain voting control of public companies). In particular, BlackRock Inc., Vanguard Group, and State Street Global Advisors, three of the world’s largest managers of index tracking funds, have called for avoiding unequal voting rights. See Lucian A. Bebchuk & Kobi Kastiel, The Untenable Case for Perpetual Dual-Class Stock, 103 Va. L. Rev. 585, 597 (2017) (discussing Vanguard’s opposition to dual-class structures). ↑

- .Dieterich et al., supra note 3. The policy change resulted in the rejection of potential eligibility for Snap Inc. and Blue Apron Holdings, Inc., both of which recently went public. Id. ↑

- .With tenure voting, shares that are traded become low-vote shares so that over time long-term investors that hold their stock gain an increased percentage of the total voting power at the company. ↑

- .See David J. Berger et al., Tenure Voting and the U.S. Public Company, 72 Bus. Law. 295, 297 (2017) (noting that the tenure voting structure has been cited as a solution to short-termism claims and proposing it as an alternative solution to the dual-class stock structure). ↑

- .Ellen Huet & Brad Stone, Silicon Valley’s Audacious Plan to Create a New Stock Exchange, Bloomberg (June 12, 2016), https://www.bloomberg.com/news/articles/2016-06-12/silicon-valley-s-audacious-plan-to-create-a-new-stock-exchange [https://perma.cc/2FCW-7QW5]. ↑

- .Alexander Osipovich & Dennis K. Berman, Silicon Valley vs. Wall Street: Can the New Long-Term Stock Exchange Disrupt Capitalism?, Wall St. J. (Oct. 16, 2017), https://www.wsj.com/articles/silicon-valley-vs-wall-street-can-the-new-long-term-stock-exchange-disrupt-capitalism-1508151600 [https://perma.cc/2LPA-SUT2]. ↑

- .Lynne L. Dallas & Jordan M. Barry, Long-Term Shareholders and Time-Phased Voting, 40 Del. J. Corp. L. 541, 550 (2016). ↑

- .Poison pills, or as they sometimes are called, Rights Plans, are a powerful anti-takeover device that effectively limit the amount of stock that any unwanted acquirer can purchase without suffering massive dilution of their stake in the company and the associated economic harm. Randall S. Thomas, Judicial Review of Defensive Tactics in Proxy Contests: When Is Using a Rights Plan Right?, 46 Vand. L. Rev. 503, 512 (1993). They have been upheld by the Delaware courts and are widely used by American public companies. Id. at 510, 523. By limiting the number of shares that a dissident shareholder can accumulate, the poison pill also limits the shareholder’s voting power in a proxy contest for corporate control. ↑

- .For us, it is the exclusivity of this power that is significant. In dual-class corporations, the high-vote shares are limited in number and generally not available on the market. This confines the voting power to the founding stockholders. By comparison, any shareholder in a corporation with tenure voting will have access to high-vote shares as long as they are willing to hold on to their shares for a sufficient time. ↑

- .Proxy voting advisory services “focus on providing information and voting services to institutional investors.” Paul H. Edelman et al., Shareholder Voting in an Age of Intermediary Capitalism, 87 S. Cal. L. Rev. 1359, 1397 (2014). They have “acquired an aura of great influence in proxy voting.” Id. at 1399. ↑

- .Bebchuk and Kastiel make one such proposal (among other proposals). See Bebchuk & Kastiel, supra note 3, at 617–21 (discussing several possible designs of a sunset clause and why they favor the fixed-time sunset). ↑

- .Shareholders that hold their stock through banks and brokers are said to hold it in “street name.” Randall S. Thomas & Catherine T. Dixon, Aranow and Einhorn on Proxy Contests for Corporate Control 3–32 (3d ed. 2001) (discussing obligations of banks and brokers in these circumstances). As we discuss below, this can make it difficult for companies to track ownership changes for shareholders to determine if they are entitled to long-term holder voting rights. ↑

- .Dallas & Barry, supra note 9. ↑

- .See id. at 602 (“A shareholder can rebut this presumption by providing evidence that the shares have not changed beneficial ownership during the relevant period.”); see also infra Part II. ↑

- .This is a measure of how frequently investors change their stock portfolios. See infra subpart III(A) (discussing average annual turnover rates). ↑

- .The comparative costs and benefits of incorporating in Delaware have been the subject of a vast legal academic literature that has gone on for several generations of scholarship. For a good review of the arguments on both sides, see Roberta Romano, Foundations of Corporate Law 114–51 (2d ed. 2010). ↑

- .See Randall S. Thomas & Paul H. Edelman, The Theory and Practice of Corporate Voting at U.S. Public Companies (discussing the shareholder franchise and presenting an argument for why shareholders should get a vote), in Research Handbook on Shareholder Power 459–65, 469 (Jennifer G. Hill & Randall S. Thomas eds., 2015). ↑

- .Id. ↑

- .David L. Ratner, The Government of Business Corporations: Critical Reflections on the Rule of “One Share, One Vote,” 56 Cornell L. Rev. 1, 3 (1970). ↑

- .“Under the first Delaware Corporation Law, voting rights were left to the by-laws . . . .” Providence & Worcester Co. v. Baker, 378 A.2d 121, 123 (Del. 1977) (citing 17 Del. Laws Ch. 147, § 18 (1883)). ↑

- .Id. at 123. ↑

- .Id. ↑

- .“Unless otherwise provided in the certificate of incorporation and subject to § 213 of this title, each stockholder shall be entitled to 1 vote for each share of capital stock held by such stockholder.” Del. Code Ann. tit. 8, § 212(a) (2011). ↑

- .Id. § 241(a). ↑

- .Id. § 242(b)(1). ↑

- .Id. § 151(a). ↑

- .378 A.2d 121 (Del. 1977). ↑

- .Id. at 123–24. ↑

- .Baker v. Providence & Worcester Co., 364 A.2d 838, 840 (Del. Ch. 1976), vacated, 378 A.2d 121 (Del. 1977). ↑

- .Providence & Worcester, 378 A.2d at 123. ↑

- .Id. ↑

- .See Sagusa, Inc. v. Magellan Petroleum Corp., Civ. A. No. 12,977, 1993 WL 512487, at *1–2 (Del. Ch. 1993), aff’d, 650 A.2d 1306 (Table) (Del. 1994) (upholding per capita voting requiring majority of persons and majority of shares to vote in favor). ↑

- .671 A.2d 1368 (Del. 1996). ↑

- .618 F. Supp. 407 (S.D.N.Y. 1985). ↑

- .Id. at 408. ↑

- .Id. ↑

- .Id. ↑

- .Id. at 409. ↑

- .Id. at 410 (finding that the tenure voting stock “strips the shareholder of the ability to transfer voting rights without prior warning, compensation or shareholder authorization, creating two classes within one series of shares—those that have been recently acquired, with reduced votes, and those that have not, with full votes”). ↑

- .Id. at 409–10. ↑

- .Id. ↑

- .Williams v. Geier, 671 A.2d 1368, 1371 (Del. 1996); see also 1 R. Franklin Balotti & Jesse A. Finkelstein, The Delaware Law of Corporations and Business Organizations § 6.50 (3d ed. 2018) (“[T]he Court rejected the reasoning of [Unilever] without citing or discussing it.”). ↑

- .Williams, 671 A.2d at 1371. ↑

- .Id. at 1372–73. The structure was based on the same tenure voting plan used by

family-controlled Smuckers. Id. at 1372. This “high–low” voting plan is essentially the same model that Berger et al. advocated more companies adopt. See Berger et al., supra note 6, at 305, 316–17 (discussing the viability of tenure voting systems). ↑ - .Williams, 671 A.2d at 1372. ↑

- .Id. ↑

- .Id. ↑

- .493 A.2d 946 (Del. 1985). ↑

- .Williams, 671 A.2d at 1371. Unocal was a landmark Delaware Supreme Court decision that created a new standard for analyzing dynamic takeover defenses adopted by a board of directors. Unocal, 493 A.2d at 949. Unocal found that a board may oppose a takeover threat it reasonably perceives to be harmful to the corporation. Id. at 953–58. The response must be reasonable in light of the perceived threat. Id. at 955. Delaware courts have given boards significant discretion to determine a “perceived threat.” See, e.g., id. (noting that threats may come from third parties or other shareholders). ↑

- .564 A.2d 651 (Del. Ch. 1988). ↑

- .Williams, 671 A.2d at 1376. Blasius requires defendants to show a “compelling justification” when they take action whose primary purpose is to impede shareholder voting. Blasius, 564 A.2d at 661. ↑

- .Williams, 671 A.2d at 1376. ↑

- .Id. at 1377. Unocal’s enhanced judicial review applies in cases where the board of directors adopts defensive tactics to fend off an unwanted hostile takeover bid. See Unocal, 493 A.2d at 954–55 (discussing the judicial standard that applies to a board’s defensive action taken in response to a takeover bid). ↑

- .Williams, 671 A.2d at 1376. The Blasius test is frequently invoked by plaintiffs but rarely applied by the Delaware courts. Id. ↑

- .Id. (quoting Stroud v. Grace, 606 A.2d 75, 92 (Del. 1992)) (alteration in original) (internal quotation marks omitted). ↑

- .Id. at 1376. ↑

- .Stephen M. Bainbridge, Corporate Governance After the Financial Crisis 31 (2012). ↑

- .Stephen M. Bainbridge, The Short Life and Resurrection of SEC Rule 19c-4, 69 Wash. U. L.Q. 565, 575–76 (1991). ↑

- .Bus. Roundtable v. SEC, 905 F.2d 406, 407–08 (D.C. Cir. 1990). ↑

- .See Bainbridge, supra note 60, at 625 (“[T]he NYSE and NASD have adopted listing standards, with SEC approval under section 19(b), that are essentially identical to rule 19c-4.”); see also Berger et al., supra note 6, at 304 (noting that the exchanges adopted voting policies that were more flexible than Rule 19c-4, recognizing the need for additional flexibility as capital markets and needs of companies change over time). ↑

- .NYSE Listed Company Manual § 313.00(A); NYSE American LLC Company Guide § 122 (quoting NYSE Listed Company Manual § 313.00(A)); see also Order Granting Approval to Rule Changes Relating to the Exchanges’ and Association’s Rules Regarding Shareholder Voting Rights, 59 Fed. Reg. 66,570, at III.A (Dec. 27, 1994) [hereinafter SEC Approval] (same); NASDAQ Listing Rule 5640 (same). ↑

- .See Bainbridge, supra note 60, at 625 (stating that NASD adopted standards essentially identical to Rule 19c-4). ↑

- .See 14 Guy P. Lander, U.S. Securities Law for International Financial Transactions and Capital Markets § 3:179 (2d ed. 2002). Explaining the NYSE’s standards on voting rights, Lander writes:To prevent listed issuers from disenfranchising public holders of common stock, the NYSE has adopted a voting rights policy that is based on, but more flexible than, former Rule 19c-4 under the Exchange Act (the Shareholder Disenfranchisement Rule). Both . . . prohibit any corporate action or issuance that would disparately reduce or restrict the voting rights of existing shareholders of publicly traded common stock registered under Section 12 of the Exchange Act. However, the NYSE policy . . . also permits certain actions or issuances that would have been prohibited under Rule 19c‑4. The NYSE has stated that it will be flexible in its interpretations under this policy because it recognizes that both the capital markets and the circumstances and needs of listed issuers change over time.

Id. (emphasis added) (footnotes omitted). ↑

- .NYSE Listed Company Manual § 313.00(A); NYSE American LLC Company Guide § 122 (quoting NYSE Listed Company Manual § 313.00(A)); SEC Approval, supra note 63 (same); NASDAQ Listing Rule 5640 (same). ↑

- .14 Lander, supra note 65, at § 3:179 n.3; see also 17 C.F.R. § 240.19c-4 (2018) (observing that “corporate action to impose any restriction on the voting power of shares . . . based on the length of time such shares have been held” is “presumed to have the effect of . . . restricting . . . the per share voting rights of an outstanding class” of stock); NYSE Listed Company Manual § 313.00(A) (prohibiting voting rights of existing shareholders from being “disparately reduced or restricted through any corporate action or issuance,” an example of which would be “the adoption of time phased voting plans”). ↑

- .See NYSE Listed Company Manual § 313.00(A) (prohibiting publicly traded companies from disparately reducing or restricting existing stockholders’ voting rights); Tamara C. Belinfanti, Shareholder Cultivation and New Governance, 38 Del. J. Corp. L. 789, 833 (2014) (referring to tenure voting as “time-weighted voting”) (“The NYSE standards thus effectively function as immutable rules and bar the use of time-weighted voting for existing public companies.”). ↑

- .Berger et al., supra note 6, at 319–20. ↑

- .Id. at 320. ↑

- .Providence & Worcester Co. v. Baker, 378 A.2d 121, 123 (Del. 1977). ↑

- .Berger et al., supra note 6, at 319–20. ↑

- .David C. Donald, Heart of Darkness: The Problem at the Core of the U.S. Proxy System and Its Solution, 6 Va. L. & Bus. Rev. 41, 50 (2011). ↑

- .See id. at 50–51. Summarizing the history leading up to the current centralized, depository model, Professor Donald noted:The current U.S. depository model of securities settlement was implemented following a major market failure that culminated in 1970 . . . . Up until the 1970s, most securities firms took care of their securities transfer paperwork through the manual work of clerks. . . . As trading volume steadily increased in the late 1960s, brokers fell behind in this “back office” processing of transaction settlements. . . . During 1969, the inability of some brokerage firms to settle securities transactions created enormous backups in deliveries, so that unperformed obligations could range from 70% to 200% of a firm’s total assets. Firms were forced to cover short positions caused by missing securities through open market purchases, a strategy that was successful while cash flow was strong. But as the market turned downward in 1970, brokers found their working capital diminished, which forced them into default on outstanding delivery obligations for which the securities had been lost or misplaced. As a result, over 100 brokerage firms either entered bankruptcy or were acquired by stronger competitors.